Strive clears Semler debt off books, buys more bitcoin after $225 million preferred stock sale

Analysis

Price Impact

HighStrive (asst) successfully raised $225 million via an oversubscribed preferred stock offering, enabling it to significantly reduce legacy debt ($110 million) and acquire an additional 333.89 btc. the company now holds 13,131 btc, valued over $1.1 billion. this demonstrates robust institutional confidence in bitcoin as a primary treasury asset and signals strong corporate adoption, which can positively influence market sentiment and attract further institutional investment.

Trustworthiness

HighThe article is from coindesk, a reputable source for crypto news. it provides specific financial figures, company names (strive, semler, coinbase), and details of the transaction, including the exact amount of btc purchased and total holdings, indicating well-researched and verifiable information.

Price Direction

BullishThe move signifies increased corporate demand and accumulation of bitcoin, reducing the company's leverage and solidifying btc's position as a strategic treasury asset. this institutional buying pressure, combined with reduced financial risk for strive, reinforces a bullish outlook for bitcoin's long-term value.

Time Effect

LongCorporate treasury decisions, especially those involving significant debt reduction and strategic asset accumulation like bitcoin, reflect a long-term commitment. this action sets a precedent for other corporations and signals sustained institutional interest and adoption, impacting bitcoin's valuation over an extended period.

Original Article:

Article Content:

