Low

While jack dorsey's opinion on stablecoins is noted, his company block is integrating them into their core payment flow due to customer demand. this news doesn't directly impact bitcoin's price as much as it highlights a shift in block's strategy driven by user adoption, rather than a fundamental change in bitcoin's value proposition.

High

The information comes directly from statements made by jack dorsey and block's business lead, as reported by wired, providing a credible source for the company's strategic decisions regarding stablecoins and their existing strong ties to bitcoin.

Neutral

Dorsey's personal preference for bitcoin over stablecoins is clear, but block's decision to support stablecoins is driven by customer demand. this indicates a pragmatic approach to user needs, which is unlikely to cause a significant immediate price movement for btc, as it doesn't signal a reduced commitment to bitcoin itself.

#btc

#stablecoins

#block

Med

The article discusses circle's stock (crcl) surging due to geopolitical events (iran war) and trader positioning. while circle is a stablecoin issuer (usdc), the direct price impact on usdc itself is indirect. the surge in circle's stock is more tied to the company's financial performance and market sentiment around its business model, rather than the direct utility or value of usdc as a stablecoin. however, increased confidence in the issuer could indirectly support usdc.

High

The article cites analysts (mizuho) and an expert (markus thielen, founder of 10x research) with supporting data (short interest). the reasoning for the stock surge is multifaceted, including geopolitical factors affecting oil and inflation, and technical trading dynamics (short squeeze). the narrative is coherent and supported by credible sources.

Neutral

The article focuses on the surge in circle's stock (crcl), not directly on the price of usdc. while a stronger circle might be positive for usdc, the primary drivers discussed are external geopolitical events and trading mechanics. the war's impact on interest rate cut expectations could indirectly influence stablecoin demand, but the article doesn't provide a clear price direction for usdc itself. instead, it points to a short squeeze as a significant factor in the stock's rally.

USDC

Circle

Geopolitics

High

Significant outflows from spot bitcoin and ethereum etfs, coupled with profit-taking and geopolitical concerns (strait of hormuz closure), have directly led to sharp price declines for both btc and eth.

High

The article cites specific data from sosovalue regarding etf inflows/outflows and mentions on-chain data for profit-taking. it also references geopolitical events impacting broader financial markets, providing a multi-faceted explanation.

Bearish

The immediate reason for the price crash is the shift from strong etf inflows to significant outflows, indicating decreased institutional demand, combined with profit-taking by short-term holders and macro-economic fears.

#btc

#eth

#etfs

Med

The us treasury's recognition of privacy tools and the upcoming xls-372 amendment for confidential transactions on the xrp ledger could significantly boost xrp's utility and adoption, especially for institutional use. however, the actual price impact depends on the successful implementation and market adoption of these privacy features.

Med

The information comes from a prominent xrpl contributor (vet) and references a us treasury report (dated march 2026, which is future-dated but likely refers to a current/recent development being discussed in the context of a future report). the xls-372 amendment is also a verifiable development within the xrp ecosystem. the trustworthiness is 'medium' due to the future date of the treasury report and the need for market adoption to confirm the impact.

Bullish

Increased utility through enhanced privacy and potential for institutional adoption are generally bullish catalysts for any cryptocurrency. if xrp becomes a more attractive option for those seeking financial privacy with regulatory compliance, demand could increase.

#xrp

#xrpl

#privacy

Med

The $25 million funding round for zodl, a key zcash development team, is positive news. it indicates strong investor confidence and will support further development of the zcash protocol and the zodl wallet. while this is a bullish signal, the immediate price impact might be moderate as the market often prices in such news, and the broader crypto market sentiment also plays a significant role.

High

The funding comes from a reputable group of investors including paradigm, andreessen horowitz, and coinbase ventures, which lends significant credibility to the zodl team and their vision for zcash. the departure of the former ecc team to zodl also strengthens the narrative of continued, focused development.

Bullish

The successful $25 million funding round, coupled with the growing adoption of the zodl wallet (400% growth in shielded pool) and the team's focus on core protocol development, suggests a positive outlook for zcash. this could attract more users and developers, potentially leading to increased demand and price appreciation.

#zec

#privacycoin

#cryptonews

Low

This news concerns anthropic, an ai company, and its legal battle with the trump administration over ai usage restrictions. it does not directly involve any cryptocurrencies or blockchain technology. therefore, the direct price impact on any crypto asset is expected to be negligible.

High

The information is derived from a news report detailing a lawsuit filed by anthropic against federal agencies. the report cites direct quotes from the lawsuit, statements from officials (via a tweet), and commentary from industry experts. this provides a good basis for trust.

Neutral

As the news has no direct link to the cryptocurrency market, there is no predictable price direction for any specific coin.

N/A

Med

President trump's statement about the iran conflict potentially ending soon has led to a general market rally, including for bitcoin. while not directly tied to the conflict, bitcoin often reacts to broader geopolitical stability.

High

The news directly links market movements to trump's statements, which are a significant factor in geopolitical and economic sentiment. the correlation with oil prices and stock market performance supports this.

Bullish

A de-escalation of geopolitical tensions typically leads to increased risk appetite, benefiting assets like bitcoin. the news caused a broader market rally, and bitcoin followed suit.

#BTC

#Geopolitics

#Markets

Med

Bitcoin experienced a bounce, but a failed breakout on the weekly chart and ongoing bearish technical indicators suggest limited upside potential in the short term. geopolitical tensions and rising vix add to market uncertainty.

High

The analysis is based on technical indicators (candlestick patterns, adx, rsi, emas) and macroeconomic factors (geopolitical tensions, vix, oil prices) which are standard tools for crypto analysis. the author also references a prediction market for sentiment.

Bearish

Despite a recent bounce, the price failed to hold above a descending triangle breakout, forming a bearish 'false breakout' signal. key moving averages (50-day ema below 200-day ema) and the rsi at 49.3 indicate a lack of strong bullish momentum. bears remain in control until btc convincingly breaks and holds above $73,000-$75,000.

#btc

#crypto

#technicalanalysis

Med

A meeting between a top ripple executive and a democratic senator discussing digital asset regulation, specifically market structure and bipartisan legislation, can positively influence xrp's price. this indicates progress towards regulatory clarity, which is a significant concern for ripple and xrp holders. however, the impact is moderate as it's a discussion, not a legislative outcome.

High

The information comes directly from ripple's chief legal officer, stuart alderoty, via his x (formerly twitter) post, and mentions a specific senator known for her involvement in crypto legislation. this provides a high degree of confidence in the event occurring.

Bullish

Positive engagement with policymakers on regulatory clarity is generally bullish for cryptocurrencies, especially for xrp which has been heavily impacted by regulatory uncertainty. bipartisan efforts suggest a potential for actual legislative progress, which would significantly reduce risk for xrp.

#XRP

#Ripple

#Regulation

Med

The article discusses xrp's long-term vision as part of the 'internet of value' and potential benefits from regulatory clarity. while this is a bullish long-term outlook, it doesn't suggest immediate price catalysts. the shift in trading volume to upbit is also noted, suggesting regional trader confidence.

Med

The article cites an analyst (rob cunningham) and a crypto commentator (xfinancebull) and refers to market data and regulatory frameworks. however, it also acknowledges that legislative acts don't guarantee adoption and that the analysis is inferential rather than definitive.

Bullish

The article's core argument is that xrp's long-term utility in a standardized 'internet of value' and potential benefits from clearer regulation position it for future growth, outweighing short-term speculation.

