Bitcoin’s thinnest price zone hints at extended stay between $70,000 and $80,000

Analysis

Price Impact

MedBitcoin's extended stay in the historically thin $70,000-$80,000 range, lacking strong historical support, suggests either prolonged consolidation or a retest of the lower end of this range.

Trustworthiness

HighAnalysis is based on glassnode's unspent realized price distribution (urpd) data, on-chain supply analysis, and historical price action, providing robust insights.

Price Direction

NeutralThe article indicates a potential consolidation within the $70,000-$80,000 range or a move towards the $70,000 mark to build stronger support, implying a lack of immediate directional breakout.

Time Effect

LongThe current behavior suggests a longer period for price discovery and base building in this range, given its historically undeveloped nature and the need to establish durable support.

Original Article:

Article Content:

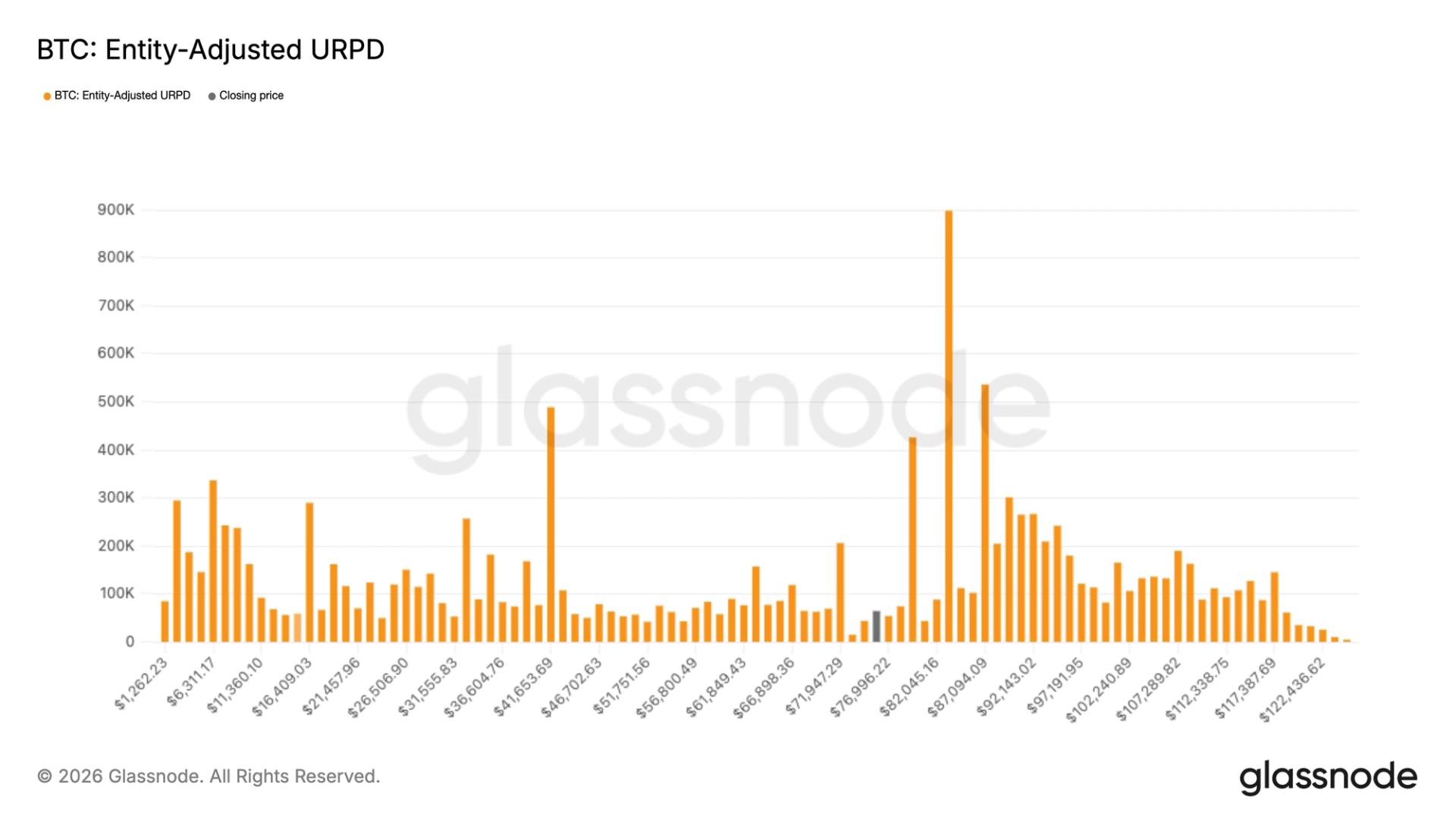

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin’s thinnest price zone hints at extended stay between $70,000 and $80,000 Limited historical trading activity and thin onchain supply suggest further consolidation or a retest of the lower range. By James Van Straten | Edited by Sheldon Reback Feb 4, 2026, 12:35 p.m. Make us preferred on Google BTC URPD: (Glassnode) What to know : Bitcoin has traded in a relatively narrow band between $70,000 and $79,999 for five days, an unusually long stay in a price zone where it has historically spent little time. Because bitcoin has seen limited trading history in that range, the area lacks strong historical support or resistance and may become a consolidation zone or see a move toward the lower end. Trading data show a structural shortage of supply in the region, evidenced by only one major purchase by Strategy and past episodes where the price moved through it rapidly. Since the weekend's slump, the bitcoin BTC $ 76.073,52 price has been constrained between $70,000 and $79,999 for five straight days. That's a remarkably long time for a range in which the largest cryptocurrency has spent a relatively short span of time. In fact, bitcoin has spent about 35 days within that $10,000 bucket. Compared with other increments, it's one of the least developed, underscoring how quickly the price has tended to move through rather than build sustained support or resistance. STORY CONTINUES BELOW Verpassen Sie keine weitere Geschichte. Abonnieren Sie noch heute den Crypto Daybook Americas Newsletter . Alle Newsletter ansehen Melden Sie mich an By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and Datenschutzrichtlinie . The longer the price spends in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support. What this means is the price is more likely to consolidate in this range or, potentially, make another move toward the lower end near before establishing a more durable base. During the tariff driven volatility last April, bitcoin held below $80,000 for just a few weeks before rebounding. Similarly, when it reached a then all-time high near $73,000 in March 2024, it spent only a short period at those levels before declining. Perhaps the clearest example of how quickly bitcoin has moved through this range occurred in November 2024 following Donald Trump’s presidential election victory. The price accelerated from roughly $68,000 to $100,000 in a matter of weeks, leaving little opportunity for consolidation between $70,000 and $80,000. It's notable that Strategy (MSTR), the largest corporate holder of bitcoin, has only once bought bitcoin within this range . On Nov. 11, 2024, the company purchased 27,200 BTC for approximately $2 billion at an average price of $74,463. Consider a chart that shows the prices at which bitcoin last moved within a specific price bucket. Each column represents the amount of bitcoin transferred at that price. The data clearly shows a lack of supply between $70,000 and $80,000, suggesting that this zone remains structurally thin. Bitcoin News Glassnode In this article BTC BTC $ 76.073,52 ◢ 3,35 %