Recapping Consensus Hong Kong

Analysis

Price Impact

MedThe discussions at consensus hong kong highlight a growing institutional adoption of ethereum, particularly through 'digital asset treasuries' (dats), treating eth as productive financial infrastructure. this signals a fundamental shift towards utility over pure speculation.

Trustworthiness

HighReporting from a major industry conference (consensus hong kong) featuring quotes from prominent figures like joe lubin and joseph chalom, discussing concrete institutional strategies for ethereum.

Price Direction

BullishDespite mentions of current price plunges, the news itself presents a strong bullish case for eth's long-term value. the emphasis on its role as 'productive financial infrastructure' for institutional use fundamentally strengthens its demand proposition and reduces its reliance on speculative trading.

Time Effect

LongThe evolution of digital asset treasuries as a distinct institutional strategy and the broader convergence of traditional finance with on-chain solutions are long-term trends that will gradually influence market dynamics and price discovery for eth.

Original Article:

Article Content:

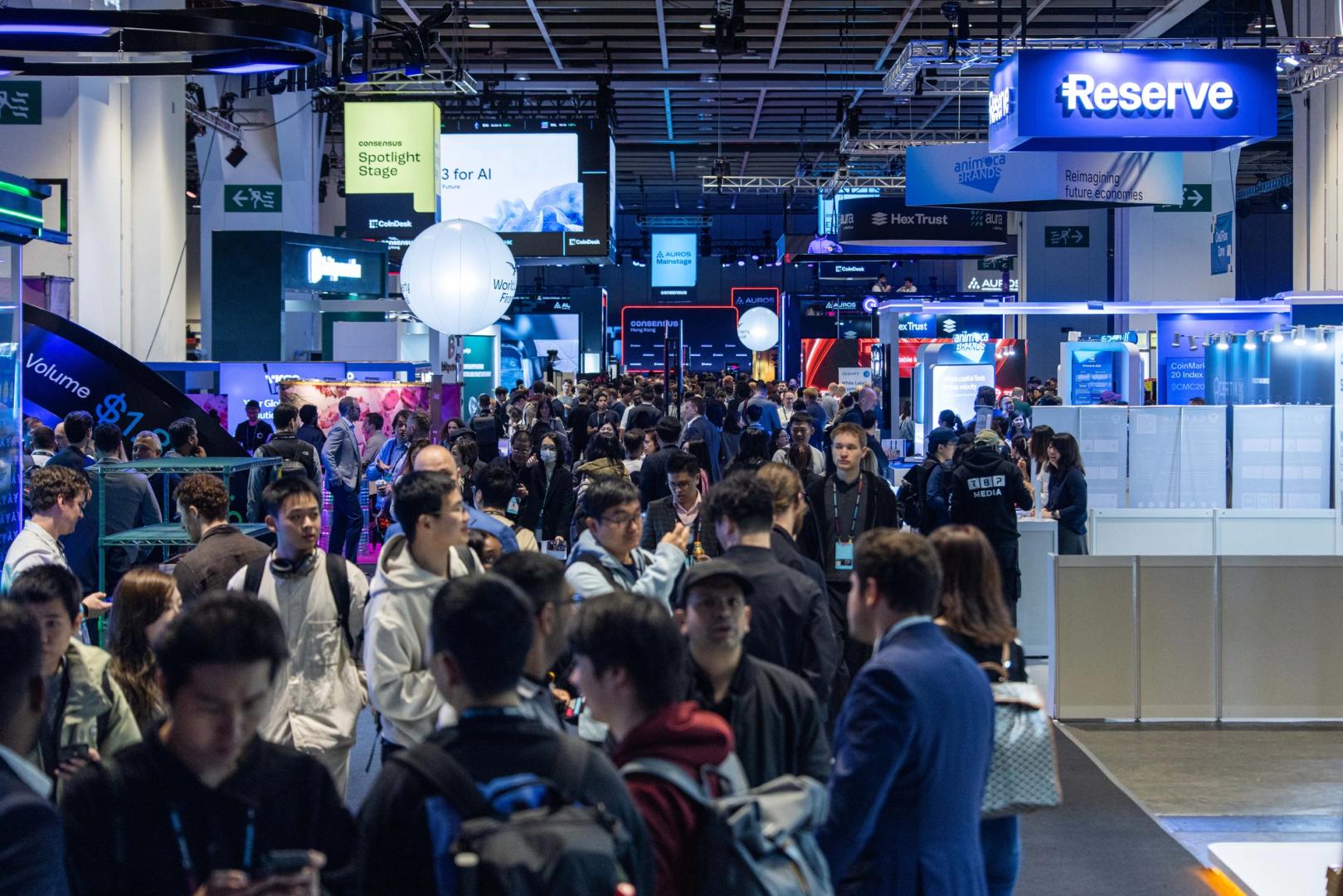

Finance Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Recapping Consensus Hong Kong Crypto's role in payments for AI, regulatory changes and the digital asset market dominated conversations on the ground. By Nikhilesh De | Edited by Sheldon Reback Feb 13, 2026, 8:33 a.m. Make us preferred on Google Consensus Hong Kong 2026 More For You Accelerating Convergence Between Traditional and On-Chain Finance in 2026? By CoinDesk Jan 30, 2026 Commissioned by Societe Generale-FORGE Read full story More For You Sharplink's Lubin and Chalom make their case for ether DATs as prices plunge By Margaux Nijkerk , AI Boost | Edited by Stephen Alpher 13 hours ago At a panel discussion at Consensus Hong Kong 2026 featuring Sharplink Gaming Chairman Joe Lubin and CEO Joseph Chalom, the two executives outlined how digital asset treasuries are evolving into a distinct institutional strategy. What to know : As institutional adoption of digital assets matures, a new corporate playbook is emerging: treat ether not just as an investment, but as productive financial infrastructure. At a panel discussion at Consensus Hong Kong 2026 featuring Sharplink Gaming (SBET) Chairman Joe Lubin and CEO Joseph Chalom, the two executives outlined how DATs are evolving into a distinct institutional strategy. Read full story Latest Crypto News Crypto execs Armstrong, Garlinghouse among many named to U.S. CFTC advisory group 10 hours ago Coinbase misses Q4 estimates as transaction revenue falls below $1 billion 11 hours ago Bitcoin tumbles back near last week's lows as AI fears crush tech and precious metals plunge 11 hours ago Crypto PAC Fairshake seeks to force resistant Texas Democrat Al Green from U.S. House 12 hours ago Sharplink's Lubin and Chalom make their case for ether DATs as prices plunge 13 hours ago Aave labs proposes ‘Aave Will Win’ plan to send 100% of product revenue to DAO 13 hours ago Top Stories Key Senate Democrat wants U.S. crypto bill to move, and SEC chief reveals danger of defeat 14 hours ago Ark Invest's Cathie Wood says bitcoin will thrive amid ‘deflationary chaos’ created by AI and innovation 14 hours ago Standard Chartered sees bitcoin sliding to $50,000, ether to $1,400 before recovery 17 hours ago Recapping day 2 of Consensus Hong Kong 19 hours ago Forget $80k: Michael Terpin warns bitcoin could revisit the $40,000s before a real recovery 20 hours ago