Moscow Exchange to add SOL, XRP, and TRX futures contracts to crypto derivatives lineup

Analysis

Price Impact

MedThe moscow exchange adding cash-settled futures for sol, xrp, and trx will increase their institutional accessibility and legitimacy within russia. while limited to qualified investors and ruble-settled, this expands the derivative market for these altcoins, potentially boosting trading volume and investor interest.

Trustworthiness

HighThe news comes from coindesk, citing maria silkina, a senior manager at moex, which is a credible source for an official announcement regarding new financial products.

Price Direction

BullishThe introduction of new financial products on a major exchange typically signals increased market maturity and accessibility, which can attract new capital and drive demand. although limited to qualified investors and settled in rubles, the added exposure and new avenues for speculation or hedging are generally seen as positive for the assets.

Time Effect

ShortInitial market reaction might see a short-term pump as investors react to the news. the longer-term impact will depend on the adoption rate of these futures, the overall regulatory environment in russia, and broader geopolitical factors.

Original Article:

Article Content:

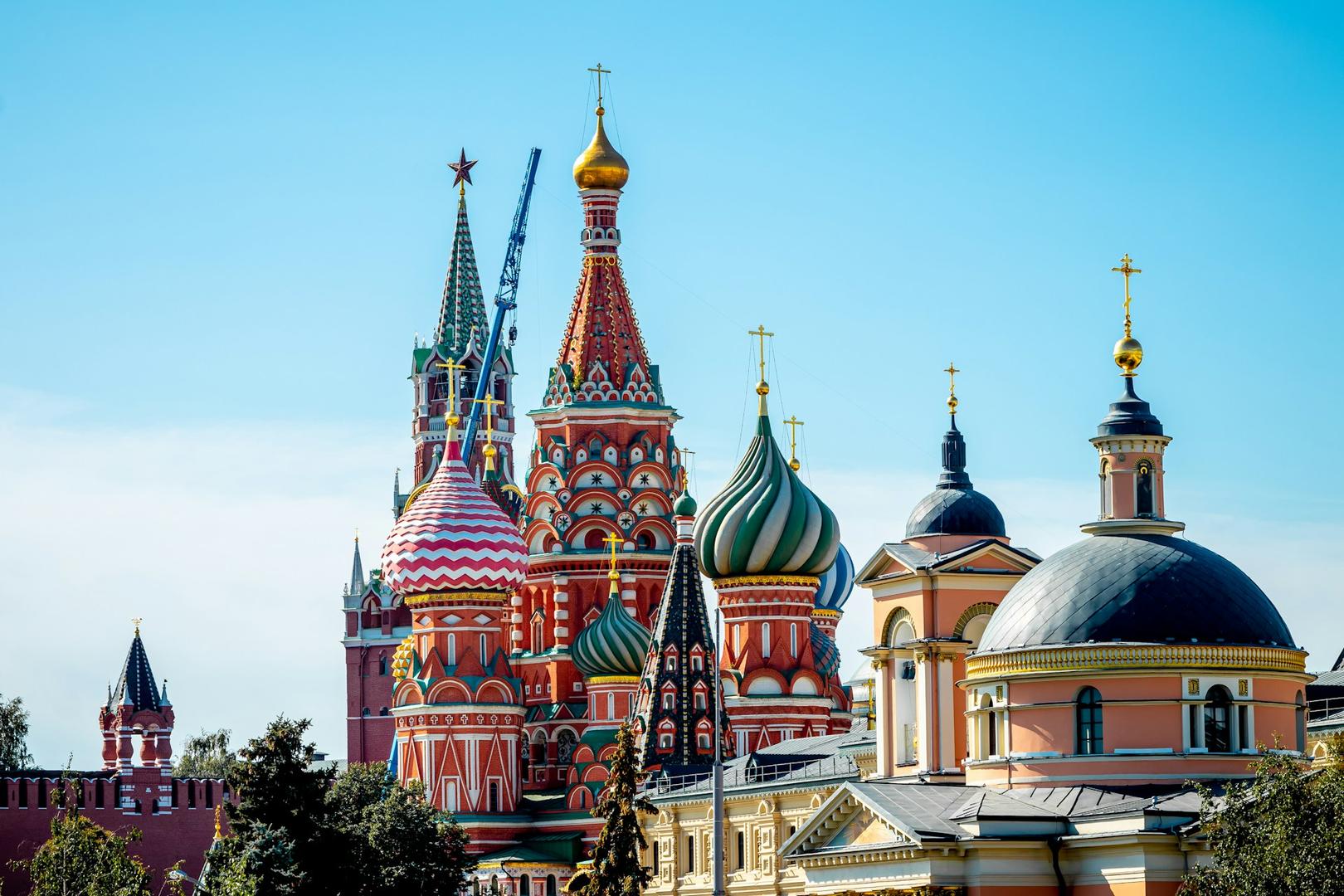

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Moscow Exchange to add SOL, XRP, and TRX futures contracts to crypto derivatives lineup The new contracts will be based on indices for each token, settled in rubles, and accessible only to qualified investors. By Francisco Rodrigues , AI Boost | Edited by Oliver Knight Feb 3, 2026, 11:28 a.m. Make us preferred on Google (Artem Beliaikin/Unsplash/Modified by CoinDesk) What to know : Moscow Exchange (MOEX) plans to introduce cash-settled futures for solana, XRP, and tron, expanding its existing cryptocurrency derivatives offerings. The new contracts will be based on indices for each token, settled in rubles, and accessible only to qualified investors. MOEX is also considering perpetual futures for bitcoin and ether, amid ongoing developments in Russia's crypto regulation landscape and amid ongoing geopolitical tensions. The Moscow Exchange (MOEX) plans to roll out cash-settled futures contracts tied to solana SOL $ 103.02 , XRP, and TRX $ 0.2831 , adding to its existing BTC and ETH products. The exchange will first introduce indices for the three altcoins before rolling out futures contracts settled in rubles. Maria Silkina, senior manager of the Derivatives Market Group at MOEX, said on Russia’s RBC radio that the exchange will first introduce indices for the three altcoins, which will serve as the foundation for rolling out futures contracts. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Under current Russian regulations, derivatives must be tied to an underlying asset, and in this case, that asset will be the published index for each token. MOEX already calculates indices for bitcoin and ether, and offers monthly cash-settled futures tied to those benchmarks. The new products will follow the same model, featuring no physical delivery of crypto, settlement in rubles, and only accessible to qualified investors. The exchange is also eyeing perpetual futures for bitcoin and ether, allowing investors to enter futures positions with no expiry. These perpetual futures contracts are already popular in the cryptocurrency space and are offered by most major global exchanges. Russia has been working on crypto regulations over the last few months. Last month, lawmakers in the country unveiled plans to cap retail crypto buys at $4,000, and earlier, the central bank outlined a new framework for crypto investors. Still, the country’s ongoing conflict with Ukraine has been weighing on the sector, given the sanctions imposed on the country. BitRiver, Russia’s largest crypto miner, was sanctioned by the United States in 2022 over the invasion, and is now facing potential bankruptcy. Russia has also labeled a crypto exchange, WhiteBIT, as “undesirable” over its support for Ukraine. Russia Moscow Exchange crypto futures AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . In this article TRX TRX $ 0.2831 ◢ 0.21 %