Med

The news of layoffs and the potential shift in ethereum's l2 strategy could create uncertainty for op, impacting its value. however, the core technology is still widely used, and the layoffs are stated to be for focus rather than financial distress.

High

Bearish

Layoffs and a potential shift away from its core technology by a major partner (base) are negative signals. while not a complete collapse, it suggests short-term headwinds and potential investor concern.

#optimism

#op

#eth

Low

While $3.5 million in crypto was frozen, this amount is relatively small compared to the total market capitalization of major cryptocurrencies. the disruption of a proxy network primarily impacts illicit activities rather than direct market trading.

High

Neutral

This news is related to law enforcement actions against cybercrime and does not directly affect the fundamental supply or demand of major cryptocurrencies for legitimate users. it may indirectly deter some illicit use of crypto, but the market impact is likely negligible.

#Crypto

#Cybersecurity

#LawEnforcement

High

The article highlights a significant contraction in the memecoin sector, with market cap falling from $150b to $31b. this indicates a major shift in investor sentiment and risk appetite away from these speculative assets, impacting all memecoins.

High

Bearish

The article details a sharp decline in the total market capitalization of memecoins and describes the technical structure as 'weak' with moving averages sloping downward. this suggests a bearish trend for the memecoin sector.

#memecoin

#crypto

#doge

High

Bitcoin's recent ~6% gain during a period of geopolitical tension, outperforming traditional safe-haven assets like gold and equities, indicates a significant shift in investor perception and asset allocation strategies.

High

Bullish

Bitcoin's resilience and gains during geopolitical turmoil, combined with consistent institutional inflows into digital asset products, suggest a growing preference for bitcoin as a hedge against instability, indicating a bullish trend.

#btc

#geopolitics

#digitalassets

High

The article criticizes the current state of crypto, highlighting its lack of everyday utility, poor user experience, and speculative nature. this fundamental critique suggests a prolonged period of stagnation or decline in adoption and potentially prices if significant improvements aren't made.

Med

Bearish

The core argument is that crypto has failed to solve everyday problems and is primarily used for speculation. this lack of tangible utility, coupled with a poor user experience and the proliferation of complex financial instruments, is presented as a major barrier to mass adoption and sustainable price growth.

#crypto

#utility

#adoption

Med

Alkimi's adfi platform built on sui aims to revolutionize online advertising by reducing fraud and intermediary fees. while promising, widespread adoption and revenue generation for sui are not yet guaranteed. the success of alkimi's platform directly influences demand for sui's network.

Med

Bullish

Increased adoption and success of alkimi's adfi platform on sui could lead to greater demand for sui tokens to facilitate transactions and utilize the network. the potential for disruption in the large online advertising market provides a significant growth opportunity.

#SUI

#AdFi

#Blockchain

Low

The ban on a potential us cbdc until 2031 does not directly impact existing stablecoins like usdt or usdc, as they are privately issued. however, it might indirectly reduce the urgency for private stablecoin innovation in the us for a period, as regulatory uncertainty around a government-backed digital dollar is lessened.

High

Neutral

The ban is on a *potential* us cbdc, not on existing stablecoins. while it removes a potential future competitor, it doesn't directly affect the current utility or demand for stablecoins. the focus is on government-issued digital currency, not private ones.

#cbdc

#usdt

#usdc

Med

The news highlights eightco's investments in ai and blockchain, specifically mentioning ethereum and worldcoin. the significant fundraise and board additions from bitmine and ark invest suggest increased institutional interest and validation for companies operating in the blockchain and ai space, which could indirectly benefit ethereum as a foundational technology. however, the direct impact on eth price is not immediate and depends on eightco's future developments.

High

The information comes from reputable financial news sources and includes direct quotes from key figures like tom lee (bitmine) and cathie wood (ark invest), adding significant credibility to the report.

Bullish

The substantial fundraise of $125 million, coupled with strategic investments in ai and blockchain projects, and the addition of influential figures to the board, indicates positive future prospects for eightco. this positive sentiment and increased investment in the sector, including ethereum, can lead to a bullish outlook.

#ETH

#AI

#Blockchain

High

The article proposes a scenario where xrp's price could reach $3,700 if a significant portion of the global financial settlement volume, currently processed by entities like dtcc, were to flow through xrp as a liquidity bridge. this represents a massive potential demand increase.

Medium

The article cites a crypto analyst ('x finance bull') and points to the involvement of former dtcc and us treasury officials in ripple as reasons to believe in its potential. while these are positive signals, the price targets are highly speculative and depend on many unproven assumptions about xrp's adoption and future market structure.

Bullish

The analysis presented in the article is inherently bullish, outlining a path to extremely high xrp prices based on capturing a fraction of the global financial settlement market. the involvement of high-profile individuals and the perceived limitations of existing financial infrastructure support this optimistic outlook.

#xrp

#ripple

#crypto

Med

The news highlights a significant miscalculation by the gemini exchange bosses, the winklevoss twins, leading to substantial financial losses for their company. this reflects poorly on the broader crypto market sentiment and management, potentially influencing investor confidence.

High

The report is attributed to the information, a reputable publication known for its in-depth business reporting. the details provided are specific and align with general market trends observed.

Bearish

Gemini's ipo timing coincided with a severe bear market, leading to plummeting trading volumes and revenue. the company's valuation has dropped significantly, indicating a negative impact on the market perception of crypto-related businesses, which could indirectly affect bitcoin's price.

#BTC

#Gemini

#Crypto

Low

The senate's vote to ban cbdcs until 2030 is a policy development that could be perceived as positive for stablecoins like usdt and usdc, as it removes a potential competitor. however, the bill faces uncertainty in the house and president trump's stance adds further doubt, limiting immediate price impact.

Med

The news is from a reputable financial news outlet (coindesk) and details a concrete legislative action (senate vote). however, the outcome is uncertain due to potential hurdles in the house and the president's position, which lowers the overall trustworthiness of a definitive price impact.

Neutral

While a ban on cbdcs could indirectly benefit stablecoins by reducing competition, the overall legislative uncertainty, potential political roadblocks, and the fact that stablecoins are already established and widely used means there is no clear immediate bullish or bearish pressure on their prices. the market may wait for more clarity.

#cbdc

#stablecoin

#regulation

Med

While the layoffs are framed as a strategic refocus rather than financial distress, any news of restructuring within a core development team of a prominent layer-2 solution can create short-term uncertainty and affect investor sentiment.

High

The information comes directly from the ceo of op labs and is corroborated by the reporting from coindesk, a reputable crypto news outlet. the ceo's statement about financial runway and narrowing focus appears transparent.

Bearish

Layoffs, even when explained as strategic, often lead to a temporary dip in token price due to market perception of instability or reduced development velocity. the article also notes the op token is already down 3%.

#op

#optimism

#ethereum

Med

Vitalik buterin's vision shift for ethereum from pure speculation to a foundational technology stack could attract new use cases and developers, positively impacting eth's long-term value. however, the impact might be gradual as the ecosystem adapts.

High

Vitalik buterin is a co-founder of ethereum and a leading figure in the crypto space. his pronouncements on the future direction of the network carry significant weight and are generally considered highly reliable.