#XRP

#InternetOfValue

#Regulation

Low

While sharplink is a significant holder of eth and a major staker, their reported loss is a company-specific financial event. the surge in staking revenue is positive for their operations but doesn't directly translate to immediate upward price pressure on eth itself. the market is more likely to focus on broader macroeconomic factors and eth's own on-chain metrics for price direction.

High

The information is derived from a company's financial disclosure and reported by reputable news outlets. the ceo's statements provide context, and the data on holdings and revenue is verifiable through blockchain explorers and financial reporting.

Neutral

The news focuses on sharplink's financial performance and operational strategy rather than significant new developments directly impacting the eth protocol or its adoption. while eth staking revenue is mentioned as increasing, the overall context of sharplink's substantial loss due to asset devaluation suggests a neutral short-term impact on eth's price.

#ETH

#Staking

#Crypto

Med

Coinbase launching regulated futures trading for european traders is a significant step towards broader institutional adoption and accessibility of crypto derivatives. this could increase trading volume and liquidity for bitcoin and ethereum, but the impact might be moderated by existing offerings from competitors like kraken and crypto.com.

High

The information is from a reputable news source reporting directly on coinbase's official announcement and regulatory compliance (mifid ii). the details are specific, including product types and leverage. the mention of competitors launching similar products in the past adds credibility.

Bullish

The introduction of regulated derivatives trading, especially with leverage, can attract more capital and trading activity to cryptocurrencies like bitcoin and ethereum. this expansion into europe provides a regulated alternative to offshore markets, potentially boosting confidence and demand.

#coinbase

#btc

#eth

Med

Nigel farage's investment in a bitcoin treasury firm, stack btc plc, could bring increased attention and a degree of legitimacy to bitcoin from a political figure. this could encourage some retail investors and potentially signal a growing acceptance of crypto by traditional political circles. however, the actual impact on bitcoin's price will likely be moderate as it's a single investment and doesn't represent a broad policy shift.

Med

The trustworthiness is moderate because while nigel farage is a well-known political figure, his involvement is with a specific private company and not a direct endorsement by a government. the company itself is relatively new and its business model of combining acquisitions with a bitcoin treasury strategy is yet to be proven at scale. the involvement of blockchain.com as a partner adds some credibility.

Bullish

The news is generally bullish for bitcoin as it signifies endorsement from a prominent political figure and potential for increased adoption by businesses. the association with a former chancellor adds a layer of political connection, which can be perceived positively in the crypto space. this could lead to increased retail interest and potentially a small price bump.

#btc

#nigelfarage

#cryptoadoption

Med

The article suggests a potential short-term breakout for dogecoin above $0.10, driven by its current compression within a falling channel and testing of a crucial support zone. however, the longer-term trend remains bearish, and a previous breakout attempt failed, indicating uncertainty.

Med

The analysis is based on technical indicators (falling channel, support zones, symmetrical triangle) and insights from crypto analysts on x. while technical analysis can be insightful, it's not always predictive, and past performance doesn't guarantee future results. the mention of a failed breakout attempt adds a layer of caution.

Neutral

The article presents both bullish and bearish scenarios. bulls are targeting a surge above $0.10, while a failed breakout attempt and indecisive mode suggest potential for further downside towards $0.06. the immediate price action is described as uncertain.

#doge

#crypto

#technicalanalysis

High

A prolonged us-iran conflict could lead to increased government deficit spending to finance military operations, injecting more liquidity into the financial system. this, coupled with rising us debt and potential currency debasement, could drive investors towards alternative assets like bitcoin. the potential for lower interest rates due to the fed's need to maintain treasury market stability also supports bitcoin.

Medium

The analysis is based on historical patterns and macroeconomic principles related to conflict spending and monetary policy. however, geopolitical events are inherently unpredictable, and other market factors could counteract these potential tailwinds.

Bullish

Increased liquidity from deficit spending, potential currency debasement, and lower interest rates are all historically bullish factors for bitcoin, which is often seen as a hedge against inflation and currency devaluation.

#BTC

#Geopolitics

#DeFi

Med

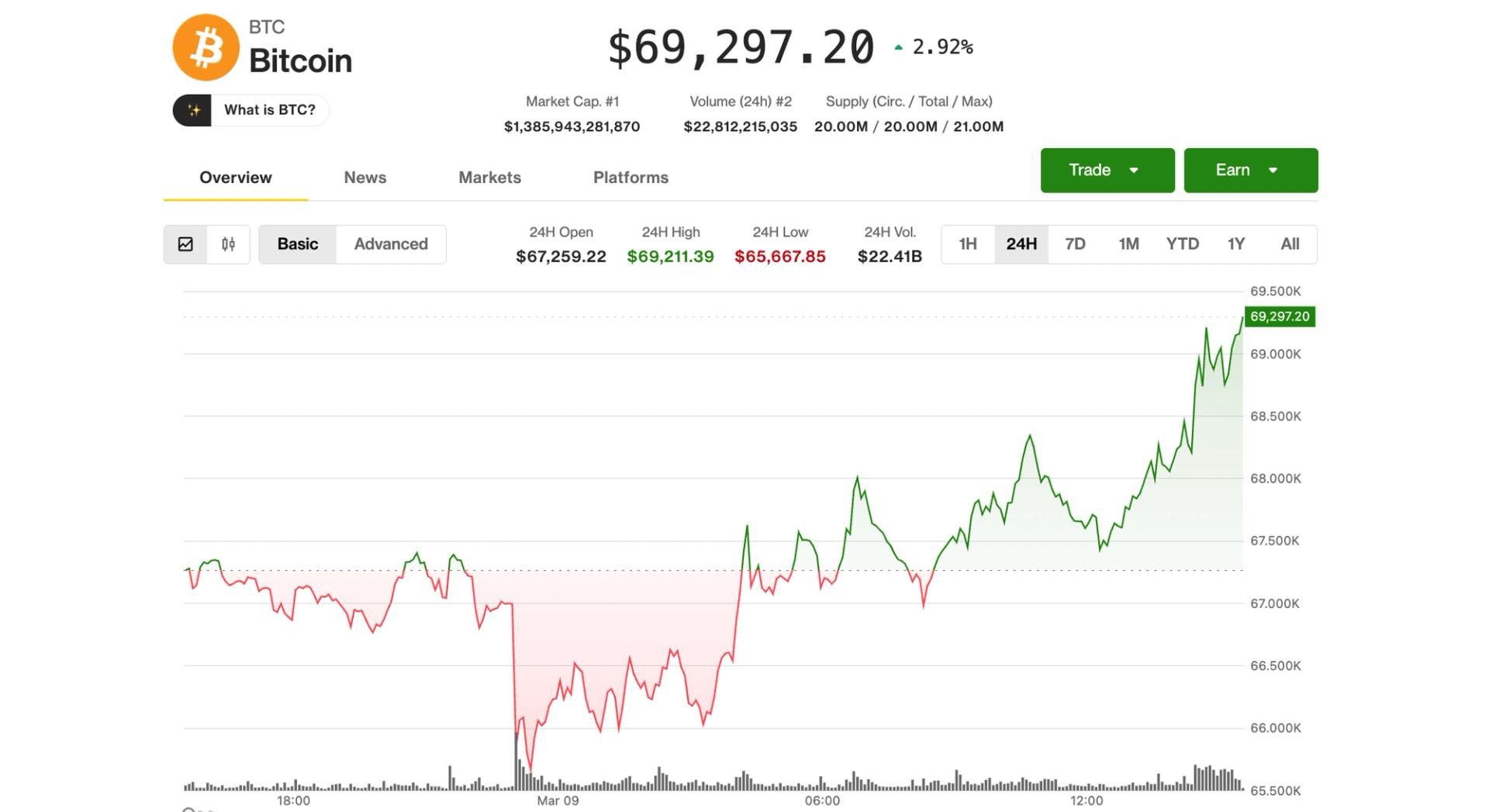

Bitcoin's rise to $69,000 is significant, especially as it reversed overnight losses. the broader market sentiment influenced by crude oil prices and stock market performance plays a key role. the mention of a potential defensive capital flow into digital assets from oil-sensitive assets adds to the impact.

