Bitcoin falls below $70,000 after erasing post-election gains during 'sell at any price' rout

Analysis

Price Impact

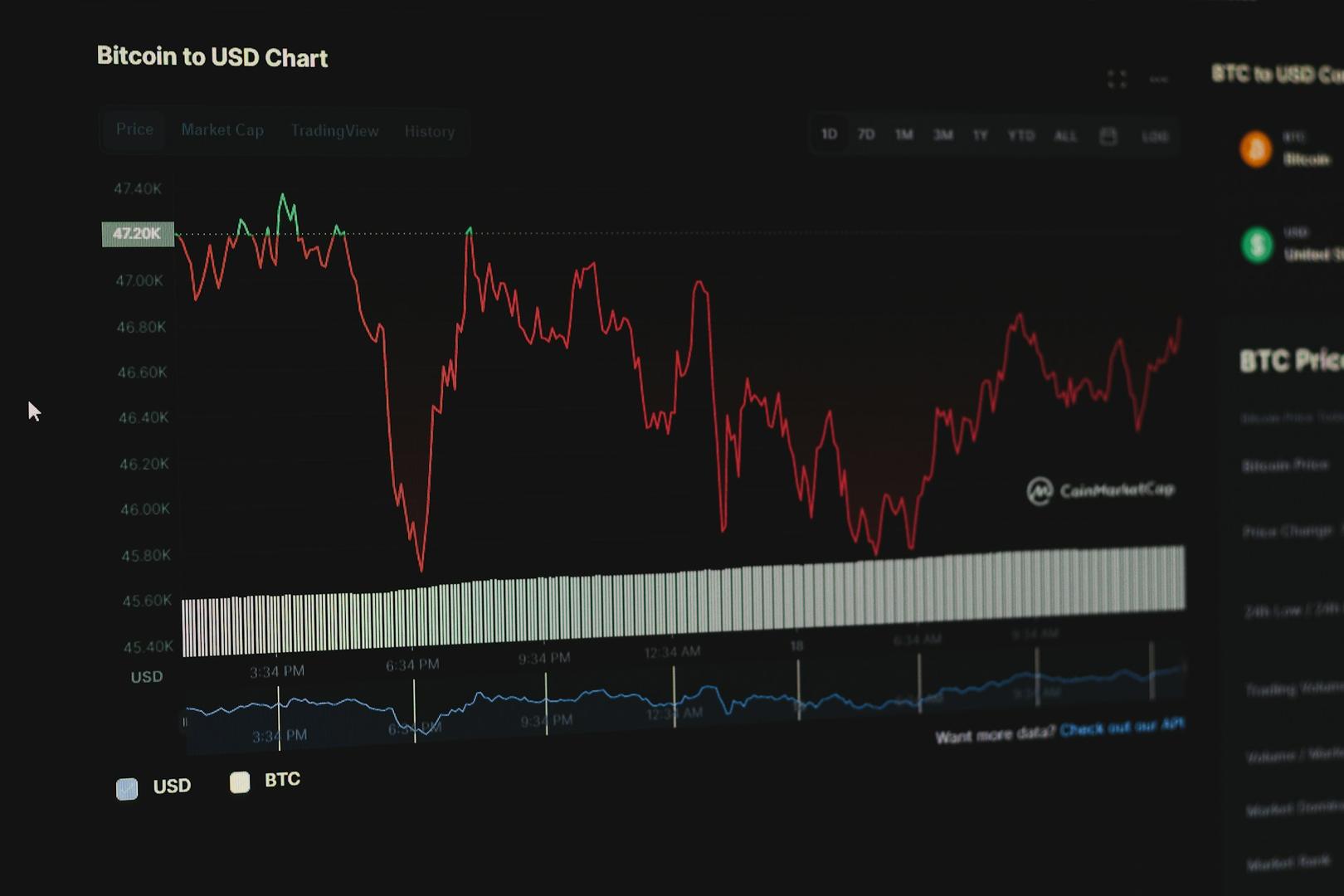

HighBitcoin fell sharply below $70,000, erasing all post-election gains. the drop was characterized as a 'sell at any price' rout, leading to widespread liquidations and significant losses across the crypto market. other major altcoins also saw substantial declines.

Trustworthiness

HighThe analysis is based on a coindesk report, quoting reputable market analysts (wintermute, bianco research, btig) and citing specific market data providers (sosovalue, kaiko), along with verifiable news events (gemini restructuring, etf flows).

Price Direction

BearishDespite a rebound from $60,000 to $69,000, the overall sentiment is bearish due to negative spot bitcoin etf flows ($1.25b net outflows), gemini's operational closures, and a broader deleveraging across assets. increased implied volatility and a tilt towards expensive put options indicate further downside concerns, with analysts eyeing $55,000 as a potential lower bound.

