U.S. dollar strength and volatility surge as markets nervously await U.S. open

Analysis

Price Impact

HighReports of a potential hawkish federal reserve chair appointment (kevin warsh) by the trump administration have triggered significant market uncertainty, leading to a strong u.s. dollar, increased volatility, and a broad risk-off sentiment across traditional and crypto markets. bitcoin has fallen significantly to $82,000, and eth also experienced substantial declines and etf outflows.

Trustworthiness

HighThe article reports observed market reactions, including a significant drop in bitcoin's price, surges in volatility indices (vix, move), and substantial outflows from spot bitcoin and ether etfs, directly correlating to the news of potential fed leadership change.

Price Direction

BearishThe speculation of a more hawkish fed chair implies potential tighter monetary policy, higher interest rates, and reduced liquidity. this scenario strengthens the dollar and pushes investors away from riskier assets like cryptocurrencies, leading to a broad sell-off.

Time Effect

LongWhile the immediate market reaction is sharp, a change in federal reserve leadership and a potential shift in monetary policy direction (e.g., more hawkish stance) can have prolonged effects on market sentiment, interest rates, and the attractiveness of risk assets over several months to years.

Original Article:

Article Content:

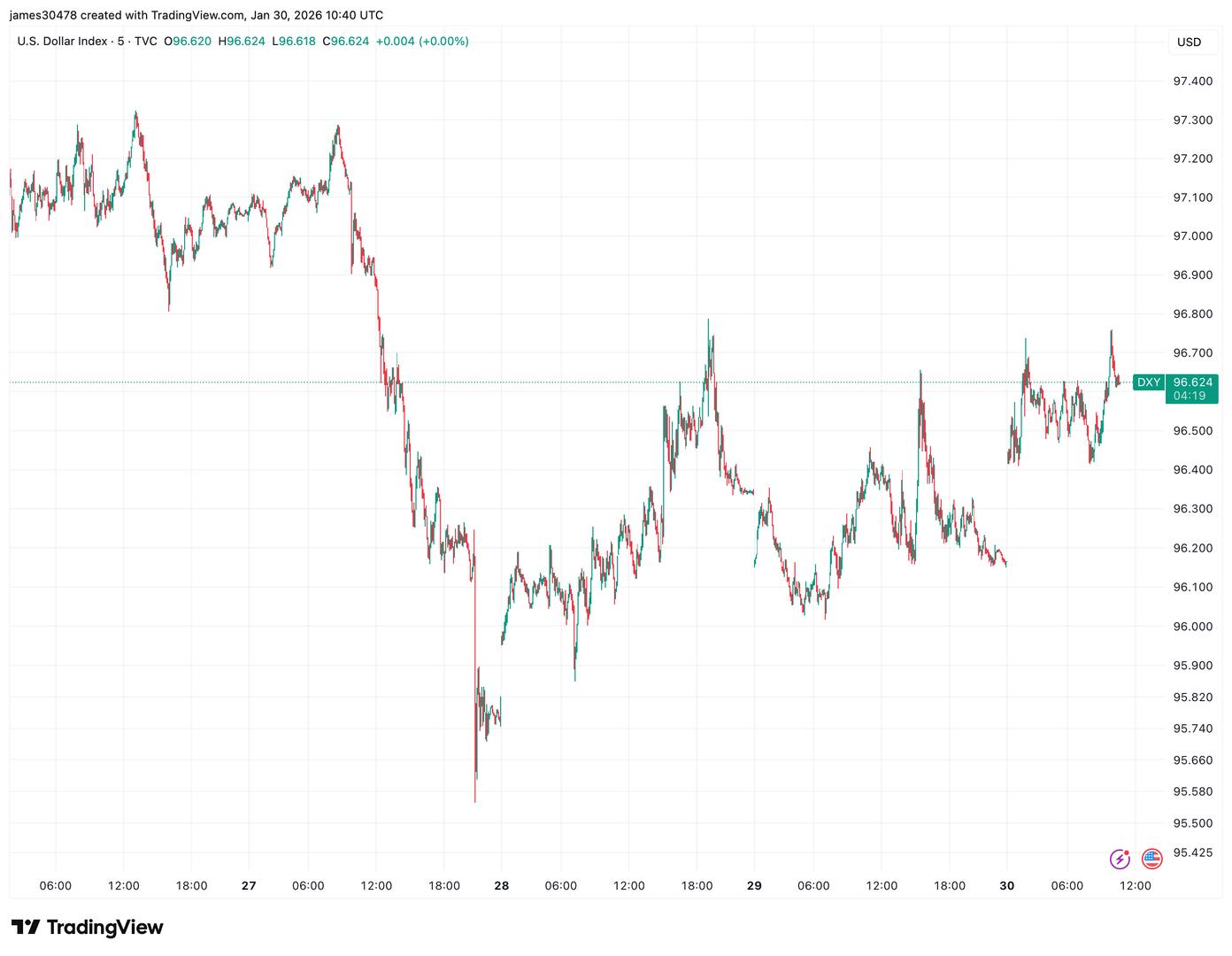

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email U.S. dollar strength and volatility surge as markets nervously await U.S. open While Fed chair speculation drives uncertainty across equities, rates, and crypto. By James Van Straten | Edited by Oliver Knight Jan 30, 2026, 10:47 a.m. Make us preferred on Google DXY Index (TradingView) What to know : Reports suggest the Trump administration may announce Kevin Warsh as the next Federal Reserve chair, replacing Jerome Powell. The VIX is up 13%, while the MOVE Index has climbed 6%, highlighting elevated uncertainty across both equity and Treasury markets. The DXY index is edging higher, reinforcing a risk off tone as U.S. equities trade lower ahead of the open. The Trump administration is reportedly preparing to announce Kevin Warsh as the next Federal Reserve chair on Friday, replacing Jerome Powell, a development that has unsettled markets and triggered a broad selloff across asset classes. As a result risk sentiment has deteriorated as investors price in potential shifts in monetary policy direction. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Meanwhile, the DXY index, which tracks the strength of the U.S. dollar against a basket of major currencies, has edged up to 96.6. U.S. Treasury yields are modestly higher, with the 10 year benchmark yield at approximately 4.25%. Volatility has surged with the Volatility Index (VIX) up 13% and the MOVE Index, which tracks volatility in the U.S. Treasury market, higher by 6%. In Friday pre-market trading, the Invesco QQQ (QQQ) is down more than 1%, trading around $622 per share. Bitcoin has fallen significantly, sliding to $82,000. As a result of this drop, bitcoin has fallen out of the top ten global assets by market capitalization and now ranks eleventh, with a market cap of $1.6 trillion. Equities tied to bitcoin have followed suit. Strategy (MSTR), the largest publicly traded holder of