Bullish

The redefinition of ethereum's core values towards utility as a global bulletin board, spam prevention mechanism, and a convenient smart contract platform, backed by upgrades like peerdas, suggests increased demand for eth for these functionalities. this could lead to a bullish price movement.

#eth

#vitalikbuterin

#ethereum

Med

While binance is delisting 21 altcoins, these tokens were on binance alpha, which is an experimental platform. this suggests they were not widely traded or fully launched on the main binance platform, limiting the direct impact on major cryptocurrencies. however, it indicates binance's commitment to quality control, which can be a positive signal for the broader market.

High

Binance is the world's largest exchange and regularly reviews its listings to maintain standards. delisting underperforming or high-risk assets is a common practice for exchanges. the announcement details specific tokens and the rationale (not meeting listing standards), lending credibility to the news.

Neutral

The delisted coins themselves will likely see a significant price drop or become illiquid on binance. however, for major coins like btc, eth, or bnb, the impact is expected to be neutral. the news might even be perceived as slightly bullish for binance's reputation as a quality-controlled exchange, but it doesn't directly trigger buying pressure for other listed assets.

#Binance

#Crypto

#Altcoins

Low

The burning of rlusd tokens, while a regular occurrence for stablecoins to manage supply, does not directly impact the price of other cryptocurrencies like xrp or eth. it primarily affects the rlusd supply itself, aiming to maintain its peg. the news is more operational than market-moving for other assets.

High

The information comes from a stablecoin tracker and is linked to a specific transaction hash on the ethereum blockchain, making it verifiable. ripple's involvement is direct, and the reporting seems factual.

Neutral

Token burns are a standard mechanism for stablecoins to manage their circulating supply and maintain their peg to the underlying asset (in this case, usd). this specific event doesn't signal a fundamental change in rlusd's value proposition or any significant shift in market sentiment that would directly cause a price movement in other cryptocurrencies.

#rlusd

#ripple

#stablecoin

Med

While only 8-10% of bitcoin's hashrate is directly tied to oil-sensitive power markets, broader macroeconomic impacts from geopolitical shocks can lead to risk-off sentiment affecting btc prices more significantly than mining costs.

High

The analysis is based on research from luxor's hashrate index, a reputable source for bitcoin mining data. the reasoning is logical, distinguishing between direct operational costs and indirect market sentiment effects.

Neutral

The immediate impact on mining costs is limited, but the potential for broader market downturns due to geopolitical instability introduces bearish pressure. however, bitcoin has shown resilience around the $70,000 level, suggesting a neutral short-term outlook pending further developments.

#btc

#oil

#mining

Med

Shiba inu has seen a 4.2% rally, overtaking zcash in market cap ranking. while this shows positive short-term momentum for shib, the overall market is described as being in an accumulation phase, suggesting this might be a localized surge rather than a broad market trend.

Med

The article notes that the drivers behind the surge are unclear and that trading volume is declining, despite a majority of top traders on binance being long on shib. this suggests a potential lack of strong fundamental backing for the rally.

Bullish

The direct price action shows a 4.2% gain and a move up in market cap ranking, indicating a bullish sentiment for shib in the short term.

#shib

#shibainu

#crypto

Low

The update on shibarium block syncing (41% indexed) is a technical progress report. while positive for the network's functionality and addressing past display issues, it doesn't immediately translate to significant price changes. the market is likely to view this as ongoing development rather than a catalyst for a major price movement.

Med

The information is derived from a shibariumscan explorer notice and tweets from a shiba inu team member (lucie). this provides a reasonable level of confidence, but 'med' is chosen because explorer indexing is a technical process that can be subject to interpretation and doesn't represent direct market sentiment or a major fundamental shift.

Neutral

The news indicates ongoing development and recovery for shibarium, which is a positive sign for the ecosystem's long-term health. however, the current price action (up 1.61%) is modest and reflects gradual adoption and recovery rather than a strong bullish or bearish trend driven by this specific update. the market is likely waiting for more substantial developments or a broader crypto market upturn.

#SHIB

#Shibarium

#Crypto

Low

The lawsuit targets jpmorgan for its alleged role in a ponzi scheme, not directly impacting bitcoin's fundamental value. while it highlights risks in the crypto space, it's unlikely to cause a significant short-term price movement for btc itself.

Med

The lawsuit is based on allegations and legal proceedings are ongoing. the claims are serious, but without a verdict or further evidence, the trustworthiness of the accusations against jpmorgan is medium.

Neutral

This news is about a specific alleged ponzi scheme and the banking infrastructure used, not a broad market trend or technological advancement affecting bitcoin's price. the market is more likely to remain focused on macroeconomic factors and broader crypto adoption trends.

#btc

#crypto

#regulation

Med

Bitcoin is holding strong above $70,000 despite a broad market sell-off driven by surging oil prices and credit issues. while this resilience is positive, the broader market sentiment is bearish, which could eventually drag bitcoin down if the geopolitical and financial instability intensifies.

High

The information is derived from multiple reputable sources like coindesk, and quotes from industry experts and financial news outlets, providing a balanced view of the market dynamics.

Neutral

Bitcoin is currently showing resilience by holding the $70,000 level, which is a bullish sign. however, the broader market is experiencing a sell-off due to geopolitical tensions and credit worries, which introduces bearish pressure. the neutral stance reflects the current equilibrium between these opposing forces.

#BTC

#CryptoMarket

#Geopolitics

Low

While quantum computing poses a long-term theoretical risk to bitcoin's cryptography, ark invest's analysis indicates that current technology is not a threat and any future risk would likely be gradual, allowing for network upgrades. this mitigates immediate price impact.

High

Ark invest, led by cathie wood, is a reputable investment management firm with significant research capabilities in emerging technologies. their analysis, co-authored with unchained, provides a detailed and reasoned perspective on a complex technical issue.

Neutral

The report concludes that quantum computing is a long-term risk and not an imminent threat. this suggests that the news itself is unlikely to cause significant short-term price fluctuations in either direction, maintaining a neutral outlook for immediate price action.

#btc

#quantumcomputing

#arkinvest

Low

This news pertains to prediction markets and regulatory guidance, not directly to specific cryptocurrencies like bitcoin or ethereum. while the crypto industry benefits from regulatory clarity, this specific development has a limited direct impact on coin prices.

High

The information comes from a reputable financial news source (coindesk) and details official actions by a u.s. regulatory body (cftc), making it highly reliable.

Neutral

The guidance aims to provide clarity and structure to prediction markets, which could foster growth in regulated platforms. however, it doesn't directly signal a price movement for major cryptocurrencies. it's more about the framework for financial products.

#regulation

#cftc

#predictionmarkets

Low

Vitalik's comments suggest a shift in perspective for ethereum's utility, focusing on its role as a data storage layer rather than just a platform for complex smart contracts. while this is a fundamental re-evaluation, the immediate price impact is likely to be low as it doesn't introduce new revenue streams or fundamentally alter the current demand drivers for eth in the short term. it's more of a long-term philosophical guidance.

High

Vitalik buterin is the co-founder of ethereum and a leading visionary in the crypto space. his opinions carry significant weight and are often influential in shaping development and community sentiment.

