CoinDesk 20 Performance Update: Bitcoin (BTC) Drops 0.3% as All Assets Decline

Analysis

Price Impact

HighWhile bitcoin's individual drop is modest (-0.3%), the news emphasizes a broader market downturn where all assets in the coindesk 20 index are declining. this signals strong negative market sentiment and indicates significant bearish pressure across the board.

Trustworthiness

HighThe information is sourced directly from coindesk indices, a reputable and reliable provider of crypto market data and performance updates.

Price Direction

BearishBitcoin's price decline, even if slight, as part of a market-wide drop where no assets are trading higher, strongly indicates a prevailing bearish trend. investors are likely to remain cautious, anticipating further downside or prolonged consolidation.

Time Effect

ShortThis is a daily market performance update, reflecting immediate and short-term price movements and prevailing market sentiment for the current trading period.

Original Article:

Article Content:

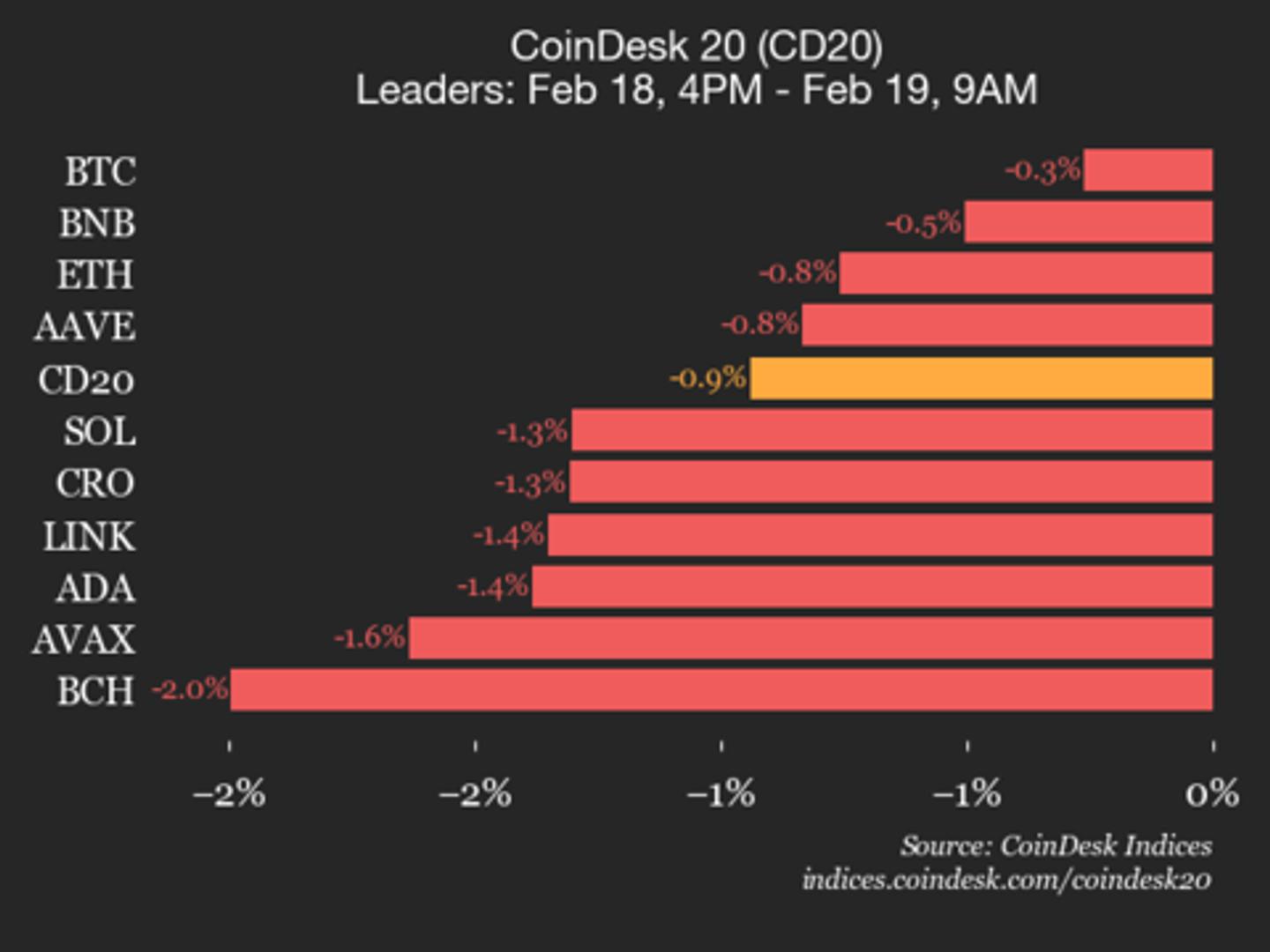

CoinDesk Indices Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email CoinDesk 20 Performance Update: Bitcoin (BTC) Drops 0.3% as All Assets Decline Binance Coin (BNB) was also among the underperformers, down 0.5% from Wednesday. By CoinDesk Indices Feb 19, 2026, 2:10 p.m. Make us preferred on Google In this article FIL FIL $ 0.9084 ◢ 4.64 % CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index . The CoinDesk 20 is currently trading at 1909.21, down 0.9% (-18.15) since 4 p.m. ET on Wednesday. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Long & Short Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . None of the 20 assets are trading higher. Leaders: BTC (-0.3%) and BNB (-0.5%). Laggards: ICP (-3.5%) and SUI (-3.0%). The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally. CoinDesk Indices CoinDesk 20 charts Prices More For You Zoomex: Precise Systems of Fairness and Transparency by Design By CoinDesk Jan 31, 2026 Commissioned by Zoomex Read full story More For You Crypto Long & Short: Crypto’s liquidity mirage By Leo Mindyuk | Edited by Alexandra Levis 21 hours ago In this week’s Crypto Long & Short Newsletter, Leo Mindyuk of ML Tech writes that while crypto markets look liquid on paper, executable liquidity at scale is more fragmented and more fragile than most institutions assume. What to know : You're reading Crypto Long & Short , our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday. Read full story Latest Crypto News Why bitcoin’s rare oversold RSI crash signals a long, slow grind ahead 40 minutes ago Figure is debuting its tokenized stock along with upsized $150 million offering 43 minutes ago SocGen taps XRP Ledger for euro stablecoin distribution 51 minutes ago Illicit networks accounted for $141 billion of the trillions of stablecoin volume in 2025 1 hour ago Crypto markets feel the chill, Base, ether.fi reorganize layer-2 landscape 1 hour ago Bitcoin, ether rise as altcoins lag in low-volatility trade 2 hours ago Top Stories Bitcoin is about to log its longest losing streak since 2022 as geopolitical nerves hit risk trades 8 hours ago Ledn raises $188 million with first bitcoin backed bond sale in asset backed market 6 hours ago Bitcoin, ether, xrp ETFs bleed while Solana bucks outflow trend 6 hours ago WLFI surges 10% after Apex stablecoin deal, outperforming BTC and ETH 11 hours ago The bank of the future: 77% of stablecoin users say they’d open a wallet with their bank today 2 hours ago Coinbase lets XRP, ADA and dogecoin holders borrow up to $100,000 without selling 9 hours ago In this article FIL FIL $ 0.9084 ◢ 4.64 %