Bitcoin steadies near $67,000 as traders pay for crash protection

Analysis

Price Impact

HighBitcoin is currently stabilizing around $67,000, but underlying market sentiment is highly cautious. traders are actively buying downside protection, and the average u.s. bitcoin etf investor is sitting on a 20% paper loss, making the market vulnerable to capitulation selling if prices slide further. geopolitical tensions and strains in private credit markets also loom large over risky assets, indicating significant downside potential.

Trustworthiness

HighInformation is sourced from coindesk, a reputable crypto news outlet, quoting industry professionals like wintermute's head of otc, and reflecting market data on etf investor positions.

Price Direction

BearishDespite a temporary stabilization, the pervasive 'crash protection' buying, the vulnerability of etf investors to capitulation selling, and external macroeconomic and geopolitical headwinds create a strong bearish pressure. bitcoin is also noted to be logging its longest losing streak since 2022, suggesting a continued downward trend.

Time Effect

ShortThe immediate defensive positioning of traders and the vulnerability of etf investors suggest that a significant price movement, potentially a sharp downturn due to capitulation or external shocks, could occur in the short term.

Original Article:

Article Content:

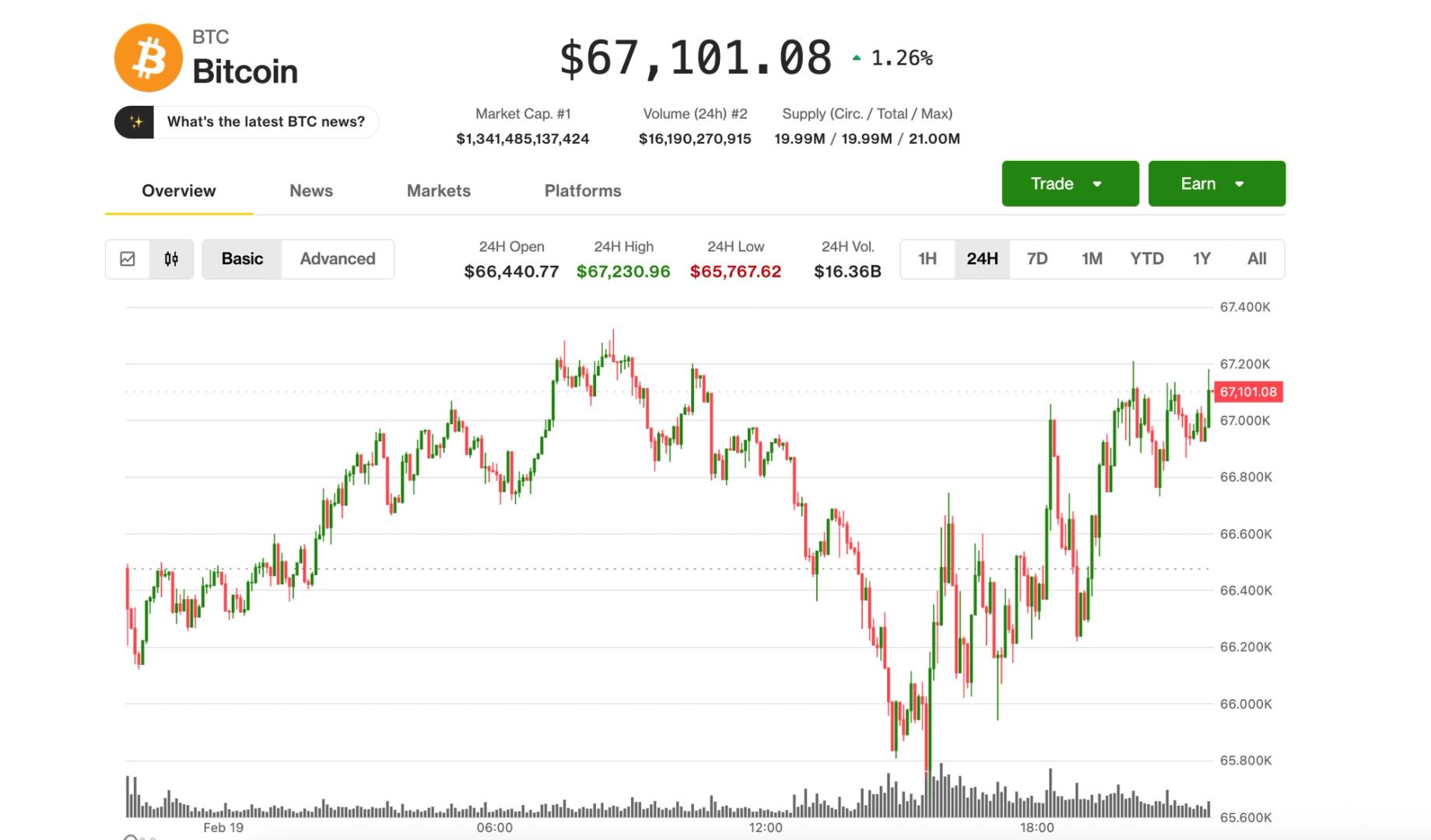

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin steadies near $67,000 as traders pay for crash protection The average bitcoin ETF investor now sits on a 20% paper loss, leaving the market vulnerable to capitulation selling if prices slide further, a Wintermute trader said. By Krisztian Sandor | Edited by Stephen Alpher Feb 19, 2026, 9:13 p.m. Make us preferred on Google Bitcoin (BTC) price on Feb. 19 (CoinDesk) What to know : Bitcoin stabilized around $67,000, avoiding a further breakdown for the moment, while altcoins lagged. Policy talks at the White House on the crypto market structure bill showed incremental progress, but strains in private credit markets and potential U.S. military action against Iran loom large over risky assets Crypto derivatives traders are playing defense, buying downside protection against a potential drop, the head of OTC at Wintermute noted. Bitcoin BTC $ 67,067.04 found its footing on Thursday, stabilizing above a key technical level after briefly slipping below $66,000 in early U.S. trading. The largest cryptocurrency recently changed hands at around $67,000, up roughly 1% over the past 24 hours. The CoinDesk 20 Index lagged, with ether (ETH), XRP, BNB, DOGE $ 0.09800 and solana (SOL) flat to slightly lower during the same period, perhaps a signal of continued caution in altcoins amid shaky crypto markets. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Crypto-related stocks climbed modestly higher across the board, with bitcoin miners CleanSpark (CLSK) and MARA (MARA) standing out with 6% gains. Meanwhile, the S&P 500 and the tech-heavy Nasdaq 100 were 0.3% and 0.6% lower, respectively. On the policy front, there were tentative signs of progress on the digital asset market structure bill. As CoinDesk’s Jesse Hamilton reported , White House-hosted talks between crypto industry representatives and bankers yielded incremental movement, though no compromise has yet emerged. At the same time, cracks from the recent crypto downturn are still surfacing. Chicago-based crypto lender Blockfills, as CoinDesk reported , is exploring a sale after enduring a $75 million lending loss during the recent price crash and having temporarily suspended client deposits and withdrawals last week. With crypto prices tumbling sharply in recent months, investors have been bracing for