Tokenized pre-IPO shares topic ignites legal debate at Consensus Hong Kong 2026

Analysis

Price Impact

MedThe debate highlights both the immense potential (forecasted $30 trillion by 2030 for rwa tokenization) and significant legal and regulatory hurdles for tokenized private equity. lack of issuer consent and clear legal frameworks could deter institutional adoption and lead to investor fallout, impacting the sentiment for rwa tokenization projects.

Trustworthiness

HighThe article is from a reputable source (coindesk) and provides a balanced view, quoting key figures from both sides of the debate (hecto finance, brickken) and citing real-world examples (robinhood/openai controversy).

Price Direction

NeutralWhile the long-term potential for rwa tokenization, including private equity, is bullish, the immediate legal and regulatory ambiguities, coupled with issuer pushback, create significant headwinds. this uncertainty leads to a neutral short-to-medium term outlook for the immediate viability and widespread adoption of such tokens, despite the underlying demand for access to private markets.

Time Effect

LongThe resolution of legal debates, establishment of clear regulatory frameworks, and gaining corporate consensus for tokenizing private equity will be a multi-year process. the projected $30 trillion market for rwa tokenization by 2030 further underscores a long-term horizon for these developments.

Original Article:

Article Content:

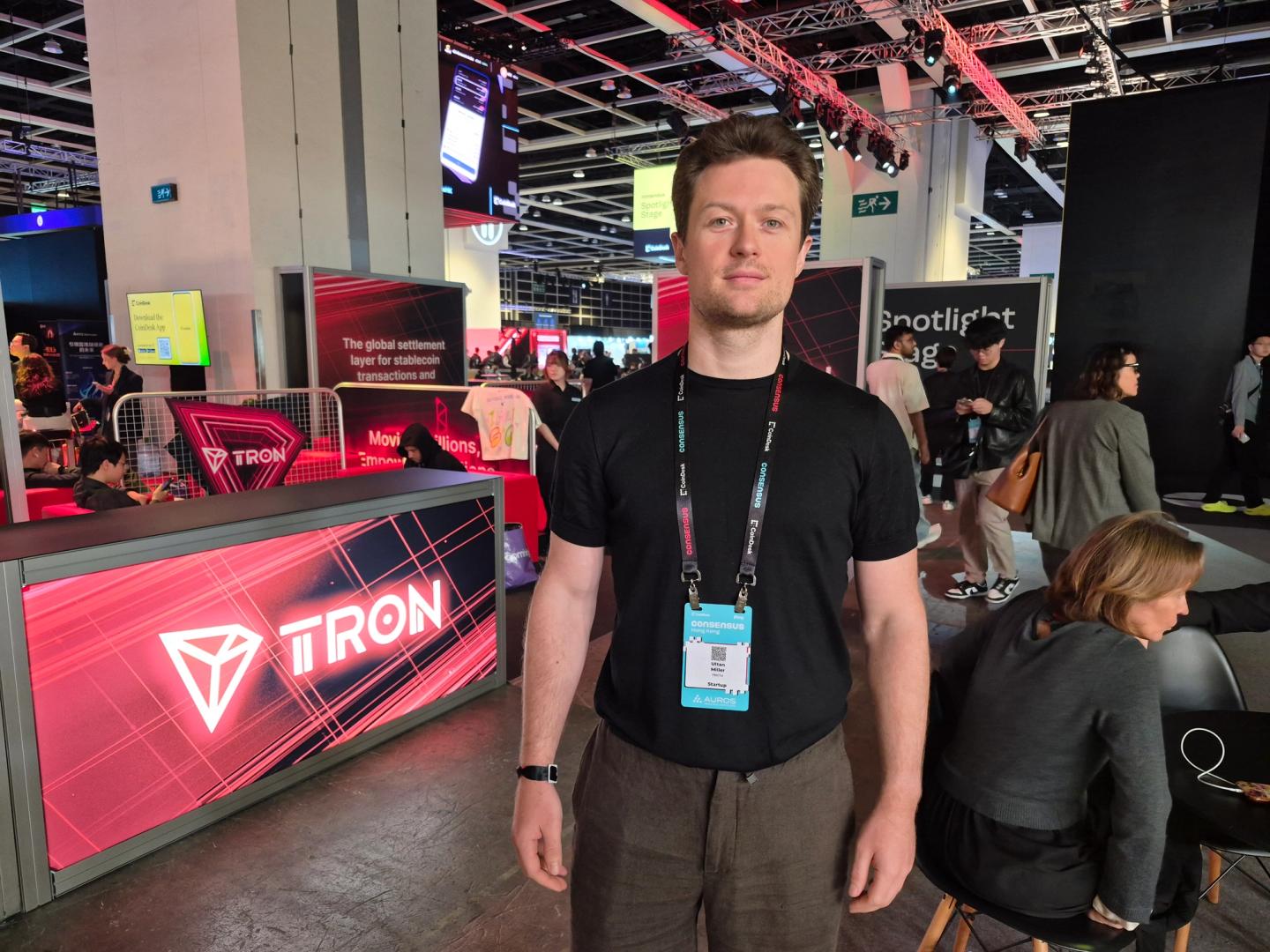

Finance Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Tokenized pre-IPO shares topic ignites legal debate at Consensus Hong Kong 2026 Ultan Miller touts a blockchain-based pre-IPO index, while critics warn unauthorized equity tokenization risks legal and investor fallout. By Olivier Acuna | Edited by Stephen Alpher Feb 18, 2026, 3:06 p.m. Make us preferred on Google Hecto Finance's Ultan Miller speaks with CoinDesk about tokenized equity at Consensus Hong Kong 2026. (Photo by Olivier Acuna/Modified by CoinDesk) What to know : Hecto Finance aims to build a tokenized index of pre-IPO "Hectocorn" companies like OpenAI, SpaceX and ByteDance, giving public investors on-chain exposure to elite private firms. Supporters say such tokenization could broaden access to high-growth private markets, but critics warn that doing so without issuer consent risks legal uncertainty, weak investor protections and reputational damage. The clash between Hecto’s vision and concerns raised by industry figures, alongside episodes like Robinhood’s disputed OpenAI tokens, underscores how tokenized private equity is outpacing regulatory clarity and corporate buy-in. Ultan Miller, CEO of Hecto Finance, laid out a bold vision during an interview with CoinDesk at Consensus Hong Kong 2026: a blockchain-native bridge to the world’s most valuable private companies, long out of reach for everyday investors. However, his strategy and the controversy it sparks, highlight how the tokenization of private equity is evolving faster than legal frameworks and corporate consensus. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Hecto bills itself as building “the world’s first tokenized pre-IPO company index,” designed to give public investors exposure to firms that traditionally stayed behind closed doors until going public. Miller said the index is being developed on the Canton Network, an institutional blockchain designed to support privacy, compliance and programmable settlement, features he claims are essential for bringing traditional securities onto blockchain rails at scale. Edwin Mata, CEO and co-founder of