Neutral

The statement emphasizes ethereum's utility as a 'bulletin board' or 'global shared memory.' this perspective doesn't directly translate to immediate increased demand for eth for transaction fees or staking, which are primary price drivers. while it reinforces the value proposition of the network, it's a nuanced point that may not immediately excite speculative traders looking for rapid price appreciation.

#eth

#vitalikbuterin

#blockchain

High

Blackrock launching a staked ethereum etf (ethb) with a significant fee cut (0.12% for the first year/ $2.5b) and offering staking rewards directly to investors is a major development. this could attract substantial capital from existing ethereum etfs and new investors seeking yield, increasing demand for eth.

High

Blackrock is a massive financial institution with a proven track record in managing vast assets. the details of the etf's structure, including fee cuts and staking reward distribution, are clearly outlined, making the information reliable.

Bullish

The introduction of a yield-generating etf by a major player like blackrock is expected to drive demand for eth. investors might rotate from non-staked etfs to ethb, and the fee cut makes it more attractive, potentially leading to price appreciation.

#eth

#blackrock

#cryptoetf

Med

Burning a significant amount of stablecoins like rlusd can reduce the circulating supply. this can potentially lead to increased scarcity and demand, which might support the price of rlusd, especially if its peg to a fiat currency is strong. however, the direct price impact on rlusd itself is generally limited as stablecoins aim to maintain a fixed value. the impact is more on the ecosystem's liquidity and potential for wider adoption.

High

The information is directly from ripple's actions and publicly available blockchain data (burn transactions). the article cites specific transaction details and mentions a partnership with mastercard, adding credibility.

Neutral

As rlusd is a stablecoin, its price is designed to remain pegged to a specific asset, typically usd. while burns affect supply, they are intended to maintain stability and manage liquidity rather than cause significant price appreciation or depreciation away from its peg. the focus is on adoption and utility, not price speculation.

#rlusd

#ripple

#stablecoin

Med

The article discusses dogecoin's significant drop from its ath and analyzes historical patterns suggesting potential for a rally when altseason mentions decrease. however, it also highlights that altcoin recovery is contingent on bitcoin's stability and faces short-term resistance levels.

Med

The information is based on data from coingecko and santiment, which are reputable crypto data providers. however, the analysis relies on historical patterns and speculation regarding x's payment feature, introducing some uncertainty.

Bullish

The article suggests a potential for a doge rally based on historical correlations between declining altseason chatter and price recoveries. while short-term resistance exists, the overall sentiment, coupled with potential positive developments like x's payment feature, leans towards a bullish outlook.

#doge

#altcoins

#crypto

Med

Binance joining mastercard's crypto partner program, alongside other industry leaders like ripple and paypal, aims to integrate crypto into everyday commerce. this could boost adoption for major cryptocurrencies used in transactions, potentially increasing their utility and demand.

High

The announcement comes directly from binance and mastercard, major players in the crypto and traditional finance space, making the information highly credible.

Bullish

The partnership is designed to increase the ease of spending cryptocurrencies for everyday purchases, which should lead to increased demand and potentially higher prices for major cryptocurrencies like btc, eth, and bnb that are likely to be supported.

#binance

#mastercard

#cryptoadoption

Med

The article highlights a bullish outlook on circle and its stablecoin usdc, driven by an analyst's report. while this suggests positive sentiment for usdc, its price is inherently stable. the impact is on the perceived value and adoption potential rather than direct price volatility.

Med

The analysis is based on a wall street analyst's report from william blair, which adds credibility. however, analyst ratings can be subjective and may not always reflect actual market performance.

Neutral

Usdc is a stablecoin designed to maintain a peg to the us dollar, so its price is expected to remain stable around $1. the bullish sentiment focuses on its market position and future utility, not its price fluctuations.

#USDC

#Stablecoin

#Crypto

High

Multiple analysts suggest bitcoin has not reached its bottom and predict further significant price drops. historical data on drawdowns is used to support this thesis, indicating potential for a substantial decline.

Med

The article cites multiple crypto analysts (leshka, doctor profit, julio moreno, benjamin cowen) and their recent analyses. however, price predictions in crypto are inherently speculative, and even expert opinions can be wrong. the editorial policy mentioned adds some credibility, but the core of the analysis relies on analyst forecasts.

Bearish

Analysts believe that based on historical drawdown percentages and current resistance levels not being overcome, bitcoin is likely to experience another significant drop, potentially to the $40,000-$50,000 range, despite current attempts at recovery.

#btc

#bearmarket

#crypto

Med

Lido is a major player in the defi space, and launching a new stablecoin yield product could attract significant capital. however, the stablecoin market is already competitive, and the impact might be diluted by existing offerings.

High

Lido is a well-established and reputable liquid staking protocol on ethereum, known for its security and reliability. the launch of a new product from such a prominent entity generally carries a high degree of trust.

Bullish

This product directly targets stablecoin holders by offering a simplified way to earn yield. increased demand for these stablecoins within lido's ecosystem could lead to a slight increase in their market value or at least stabilize their price against other assets.

#usdc

#usdt

#defi

Low

This article discusses accounting and auditing challenges for crypto assets in the us and eu. it does not directly mention any specific cryptocurrency or provide price predictions. the focus is on regulatory and accounting frameworks, which may indirectly influence the broader market over time but do not have an immediate price impact on specific coins.

High

The article is from coindesk, a reputable source for cryptocurrency news and analysis. it features contributions from ganna vitko, president of the toronto chapter of women in crypto, and aaron brogan of brogan law, lending credibility to the information presented.

Neutral

The article does not offer any price predictions or analyze the current market trends of any specific cryptocurrency. it focuses on the complexities of accounting and auditing for digital assets and the differing regulatory approaches between the us and eu.

#CryptoAccounting

#Regulation

#CryptoAdvisors

Med

The statement from avalanche's business chief suggests a strategic shift towards enterprise solutions and real-world problem-solving rather than pure speculation. this could attract more institutional adoption and diverse use cases, potentially boosting avax's long-term value. however, the immediate market reaction may be muted as the focus is on future utility rather than short-term price action.

High

The source is coindesk, a reputable crypto news outlet. the information is directly from avalanche's business chief, john nahas, making it a primary source for the company's strategy. the arguments presented are logical and align with broader industry trends towards enterprise blockchain solutions.

Bullish

The emphasis on building a robust business infrastructure, attracting enterprise clients, and solving real-world problems with tailored blockchain solutions positions avalanche for sustainable growth. this shift away from speculative hype towards tangible utility is a positive signal for long-term price appreciation.

#AVAX

#EnterpriseBlockchain

#RealWorldAssets

High

A 75% drop in development activity suggests a significant slowdown in innovation, bug fixes, and new feature rollouts across the entire crypto ecosystem, potentially leading to stagnation and reduced investor confidence.

Medium

The data is sourced from 'solid intel' and supported by charts showing a decline in commits and active developers. while the source is not universally recognized as a top-tier analytics firm, the reported figures and trends are plausible given the current hype around ai.

