Hong Kong is trying to build up its crypto regulations: State of Crypto

Analysis

Price Impact

HighHong kong's proactive approach to crypto regulation, including frameworks for perpetual contracts and stablecoin licenses, significantly reduces regulatory uncertainty. this clarity is a major catalyst for institutional investment and broader adoption, fostering a more robust and trusted digital asset ecosystem.

Trustworthiness

HighThe news comes from coindesk, a reputable crypto news source, reporting direct announcements from hong kong policymakers and sentiments from industry leaders at consensus hong kong. the details provided are specific and grounded in official initiatives.

Price Direction

BullishRegulatory clarity from a major financial hub like hong kong is a strong positive signal for the entire crypto market. it encourages traditional institutions to enter the space, bringing significant capital and legitimacy, which typically leads to increased demand and upward price pressure, particularly for major assets and stablecoins.

Time Effect

LongWhile initial announcements might generate short-term positive sentiment, the full impact of these regulatory frameworks – in terms of attracting substantial institutional capital, developing new products, and widespread adoption – will unfold over several months to years as companies build and invest under the new guidelines.

Original Article:

Article Content:

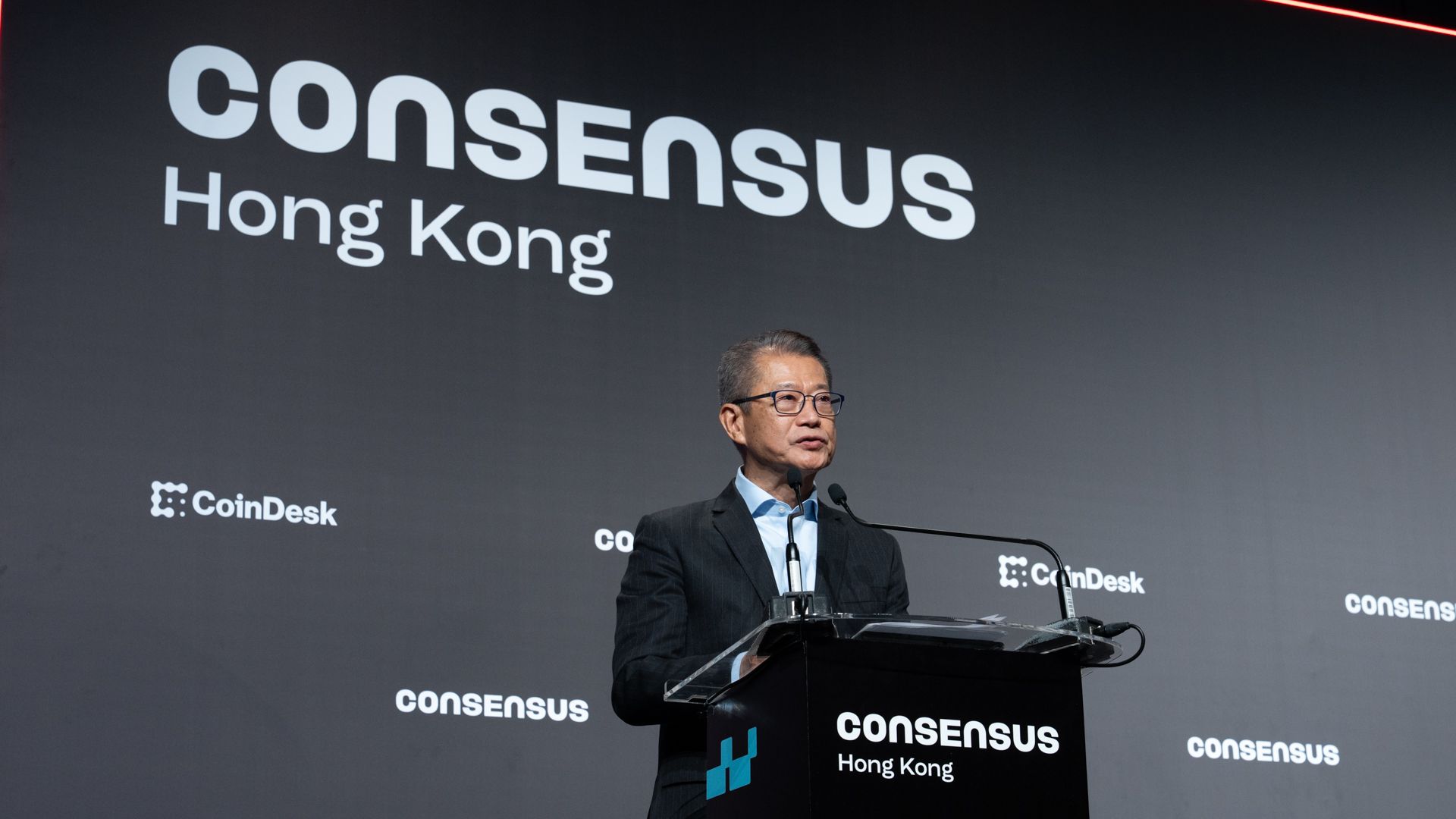

Policy Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Hong Kong is trying to build up its crypto regulations: State of Crypto Several leaders in Hong Kong announced efforts to advance the region's regulatory environment. By Nikhilesh De | Edited by Sheldon Reback Feb 15, 2026, 7:00 p.m. Make us preferred on Google Hong Kong Financial Secretary Paul Chan Mo-po (David Paul Morris/Consensus) Consensus Hong Kong wrapped up with a bang as policymakers announced new initiatives to grow the digital assets sector. You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions. STORY CONTINUES BELOW Don't miss another story. Subscribe to the State of Crypto Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Slow and steady The narrative Policymakers at Consensus Hong Kong announced a slew of initiatives aimed at strengthening the local digital asset ecosystem. Why it matters Philosophically speaking, the question of why we still care about this industry remains top of mind. Consensus showed that despite the sometimes ridiculous projects and unachievable hype cycles, companies still have a genuine use for the technology. Breaking it down Hong Kong's regulators are trying to encourage growth in the local digital asset ecosystem, unveiling a framework for perpetual contracts and saying that stablecoin licenses will be announced in the coming month. "That certainty of direction gives a lot of companies confidence to invest in Hong Kong and to build further," said Jason Atkins, the chief commercial officer of crypto trading firm Auros. While the Special Administrative Region of China is not yet close to approving all applicants and activities, the fact that regulators like the Securities & Futures Commission and the Hong Kong Monetary Authority are willing to engage and adapt their approaches to digital assets is still significant, he told CoinDesk. They're asking companies what they need to do to encourage investment, he said. "We've gone into the SFC a few times, spoken with the HKMA on think tanks and panels and groups where they literally are just trying to understand how our businesses operate and what we need to invest even more into the city, which is really positive," he