tokenization platform Brickken, offered a sharply contrasting tone at the same conference. Mata, who also participated in CoinDesk’s PitchFest competition, warned that tokenizing company shares without issuer knowledge or consent risks undermining both investor protection and market credibility. Now that tokenization of real-world assets is forecasted to become a $30 trillion industry by 2030, Mata said, too many inexperienced players are entering the space in pursuit of quick profits. “This is a recipe for chaos, low-quality projects, and massive losses for investors lured into ventures with no solid foundations, especially lacking real know-how in securities structuring, issuance mechanics, and corporate law,” Mata warned. Robinhood backlash highlights the tension Skepticism around tokenized private equity isn’t theoretical. In June 2025, Robinhood announced it would offer tokenized equities in Europe and launched a limited giveaway of equity-linked tokens tied to OpenAI and SpaceX. OpenAI responded publicly. “These ‘OpenAI tokens’ are not OpenAI equity,” the company said . “We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval — we did not approve any transfer. Please be careful.” The episode brought to life the core issue confronting the sector: when third parties create blockchain-based instruments referencing private companies, what exactly are investors buying and who has authorized it? Miller: ‘A grey area’ for now Miller, who, prior to Hecto, founded one of the first digital asset investment banks regulated by the U.K. Financial Conduct Authority (FCA), said he and his co-founders, including former executives from Goldman Sachs and Barclays, acknowledge the tension but maintain their structure is different. He described the space as operating in a “grey area,” and said incentives could align over time as regulation matures and market demand crystallizes. Rather than see tokenization as a legal workaround, Miller portrayed it as part of an inevitable transition of traditional securities onto programmable rails. He argued that as companies remain private longer and valuations grow in secondary markets, demand for broader access will continue to build. Hecto’s social channels also indicate active ecosystem growth and community engagement, positioning the product as more than a theoretical construct but a live endeavor networking with institutional custody solutions and on-chain governance mechanisms. The pre-IPO Index: Hectocorns and institutional rails Miller frames Hecto’s inaugural product around a collection of elite private companies or as he called them, “Hectocorns” with valuations north of $100 billion, including SpaceX, OpenAI, ByteDance, xAI, Stripe, Tether and Anthropic. The idea is to wrap exposure to this basket into a single on-chain token, enabling investors to gain diversified access via a programmable instrument rather than individual share purchases. The Hecto CEO explained that the token functions by having investors deposit capital into a vault, after which the protocol issues tokens representing proportional exposure to the basket’s aggregate performance. The index is rules-based and dynamic: if a company exits via IPO or liquidity event, proceeds are directed into a liquidity pool used to buy back tokens, potentially benefiting remaining holders. Governance token holders also vote on future index composition. Miller’s broader thesis is structural. He argues public markets no longer define an era; instead, massive private companies create value long before traditional IPOs. Tokenization, in his telling, is the missing link between private