Banking trade groups responsible for impasse on market structure bill, Brian Armstrong says

Analysis

Price Impact

MedThe ongoing legislative impasse creates regulatory uncertainty, which can hinder broader institutional adoption and the clear framework for stablecoins. however, the underlying interest from individual banks and the potential for a future compromise provide a basis for long-term positive sentiment.

Trustworthiness

HighThe information comes directly from brian armstrong, ceo of coinbase, a major industry player, and is reported by coindesk, a reputable crypto news source. armstrong's insights into banking motivations are well-informed.

Price Direction

NeutralWhile the stalled legislation on market structure means continued regulatory uncertainty, preventing immediate bullish catalysts, armstrong's view that banks are ultimately interested in crypto and a compromise is possible, suggests no immediate bearish crash. the market remains in a holding pattern regarding us crypto regulation.

Time Effect

LongLegislative processes and significant market structure reforms take considerable time to develop, pass, and implement. their effects on the market are typically realized over an extended period, shaping the regulatory landscape for years.

Original Article:

Article Content:

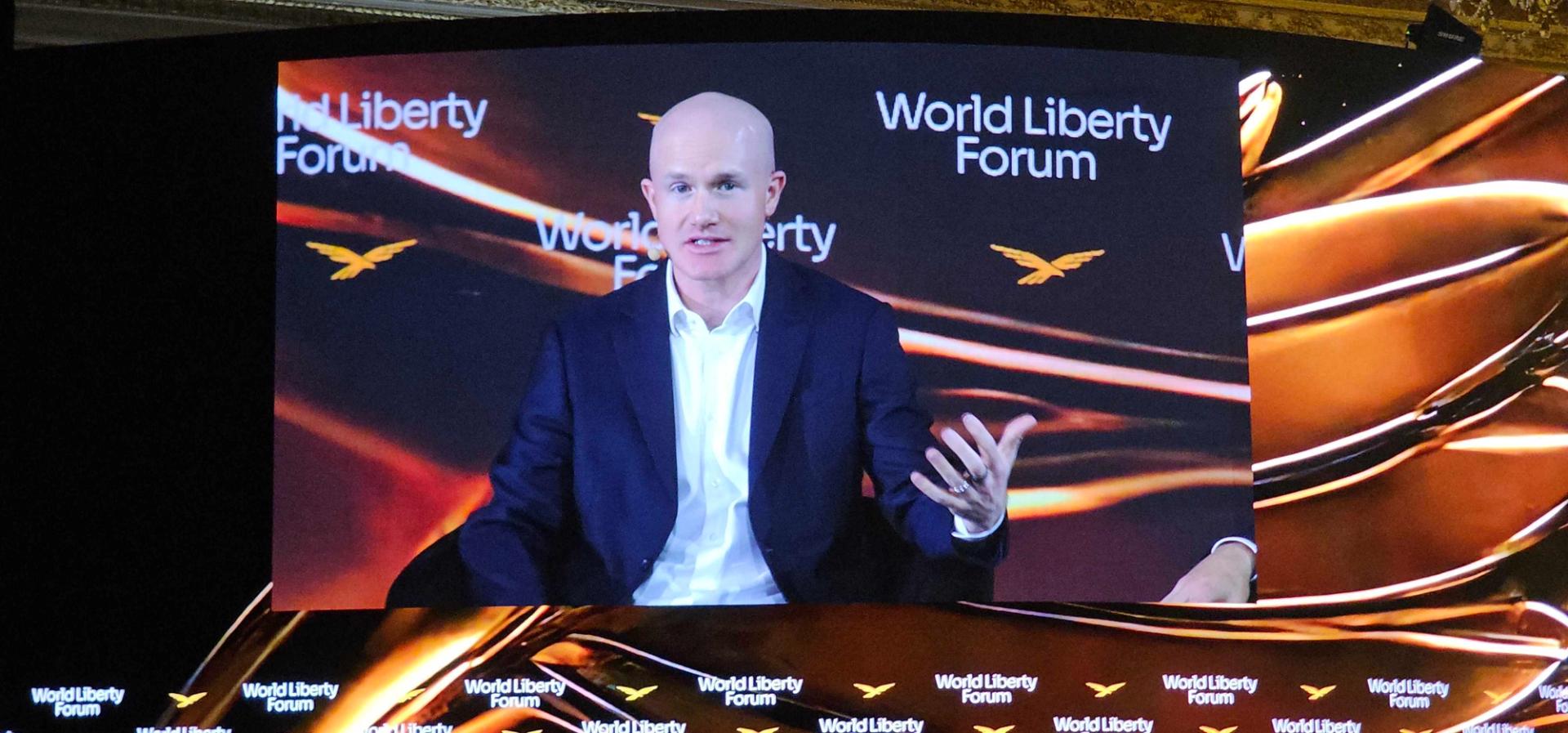

Policy Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Banking trade groups responsible for impasse on market structure bill, Brian Armstrong says Coinbase CEO Brain Armstrong said updated market structure legislation may offer banks other benefits to get them on board with allowing stablecoin rewards. By Nikhilesh De | Edited by Jesse Hamilton Feb 18, 2026, 10:09 p.m. Make us preferred on Google Coinbase CEO Brian Armstrong (Nikhilesh De/CoinDesk) PALM BEACH, Fla. — Banking trade groups, rather than individual banks, are chiefly responsible for stalled negotiations on crypto market structure legislation, Coinbase CEO Brian Armstrong said. Banks themselves are looking at crypto as an opportunity, he said Wednesday at the World Liberty Forum hosted at Mar-a-Lago. STORY CONTINUES BELOW Don't miss another story. Subscribe to the State of Crypto Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . "For whatever reason, sometimes incumbent industries have trade groups, and they view the world with a zero-sum mindset [where they believe] for the banks to win, crypto has to lose," he said. "They're not viewing this as a positive [step]." Banking trade groups have represented the industry in meetings with the crypto industry hosted by the White House since the Senate Banking Committee's push to advance market structure legislation last month fell apart. The latest such meeting, which took place last week, saw the banking industry holding the line on its demands that the bill block stablecoin rewards. The next meeting