Bearish

Reduced development activity implies less innovation and slower adoption. if developers are flocking to ai, it suggests that the perceived future growth and opportunities are stronger in ai, which could divert capital and talent away from crypto, negatively impacting prices.

#cryptodev

#ai

#blockchain

Low

While the burn rate has increased, the amount burned is still a tiny fraction of the total circulating supply, making a significant price impact unlikely in the short term.

Medium

The data from shibburn is reliable for tracking burn events, but the interpretation of its market impact is subject to debate among analysts.

Neutral

The recent uptick in price is likely a short-term reaction to the news of the burn, but the overall bearish market pressure and massive supply will likely counteract any sustained bullish movement.

#SHIB

#ShibaBurn

#MemeCoin

Med

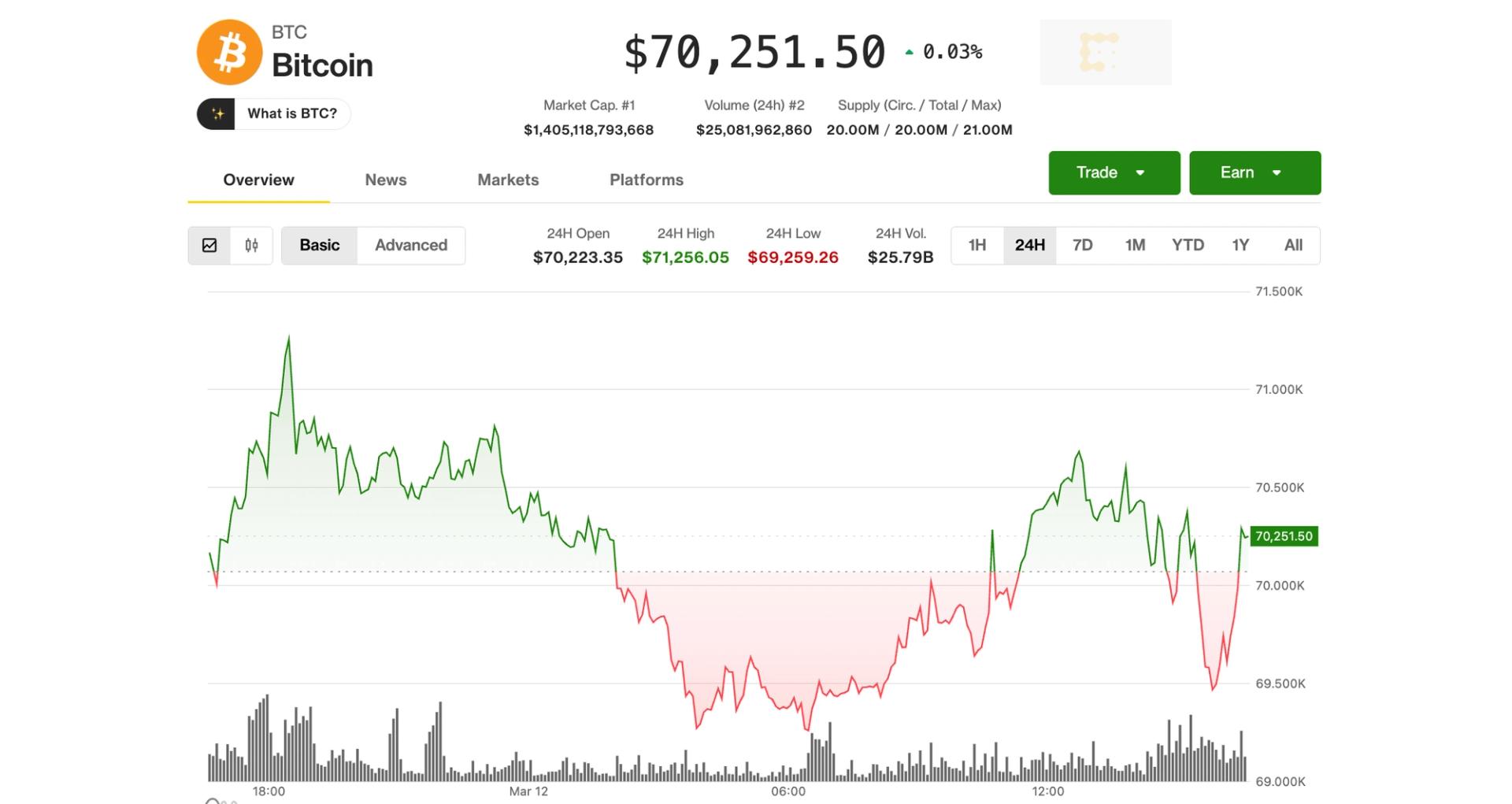

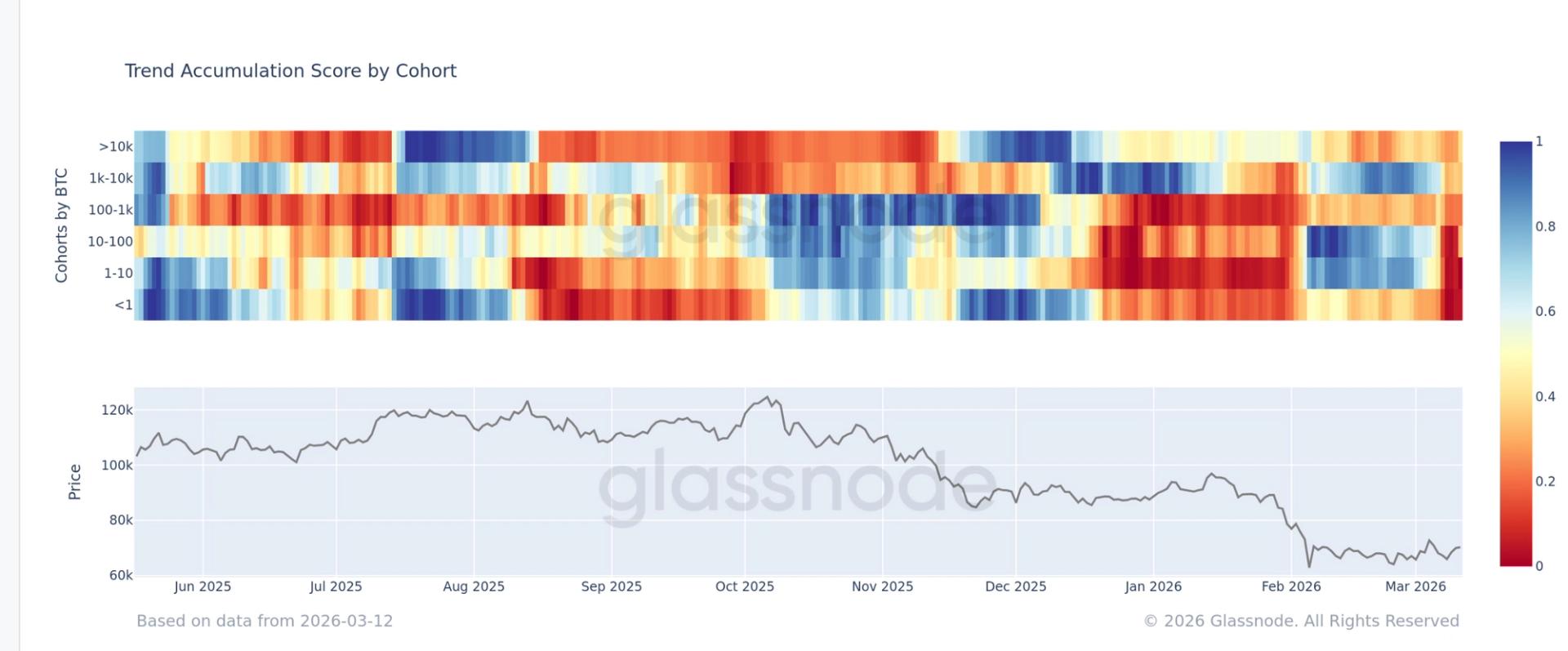

Selling pressure from various wallet sizes, particularly retail, is noted. however, bitcoin's resilience near $70,000 despite macro headwinds suggests underlying demand could absorb this selling.

