U.S. bitcoin ETFs register back-to-back inflows for first time in a month

Analysis

Price Impact

HighThe first back-to-back inflows into u.s. bitcoin etfs in a month, totaling $616 million, signal renewed institutional interest and demand after a significant price drawdown. this consistent buying pressure through etfs often indicates a potential reversal of bearish sentiment and a re-accumulation phase.

Trustworthiness

HighThe information is from coindesk, a reputable crypto news source, citing data from soso value and checkonchain, providing clear figures for inflows and aum changes.

Price Direction

BullishThe renewed inflows into bitcoin etfs, coupled with the resilience of total btc held in etfs despite price corrections, suggest strong underlying long-term confidence. increased demand from institutional vehicles typically leads to upward price pressure, especially as btc has already bounced from recent lows.

Time Effect

LongEtf inflows, particularly after a correction, often signify sustained institutional accumulation rather than short-term speculation. this can build momentum over weeks to months, contributing to a more prolonged bullish trend.

Original Article:

Article Content:

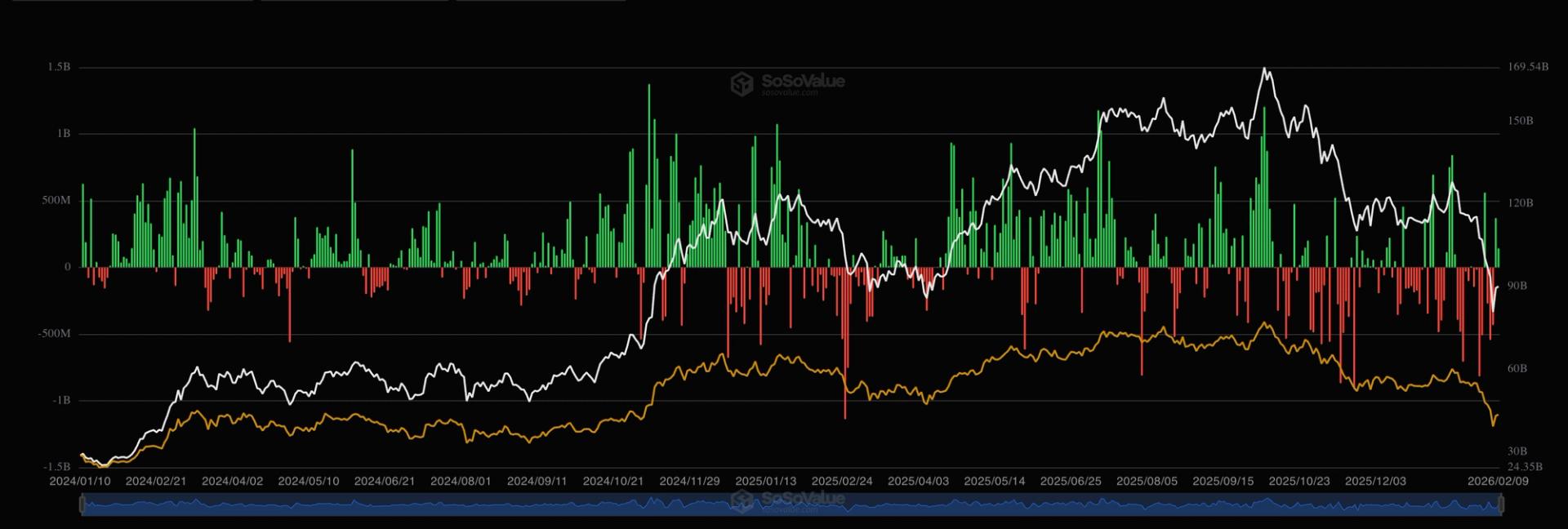

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email U.S. bitcoin ETFs register back-to-back inflows for first time in a month ETF assets under management continue to diverge from spot bitcoin price. By James Van Straten | Edited by Omkar Godbole Feb 10, 2026, 7:58 a.m. Make us preferred on Google US BTC ETF Inflow/Outflow (SoSo Value) What to know : U.S. bitcoin ETFs register back to back inflows for the first time in a month, a total of $616 million. Despite a 50% price drawdown from the October highs, total BTC held in ETFs has only dipped by 6%. For the first time in nearly a month, U.S. bitcoin exchange-traded funds (ETFs) have recorded back-to-back net inflows, snapping a redemption streak that stretched back to mid-January. According to SoSo value data, the consecutive inflows shift began on Friday with $471.1 million in fresh capital, followed by a $144.9 million on Monday. This comes as bitcoin bounced back from Thursday's $60,000 low to around $70,000. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . In mid-January, bitcoin peaked near $98,000 after a two week rally that started at $87,000. The subsequent sell-off to $60,000 saw investors yank millions of these spot ETFs. Broadly speaking, investors still appear confidence about the cryptocurrency's long-term prospects, as evident from the spot ETFs' resilient asset under management (AUM). According to Checkonchain , the cumulative AUM of the 11 funds has only decreased by about 7% since early October, sliding from 1.37 million BTC to 1.29 million BTC. Bitcoin, meanwhile, is down over 40% since hitting record highs above 126,000 in October. Bitcoin News bitcoin spot ETF