Med

The analysis is based on market movements and expert opinions from financial analysts. while the price rebound is notable, the sustainability depends on broader market conditions and geopolitical factors which can be unpredictable.

Bullish

The article clearly states bitcoin rallied back to $69,000 after falling to $65,000 overnight. this upward movement, coupled with positive sentiment around crude oil easing and potential defensive capital flow, indicates a short-term bullish trend.

#BTC

#Crypto

#Oil

High

The article discusses a specific mathematical method using fibonacci levels to identify bitcoin's potential price bottom and future targets. this type of detailed analysis can significantly influence trader sentiment and investment decisions.

Med

The analyst's previous prediction was accurate in terms of price target, although slightly off on timing. the methodology is based on established technical analysis tools (fibonacci) applied to macro charts, which is a common and respected approach. however, it's still a single analyst's prediction and relies on historical patterns repeating.

Bullish

The analysis suggests that bitcoin has successfully transitioned the 1.618 fibonacci level from resistance to support. holding this level on a quarterly basis, as indicated by recent price action, is interpreted as a bullish sign, pointing towards potential higher targets based on fibonacci expansions.

BTC

Fibonacci

Analysis

Med

Peter brandt, a veteran analyst, disputes the 'cup and handle' pattern prediction for bitcoin reaching $500,000. his expertise lends credibility to the rebuttal, suggesting the pattern is incorrectly applied, which could temper extreme bullish sentiment based on this specific technical analysis.

High

Peter brandt has nearly 50 years of trading experience and is considered a legend in financial markets. his opinion on technical analysis patterns carries significant weight.

Neutral

Brandt's statement challenges a specific bullish pattern, implying that the $500,000 prediction based on it is flawed. however, he doesn't offer an alternative price prediction, making the overall market direction uncertain based solely on this news. it neutralizes a specific bullish narrative but doesn't introduce a bearish one.

#btc

#peterbrandt

#technicalanalysis

Med

A significant amount of doge moved from an exchange to an unknown wallet, which can reduce selling pressure. however, it doesn't guarantee immediate price movement without a market catalyst.

Med

The information comes from whale alert, a reputable source for tracking large crypto transactions. however, the 'unknown wallet' nature means the ultimate intent is speculative.

Bullish

The withdrawal of a large sum from an exchange to a private wallet often suggests accumulation by large holders who believe the current price is a good entry point. the upcoming cpi report could also be a bullish catalyst if it indicates lower inflation.

#doge

#whalealert

#cpi

Med

A 658% increase in spot flows suggests a significant uptick in trading activity, potentially indicating rising demand or supply in the market. coupled with rising open interest, this points to increased speculative interest.

Med

The data is sourced from coinglass, a reputable crypto analytics platform. however, the interpretation of 'spot flows' can be complex and doesn't always directly translate to price action. market recovery context also plays a role.

Bullish

The increase in spot flows and open interest, combined with the contracting bollinger bands suggesting consolidation for a potential move, points towards upward price pressure. the recent price reversal from a four-day drop also supports this.

#SHIB

#ShibaInu

#Crypto

High

This partnership between nasdaq and kraken is a significant step in bridging traditional finance (tradfi) with the crypto space. it could lead to increased institutional adoption and legitimacy for tokenized assets, potentially driving demand for cryptocurrencies that facilitate such transactions or are used in related infrastructure.

High

Nasdaq is a reputable and established financial market operator. their involvement, along with a major us crypto exchange like kraken, lends significant credibility to the initiative. the sec proposals also suggest a regulatory-focused approach, increasing confidence.

Bullish

The tokenization of traditional assets on-chain, facilitated by major players, could increase overall demand for blockchain technology and the cryptocurrencies associated with it. this innovation might attract new capital and users into the crypto ecosystem, benefiting major cryptocurrencies.

#crypto

#tradfi

#tokenization

High

Significant seed funding ($25m) for zcash open development lab (zodl), especially from major investors like paradigm and a16z crypto, indicates strong backing and potential for future development and adoption of the zcash protocol and its privacy-focused wallet. this news directly addresses the development and future of zec.

High

The funding comes from reputable venture capital firms and prominent figures in the crypto space, including paradigm, a16z crypto, winklevoss capital, and coinbase ventures. the involvement of josh swihart, former ecc ceo, and the entire former ecc engineering team lends further credibility.

Bullish

The substantial funding injection and the clear plan to expand development of the zcash protocol and its wallet are bullish catalysts. increased development activity often leads to improved technology, wider adoption, and consequently, price appreciation for the underlying asset.

ZEC

Crypto

Privacy

Low

The mining of the 20 millionth bitcoin is a significant milestone from a supply perspective, but it was anticipated and priced into the market over time. the remaining 1 million btc will be mined very gradually until 2140, so the immediate supply shock is minimal.

High

The information regarding the 20 millionth bitcoin being mined is verifiable through blockchain explorers and has been widely reported by reputable crypto news outlets.

Neutral

While the news highlights bitcoin's scarcity, which is a long-term bullish factor, the actual event of the 20 millionth coin being mined is a predictable outcome and doesn't represent new information that would drastically alter short-term price action.

#BTC

#Bitcoin

#Scarcity

Med

While blackrock is a significant institutional player, the transfer of $153 million in btc and eth to coinbase for potential rebalancing or other operational reasons, while notable, does not necessarily indicate a large-scale sell-off or accumulation event that would drastically alter market prices in the short term. the market has become accustomed to institutional movements.

High

The information is sourced from on-chain data analytics platform onchain lens and u.today, which are generally reliable for reporting such financial movements. blackrock's involvement is also confirmed through their known etf activities.

Neutral

The transfer to an exchange can be for various reasons, including rebalancing, liquidity management, or preparation for new product launches. without further context on blackrock's intentions (e.g., selling to clients, internal transfers), it's difficult to predict a definitive bullish or bearish price movement solely based on this transaction.

#blackrock

#btc

#eth

Med

Aon's test of stablecoin payments for insurance premiums is a significant step for mainstream adoption. this could lead to increased demand for stablecoins like usdc and pyusd, potentially driving their prices up if adoption accelerates. however, the impact is currently limited as it's a test.

High

Aon is a major global insurance broker, and their involvement lends significant credibility to the test. the participation of established players like coinbase and paxos further strengthens the reliability of the news. the inclusion of regulatory developments like the genius act adds to the trustworthiness of the potential for broader adoption.

Bullish

The news indicates a growing integration of stablecoins into traditional finance, which is generally bullish for stablecoins. as more large institutions explore and adopt stablecoin payments, it suggests increased utility and demand for these digital assets.

#stablecoins

#usdc

#insurance

High

A major ethereum treasury firm, bitmine, has significantly increased its eth holdings, becoming the largest corporate holder. this signals strong institutional confidence and a belief in ethereum's future value, especially given the timing during a potential market bottom.