bitcoin, is down 4% in pre market trading after falling roughly 10% on Thursday, now trading near $138. In the bitcoin mining and AI sector, IREN (IREN) is down 5% at $57, while Cipher Mining (CIFR) is lower by 4%. While both Galaxy Digital (GLXY) and Coinbase (COIN) are down 3%. Metals have absorbed much of the downside during the last 24 hours. Gold has retreated toward $5,000 per ounce, while silver has fallen back to around $100 per ounce. Other commodities have also weakened, with copper and oil both trading lower. Bitcoin News Gold US More For You Pudgy Penguins: A New Blueprint for Tokenized Culture By CoinDesk Research Dec 30, 2025 Commissioned by Pudgy Penguins Pudgy Penguins is building a multi-vertical consumer IP platform — combining phygital products, games, NFTs and PENGU to monetize culture at scale. What to know : Pudgy Penguins is emerging as one of the strongest NFT-native brands of this cycle, shifting from speculative “digital luxury goods” into a multi-vertical consumer IP platform. Its strategy is to acquire users through mainstream channels first; toys, retail partnerships and viral media, then onboard them into Web3 through games, NFTs and the PENGU token. The ecosystem now spans phygital products (> $13M retail sales and >1M units sold), games and experiences (Pudgy Party surpassed 500k downloads in two weeks), and a widely distributed token (airdropped to 6M+ wallets). While the market is currently pricing Pudgy at a premium relative to traditional IP peers, sustained success depends on execution across retail expansion, gaming adoption and deeper token utility. View Full Report More For You U.S. listed bitcoin, ether ETFs bleed nearly $1 billion in a day By Shaurya Malwa | Edited by Omkar Godbole 1 hour ago U.S.-listed spot bitcoin and ether ETFs saw one of their worst combined outflow days of 2026 as falling prices, rising volatility and macro uncertainty pushed investors to cut exposure. What to know : U.S.-listed spot bitcoin and ether ETFs saw nearly $1 billion in outflows in a single session, as crypto prices tumbled and risk appetite faded. Bitcoin dropped below $85,000 and briefly neared $81,000, while ether fell more than 7%, prompting heavy redemptions from major ETFs run by BlackRock, Fidelity and Grayscale. Analysts say the synchronized ETF selling reflects institutions cutting overall crypto exposure amid rising volatility, hawkish Federal Reserve expectations and forced unwinding of leveraged positions, though some see the move as a leverage shakeout rather than the start of a bear market. Read full story Latest Crypto News Vitalik Buterin to spend $43 million on Ethereum development 59 minutes ago U.S. listed bitcoin, ether ETFs bleed nearly $1 billion in a day 1 hour ago Binance to shift $1 billion user protection fund into bitcoin amid market rout 4 hours ago Plunge in gold, silver, and copper sparks $120 million rout in blockchain metal clones 4 hours ago Here's why Fed contender Kevin Warsh is seen as bearish for bitcoin 5 hours ago XRP bulls lose $70 million as Ripple-linked token plunges 7% 5 hours ago Top Stories Bitcoin is going nuts with biggest volatility spike since November 5 hours ago Rollercoaster bitcoin price moves end up liquidating $1.7 billion in bullish crypto bets 6 hours ago Bitcoin’s major safety net just snapped. Why a drop below $85,000 might risk more selloff 17 hours ago