potential blowups like those of Celsius and FTX in 2022. So far, however, the fallout appears contained — on the one hand, tempering worst-case fears, but on the other, avoiding the kind of complete washout that set the stage for the bottom of that brutal bear market and the beginning of the 2023-25 bull run. Still, risks outside the crypto sphere continue to loom that leave investors hesitant to take risks. Worries about mounting stress in credit markets flared up after private-equity company Blue Owl (OWL) permanently curbed redemptions in its $1.7 billion retail-focused private credit fund. OWL fell 6% on Thursday, while the shares of other major private credit managers, including Apollo Global (APO), Ares Capital (ARES) and Blackstone (BX) slid more than 5%. Geopolitical tensions remain another overhang, with the prospect of U.S. military action against Iran still in play amid an ongoing regional buildup. Crude oil rallied another 2.8% over $66 per barrel, hitting its highest price since August. Traders play defense That caution is reflected in crypto derivatives markets, Jake Ostrovskis, head of OTC at trading firm Wintermute, pointed out. Many traders are buying downside protection while limiting upside participation, he noted, which means they are effectively paying for insurance against another drop while capping potential gains in a breakout to the upside. The average U.S. bitcoin ETF cost basis now sits near $84,000, leaving a large share of ETF investors underwater — nursing a 20% paper loss on average — and potentially vulnerable to "capitulation selling" if prices slide further. Still, total ETF holdings remain within about 5% of their peak in bitcoin terms, suggesting institutions are trimming exposure rather than rushing for the exits. Market Wrap Bitcoin News Wintermute More For You Zoomex: Precise Systems of Fairness and Transparency by Design By CoinDesk Jan 31, 2026 Commissioned by Zoomex Read full story More For You Eric Trump reitrates claim bitcoin is just getting started on its road to $1 million By Olivier Acuna | Edited by Jamie Crawley 3 hours ago U.S. President Donald Trump’s son Eric Trump acknowledged bitcoin’s volatility but said its upside potential outweighs the risks as prices hover below $70,000. What to know : Eric Trump reiterated his prediction that bitcoin will eventually reach $1 million, saying he has never been more bullish on the cryptocurrency. Speaking at the World Liberty Financial forum at Mar-a-Lago, he cited bitcoin's roughly 70% average annual gain over the past decade and challenged critics to name a better-performing asset class. His renewed optimism comes despite bitcoin trading below $67,000 and falling from its 2025 peak above $126,000, and as the Trump family deepens its involvement in crypto through the World Liberty Financial venture. Read full story Latest Crypto News Latest White House talks on stablecoin yield make 'progress' with banks, no deal yet 2 hours ago Eric Trump reitrates claim bitcoin is just getting started on its road to $1 million 3 hours ago Susquehanna-backed Blockfills up for sale after $75 million lending loss 3 hours ago U.S. Federal Reserve researchers sing praises of prediction markets 4 hours ago Fed's Neel Kashkari calls crypto 'utterly useless,' dismisses stablecoins as 'buzzword salad' 4 hours ago Robinhood vs. Vitalik: Why the trading app is building it own L2 while Ethereum founder cools on them 4 hours ago Top Stories Trump-linked World Liberty taps BlackRock-backed Securitize for hotel tokenization 5 hours ago Bitcoin is about to log its longest losing streak since 2022 as geopolitical nerves hit risk trades 15 hours ago Anchorage Digital offers non-U.S. banks a stablecoin stand-in for correspondent banking 5 hours ago