High

The information comes from a reputable crypto news outlet (u.today) and is corroborated by on-chain data shared by @onchainlens, including specific figures for the purchase and total holdings. tom lee's strategic outlook further strengthens the credibility of this news.

Bullish

The substantial purchase by a major firm, coupled with tom lee's positive price outlook and the anticipation of ethereum's network upgrades and adoption in areas like rwa tokenization and ai agents, suggests a bullish sentiment for eth.

#ETH

#Ethereum

#InstitutionalBuying

High

The introduction of programmable tokens for real world assets (rwa) like stocks and real estate, along with compliance features (kyc/aml), significantly enhances cardano's utility and attractiveness for institutional and regulated defi use cases. this could lead to increased adoption and demand for ada.

High

The news comes from a direct announcement by the cardano foundation about a key roadmap milestone. the description of the cip-0113 standard and its capabilities provides concrete details, and the mention of a live preview platform and upcoming security audits suggests a well-defined development path.

Bullish

This development addresses a key limitation in cardano's previous token capabilities, enabling it to compete more effectively in the tokenization and regulated defi space. the ability to implement compliance and control features directly into tokens is a major draw for traditional finance and regulated entities, which could drive significant demand and price appreciation.

#ADA

#Tokenization

#RWA

Med

The article suggests that a spike in the vix (stock market volatility) might indicate a bottom for bitcoin. historically, high vix levels have coincided with local bottoms for btc. however, bitcoin has shown divergence, potentially front-running the traditional market stress. this suggests a potential positive impact, but the continued high vix implies traditional markets may still be volatile.

Med

The analysis is based on historical correlations between the vix and bitcoin's price movements, as well as bitcoin's own volatility index (bviv). while historical data is useful, past performance is not indicative of future results. the article also mentions that a vix near 30 suggests volatility in traditional markets may not be finished, adding an element of uncertainty.

Bullish

The article points to historical patterns where a surge in the vix often aligns with bitcoin market lows. furthermore, bitcoin has recently diverged from the negative trend in traditional markets, showing resilience and even gains while equities and gold fall. this divergence, coupled with the historical correlation, suggests a potential upward price movement for bitcoin.

#btc

#vix

#crypto

Med

Strategy's significant bitcoin purchase indicates strong conviction from a major institutional player. while not directly impacting the price in the short term due to the sheer volume of the market, it adds to positive sentiment and potential future demand.

High

The information is based on a press release from strategy and widely reported financial news outlets, making it highly reliable.

Bullish

The large purchase by a prominent holder suggests confidence in bitcoin's future value. additionally, the use of preferred shares to fund the purchase indicates a strategic long-term approach to accumulating btc.

#btc

#strategy

#institutionaladoption

Med

Bitcoin saw significant inflows early in the week, leading to a rally, but subsequent outflows suggest a pullback due to geopolitical tensions and rising oil prices. this suggests a temporary market consolidation rather than a fundamental shift.

High

The analysis is based on a coinshares report and expert commentary from market analysts regarding fund flows, geopolitical events, and the relationship between oil prices, equities, and bitcoin as a risk asset. this provides a robust basis for the assessment.

Neutral

While bitcoin rallied on early inflows, the late-week outflows and the correlation with risk assets suggest potential short-term selling pressure. however, the underlying conviction may not have collapsed, indicating a neutral to slightly bearish short-term outlook, with potential for recovery if geopolitical tensions subside.

#BTC

#Bitcoin

#Crypto

Med

The rsi trendline on the sui/btc pair is identified as a key trigger. a break below could lead to a drop to $0.82, while holding could trigger a bounce to $0.94. the usdt pair's weakness suggests broader market pressure.

Med

The analysis is based on technical indicators (rsi) and price action, with specific price targets mentioned. the information is attributed to crypto analysts umair crypto and bitguru, lending some credibility, but the predictive nature of technical analysis always carries inherent uncertainty.

Neutral

The article presents two distinct scenarios based on the rsi trendline: a bearish breakdown to $0.82 or a bullish bounce to $0.94. while the broader market bias is mentioned as tilted to the downside, the immediate trigger is at a decision point, making the short-term direction uncertain.

#sui

#crypto

#technicalanalysis

Low

The article discusses the minting and burning of rlusd stablecoin by ripple. while the 'money printer' analogy highlights ripple's supply management, the actual amounts minted (1.965 million) and burned (9.1 million) are relatively small compared to the overall market cap and daily trading volume of major stablecoins. this suggests a controlled and localized operational adjustment rather than a market-moving event.

Medium

The information is sourced from 'rlusd tracker' and 'ripple stablecoin tracker,' which appear to be dedicated tracking platforms. the article also references general market rankings. however, it's important to note that ripple's rlusd is still a relatively new stablecoin, and its long-term stability and market impact are yet to be fully established. the 'genius act' reference for 2026 requires further verification of its direct impact on rlusd operations.

Neutral

The actions described (burning and minting) are part of ripple's stablecoin management strategy to maintain a low idle supply and comply with potential future regulations. these are operational adjustments rather than indications of a strong bullish or bearish sentiment for rlusd itself or its associated coin xrp. the stablecoin's price is designed to remain pegged to the usd.

#RLUSD

#Ripple

#Stablecoin

Med

Significant exchange outflow and high volatility in the futures market could indicate strong sentiment shifts. however, the inflow/outflow data on smaller timeframes suggests instability, meaning the overall impact might be moderate.

Med

The data from coinglass is generally reliable for exchange flows. however, the interpretation of futures market instability and its direct impact on price can be subjective and prone to short-term fluctuations.

Bullish

The substantial net outflow (-153%) suggests that large amounts of xrp are moving off exchanges, which is typically seen as a bullish indicator as it reduces the available supply for sale. while current price action is flat, the underlying futures market activity points towards potential upward pressure.

#xrp

#crypto

#ripple

Med

A 70% jump in xrp's trading volume, especially on derivatives markets, indicates increased trader interest and potential for significant price movement. this is driven by anticipation of key us economic data releases, which could influence federal reserve policy and overall market sentiment.

Med

The data comes from reputable sources like coinmarketcap and coinglass, which are standard for crypto market analysis. however, the article also contains disclaimers about the speculative nature of crypto trading and the opinions of individual writers, suggesting a need for caution.

Neutral

While volume has increased, xrp's price is only slightly up, indicating a mixed sentiment. the upcoming economic data is a significant wildcard; positive data could be bullish, while negative data could be bearish. the market remains cautious overall.

#xrp

#cryptotrading

#economicdata

Med

Bitcoin rebounded to $69k after a dip influenced by oil price volatility due to geopolitical tensions. the rebound suggests resilience, but the dependence on oil prices introduces a degree of uncertainty. other major cryptocurrencies like eth and sol also saw gains, aligning with bitcoin's recovery. meme coins are also rising, indicating increased speculative activity.

Med

The information is derived from a newsletter summarizing market news and expert opinions. while generally reliable, the price movements are influenced by external factors like oil prices and geopolitical events, which are inherently unpredictable. the prediction market valuations and florida's stablecoin bill add to positive sentiment, but the recent $46m crypto theft from u.s. government wallets introduces a bearish undertone.

Neutral

Bitcoin is trading within its recent range ($60k-$70k) after a failed breakout. the rebound from lows shows support, but the inability to sustain higher prices indicates a lack of strong bullish momentum. the influence of oil prices and a recent large theft add to the choppiness.

#btc

#crypto

#markets

Med

Bitmine's significant purchase of eth, coupled with their substantial existing holdings and the company's positive sentiment, could create upward pressure on eth price. however, the overall market sentiment remains bearish, and the company itself is currently underwater on its holdings, which may temper the impact.