Time Effect

ShortThe article describes a rapid, 'violent drop' over a few days, indicating immediate market turbulence. while there's a short-term rebound, the underlying issues like negative etf flows and reduced market depth suggest continued volatility and price discovery in the near term, with potential for further drops or consolidation.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin falls below $70,000 after erasing post-election gains during 'sell at any price' rout Crypto sentiment was hit as Gemini plans to close operations in several regions and cut staff, while spot bitcoin ETF flows turned negative. By Francisco Rodrigues | Edited by Aoyon Ashraf Feb 7, 2026, 4:08 p.m. Make us preferred on Google (Behnam Norouzi/Unsplash/Modified by CoinDesk) What to know : Bitcoin has risen to around $69,000 after dropping near $60,000, failing to keep gains post-Trump's 2024 election amid a broader market sell-off, with the CoinDesk 20 index down over 17%. Other cryptocurrencies suffered more over the week, with ETH down 22.4%, BNB 23.4%, and SOL 25.2%. Crypto sentiment was hit as Gemini plans to close operations in several regions and cut staff, while spot bitcoin ETF flows turned negative. Bitcoin has recovered from a low near $60,000 to now stand around $69,000, having effectively given back the gains it made after Donald Trump’s election in November 2024 this week. The cryptocurrency’s drop was accompanied by a broader market sell-off that saw the CoinDesk 20 ( CD20 ) index lose more than 17% of its value in a week. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . While bitcoin dropped around 16.5% in the last 7-day period, other cryptocurrencies fared worse. Ether lost 22.4% of its value, BNB dropped 23.4%, and solana 25.2%. Shares of crypto-linked firms registered significant declines despite a Friday rebound, as the price of BTC briefly retook $70,000. The move followed a violent drop a day earlier that Wintermute described as the worst single-day drawdown in bitcoin since the FTX collapse. The sell-off was driven by market-wide liquidations and what “felt like a ‘sell at any price’ working order,” said Jasper De Maere, desk strategist and OTC trader at Wintermute in an emailed statement. De Maere said institutional desks reported “small but manageable liquidation,” which did not fully explain the size of the move, fueling debate over where the stress sat in the system. De Maere added that the cascade came alongside a wider cross-asset deleveraging. The Nasdaq 100 tracker QQQ fell about 500 basis points over three sessions, while silver and gold dropped roughly 38% and 12% below their cycle highs, respectively. In crypto options, implied volatility jumped into the 99th percentile, with skew tilting toward unusually expensive puts, he said. De Maere flagged ether as the “epicenter of the pain,” saying many traders rushed to buy protection against further losses using put options, which can pay out if prices fall and give the holder the right to sell at a set price. In bitcoin, he said positioning pointed to expectations of continued turbulence, with traders focused on a wide range that could run from about $55,000 to $75,000. Further hitting sentiment, this week crypto exchange Gemini said it plans to shutter operations in the U.K., European Union and Australia , and cut about 25% of staff as part of a restructuring.The firm will enter withdrawal-only mode for users in affected regions and partner with brokerage platform eToro for users to transfer their assets. Meanwhile, Bitfarms (BITF) saw its shares rise after ditching its “bitcoin company” identity to instead focus on artificial intelligence (AI) infrastructure. Market structure has added to the turbulence. Bitcoin’s average 1% market depth, a measure of how much can be traded near the current price without moving the market, has fallen to around $5 million from more than $8 million in 2025, Kaiko research analyst Thomas Probst told Reuters . Lower depth can make price moves more abrupt. Flows in spot bitcoin ETFs have also turned negative. Data from SoSoValue shows about $1.25 billion of net outflows over the past three days. Jim Bianco of Bianco Research estimated on social media that the average ETF cost basis is near $90,000, leaving holders with about $15 billion in unrealized losses. “It has been said that crypto is 'programmable money.' If so, BTC should trade like a software stock,” Bianco said in an X post , adding that the recent decline shows it is trading alongside software stocks. Software stocks tumbled this week after Anthropic released a new automation tool for its AI models targeting legal and other knowledge-focused workflows. Shares of Salesforce (CRM), Adobe (ADBE), and ServiceNow (NOW) lost 8%, 9%, and 13% respectively over the week, to name a few. BTIG chief market technician Jonathan Krinsky also said bitcoin has been correlated with software stocks lately. “There’s some pretty compelling evidence both of those [bitcoin and software stocks] have put in tactical lows,” Krinsky said during an interview with CNBC . “[Bitcoin] bottomed last night right around $60,000 so I think that’s a pretty good level to trade against.” “On the upside you really need to see it back above $73,000, that was the key breakdown level, that would kind of confirm a tradable low is certainly in,” he added. The Trump administration has maintained a pro-crypto stance, which helped the price of bitcoin hit a new all-time high above $125,000 last year, before a correction kicked in. Bitcoin News crypto market crypto prices