Miner capitulation is back as bitcoin’s $70,000 price fails to cover $87,000 production costs

Analysis

Price Impact

HighBitcoin's spot price ($70,000) is significantly below the estimated average production cost ($87,000), forcing miners to sell holdings to cover operational expenses and debt. this creates significant selling pressure.

Trustworthiness

HighThe analysis is based on historical patterns of bitcoin trading below production cost during bear markets, using network difficulty as a proxy for mining costs, a recognized metric in the industry.

Price Direction

BearishMiner capitulation, driven by unprofitability, leads to increased selling of btc by miners to sustain operations, adding downward pressure on the price. historically, this has been a feature of bear markets.

Time Effect

ShortThe immediate effect of miners selling their btc holdings to cover costs will exert short-term bearish pressure on the price. this selling typically continues until profitability improves or less efficient miners exit the market.

Original Article:

Article Content:

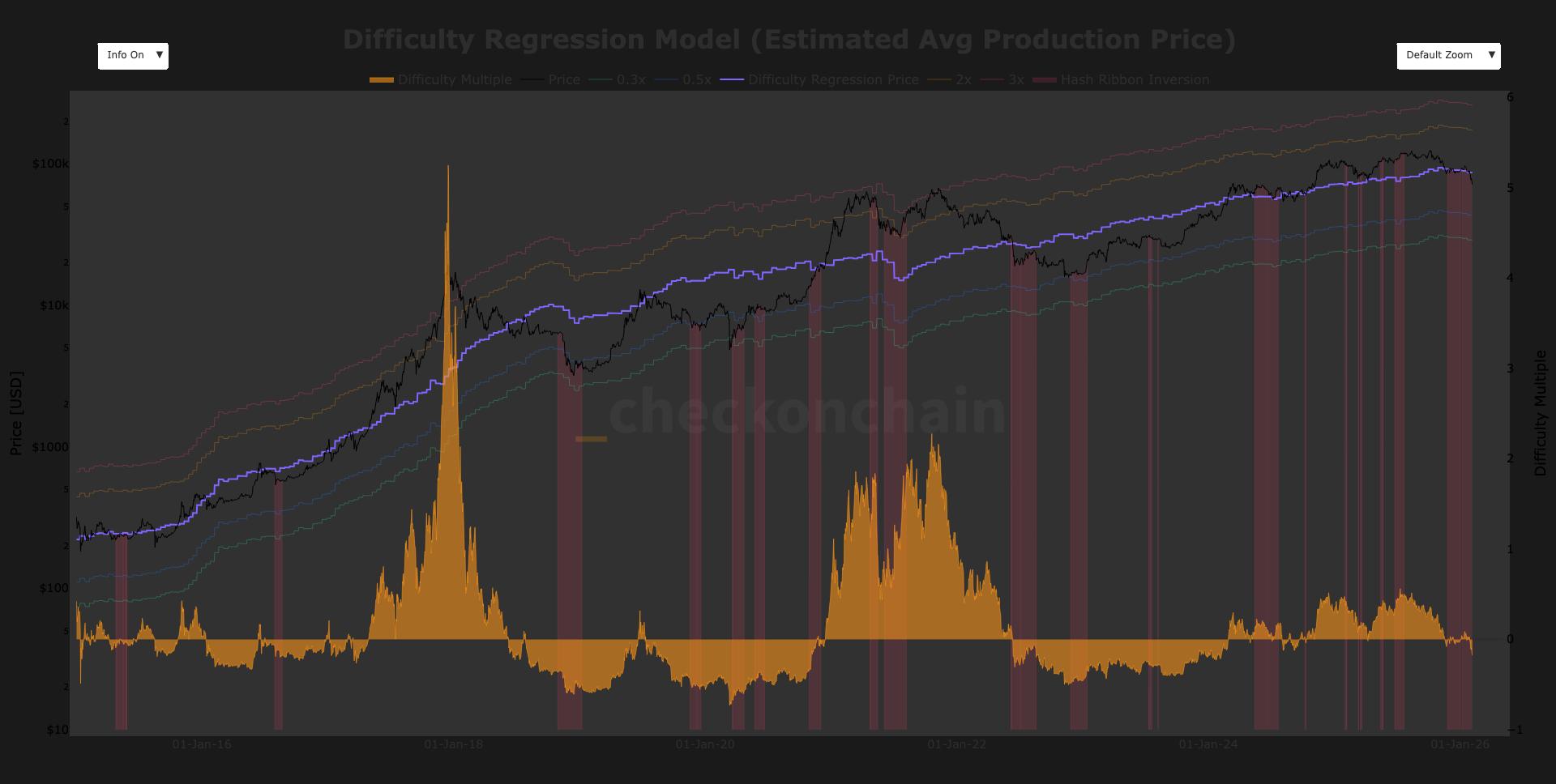

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Miner capitulation is back as bitcoin’s $70,000 price fails to cover $87,000 production costs Bitcoin is now approximately 20% below its estimated average production cost, historically a feature of a bear market. By James Van Straten | Edited by Jamie Crawley Feb 5, 2026, 10:41 a.m. Make us preferred on Google Average Production Cost (Checkonchain) What to know : Bitcoin near $70,000 is roughly 20% below the estimated average production cost of around $87,000, historically a feature of a bear market. In previous bear markets, including 2019 and 2022, bitcoin traded below production cost before gradually converging back toward it. Hashrate has rebounded after a 20% drawdown from all time highs near 1.1 ZH/s in October. Bitcoin BTC $ 71,016.17 is now approximately 20% below its estimated average production cost, increasing financial pressure across the BTC mining sector. The average cost to mine one bitcoin is around $87,000, according to data from Checkonchain , while the spot price has fallen towards $70,000. Historically, trading below production cost has been a feature of a bear market. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . The production estimate uses network difficulty as a proxy for the industry’s all-in cost structure. By linking difficulty to bitcoin’s market capitalization, the model provides an estimate of average mining costs. In previous bear markets, including 2019 and 2022, bitcoin traded below production cost before gradually converging back toward it. Hashrate, which measures the total computational power securing the bitcoin network, peaked near 1.1 zettahash (ZH/s) in October, subsequently declining by roughly 20% as less efficient miners were forced offline. More recently, hash rate has rebounded to 913 EH/s, suggesting some stabilization. However, many miners remain unprofitable at current prices. With revenues below operating costs, miners are continuing to sell bitcoin holdings to fund day-to-day operations, cover energy expenses, and service debt. This ongoing miner capitulation highlights persistent stress in the sector. Bitcoin News Bitcoin Miner Hashrate In this article BTC BTC $ 71,016.17 ◢ 6.85 %