Dogecoin falls 7% as risk-off trade hits Ethereum tied tokens

Analysis

Price Impact

HighDogecoin fell 7% due to broad risk-off sentiment and heavy derivatives speculation, acting as a high-beta asset. key support levels were breached, indicating significant price movement.

Trustworthiness

HighAnalysis is based on coindesk data and professional market commentary, detailing specific price levels and trading activity.

Price Direction

BearishDoge dropped from $0.1085 to $0.1030. technicals show a sharp rejection near $0.110 and a breakdown below $0.106. the crucial support is $0.10; a break below this level could lead to a further decline towards $0.08.

Time Effect

ShortThe analysis focuses on immediate support ($0.10) and resistance levels ($0.106, $0.110) and the potential for short-term downside acceleration if $0.10 fails to hold.

Original Article:

Article Content:

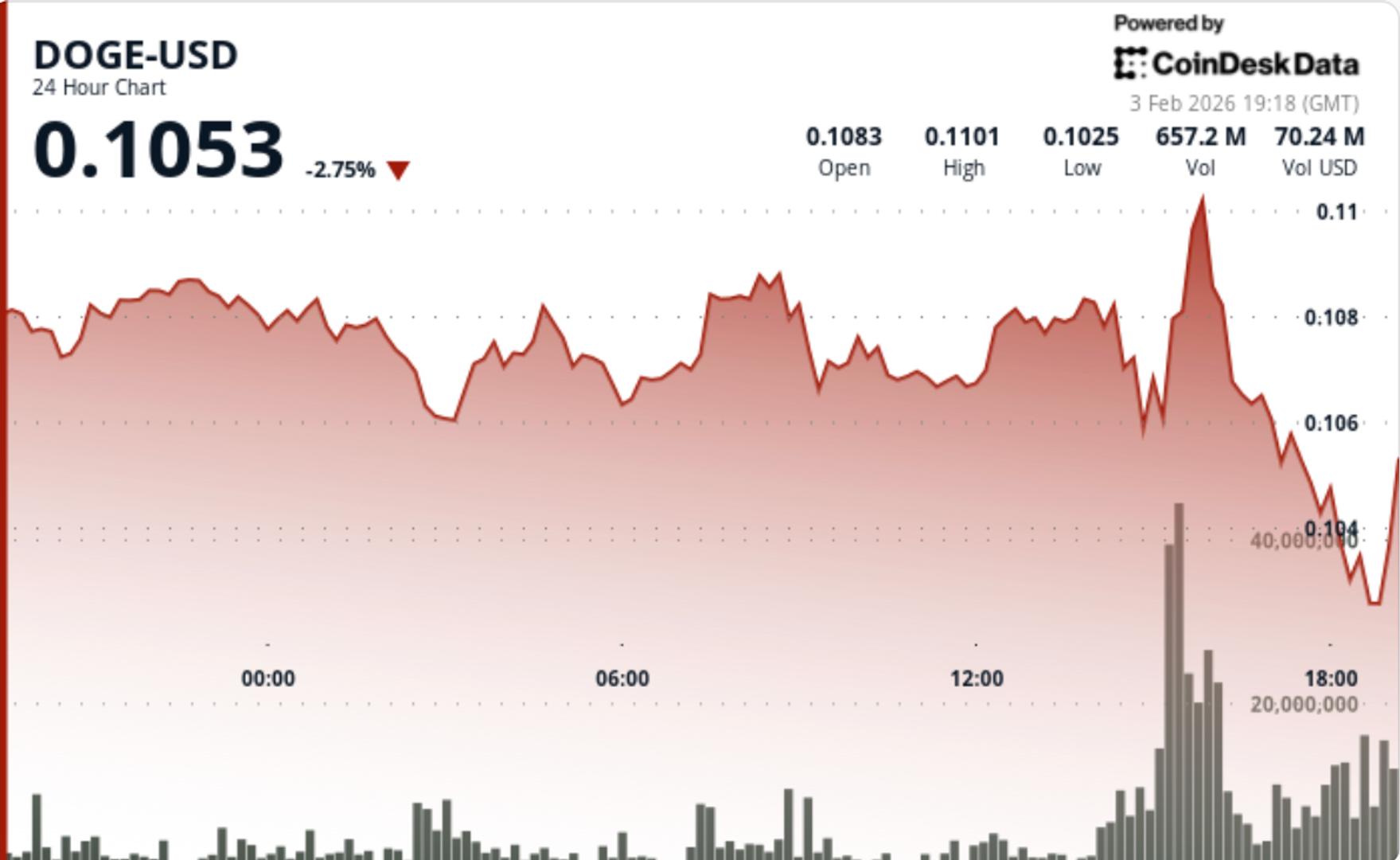

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Dogecoin falls 7% as risk-off trade hits Ethereum tied tokens The sell-off was driven by risk-off positioning and heavy derivatives speculation, with futures volume surging even as spot trading declined. By Shaurya Malwa Feb 3, 2026, 7:35 p.m. Make us preferred on Google (CoinDesk Data) What to know : Dogecoin dropped about 6.9 percent, sliding from roughly $0.1085 to $0.1030 as broader crypto markets weakened. The sell-off was driven by risk-off positioning and heavy derivatives speculation, with futures volume surging even as spot trading declined. Traders view $0.10 as a key support level, with a break lower potentially opening downside toward $0.08, while a sustained move back above $0.106–$0.110 would be needed to signal recovery. DOGE slid sharply as sellers pushed price through multiple support levels, with a spike in derivatives activity signaling speculation rather than conviction buying. News Background Dogecoin fell alongside broader crypto weakness, acting as a high-beta proxy as ether slid roughly 7% over the same period. The move wasn’t driven by DOGE-specific news, but by risk-off positioning that weighed on speculative assets. Macro sentiment remained mixed even as U.S. lawmakers narrowly passed a funding bill to end the government’s partial shutdown, removing one near-term uncertainty but doing little to improve appetite for risk across crypto markets. Price Action Summary DOGE fell about 6.9% , sliding from $0.1085 to $0.1030 Multiple support levels failed during the decline A sharp volume spike near $0.110 marked a failed breakout and reversal Price stabilized late in the session near $0.103–$0.104 Technical Analysis DOGE rejected sharply near $0.110, where a high-volume spike gave way to a fast reversal, flipping that zone into resistance. Selling accelerated once price broke below $0.106, confirming a distribution-led breakdown rather than a brief liquidity sweep. The final hour saw capitulation-style selling into the $0.103 area, where bids finally emerged to slow the decline. While that suggests short-term stabilization, structure remains bearish unless DOGE can reclaim lost support. A notable feature of the session was the disconnect between futures and spot: derivatives volume surged while spot trading declined, pointing to speculative positioning rather than fresh demand. What traders say is next? Traders see $0.10 as the immediate line in the sand. If $0.10 holds, DOGE may consolidate as liquidation pressure fades — but bulls would need a reclaim of $0.106, and eventually $0.110, to argue the selloff has run its course. If $0.10 breaks, downside risk opens toward $0.08, with momentum likely to accelerate given the recent failure of multiple support levels. For now, DOGE remains a high-beta trade, with futures activity amplifying moves but spot demand needed to confirm any meaningful recovery.