said. The regulators have been positively engaged, trying to discern what companies need from them to operate in the region. This includes asking whether certain regulations need to be adjusted to address market needs, he said. "So they think about ways they can loosen those or lighten them up for certain types of investor classes," he said. This fits with a broader trend of more traditional institutions wanting to get into crypto — or at least blockchain. Multiple panelists, representing companies like Franklin Templeton and Swift, said they were using or exploring blockchain technology to streamline their operations. It's reminiscent of the 2018 "blockchain, not Bitcoin" era, but these entities are actually executing, rather than just announcing pilots. That an increasing number of traditional entities are moving into blockchain may be the story of 2026, said Edge & Node CEO Rodrigo Coelho. Companies are "rushing to figure this out," he told CoinDesk. "Companies are seeking out consulting and expertise." Shawn Chan, of Singapore Gulf Bank, described these types of rails as being superior for transferring value. While international regulatory hurdles need to be worked out, he estimated that companies will increasingly adopt blockchain tooling within the next decade. This week This week Congress and federal regulators are not holding any hearings tied to crypto this week. If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social . You can also join the group conversation on Telegram . See ya’ll next week! Newsletters State of Crypto Consensus Hong Kong 2026 More For You Accelerating Convergence Between Traditional and On-Chain Finance in 2026? By CoinDesk Jan 30, 2026 Commissioned by Societe Generale-FORGE Read full story More For You Crypto group counters Wall Street bankers with its own stablecoin principles for bill By Jesse Hamilton | Edited by Nikhilesh De Feb 13, 2026 After the bankers shared a document at the White House demanding a total ban on stablecoin yield, the crypto side answers that it needs some stablecoin rewards. What to know : The U.S. Senate's crypto market structure bill has been waylaid by a dispute over something that's not related to market structure: yield on stablecoins. The Digital Chamber is offering a response to a position paper circulated earlier this week by bankers who oppose stablecoin yield. The crypto group's own principles documents argues that certain rewards are needed on stablecoin acvitity, but that the industry doesn't need to pursue products that directly threaten bank deposits business. Read full story Latest Crypto News Prediction markets vs. insider trading: Founders admit blockchain transparency is the only defense 1 hour ago BlackRock's digital assets head: Leverage-driven volatility threatens bitcoin’s narrative 5 hours ago XRP outruns bitcoin, ether after investors piled into the recent crash 5 hours ago Wall Street remains bullish on bitcoin while offshore traders retreat 7 hours ago The Genius Act ripple effect: Sui executives say institutional demand has never been higher Feb 14, 2026 Elon Musk's X to launch crypto and stock trading in ‘couple weeks’ Feb 14, 2026 Top Stories Crypto group counters Wall Street bankers with its own stablecoin principles for bill Feb 13, 2026 Recapping Consensus Hong Kong Feb 13, 2026 Trump-linked Truth Social seeks SEC approval for two crypto ETFs Feb 13, 2026 Wall Street analysts slash Coinbase price targets after Q4 miss — but shares rally Feb 13, 2026 Galaxy’s Steve Kurz sees ‘great convergence’ driving crypto’s long-term outlook Feb 14, 2026 Ethereum Foundation leadership shake-up: Tomasz Stańczak out as co-executive director Feb 13, 2026