enterprise growth and broader investor access. The regulatory and legal divide Yet even as Miller promotes the mechanics, the legal foundations remain unsettled. Mata emphasized that equity tokenization does not alter the legal nature of shares. It is a technological overlay on traditional shareholding, governed by corporate law and documentation, rather than something that derives legitimacy from blockchain itself. If the issuer consents and securities regulations are followed, tokenization can modernize recordkeeping and transfer processes, he added. If not, it risks misrepresenting rights and exposing investors to governance uncertainty. Mata also stressed that tokenization does not automatically create liquidity. Real liquidity requires compliant secondary markets, credible settlement infrastructure, investor demand, and regulatory clarity — elements that are still developing across jurisdictions. Ambiguity around voting rights, dividend entitlements and transferability, he said, introduces both legal and reputational risk. Market implications and investor access If Hecto’s index gains traction, it could represent a meaningful shift in how private-market exposure is distributed by embedding high-growth private-company exposure into programmable blockchain instruments. However, without issuer cooperation, clear securities compliance and functioning secondary markets, the promise of tokenized private equity could remain restricted by the same structural issues it seeks to transform. At Consensus Hong Kong 2026 , one thing became clear: tokenization of private equity is no longer an experiment but an emerging asset with inherent challenges. Tokenization Blockchain Adoption Real World Assets Consensus Hong Kong 2026 More For You Zoomex: Precise Systems of Fairness and Transparency by Design By CoinDesk Jan 31, 2026 Commissioned by Zoomex Read full story More For You American crypto holders are scared and confused about this year’s new IRS tax rules By Ian Allison | Edited by Sheldon Reback 1 hour ago Crypto tax platform, Awaken Tax, polled 1,000 crypto holders about a radical shift from self-disclosure to automatic reporting of transactions. What to know : New rules compel crypto exchanges like Coinbase to issue a Form 1099-DA to the IRS this week. The rules are a “blunt instrument,” according to Awaken Tax founder Andrew Duca, created by legislators who know nothing about crypto. The onus falls on the holder of crypto to “patch” what’s missing in terms of their crypto acquisition costs and actual tax basis. Read full story Latest Crypto News Hyperliquid starts DeFi lobbying group with $29 million token backing 3 minutes ago Canary lists spot SUI ETF with staking rewards 14 minutes ago CoinDesk 20 performance update: Aptos (APT) declines 3%, leading index lower 48 minutes ago American crypto holders are scared and confused about this year’s new IRS tax rules 1 hour ago From 2016 hack to $150M Endowment: the DAO’s second act focuses on Ethereum security 2 hours ago While some big investors cash out of crypto, others double down 2 hours ago Top Stories Bitcoin holds near $68,000 as volatility cools, WLFI jumps ahead of Mar-a-Lago forum 3 hours ago Peter Thiel's Founders Fund dumps every ETHZilla share 8 hours ago Bitcoin ETFs hold billions despite price crash, but resilience masks harsh reality 9 hours ago Bitcoin losing $70,000 is a warning sign for further downside 8 hours ago Moonwell's $1.12 nightmare: A pricing glitch just let bots seize millions in ETH collateral 4 hours ago Brevan Howard's crypto fund said to lose 30% in worst year since inception: FT 4 hours ago