Why bitcoin’s rare oversold RSI crash signals a long, slow grind ahead

Analysis

Price Impact

HighBitcoin's rare oversold 14-day rsi (below 30) has historically signaled multi-month consolidation phases, suggesting a significant period of sideways movement.

Trustworthiness

HighThe analysis is based on historical occurrences of bitcoin's 14-day rsi dropping below 30, a technical indicator with a clear track record in 2015 and 2018.

Price Direction

NeutralWhile oversold conditions often precede a recovery, historical patterns suggest an initial 'long, slow grind' of consolidation around the $60,000 region for several months before a sustained bullish breakout.

Time Effect

LongThe article explicitly states 'months ahead' for the consolidation phase, aligning with previous instances of such rsi readings.

Original Article:

Article Content:

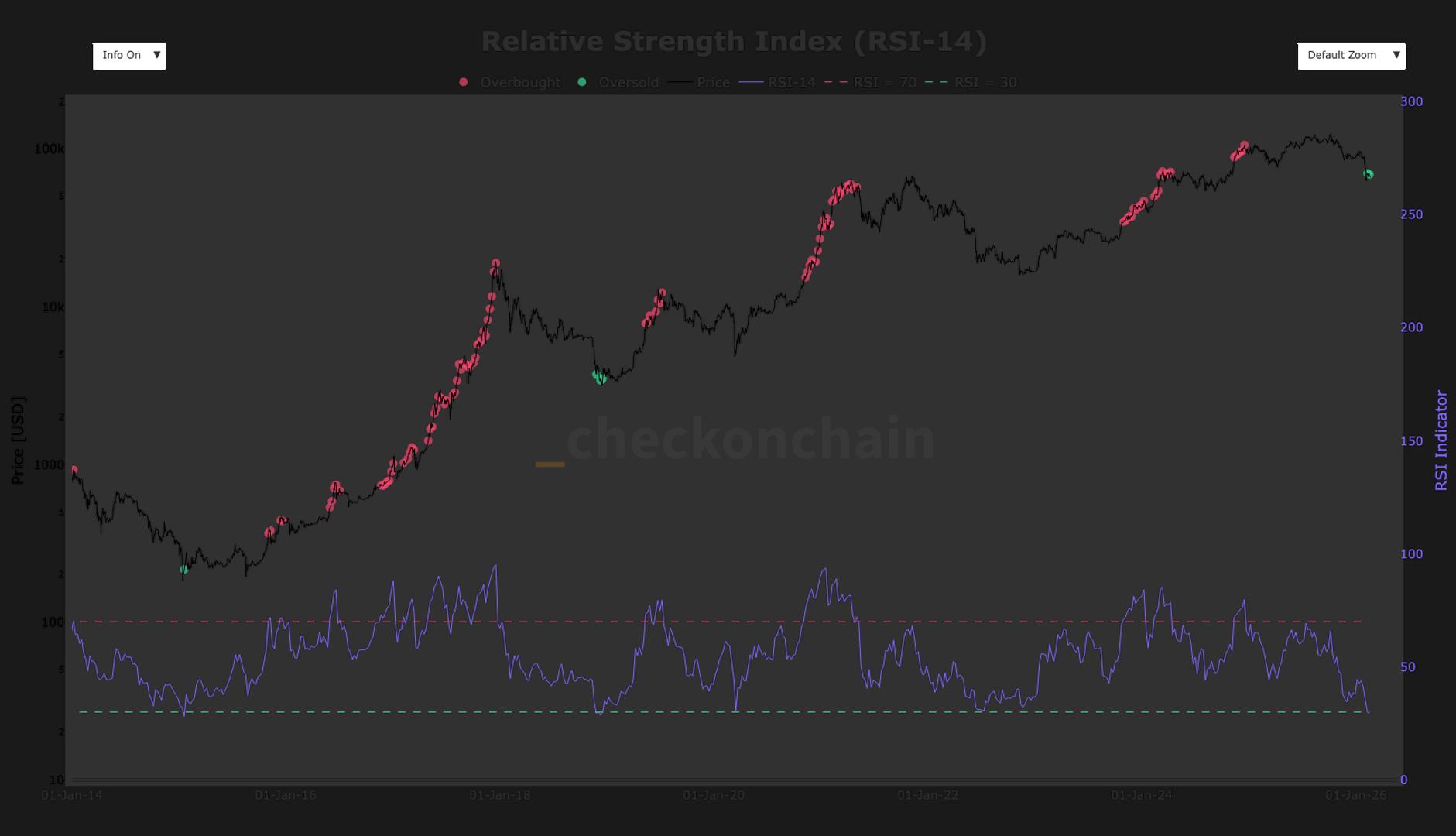

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Why bitcoin’s rare oversold RSI crash signals a long, slow grind ahead History suggests the current move could lead to consolidation around the $60,000 region in the months ahead before the next leg upward. By James Van Straten | Edited by Jamie Crawley Feb 19, 2026, 1:31 p.m. Make us preferred on Google BTC RSI 14 (Checkonchain) What to know : Bitcoin’s 14-day Relative Strength Index (RSI) dropped below 30 for only the third time in its history this month, according to checkonchain, The RSI is a momentum oscillator that measures the speed and magnitude of recent price movements by comparing average gains and losses over a set period of 14 days. In both 2015 and 2018, similar RSI readings were followed by multi-month consolidation phases before a sustained breakout. Bitcoin’s 14-day Relative Strength Index (RSI) dropped below 30 for only the third time in its history this month , according to checkonchain . The RSI is a popular tool for detecting an asset's momentum by measuring the speed and magnitude of recent price movements and comparing average gains and losses over a set period of 14 days. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . The index produces a reading between 0 and 100, with levels above 100 generally considered overbought, while readings below 30 indicate oversold conditions, suggesting that selling may be overextended. Bitcoin's 14-day RSI has not hit 100 since December 2024 when bitcoin first surpassed $100,000. Previous readings below 30 marked prior cycle bottoms. In January 2015, bitcoin’s RSI fell to roughly 28 as price hovered near $200. The market then spent