High

Glassnode is a reputable on-chain analytics firm, and their accumulation trend score is a widely followed metric for understanding holder behavior.

Neutral

While selling is intensifying, the price holding strong near a significant psychological level ($70,000) indicates a potential tug-of-war between sellers and buyers, making the immediate direction uncertain.

#BTC

#Crypto

#OnChain

Low

Binance explaining the smallest unit of bitcoin (satoshi) is informational for new users but unlikely to directly impact btc's price in the short term. it doesn't introduce new market-moving information.

High

Binance is a major and reputable cryptocurrency exchange, and their explanations of fundamental concepts are generally accurate and reliable.

Neutral

The article focuses on the definition and utility of satoshis for smaller transactions, rather than providing predictions or catalysts for significant price movement. current price action details are also within a tight range.

#btc

#binance

#satoshi

High

The article links hype's performance directly to the surge in oil prices and geopolitical instability, with arthur hayes predicting a significant price increase ($150 by august 2026). this creates strong bullish sentiment for hype.

High

The information comes from reputable sources: hyperliquid's official announcements and analysis from well-known figure arthur hayes (co-founder of bitmex). the article also cites tradingview for price trends, adding credibility.

Bullish

The article highlights a recent 8% surge in hype's price, attributes it to rising oil prices and geopolitical events, and includes a bold prediction of a 300%+ increase by august 2026 from a respected industry figure.

#hype

#crypto

#oil

Med

The article mentions bitcoin as an alternative asset that could benefit from higher inflation. it also references a podcast discussing bitcoin market catalysts and ai's potential to trigger an 'explosion' in bitcoin's price, suggesting a positive outlook.

Med

The article cites a cfo's breakdown and mentions ai models for asset allocation, but the direct link between the strait of hormuz closure, rising inflation, and bitcoin's price movement is presented as a potential scenario rather than a confirmed correlation. the mention of ai triggering an 'explosion' is speculative.

Bullish

Bitcoin is listed as an 'alternative asset' that could perform well in an inflationary environment. the secondary mention of ai potentially triggering an 'explosion' further supports a bullish sentiment.

#BTC

#Inflation

#AlternativeAssets

High

The news of eightco's significant funding and strategic shift towards ai and blockchain, coupled with substantial investments in openai and mrbeast's ventures, directly impacts wld and eth due to eightco's large holdings in these cryptocurrencies. the direct investment in openai also creates a strong indirect positive sentiment for wld, as the worldcoin project is co-founded by openai's ceo and aims to use biometric verification to distinguish humans from ai.

High

The information is reported by coindesk, a reputable source for cryptocurrency news, and cites specific funding amounts, investors (ark invest, kraken), and direct investments in major entities like openai. the company update mentioned provides further validation.

Bullish

Eightco's $125 million funding commitment and its strategic pivot towards ai and blockchain, along with direct investments in openai and mrbeast's businesses, creates positive sentiment. the direct correlation of eightco's treasury with wld and eth suggests increased demand and potential price appreciation for these assets. the synergy identified between worldcoin (wld), openai, and mrbeast further amplifies this bullish outlook.

#wld

#eth

#ai

Med

A shift from net outflows to zero netflow for xrp etf products suggests a potential easing of selling pressure from institutional investors, which could support a price rebound. however, the lack of positive netflow means immediate strong upward pressure is unlikely.

Med

The data is based on sosovalue, a reputable crypto data aggregator. however, etf netflows are just one indicator, and other market factors can influence price. the analysis infers institutional sentiment, which is not explicitly stated.

Bullish

The cessation of outflows, combined with a bullish derivatives market and a bollinger bands squeeze, suggests that xrp may be consolidating for a potential upward move. the article mentions a target of $2 if bullish sentiment and volume recover.

#XRP

#CryptoETF

#Ripple

Med

Tether's investment in ark labs aims to enhance bitcoin's functionality for stablecoin transactions, which could increase demand for usdt and potentially boost bitcoin's utility as a payment network. however, the success of arkade is still unproven.

Med

Tether is a major player in the stablecoin market, and its strategic investments carry weight. ark labs' focus on bitcoin infrastructure is also a relevant development. however, the technology is new and its actual impact remains to be seen.

Bullish

This development could lead to greater adoption of stablecoins on the bitcoin network, increasing transaction volume and potentially driving up the value of both bitcoin and usdt as they become more integrated into payment systems.

#btc

#usdt

#stablecoins

Low

Polkadot (dot) experienced a minor drop of 2.3% as part of a broader market index (coindesk 20) which also saw a slight decline. this indicates a general market sentiment rather than a specific negative event for dot.

High

The information is directly from coindesk indices, a reputable source for crypto market data and analysis, and details specific performance metrics of the coindesk 20 index and its components.

Neutral

The 2.3% drop is a short-term fluctuation within a larger index that is also trading lower. without further context on market trends or specific news impacting dot, it's difficult to predict a sustained direction, suggesting a neutral short-term outlook.

#DOT

#Polkadot

#Crypto

Med

Tether's investment in ark labs, focusing on stablecoin revival on bitcoin, could boost bitcoin's utility beyond simple transactions and potentially increase demand for usdt if it is eventually integrated. however, the impact is moderated as it's an early-stage project and usdt integration isn't confirmed.

Med

Tether is a major player in stablecoins, and ark labs' focus on bitcoin infrastructure is innovative. the backing from anchorage digital also adds credibility. however, the success of arkade and the actual integration of usdt remain to be seen, which introduces some uncertainty.

Bullish

The news suggests an effort to bring more utility and stablecoin activity to the bitcoin network, which could be bullish for btc. if arkade becomes a successful platform for stablecoins like usdt, it could also lead to increased demand and a bullish outlook for usdt.

#btc

#usdt

#crypto

Low

While this partnership is positive for moonpay and exodus, the direct impact on the price of stablecoins like usdc is minimal, as it's an endorsement and not a large-scale adoption or burning mechanism.

Med

Moonpay and exodus are established players in the crypto space, and the x games is a reputable sports event. the partnership is likely genuine, but the scale of the bonus ($2,500 to 40 athletes) limits its potential market-moving influence.

Neutral

The news focuses on a specific promotional activity rather than a fundamental shift in the stablecoin market. the amount of stablecoins being distributed is small, and the primary benefit is exposure for the brands involved.

