Ondo and Securitize execs say utility, not hype, will drive tokenization’s next phase

Analysis

Price Impact

MedThe emphasis on utility, compliance, and capital efficiency by leading tokenization firms like ondo and securitize provides a strong fundamental case for the long-term growth of the real world assets (rwa) sector. while not an immediate price catalyst, it reinforces sustainable value creation.

Trustworthiness

HighInformation comes from executives of prominent firms (ondo finance, securitize) directly quoted at a major industry conference (consensus hong kong) and reported by a reputable news source (coindesk).

Price Direction

BullishThe focus on real-world utility, such as tokenized assets being used as defi collateral, and regulatory compliance will drive adoption, increase capital efficiency, and attract more institutional interest. this creates a more robust and sustainable market for rwa tokens, including ondo, leading to long-term price appreciation.

Time Effect

LongThe shift from 'hype' to 'utility and compliance' as the primary drivers of tokenization represents a foundational change that will unfold and gain momentum over an extended period, leading to sustained growth rather than short-term speculative spikes.

Original Article:

Article Content:

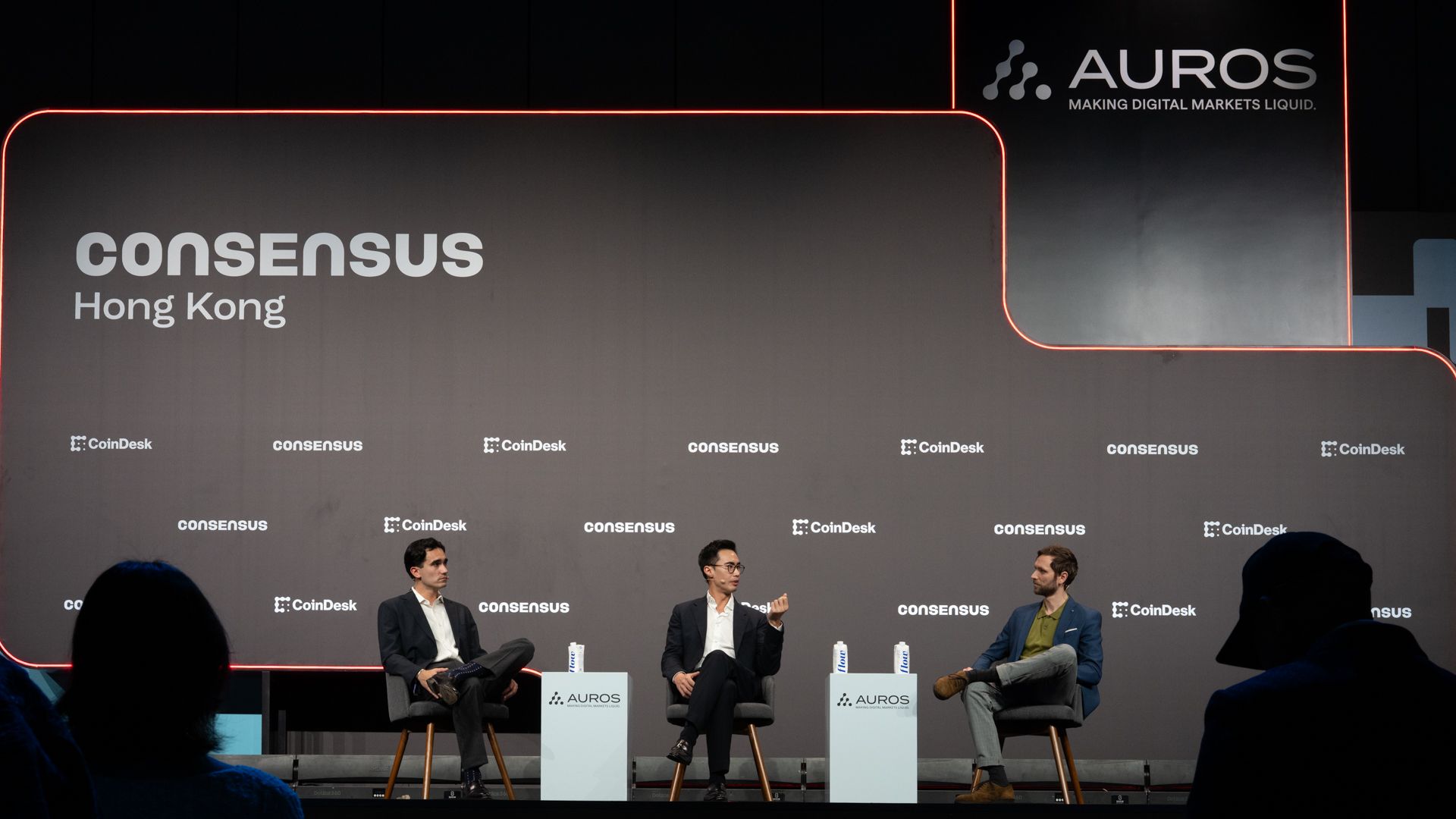

Finance Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Ondo and Securitize execs say utility, not hype, will drive tokenization’s next phase Executives from both firms say the next phase of tokenization must prioritize functionality and compliance during a panel at Consensus in Hong Kong. By Helene Braun | Edited by Stephen Alpher Feb 11, 2026, 5:48 p.m. Make us preferred on Google Left to right: Graham Ferguson, head of ecosystem at Securitize; Min Lin, managing director of global expansion at Ondo; and Coindesk’s Kris Sandor (Coindesk) What to know : Executives from Securitize and Ondo Finance say tokenization’s growth will depend less on hype and more on delivering clear, real-world uses for tokenized assets. While institutional interest is strong, Securitize’s Graham Ferguson says regulatory compliance and on-chain distribution via exchanges and DeFi protocols remain major bottlenecks. Ondo’s Min Lin argues that enabling tokenized Treasuries, stocks and ETFs to be used as margin collateral in DeFi shows how added utility and capital efficiency can drive the next phase of tokenization. Hong Kong — Tokenization is gaining traction, but its success depends less on market hype and more on real-world utility, say executives from Ondo Finance and Securitize. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . “There’s no shortage of firms, of issuers, of companies that are interested in tokenizing,” said Graham Ferguson, head of ecosystem at Securitize, during a panel discussion at Consensus Hong Kong. “But it’s on us to figure out how to distribute these assets on-chain via exchanges in a way that is compliant, regulatory-friendly globally.” Ferguson emphasized that despite high interest on the institutional side, distribution and compliance remain