Med

The information comes from a public company announcement and reports from financial news outlets. while the facts of the purchase are likely accurate, the sentiment and future price predictions from the company should be viewed with some skepticism.

Bullish

The direct purchase of a large amount of eth by a major holder like bitmine, along with their chairman's optimistic outlook, suggests a short-term bullish sentiment from a significant market participant. the recent price recovery also supports this.

#ETH

#Crypto

#BitMine

Med

Bitmine, a large eth holder, is increasing its acquisition pace, suggesting confidence in a market bottom. while this is a positive signal, it's from a single entity and doesn't represent broad market sentiment.

Med

The information comes from a named individual (thomas lee) and a specific company (bitmine), making it more reliable than anonymous sources. however, the company is currently sitting on significant unrealized losses, which could influence their sentiment.

Bullish

Tom lee's statement about the 'mini crypto winter' being in its final stages and bitmine increasing its eth accumulation pace indicates a belief in an upcoming price recovery.

#ETH

#CryptoWinter

#Bitmine

Med

A decrease in active addresses indicates lower network demand and potential waning momentum. while this specific drop is mild, sustained lower activity could pressure the price.

Med

The data is sourced from a reputable analytics platform (cryptoquant) and directly relates to network activity, but the overall market sentiment and other factors can also influence xrp's price.

Neutral

The article notes mixed price action and a failure to stabilize above resistance, despite a slight upward movement from intraday lows. the decrease in active addresses suggests potential downside, but the article also mentions other cryptocurrencies are on an upside trajectory, implying xrp might follow.

#xrp

#crypto

#networkactivity

Med

This partnership between nasdaq and kraken focuses on tokenized stocks, which could indirectly increase adoption and infrastructure development for blockchain technology, potentially benefiting cryptocurrencies like bitcoin that are often seen as foundational to the broader digital asset ecosystem. however, it's not a direct use case for bitcoin itself.

High

Nasdaq is a major traditional financial exchange, and kraken is a well-established crypto exchange. their collaboration on tokenized equities lends significant credibility to the potential of blockchain in traditional finance.

Bullish

The news signals a growing acceptance and integration of blockchain technology within traditional finance. this could lead to increased institutional interest and investment in the broader crypto market, potentially boosting bitcoin's price as the leading cryptocurrency.

#BTC

#Tokenization

#Nasdaq

Low

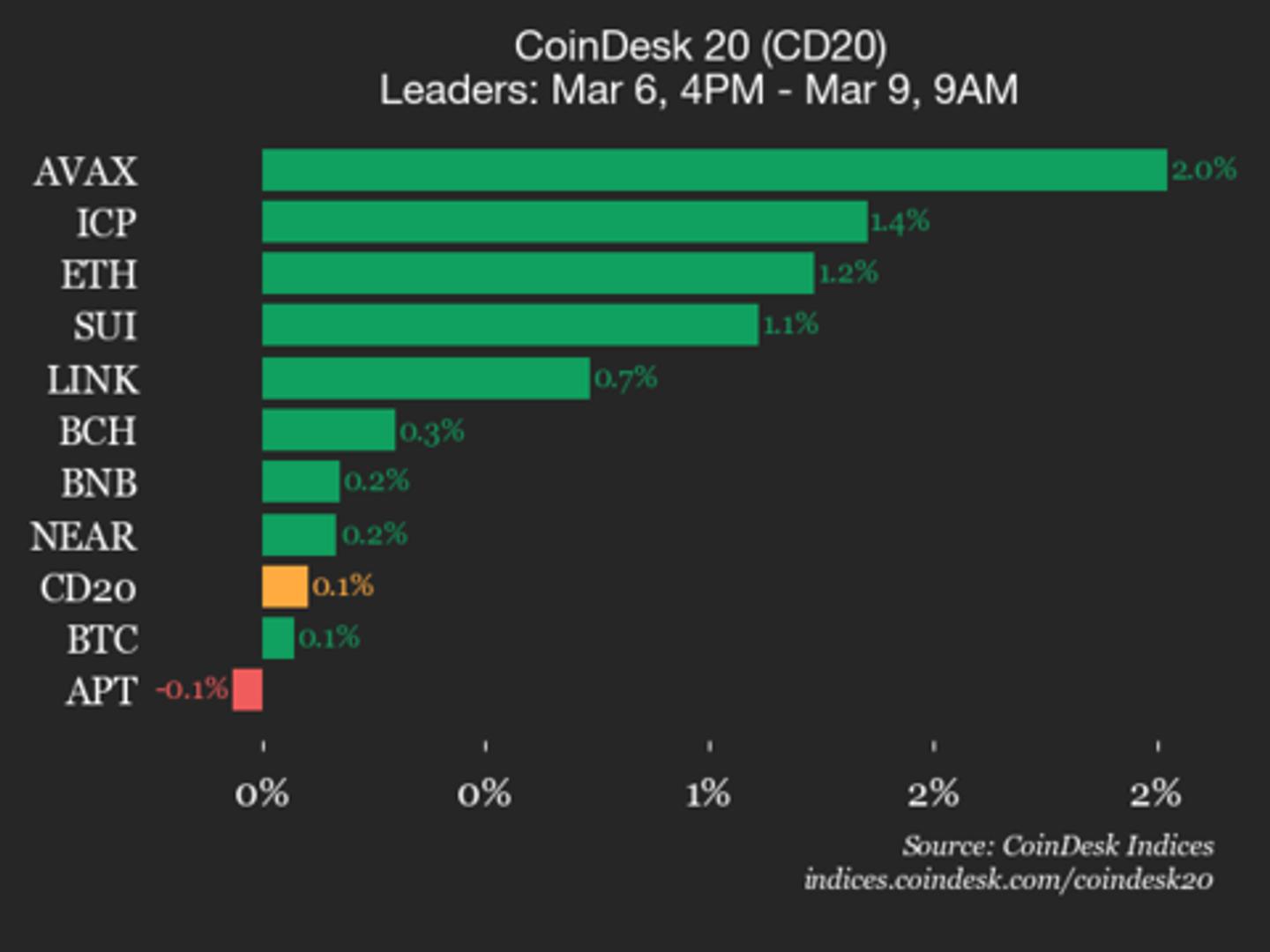

The article highlights avax's 2% gain as a top performer in the coindesk 20 index. while positive, this is a modest gain within a broadly flat index, suggesting limited immediate impact on avax's overall market sentiment or price trajectory.

High

Coindesk indices is a reputable source for market data and analysis, and the information provided is based on observed trading performance within their established index.

Neutral

The article focuses on a single day's performance where avax outperformed a flat index. this isolated gain doesn't provide enough momentum or fundamental shift to indicate a sustained bullish or bearish trend. broader market conditions and other factors would be needed for a stronger price direction assessment.

#AVAX

#CoinDesk20

#Crypto

Low

The article features a tech investor who believes crypto is a 'different animal' and does not belong in ai portfolios. while he holds some crypto-related assets, they are not part of his ai strategy. this perspective, while from a notable figure, represents one opinion and doesn't directly contradict or support a significant price movement for bitcoin.

Med

The information comes from a credible source, a tech investor and former snap exec, but it's based on a subjective investment thesis rather than concrete market data or a broad consensus.

Neutral

The investor's view is a strategic one about portfolio allocation and does not offer a direct prediction on bitcoin's price. his firm's holdings, mentioned as part of a broader tech mandate, are not explicitly tied to a bullish or bearish outlook.