#stablecoin

#moonpay

#xgames

Med

Blackrock's launch of a new ethereum staking fund (ethb) offering 82% of staking rewards to investors is a significant development. this could attract more capital into ethereum staking, potentially increasing demand for eth. however, it directly competes with existing products like grayscale's ethe and eth, and the market has already priced in blackrock's entry into the spot ethereum etf space. the offering of staking rewards directly to investors, rather than just price appreciation, could be a unique selling point.

High

Blackrock is a leading global asset manager with a proven track record. their entry into the ethereum staking fund market, backed by robust partnerships with custodians like coinbase and established validators, lends significant credibility to the product. the transparency in reward distribution and fees further enhances trustworthiness.

Bullish

The direct offering of staking rewards by a major institution like blackrock is a strong incentive for investors to hold and stake eth through this product. this could lead to increased accumulation of eth and potentially reduce selling pressure as investors focus on earning yield. the fund's strategy to stake a significant portion of its eth (70-95%) directly supports demand for the underlying asset.

#eth

#blackrock

#staking

Low

This news is about a crypto accounting firm raising funds, which is a positive development for the broader crypto infrastructure but does not directly impact the price of any specific cryptocurrency.

High

The news is reported by coindesk, a reputable source for cryptocurrency news, and includes details about investors and the company's services.

Neutral

The funding round for cryptio is a positive indicator for the digital asset industry's growth and adoption, suggesting increased institutional interest and the need for robust financial tools. however, it doesn't provide direct buy or sell pressure on any particular cryptocurrency.

#crypto

#defi

#finance

Med

The article highlights strong on-chain activity with over 2 million transactions, indicating network health and consistent usage. however, it also points out a disconnect between this activity and price performance, with xrp trapped in a downtrend and lacking new financial inflows, suggesting a medium impact as network fundamentals are good but market sentiment is cautious.

Med

The article cites on-chain data for transaction counts and discusses price action based on chart analysis. it also mentions potential causes for price stagnation like lack of new financial inflows. while the analysis seems logical, the missing 'one detail' mentioned in the title and the disclaimer about potential inaccuracies and non-liability reduce the trustworthiness.

Neutral

The article states xrp is currently trading between $1.37 and $1.40 and is 'still trapped in a longer-running downward trend' and that 'market is stabilizing but not yet rebounding'. this suggests a neutral short-term outlook with potential for future recovery but immediate downward pressure or consolidation.

#XRP

#Crypto

#XRP

Low

This news involves a past event of crypto theft and a jail sentence. while it touches upon the use of tornado cash, it does not present new market-moving information or a direct threat to current market participants' funds. the amount stolen, while significant, is a small fraction of the total crypto market cap.

High

The information is reported by multiple reputable news outlets, with details from court proceedings and official statements. the sentencing and the specifics of the theft and recovery are presented as factual.

Neutral

The event is a resolved legal case concerning a past theft. it does not directly influence current market sentiment or offer insights into future price movements of major cryptocurrencies. the mention of tornado cash is in the context of an investigation into past activities.

#crypto

#tornadocash

#security

Med

A significant portion of top traders on binance are going long on shib, indicating strong positive sentiment and potential buying pressure. this is coupled with shib's recent recovery and oversold conditions, suggesting a short-term upward trend.

Med

The trustworthiness is medium because while the data from binance top traders' positions is concrete, shib's price movements are often driven by speculative sentiment rather than pure fundamentals. the 'relief rally' narrative could also reverse quickly.

Bullish

The bullish outlook for shib is driven by the high percentage of long positions among top binance traders and recent price recovery, suggesting a positive short-term trend. the oversold condition also supports a bounce.

#SHIB

#CryptoTrading

#Binance

Med

Ripple's buyback of its own equity at a significant valuation signals strong internal confidence and potential future growth, which could positively influence xrp's perception and demand, although the direct impact on xrp's price is not immediate.

High

The information comes directly from ripple's announcement and is a concrete corporate action, making it a reliable piece of news.

Bullish

A substantial buyback at a high valuation suggests ripple anticipates significant future value, potentially increasing investor interest in xrp as its primary utility token.

#xrp

#ripple

#buyback

Med

While a significant amount of ada was sold, the price has shown some recovery, indicating that the selling pressure might be absorbed by demand, especially with recent adoption news.

Med

The report is based on on-chain data from santiment and an analyst's interpretation, which is generally reliable for tracking whale movements. however, accusations of paid promotion introduce a slight doubt.

Neutral

The recent price action shows a drop followed by a partial recovery, influenced by broader market trends (bitcoin's reaction to geopolitical tensions). the whale selling adds bearish pressure, but adoption news provides some bullish counter-balance, leading to a neutral outlook for now.

#ada

#cardano

#crypto

High

Bloomberg intelligence senior commodity strategist mike mcglone, a respected voice in market analysis, has issued a strong warning about bitcoin's potential to fall significantly, even below $10,000. this prediction carries weight due to his track record and the current macro-economic context he outlines.

High

Mike mcglone is a senior commodity strategist at bloomberg intelligence, known for his detailed market analysis. his views are often backed by extensive research and a deep understanding of macro trends, making his predictions generally reliable. the article highlights his strict editorial policy and expert review process.

Bearish

Mcglone argues that bitcoin is no longer an independent asset but is now deeply intertwined with broader risk assets like equities and commodities. he believes that a macro 'unwind' driven by deflationary pressures and speculative asset corrections will lead bitcoin down, potentially revisiting the $10,000 to $20,000 range seen in 2019-2020.

#btc

#crypto

#bearmarket

High

Blackrock's debut of a staked ether etf (ethb) is a significant event. it directly addresses a demand for yield in crypto funds by allowing investors to earn staking rewards alongside spot ether exposure. this could attract a wider range of investors, including those previously hesitant to move from direct eth holdings due to the loss of staking benefits. increased institutional adoption and product offerings typically have a substantial impact on a cryptocurrency's price.

High

Blackrock is a globally recognized financial institution with a strong track record in managing large-scale investment products. their entry into the staked ether etf market signifies a high level of confidence and validation for the product and the underlying asset. the company's size and reputation suggest a serious commitment to this space.

Bullish

The introduction of a product that combines price appreciation with yield generation (staking rewards) is inherently bullish for eth. it broadens the investor base, potentially leading to increased demand. the operational advantages of an etf structure (traditional brokerage, custody) further lower the barrier to entry for both retail and institutional investors.

#eth

#etf

#blackrock

Med

Geopolitical tensions and rising oil prices are creating market uncertainty, which could impact bitcoin's short-term price movements. however, bitcoin's resilience and outperformance against gold suggest a potential for continued strength.

Med

The analysis is based on expert opinions and market data, but the geopolitical situation is fluid and unpredictable, making it difficult to ascertain the full impact.

Bullish

Bitcoin's ability to recover above $70,000 despite rising oil prices and geopolitical risks suggests underlying strength and demand. its outperformance against gold and the nasdaq-100 further supports a bullish outlook.