about eight months consolidating before a sustained recovery began. A similar pattern emerged in December 2018, when RSI dipped below 30 around $3,500. That period was followed by roughly three months of sideways accumulation before bitcoin broke higher. BTC is trading around $66,000, with sentiment stuck in "fear" or "extreme fear" on the Crypto Fear & Greed Index for much of the past 30 days . Since peaking in October, bitcoin has shedded more than 50%, briefly falling toward $60,000. History suggests the current move could lead to consolidation around the $60,000 region in the months ahead before the next leg upward. Bitcoin News RSI Relative Strength Index More For You Zoomex: Precise Systems of Fairness and Transparency by Design 作者 CoinDesk 2026年1月31日 Commissioned by Zoomex Read full story More For You Bitcoin, ether rise as altcoins lag in low-volatility trade By Oliver Knight , Saksham Diwan | Edited by Sheldon Reback 2 hours ago Bitcoin and ether tick higher, but weak altcoin breadth, heavy liquidations and elevated options hedging suggest traders remain cautious. What to know : BTC trades near $67,000 and ETH near $1,970, with volatility fading after Feb. 5’s selloff. Derivatives show stabilization, with open interest at $15.38 billion and funding positive Elevated short-term implied volatility signals caution. $218 million in liquidations and 97 of top 100 tokens in the red underscore fragile sentiment. Read full story Latest Crypto News Figure is debuting its tokenized stock along with upsized $150 million offering 20 minutes ago SocGen taps XRP Ledger for euro stablecoin distribution 28 minutes ago Illicit networks accounted for $141 billion of the trillions of stablecoin volume in 2025 1 hour ago Crypto markets feel the chill, Base, ether.fi reorganize layer-2 landscape 1 hour ago Bitcoin, ether rise as altcoins lag in low-volatility trade 2 hours ago The bank of the future: 77% of stablecoin users say they’d open a wallet with their bank today 2 hours ago Top Stories Ledn raises $188 million with first bitcoin backed bond sale in asset backed market 6 hours ago Bitcoin, ether, xrp ETFs bleed while Solana bucks outflow trend 6 hours ago WLFI surges 10% after Apex stablecoin deal, outperforming BTC and ETH 10 hours ago Coinbase lets XRP, ADA and dogecoin holders borrow up to $100,000 without selling 8 hours ago Ether, XRP, Solana slide in crypto retreat despite tech-led lift in Asia stocks 7 hours ago Bitcoin is about to log its longest losing streak since 2022 as geopolitical nerves hit risk trades 8 hours ago