#btc

#ai

#crypto

Med

A significant outflow of 275 billion shib from exchanges indicates holders are moving tokens to private wallets, reducing market supply. while this often suggests a belief in future price appreciation, the article also notes that the broader trend is still bearish and a price rally is not guaranteed.

Med

The article cites specific on-chain data (exchange netflow) and mentions technical analysis indicators (moving averages, lower highs/lows). however, it also includes a disclaimer about financial advice and emphasizes that these are opinions, suggesting a moderate level of trustworthiness.

Neutral

Despite the large outflows, the article explicitly states that shib is still in a larger downtrend with lower highs and lower lows. while outflows are a positive sign, they are not enough to overcome the existing bearish technical structure and market pressure. the asset is described as entering a 'gradual stabilization phase' rather than an immediate recovery.

#shib

#shibainu

#crypto

Med

Coinbase launching futures trading in europe allows more sophisticated traders to access leveraged products on major cryptocurrencies like bitcoin and ethereum. while this expands market access and could increase trading volume, the impact on spot prices is likely to be moderate as it primarily caters to a specific segment of traders and is limited to eligible users in 26 european countries.

High

Coinbase is a reputable and regulated exchange, and the announcement of new product offerings in europe is a direct statement from the company, making it highly trustworthy.

Neutral

The launch of futures trading offers more trading options but doesn't directly translate to immediate price increases or decreases in the underlying assets. the impact will depend on market sentiment and the actual trading activity that ensues.

#coinbase

#eth

#btc

Low

This news is about ai in game development, not directly related to cryptocurrency markets. while ai and blockchain can intersect, this specific announcement does not have a direct, immediate impact on major cryptocurrencies.

High

The news is from a reputable source (decrypt) and details a specific product launch with named studios as beta testers.

Neutral

There is no direct link between this news and cryptocurrency price movements. it's a sectoral development in the gaming industry.

#AI

#Gaming

#Tech

High

The article discusses a historically reliable 23-month cycle for bitcoin potentially indicating a bottom, which could lead to a significant rally. it also contrasts this with a warning of a potential bull trap from another analyst, creating significant uncertainty and potential for sharp price movements.

Med

The article presents two contrasting expert opinions on bitcoin's price direction. while one analyst's 'never failed' cycle is compelling, the warning of a bull trap from a respected analyst like willy woo adds a layer of caution. the geopolitical tensions also introduce external volatility.

Bullish

The primary analysis points to a historical 23-month cycle that has always signaled a bear market bottom, suggesting a significant rally is imminent. this is further supported by a comparison to gold's historical bull market pattern. however, the counter-argument of a potential bull trap introduces a bearish risk.

#btc

#crypto

#trading

Low

This news is about kast, a stablecoin payment platform, not directly about a specific major stablecoin like usdt, usdc, or dai. while it indicates growth in the stablecoin payment sector, the impact on the price of a dominant stablecoin like usdt is likely to be minimal in the short term.

High

The information is derived from a reputable financial news outlet (coindesk) and details a significant funding round with named investors (qed investors, left lane capital), indicating reliable reporting.

Neutral

The news focuses on the growth and funding of a stablecoin payments platform, which is a positive development for the stablecoin ecosystem overall. however, it does not directly cause a price fluctuation for individual stablecoins, which are designed to maintain a peg to a fiat currency.

#stablecoin

#payments

#kast

Low

The news concerns bithumb, a south korean exchange, facing a potential 6-month partial ban for aml breaches. while bithumb is a significant exchange, the ban is partial and only affects new users. this is unlikely to have a major direct impact on the price of bitcoin itself, but could sentimentally affect the broader south korean crypto market.

High

The report cites local media and the financial intelligence unit (fiu) of south korea's financial services commission, which are official regulatory bodies. the details provided, including the nature of the proposed sanctions and previous similar actions against other exchanges like upbit, lend credibility to the report.

Neutral

The news is regulatory and specific to one exchange's operational restrictions, not a fundamental change in bitcoin's utility or adoption. the partial nature of the ban limits its market-moving potential. while negative sentiment can arise, it's unlikely to cause a significant directional shift for bitcoin as a whole.

#btc

#regulation

#cryptonews

Low

While samson mow is a prominent figure and his prediction of saylor acquiring one million bitcoin is noteworthy, the core event is michael saylor's ongoing accumulation strategy, which is already priced into the market. the news of a specific target for this accumulation, especially when the price is below previous thresholds, reinforces the existing bullish sentiment but doesn't introduce entirely new price-driving information.

Med

Samson mow is a known bitcoin maximalist and ceo of jan3, a company focused on bitcoin adoption. his opinions carry weight within the crypto community. however, predictions, especially price targets and accumulation figures, are inherently speculative. the 'trustworthiness' is moderate because while his insights are informed, they are still projections.

Bullish

The news reinforces the scarcity narrative of bitcoin, with only one million coins left to be mined. michael saylor's continued accumulation, even after surpassing a significant milestone (500,000 btc), suggests strong conviction from a major player. this, coupled with mow's bullish outlook, contributes to a generally positive sentiment for btc.

#btc

#bitcoin

#samsonmow

High

Upcoming us cpi, jobless claims, and pce data, along with geopolitical tensions impacting oil prices, are significant macroeconomic and geopolitical events that can heavily influence bitcoin's price due to their effect on inflation expectations and risk sentiment.

High

The analysis is based on well-established economic indicators (cpi, jobless claims, pce) and current geopolitical events (iran tensions affecting oil prices), which are widely recognized as having a substantial impact on financial markets, including cryptocurrency.

Neutral

The market is currently in a 'holding pattern' with bitcoin consolidating around $68,000. the upcoming data could lead to either increased inflationary pressure (bearish) or a more favorable inflation outlook (bullish), creating a period of uncertainty until the results are known.

#btc

#cpi

#inflation

Med

Coinbase ceo brian armstrong's vision for crypto in capital formation and fundraising, while positive for the broader crypto ecosystem and startups, has a moderate direct impact on specific coin prices like btc and eth. the innovation could indirectly boost adoption and utility, which is bullish long-term, but immediate price reactions are likely muted as it's a forward-looking statement.

High

Brian armstrong is the ceo of coinbase, a major cryptocurrency exchange, and his statements carry significant weight and insight into the industry's direction. the information about futures contracts being available on coinbase in europe is also verifiable and directly impacts trading opportunities.

Bullish

The commentary suggests a future where crypto significantly streamlines fundraising, potentially leading to more startups and increased adoption of blockchain technology. the introduction of futures contracts on coinbase in europe also provides new trading avenues and could increase demand for underlying assets like btc and eth.

#crypto

#coinbase

#capitalformation

Med

The u.s. treasury's acknowledgment of legitimate uses for crypto mixers and privacy tools, while still emphasizing concerns about illicit finance, could lead to more nuanced regulatory frameworks. this might reduce the perceived risk associated with privacy-enhancing technologies and potentially benefit projects focused on privacy or those utilizing mixers for legitimate purposes. however, the continued focus on aml/kyc implies that outright anonymity will likely remain restricted. stablecoins could see indirect benefits from increased clarity and potential for wider adoption if regulatory concerns are addressed.

High

The u.s. treasury department's reports and policy statements are highly influential in shaping regulatory landscapes and market sentiment. their acknowledgment, even with caveats, of legitimate uses for privacy tools carries significant weight.

Neutral

The announcement is a mixed bag. while it signals a potential softening on privacy tools, it also reiterates concerns about illicit finance and calls for stronger aml/kyc. this could lead to a more balanced regulatory approach rather than a strong bullish or bearish push. the market may wait for further concrete legislative actions or regulatory guidance before reacting decisively.