#btc

#crypto

#geopolitics

Med

The news highlights ripple's executive emphasizing the shift from speculative crypto to real-world utility, especially through partnerships like the one with mastercard. this suggests a growing institutional interest and integration, which could positively influence xrp's perceived value and adoption, but the direct price impact is moderated as it's more about long-term utility than immediate demand.

Med

The statement comes from a ripple executive, giving it an inside perspective. however, it's a strategic statement aimed at promoting ripple's vision and its products. while the partnership with mastercard is real, the executive's interpretation and emphasis are aligned with ripple's business goals, warranting a medium trustworthiness rating.

Bullish

The narrative focuses on the increasing utility of digital assets and stablecoins for enterprise treasury operations, vendor payments, and payroll, moving beyond market fluctuations. the collaboration with mastercard is a key indicator of mainstream adoption, which generally positions xrp and ripple's ecosystem in a more favorable, bullish light due to its intended use cases.

#XRP

#Ripple

#Mastercard

High

The significant increase in bitcoin futures trading volume compared to spot trading on binance (5.1x ratio) suggests increased leverage and speculative activity. this can lead to amplified price swings and higher volatility, especially during liquidation events.

High

The article cites cryptoquant data for the futures-to-spot ratio and mentions on-chain metrics and santiment data regarding whale and retail behavior, which are generally reliable sources for market analysis.

Bearish

On-chain metrics like negative apparent demand and increasing supply in loss historically precede downturns. furthermore, whale selling and retail buying at higher prices suggest a potential for a price correction. the high leverage also increases the risk of cascading liquidations if the price moves against leveraged positions.

#BTC

#Futures

#Volatility

Med

While bitcoin shows resilience around $70,000, significant open interest in $20,000 puts suggests some traders are hedging against a potential sharp downturn. this indicates underlying caution despite current price stability.

Med

The information comes from deribit, a major crypto options exchange, and is analyzed by industry observers. however, the interpretation of the put options as direct bearish bets versus strategies like selling far out-of-the-money puts introduces some uncertainty.

Neutral

Bitcoin's price is currently stable around $70,000, showing resilience. the presence of bearish options indicates potential downside risk, but the overall market structure and reduction of leverage suggest potential for upside. the immediate direction remains uncertain, leaning towards consolidation.

#BTC

#Options

#Crypto

Med

Strategy's strc buying 7,000 btc is a significant inflow, but the overall market impact is moderate due to the continued risk warnings from experts and the instrument's specific target audience.

Med

The information comes from reputable sources like bitcoin news and includes a warning from a ceo of an investment advisory firm focused on crypto yield. however, the exact impact is an estimate, and the risk associated with the product is still debated.

Neutral

While the demand for strc and its associated btc purchases is positive, the ceo's warning about 'no free lunch' and inherent risks introduces a bearish counterpoint. the market is likely to digest this conflicting information, leading to a neutral short-term outlook.

#btc

#strc

#crypto

Med

The article highlights bitcoin's resilience around $70,000 despite geopolitical tensions and stock market losses, outperforming other major assets. while price stability is noted, negative funding rates and extreme fear indicators suggest underlying pessimism. this mixed signal implies a moderate impact, as the price is holding but the sentiment is cautious.

High

The analysis is based on multiple data points including price action, funding rates, fear and greed index, and comparisons with traditional assets (s&p 500, nasdaq, gold, silver). it also references specific events like the escalating iran war and institutional buying. the information is from a reputable crypto news source.

Neutral

Bitcoin has shown impressive stability near $70,000, indicating a neutral short-term outlook. while it's outperforming other assets, the prevailing market sentiment (negative funding rates, extreme fear) suggests potential for a pullback if sentiment shifts, or continued sideways movement until a clearer catalyst emerges.

#BTC

#Geopolitics

#MarketSentiment

Low

Bitcoin is trading steadily near $70,000 with a slight bearish undertone suggested by rising open interest and flat-to-negative funding rates. while this indicates caution, it doesn't point to immediate large price movements.

High

The analysis is based on concrete derivatives data like open interest, funding rates, and cumulative volume delta, as well as on-chain activity and macro market conditions, providing a reliable outlook.

Neutral

The current data points to a consolidation phase. rising open interest with negative funding suggests bearish bets are being placed, but the lack of aggressive selling pressure and altcoin strength indicate a neutral short-term outlook, awaiting a breakout catalyst.

#btc

#derivatives

#crypto

Med

While negative funding rates historically have preceded both rallies and crashes for xrp, the current low open interest and trading volume suggest a lack of broad market participation which could dampen the magnitude of any potential price movement.

High

The analysis is based on observable data like funding rates, open interest, and trading volume, and references historical patterns. the source's editorial policy emphasizes accuracy and impartiality.

Bullish

Historically, prolonged periods of negative funding rates for xrp have been followed by significant price rallies, potentially indicating a market bottom and an opportunity for a bounce as more traders are in short positions.

#xrp

#crypto

#trading

Med

The news highlights a potential new revenue stream for bitcoin miners by leveraging their infrastructure for ai demand and grid balancing. while this could indirectly support bitcoin's ecosystem, the direct price impact on btc itself is moderate as it doesn't immediately increase demand for bitcoin as a currency.

High

Vaneck is a reputable investment management firm with a dedicated digital asset research arm. their analyst's insights are generally well-researched and based on market trends.

Bullish

The argument that miners are diversifying into ai and grid services suggests a strengthening of the bitcoin mining infrastructure. this increased utility and potential profitability for miners can indirectly support the bitcoin price by encouraging continued mining operations and potentially reducing miner sell pressure.

#BTC

#Mining

#AI

High

The sec and cftc reaching a settlement and commissioner pham's six-point plan for regulatory clarity, especially with her known pro-ripple stance, could significantly reduce legal uncertainty for xrp and the broader crypto market in the us. this could attract more institutional investment and adoption.

High

The news directly involves two major us regulatory bodies (sec and cftc) and a key figure known for her industry-friendly views (caroline pham). the settlement and proposed plan are concrete steps towards regulatory clarity, which is a significant development.

Bullish

Reduced regulatory uncertainty and a clear roadmap for crypto regulation in the us, particularly from a pro-industry voice like pham, are bullish signals. this could lead to increased confidence, investment, and potentially higher prices for xrp and other digital assets.

#xrp

#sec

#cftc

Med

Samson mow's question about michael saylor's strategy accumulating 1 million btc versus bitcoin reaching $1 million per coin highlights a key narrative in the bitcoin market. while it doesn't directly cause immediate price change, it reinforces the bullish sentiment around long-term bitcoin accumulation and potential price appreciation.

High

Samson mow is a prominent figure in the bitcoin community, known for his strong bullish stance and advocacy for bitcoin adoption. his platform, jan3, is focused on bitcoin development and ecosystem growth. michael saylor and his company, microstrategy, are also well-known for their significant bitcoin holdings and bullish strategy.

Bullish

The discussion revolves around the potential for bitcoin to reach $1 million, which is a strongly bullish long-term outlook. the mention of a potential 'near-term relief rally' further supports a short-to-medium term bullish sentiment, driven by indicators like low funding rates and whale accumulation.