is set to take place Thursday morning, individuals familiar with the plan told CoinDesk. Read more: Crypto's banker adversaries didn't want to deal in latest White House meeting on bill Armstrong said he did expect some sort of compromise where banks would have new benefits under a fresh draft market structure bill, though he did not elaborate. When the Digital Asset Market Clarity Act stalled the night before a Senate Banking Committee hearing, it was after Armstrong publicly withdrew his company's support. In the current talks, the Coinbase co-founder argued that individual small and medium-sized banks did not really fear deposit flight to stablecoin issuers, but rather said their more urgent concerns were with deposit flight to larger banks. Major banks are leaning into crypto as well, he said, adding that Coinbase is supporting crypto infrastructure for "five of the largest banks in the world." Other banks are hiring for blockchain or crypto-focused employees on LinkedIn. "We now live in this world where we have regulated U.S. stablecoins with rewards," he said. "You have to accept that as a reality and decide if you want to treat that as an opportunity or as a threat." Brian Armstrong Coinbase More For You Zoomex: Precise Systems of Fairness and Transparency by Design By CoinDesk Jan 31, 2026 Commissioned by Zoomex Read full story More For You What happens on prediction platforms can steer traditional markets, NYSE chief says By Helene Braun , Nikhilesh De | Edited by Jesse Hamilton 5 hours ago Prediction market outcomes are being used as inputs for how players deal with traditional financial markets, NYSE President Lynn Martin said at Mar-a-Lago on Wednesday. Read full story Latest Crypto News Bitcoin sinks to $66,000, U.S. stocks lose steam as Fed minutes mention possible rate hike 1 hour ago Sam Altman's OpenAI unveils ‘EVMbench’ to test whether AI can keep crypto’s smart contracts safe 2 hours ago Kraken continues acquisition streak by buying token management firm Magna ahead of IPO push 3 hours ago The Protocol: Zora moves to Solana 4 hours ago Optimism's OP token falls after Base moves away from the network's 'OP stack' in major tech shift 4 hours ago Ethereum’s 50% staking milestone triggers backlash over 'misleading' supply data 4 hours ago Top Stories What happens on prediction platforms can steer traditional markets, NYSE chief says 5 hours ago Goldman Sachs' David Solomon says he owns 'very little' bitcoin but watching it closely 5 hours ago Bitcoin's plunge signals coming AI crisis, but massive Fed response will drive new record high: Arthur Hayes 6 hours ago American crypto holders are scared and confused about this year’s new IRS tax rules 8 hours ago Hyperliquid starts DeFi lobbying group with $29 million token backing 7 hours ago From 2016 hack to $150M Endowment: the DAO’s second act focuses on Ethereum security 9 hours ago