#cryptoregulation

#privacy

#defi

High

A significant purchase of $1.3 billion worth of bitcoin by a major corporate buyer like strategy (microstrategy) demonstrates strong conviction and can absorb a substantial amount of sell-side liquidity, potentially driving up the price.

High

The information is based on a form 8-k filing with the u.s. securities and exchange commission (sec), which is a reliable and official source for corporate disclosures. michael saylor's previous tease also aligns with this official filing.

Bullish

Large-scale accumulation by a well-known bitcoin proponent like strategy often signals confidence in the asset's future value. this sustained buying pressure, especially when financed through stock offerings, can lead to upward price momentum.

#BTC

#MicroStrategy

#Bullish

Low

While higher oil prices can contribute to inflation, the article suggests that the impact on consumer prices (cpi) is less significant than on producer prices (ppi) due to the structure of the us economy and the relatively small weight of energy in the cpi. additionally, deflationary forces like ai and robotics, along with the resilience of the economy, are expected to counteract significant inflation.

High

The analysis cites reputable sources like the world bank and the federal reserve, and references commentary from the wall street journal. it also presents a balanced view by acknowledging the relationship between oil and inflation while providing counterarguments and contextual information.

Neutral

The article does not directly predict the price movement of any specific cryptocurrency. it focuses on the economic implications of oil prices and inflation.

#OilPrices

#Inflation

#Economy

High

Michael saylor's microstrategy is a significant institutional holder of bitcoin. their substantial purchase of $1.3 billion signals strong conviction and can lead to increased demand, potentially driving prices up. it also reinforces bitcoin's narrative as a digital store of value.

High

This information comes from a direct filing by microstrategy, which is a public company. michael saylor is a well-known bitcoin advocate, and his company's actions are generally transparent and reported by major financial news outlets.

Bullish

The purchase itself represents significant buying pressure. coupled with the broader market sentiment from middle east conflict potentially benefiting bitcoin as a safe haven, this news is likely to be bullish for bitcoin's price.

#btc

#microstrategy

#institutionaladoption

High

Xrp experienced a significant outflow of $30.3 million from etfs, indicating a potential institutional shift away from the asset, which could lead to further price decreases.

High

The information comes from a coinshares report, a reputable source for digital asset fund flows, making the outflow data reliable.

Bearish

The substantial outflow suggests profit-taking and cooling institutional interest, which typically puts downward pressure on the price.

#XRP

#ETFs

#Sell

Med

The golden cross is a bullish technical indicator suggesting a potential upward trend. the significant 87% volume increase, driven by derivatives and whale activity, further supports this. however, the rsi at 40.94 indicates some bearish pressure, and sustained interest is needed.

Med

The article cites technical indicators like the golden cross and volume changes, along with specific data from coinmarketcap and mentions of whale activity. however, it also includes a disclaimer and discusses a very long-term price prediction ($1.60 by 2026) which adds a layer of speculation.

Bullish

The formation of a golden cross, coupled with a substantial surge in trading volume and whale accumulation, points towards a potential rebound and upward price movement for dogecoin.

#DOGE

#GoldenCross

#Crypto

High

The ongoing middle east conflict is causing traditional markets like stocks and gold to decline, while bitcoin is showing resilience and even outperforming them. this suggests a potential shift in investor sentiment, with bitcoin acting as a 'digital gold' or a safe haven asset, especially with institutional demand showing signs of returning.

Medium

The article provides data comparing bitcoin's performance against gold, silver, nasdaq 100, and s&p 500 since the conflict began. it also mentions indicators like the 'coinbase premium' and etf inflows, which are generally reliable for gauging institutional interest. however, the geopolitical situation is volatile, making definitive predictions challenging.

Bullish

Bitcoin has already climbed 3.5% since the conflict started, outperforming traditional safe havens. the return of the coinbase premium and steady etf inflows indicate that large u.s. investors are potentially seeing current prices as an attractive entry point, suggesting upward momentum.

#BTC

#MiddleEastConflict

#DigitalGold

Med

Bitcoin has remained steady despite broader market panic driven by oil price surges and geopolitical tensions. however, key levels at $60,000 and $75,000 are critical; a break beyond these could trigger increased volatility.

High

The article is based on market data, analysis from derivatives experts (amberdata), and current geopolitical events, providing a multi-faceted view.

Neutral

Bitcoin is currently trading within a defined range ($60k-$75k). while it has shown resilience, the market makers' short gamma positions at the boundaries suggest potential for amplified price movements in either direction if these levels are breached.

#btc

#crypto

#volatility

Med

The news is about a court case involving binance and terrorist financing allegations. while the case was dismissed, it highlights ongoing scrutiny of major exchanges. this could indirectly affect broader market sentiment and potentially the price of bitcoin (btc) and other cryptocurrencies if similar concerns were to arise or persist.

High

The article is based on a court opinion from the u.s. district court for the southern district of new york and cites specific legal acts (anti-terrorism act, jasta). it also references 'strict editorial policy' and 'meticulously reviewed' content, suggesting a high standard of reporting.

Neutral

The court's dismissal of the case is positive for binance and reduces immediate legal pressure. however, the article notes that binance is still under intense scrutiny and plaintiffs have time to refile. this creates uncertainty rather than a clear bullish or bearish signal for btc.

#btc

#binance

#regulation

High

This partnership between nasdaq and kraken is a significant development for the tokenization of traditional assets. it brings legitimacy and broader adoption to blockchain technology within traditional finance. if successful, it could pave the way for other major financial institutions to explore similar ventures, potentially increasing demand for cryptocurrencies used in settlement or as underlying assets for tokenized products.

High

Nasdaq is a reputable global financial market, and kraken is a well-established cryptocurrency exchange. their collaboration on tokenized stocks indicates a serious intent to bridge traditional and digital assets. the involvement of a major exchange like nasdaq lends significant credibility to the initiative.

Bullish

The tokenization of stocks could lead to increased institutional adoption of blockchain technology and digital assets. this could drive demand for cryptocurrencies and potentially boost the prices of major coins like bitcoin, which is often seen as a store of value and a gateway into the digital asset space. the increased efficiency and accessibility promised by tokenized stocks might attract new capital into the crypto ecosystem.

#btc

#tokenization

#crypto

High

The u.s. inflation data on march 11 is the primary catalyst this week. higher-than-expected inflation could lead to the federal reserve delaying interest rate cuts, dampening market sentiment across all risk assets, including cryptocurrencies. conversely, lower inflation could boost confidence. polkadot's upgrade is a significant event for its ecosystem, potentially increasing demand for dot. solstice and kamino's announcement, while vague, could also generate interest if it's a substantial development.

High

The article clearly outlines upcoming events and their potential market impact, citing specific dates and key economic indicators. the geopolitical context adds further weight to the inflation data's importance.

Neutral

The short-term direction is uncertain due to conflicting factors. inflation data is a major wildcard. while polkadot's upgrade is bullish for dot, overall market sentiment driven by macroeconomics will likely dictate the broader crypto market's direction. any positive news from solstice/kamino could offer localized bullishness.

#cryptonews

#inflation

#polkadot

High

Bitcoin showed resilience by rising as oil prices spiked and equities dropped, indicating it's becoming a perceived safe haven in times of geopolitical uncertainty and traditional market turmoil.

Med

The analysis relies on market reactions and expert commentary, which are generally reliable indicators, but future price movements can be influenced by unforeseen events.