the bottlenecks. “The biggest issue that we run into is communicating with exchanges and DeFi protocols about the requirements that are necessary to adhere to our obligations as a regulated entity,” he said. Securitize has partnered with firms such as BlackRock to tokenize real-world assets, including U.S. Treasury funds. BlackRock’s BUIDL fund, launched in 2024, now holds over $2.2 billion in assets, making it the largest tokenized Treasury fund on the market. Ondo Finance, which also focuses on tokenized Treasuries and exchange-traded funds (ETFs), has about $2 billion in total value locked (TVL) according to data from rwa.xzy. Min Lin, Ondo’s managing director of global expansion, said tokenized Treasuries today are a fraction of the potential market. Both speakers stressed that the next phase of tokenization will be driven by what users can actually do with tokenized assets. Ondo recently enabled tokenized stocks and ETFs to be used as margin collateral in DeFi perpetuals — a first, Lin said. “That brings a lot more capital efficiency in terms of the utility of those tokenized assets,” he added. Ferguson agreed, arguing that technological advantages like programmable compliance and fast settlement aren’t enough on their own. “Utility is absolutely far and away number one,” he said. “That’s what will drive the next phase.” Tokenization Consensus Hong Kong 2026 More For You Why crypto VCs at Consensus Hong Kong are playing a 15-year game By Jamie Crawley , AI Boost | Edited by Sheldon Reback 46 minutes ago With capital tightening, investors are backing “what’s working,” like stablecoins and tokenization, while selectively betting on AI and prediction markets. What to know : Capital is concentrating in stablecoins, payments and tokenization as deal counts fall. Venture capitalists cited missed bets (Polymarket) and late pivots (NFTs) as reminders to balance conviction and flexibility. Investors report a “flight to quality,” backing experienced founders and real revenue over hype. Read full story Latest Crypto News SEC's Paul Atkins grilled on crypto enforcement pull-back, including with Justin Sun, Tron 6 minutes ago JPMorgan bullish on crypto for rest of year as institutional flows set to drive recovery 14 minutes ago Why crypto VCs at Consensus Hong Kong are playing a 15-year game 46 minutes ago Crypto Long & Short: Gen Z trusts code over bank promises 48 minutes ago Institutional crypto platform BlockFills reportedly halts withdrawals, restricts trading 1 hour ago The Protocol: Robinhood unveils its layer-2 testnet 1 hour ago Top Stories Cryptos crumble, bitcoin falls through $66,000, as Friday's bounce fades 1 hour ago BlackRock takes first DeFi step, lists BUIDL on Uniswap as UNI jumps 25% 2 hours ago Analysts react as Robinhood slumps 10%, with slowdown in crypto trading weighing on results 3 hours ago U.S. added stronger than expected 130,000 jobs in January, with unemployment rate falling to 4.3% 4 hours ago Recapping day 1 of Consensus Hong Kong 4 hours ago Tokenization still at start of hype cycle, but needs more use cases, specialists say 7 hours ago