#BTC

#MichaelSaylor

#SamsonMow

Med

The article suggests shib is nearing a crucial technical test at the 26 ema. a break above could signal a recovery, while failure might lead to continued downtrend. the market shows weak momentum and buyer interest, making a breakout uncertain.

Med

The analysis is based on technical indicators like emas and price action patterns (lower highs, lower lows). while technical analysis is a common tool, it's not always predictive, and market sentiment can shift rapidly. the disclaimer also advises independent research.

Neutral

The immediate price direction is uncertain. the article highlights a potential test of resistance which could lead to either a bullish breakout or a bearish continuation of the downtrend. current momentum is weak.

#SHIB

#Crypto

#TechnicalAnalysis

Med

Bollinger bands squeezing indicates a potential upcoming volatility spike. while the direction is uncertain, such periods often lead to significant price movements.

High

The analysis is based on a recognized technical indicator (bollinger bands) and is cited by a known analyst (ali martinez), suggesting a reliable assessment of market conditions.

Neutral

The tight bollinger bands suggest volatility is building, but the direction of the breakout is not yet clear. the price is currently around the middle band, indicating a neutral stance from this indicator.

#XRP

#Volatility

#TechnicalAnalysis

Med

The resilience of xrp etfs despite a significant price drawdown suggests strong investor conviction, which could support price stability or gradual recovery. however, the underlying xrp price is still subject to broader market sentiment and regulatory developments.

High

The report is based on data from sosovalue and observations from bloomberg etf analysts, with direct commentary from ripple ceo brad garlinghouse, indicating a reliable source of information.

Bullish

The strong inflows and 'remarkable staying power' of xrp etfs, even during a market downturn, indicate underlying demand and investor confidence. this positive sentiment, highlighted by the ripple ceo, suggests a potential for price appreciation once market conditions improve.

#xrp

#ripple

#etfs

Med

Cryptoquant's analysis suggests bitcoin is in a 'frustrating phase' with bear market signals like declining apparent demand and long-term holder sopr, indicating caution among investors. however, recent geopolitical events have shown bitcoin's resilience, and positive comments regarding de-escalation could provide short-term support.

High

The information is from cryptoquant, a reputable analytics platform, and its analysis is based on multiple on-chain metrics. the article also references industry experts like gabe selby from cf benchmarks, adding credibility.

Neutral

While on-chain metrics suggest caution and a potential 'bear market consolidation' phase, bitcoin has shown resilience against geopolitical events and could see a push towards the $72,000-$73,000 resistance level if it can sustain a close above $70,000 with significant volume.

#btc

#cryptoquant

#onchain

High

The tokenization of crude oil, especially with a 1:1 peg to physical reserves and the potential for direct redemption, could significantly disrupt the traditional $6 trillion oil market. this innovation might attract substantial institutional and retail investment into the crypto space, impacting not only litro but potentially other rwas and related blockchain infrastructure.

Med

The project is led by a former head of trading at petronas, bringing industry expertise. the clear timeline for testnet and launch adds credibility. however, it's still in early stages, with partnerships and banking arrangements still being finalized, which introduces some uncertainty.

Bullish

The ambition to modernize a massive, archaic market with 24/7 on-chain trading and redemption for a highly sought-after commodity like oil suggests strong potential for demand and price appreciation once the project gains traction and proves its functionality.

#litro

#rwa

#tokenization

Med

Metaplanet's initiative to build the btc ecosystem in japan is a positive development for bitcoin's long-term adoption. however, the direct price impact on btc itself may be moderate in the short term as the focus is on infrastructure development rather than immediate large-scale buying.

High

Metaplanet is a publicly listed company with a significant btc holding, and their strategic shift towards ecosystem development is well-articulated with concrete investment plans and a clear rationale tied to japan's regulatory landscape.

Bullish

The expansion into funding, incubating, and granting for bitcoin financial infrastructure, especially in a regulated market like japan, signals a commitment to strengthening the bitcoin network and its utility, which is fundamentally bullish for btc.

#BTC

#Japan

#Ecosystem

High

The news of across protocol planning to dissolve its dao and token structure to form a u.s. c-corporation has caused acx to surge by 80%. this radical shift towards a traditional corporate structure is a significant development in the defi space, attracting substantial speculative interest and driving a massive increase in trading volume.

Medium

The proposal is from the core team and has been published as a 'temp-check' proposal, indicating a structured process for community feedback before a formal vote. however, the ultimate success depends on the community's governance vote, making the outcome not entirely guaranteed.

Bullish

The immediate 80% surge and the fact that the current price is trading above the proposed buyout premium suggest that traders are betting on either a higher offer, the equity option being more valuable, or a successful transition to the new corporate structure which they believe will unlock more value.

#acx

#defi

#dao

High

A significant 75% drop in developer commits and a 56% decrease in active developers across major blockchains, with talent shifting to ai, indicates a potential long-term slowdown in innovation and development for many cryptocurrencies. this could lead to reduced network upgrades, fewer new dapps, and potentially lower investor confidence.

High

The data comes from artemis, a reputable analytics platform, and is corroborated by mentions of specific blockchain networks (ethereum, solana, bnb chain) and trends on github, which is the primary platform for code development. the report references electric capital's annual developer report as well, adding further credibility.

Bearish

The substantial decline in developer activity suggests a potential decrease in future development and innovation for many cryptocurrencies. this could lead to a less attractive investment landscape compared to sectors with booming development, like ai, which may put downward pressure on prices.

#crypto

#ai

#developer

Med

The news centers on allegations that coinbase is lobbying against a bitcoin tax exemption to favor its stablecoin, usdc. while coinbase denies this, the controversy creates uncertainty and could impact investor sentiment towards both assets if the allegations were true. however, the direct denial and existing narratives may limit the immediate price impact.

Med

Coinbase executives have directly and strongly denied the allegations, with the ceo himself responding to industry figures. however, the accusations come from some in the bitcoin community, and the financial incentive for coinbase to favor usdc is clear, creating a degree of skepticism until further clarity emerges.

Neutral

The strong denials from coinbase leadership and the ongoing nature of the debate suggest a neutral immediate price reaction. investors may wait for more concrete evidence or further developments before making significant moves.

#btc

#usdc

#coinbase

Med

The news focuses on regulatory efforts concerning stablecoins, specifically usdt, as part of the clarity act. while the act aims for clarity, the ongoing debate and potential for stricter regulations or outright opposition from the banking sector could create uncertainty around stablecoins and their future use, impacting their price stability and adoption. however, the direct price impact on usdt itself is moderated by the fact that the debate is about future legislation and not immediate enforcement.

High

The source is a reputable crypto news outlet with a stated commitment to accuracy, relevance, and impartiality, reviewed by industry experts. the reporting cites specific statements from a white house crypto advisor and addresses the ongoing legislative process, indicating a high level of credibility.

Neutral

The news highlights a legislative debate and potential roadblocks for the clarity act, which includes provisions for stablecoins. while this could lead to regulatory changes, the outcome is uncertain. the banking sector's opposition and the ongoing negotiations suggest a period of wait-and-see for the market. therefore, the immediate price direction for usdt remains neutral as the market digests the potential implications without a clear immediate catalyst for a significant price move.

#usdt

#regulation

#clarityact