Bitcoin's rising leveraged position points to continued dip buying, but may not yet signal price bottom

Analysis

Price Impact

HighA significant surge in bitfinex margin longs (77,100 btc) indicates strong dip buying by whales. historically, such levels precede market bottoms but also coincide with market stress, suggesting the full impact might unfold over time.

Trustworthiness

HighBased on reputable crypto news source (coindesk) referencing specific exchange data (bitfinex margin longs via tradingview) with historical analysis.

Price Direction

NeutralWhile significant whale dip buying is occurring (bullish), historical data indicates that a peak in margin longs often precedes, rather than signals, a definitive price bottom. this suggests potential for continued market stress or further consolidation before a sustained recovery, despite the underlying demand. bitcoin has also seen five consecutive monthly declines.

Time Effect

LongThe current buildup of margin longs, while indicating demand, aligns with historical patterns where peak longs occur before a true price bottom. this implies a longer period may be required for the market to find a definitive floor and establish a sustained reversal.

Original Article:

Article Content:

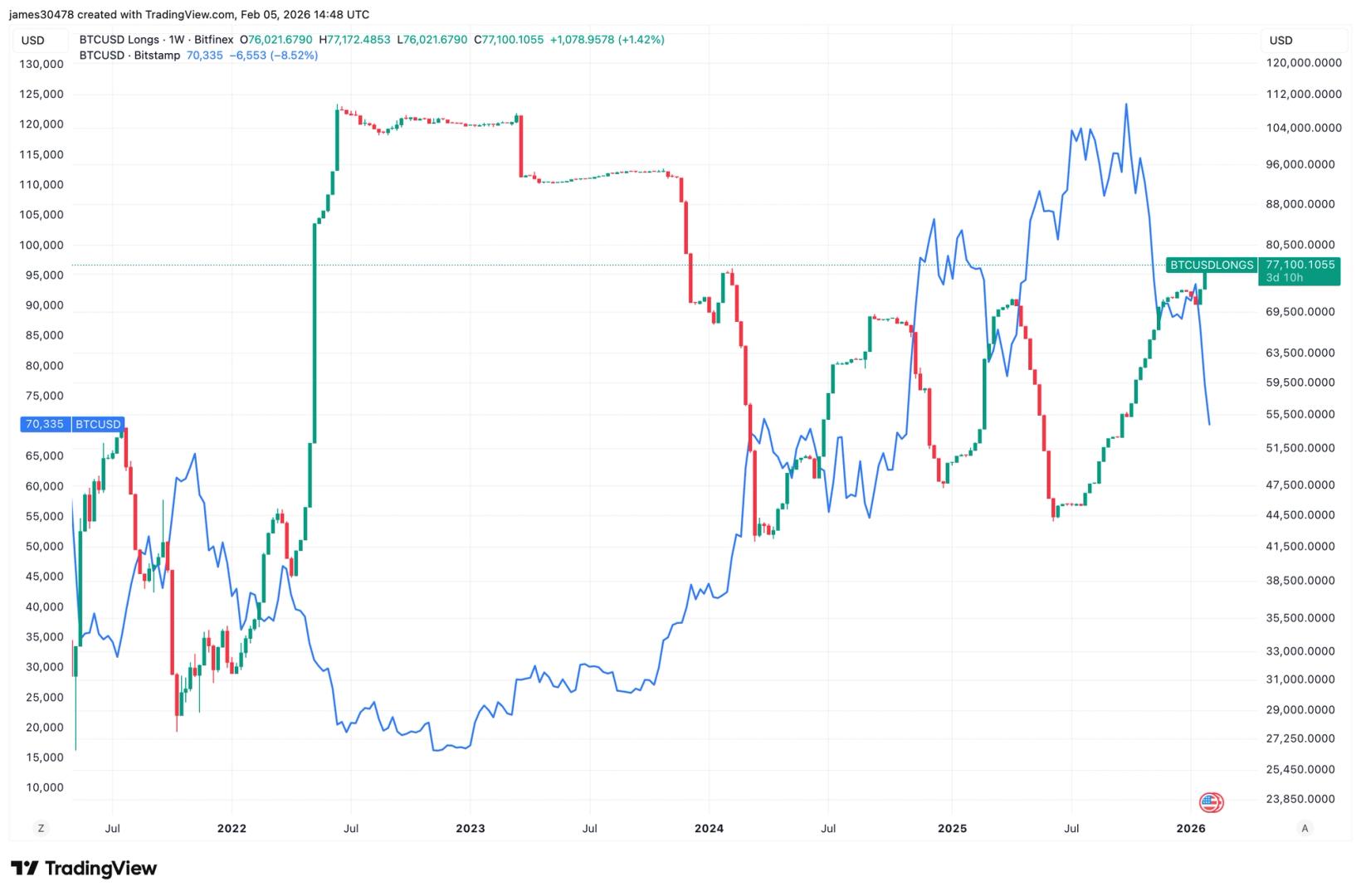

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin's rising leveraged position points to continued dip buying, but may not yet signal price bottom Bitfinex margin longs surge to a two-year high as bitcoin falls below $69k. By James Van Straten | Edited by Aoyon Ashraf Feb 5, 2026, 3:32 p.m. Make us preferred on Google BTCUSD Longs Bitfinex (TradingView) What to know : Bitfinex margin long positions have climbed to around 77,100 BTC, up 64% in six months. The steady build in leveraged longs has historically coincided with periods of market stress, but also indicates that a clear price bottom has yet to occur. Bitcoin has fallen below $69,000. Bullish bitcoin bets funded with borrowed money are rising on Bitfinex, one of the oldest crypto exchanges, even as the price continues to fall. Margin long positions have climbed to roughly 77,100 BTC, the highest level since December 2023, when bitcoin was trading near $40,000, according to TradingView data. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Margin longs are up 64% over the past six months, as bitcoin has fallen nearly 50% from its October all-time high. This suggests that a large holder, often referred to as a whale, is continuing to buy into the correction, with bitcoin dropping below $69,000 for the first time since November 2024. Historically, Bitfinex margin long positions have acted as a contrarian indicator. The position tends to expand during periods of market stress and narrow when prices rise. At previous cycle lows, margin long exposures were held near peak levels as prices bottomed out. This behavior was evident around the FTX collapse in November 2022, the August 2024 "carry-trade" unwind, and most recently during the "tariff tantrum" in April 2025. The current buildup in margin longs coincides with bitcoin being on track for five consecutive monthly declines. However, as the position continues to grow, it may suggest that bitcoin has yet to find a definitive price bottom. Bitcoin News Bitfinex