Bullish

The article highlights bitcoin's relative strength against traditional assets like gold and equities during a period of market stress, suggesting a positive short-term outlook.

#BTC

#Crypto

#Geopolitics

Med

William shatner clarifying that x money is fiat, not crypto, dampens immediate speculation about x integrating crypto payments. however, elon musk's persistent confirmation of dogecoin's 'inevitable' trip to the moon via the doge-1 mission still provides a bullish outlook for doge itself.

High

William shatner's direct tweet from his verified account and elon musk's continued affirmations on the doge-1 mission make the information highly reliable.

Bullish

Despite the x money news being fiat-focused, the sustained commitment from elon musk towards the doge-1 mission and the 'inevitable' moon journey for doge creates positive sentiment and potential for price appreciation for dogecoin.

#doge

#elonmusk

#crypto

Med

Nigel farage's investment in stack btc is a positive signal for the company and potentially for bitcoin adoption in the uk. however, his personal stake, while notable, is unlikely to cause a significant immediate price movement in bitcoin itself.

Med

The news is from a reputable crypto news source (coindesk) and details a specific financial transaction. the involvement of a political figure and a former chancellor adds a layer of interest, but the direct impact on bitcoin's global market price is limited.

Bullish

The news suggests increased interest and potential for wider adoption of bitcoin in the uk through a publicly listed company. farage's stated long-term support for bitcoin and the uk positioning itself as a crypto hub are bullish indicators for the asset.

#BTC

#UKCrypto

#Adoption

High

The war token experienced a dramatic 100% surge followed by a 20% crash, indicating extreme volatility. this is further exacerbated by a single entity controlling 31% of the tokens, which could lead to significant price manipulation or rapid sell-offs.

Low

The article explicitly states the token's price is purely narrative-driven and does not track geopolitical events through any technical mechanism. the core value proposition is speculative and tied to news cycles, making it highly unreliable.

Neutral

Given the token's extreme volatility and its reliance on external geopolitical narratives, predicting a sustained bullish or bearish trend is impossible. the price is likely to continue fluctuating dramatically based on sensational news.

#war

#politifi

#solana

Med

The article suggests that key indicators are converging, potentially weakening selling pressure and forming a recovery base. this could lead to a price rebound, but the overall trend is still technically bearish, limiting the immediate impact.

Med

The analysis is based on technical indicators like ascending support lines and emas, which are standard trading tools. however, it relies on interpreting chart patterns and future price movements, introducing some subjectivity.

Bullish

The article points to signs of a potential recovery, including higher lows, buyer absorption of selling pressure, and converging emas. this suggests a possible upward movement if key resistance levels are broken.

#XRP

#Crypto

#TechnicalAnalysis

Med

The clarity act aims to provide regulatory certainty for digital assets, which could encourage institutional investment. however, the disagreement over stablecoin rewards is causing delays, creating uncertainty. if the bill passes, it could boost adoption and prices. if it fails or moves overseas, it might hinder us-based innovation.

High

Christopher giancarlo is a former cftc chair and a respected figure in the regulatory space. his insights carry significant weight regarding policy impacts on the crypto market.

Neutral

The current deadlock and differing interests between banks and crypto firms create a neutral outlook. while regulatory clarity is generally bullish, the specific issues being debated (stablecoin rewards) could lead to either positive or negative outcomes depending on the final legislation.

#cryptoregulation

#clarityact

#stablecoins

High

A significant portion of bitcoin supply (43%) being in loss indicates potential selling pressure as investors may exit positions to cut losses. this metric historically aligns with bear market conditions.

High

The analysis is based on on-chain data (utxo distribution) from a cryptoquant contributor, darkfost, who is presented as an industry expert. the methodology is explained, and historical data is referenced to support the claims, aligning with the news source's stated editorial policy of accuracy and impartiality.

Bearish

With 43% of supply in loss and the market nearing historical bear territory (historically 75% in profit marks a bull trend boundary), the price is likely to face downward pressure. further supply entering loss could deepen corrections.

#btc

#onchain

#crypto

Med

The surge in bitflyer volume and btc's rise against the jpy suggests increased interest in btc as a safe haven or alternative asset during regional stock market instability. however, the impact is limited as it's specific to japanese trading and influenced by yen weakness.

Med

The article cites coingecko data for volume comparisons and tradingview for price action, which are generally reliable sources for crypto market data. the analysis links trading activity to geopolitical events (oil prices, iran war) and macroeconomic factors (yen weakness), providing a plausible explanation.

Bullish

Bitcoin showed a stronger performance against the japanese yen than against the usd or korean won. this, coupled with the surge in trading volume on a japanese exchange during a stock market sell-off, indicates a positive short-term sentiment among japanese traders looking to hedge against local market risks.

#BTC

#JPY

#Crypto

High

The potential release of strategic oil reserves by g7 nations to counteract price surges driven by geopolitical conflict has a significant impact on oil-related markets and potentially broader financial markets due to oil's influence on inflation and global economics. while this directly affects oil futures, indirect impacts on inflation-sensitive assets or assets that perform well during geopolitical instability could occur.

High

The information comes from a reputable financial news source (coindesk) reporting on discussions among g7 finance ministers and the international energy agency. the swift price reversal on hyperliquid validates the immediate market reaction to these reports.

Neutral

The news describes a sharp pullback in oil prices from a spike due to reports of a potential g7 intervention. while this intervention is intended to stabilize prices, the ultimate direction will depend on the scale of the release and the ongoing geopolitical situation. for cryptocurrencies, the impact is less direct and could be influenced by overall market sentiment towards risk assets.

#oil

#geopolitics

#markets

Med

Bitcoin is showing resilience against a major sell-off in asian markets triggered by energy price spikes. however, contagion risk to us markets could challenge this stability.

Med

The article cites a specific bitcoin analyst (willy woo) with a clear thesis, but also acknowledges the uncertainty of broader market contagion. the immediate price action is described, but future predictions are speculative.

Neutral

Btc is currently holding steady and trading in the green, attempting to establish higher support. however, the potential for broader market declines creates uncertainty, preventing a clear bullish or bearish call.

#btc

#crypto

#marketcrash

High

The analysis suggests a potential significant crash for cardano's ada token, with an analyst predicting a fall to specific support levels. the historical data of consecutive red months and current bearish indicators amplify this concern.

Med

The article cites a crypto analyst, lingrid, and provides specific price levels ($0.26, $0.27) as reference points. it also references data from cryptorank for historical monthly performance, which adds some credibility. however, the reliance on a single analyst's prediction and the speculative nature of market analysis introduce some uncertainty.

Bearish

The analyst points to the failure of bulls to reclaim control, ada trading below key support at $0.26, and rejection at this level as strong indicators of continued downward pressure. the historical trend of five consecutive red monthly closes further supports a bearish outlook.

#ADA

#Cardano

#Crypto

Low

While the u.s.'s relative insulation from oil shocks is a positive for bitcoin's correlation with u.s. risk assets, the broader market sentiment and potential for delayed inflation are factors that prevent a higher impact.

High

The analysis is based on reputable financial news sources (coindesk, jp morgan notes) and clearly outlines the causal links between oil prices, u.s. economic conditions, and bitcoin's behavior as a risk asset. the explanation of u.s. oil export status is factual.

Neutral

Bitcoin is currently trading like a u.s. risk asset and has remained relatively stable due to u.s. insulation. however, the potential for lagged inflation and broader market uncertainties introduce conflicting pressures, leading to a neutral short-term outlook.

#BTC

#OilShock

#RiskAsset