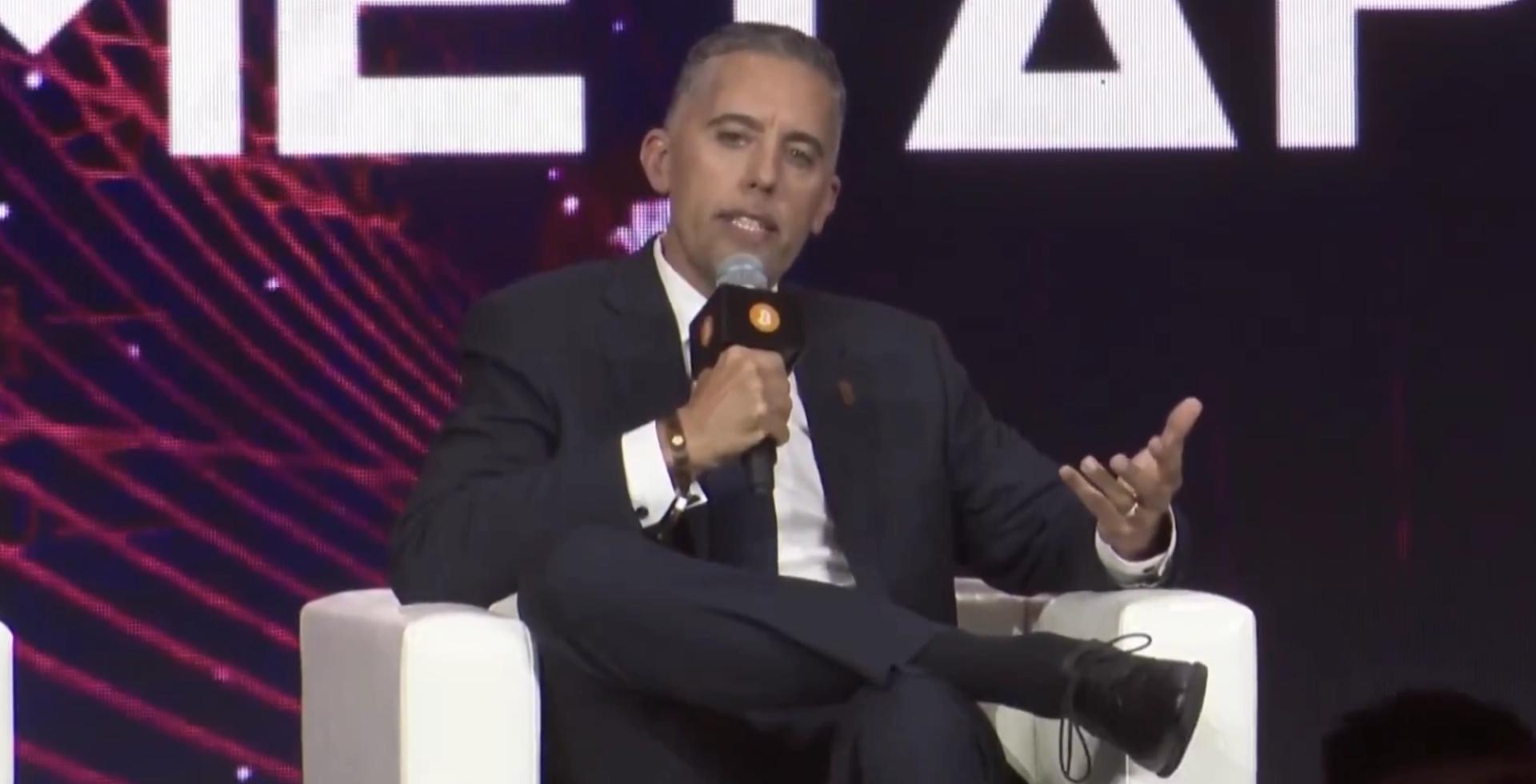

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Strive clears Semler debt off books, buys more bitcoin after $225 million preferred stock sale The offering of SATA shares was oversubscribed and upsized from the initial $150 million target. By James Van Straten , AI Boost | Edited by Stephen Alpher Jan 28, 2026, 3:18 p.m. Make us preferred on Google What to know : Strive (ASST) raised $225 million through an upsized and oversubscribed SATA preferred offering. The company retired $110 million of the $120 million of legacy debt from recently acquired Semler Scientific (SMLR) Strive also increased its bitcoin treasury by 333.89 coins, bringing the total to roughly 13,132 BTC worth more than $1.1 billion. Bitcoin treasury company Strive (ASST) now has less debt and more bitcoin on its books after raising $225 million via an offering of its SATA preferred stock. With more than $600 million in orders, according to a press release , the offering was upsized from an initially targeted $150 million. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . The proceeds and exchanges enabled Strive to rapidly reduce leverage following its acquisition of Semler Scientific (SMLR). The company retired $110 million of the $120 million of legacy Semler debt, including $90 million of convertible notes exchanged into SATA Stock and the full repayment of a $20 million Coinbase Credit loan. As a result, 100% of Strive’s bitcoin holdings are now unencumbered, with plans to retire the remaining $10 million of debt by April 2026, ahead of its original 12 month timeline. Strive also used some of the funds to acquire an additional 333.89 bitcoin at an average price of $89,851, bringing total holdings to 13,131 BTC and making it the tenth largest public corporate holder globally. Those holdings are worth more than $1.1 billion at bitcoin's current price of $89,100. ASST shares remain under pressure, down 1.5% early Wednesday to $0.81. Bitcoin News Vivek ramaswamy AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . More For You Pudgy Penguins: A New Blueprint for Tokenized Culture By CoinDesk Research Dec 30, 2025 Commissioned by Pudgy Penguins Pudgy Penguins is building a multi-vertical consumer IP platform — combining phygital products, games, NFTs and PENGU to monetize culture at scale. What to know : Pudgy Penguins is emerging as one of the strongest NFT-native brands of this cycle, shifting from speculative “digital luxury goods” into a multi-vertical consumer IP platform. Its strategy is to acquire users through mainstream channels first; toys, retail partnerships and viral media, then onboard them into Web3 through games, NFTs and the PENGU token. The ecosystem now spans phygital products (> $13M retail sales and >1M units sold), games and experiences (Pudgy Party surpassed 500k downloads in two weeks), and a widely distributed token (airdropped to 6M+ wallets). While the market is currently pricing Pudgy at a premium relative to traditional IP peers, sustained success depends on execution across retail expansion, gaming adoption and deeper token utility. View Full Report More For You Fidelity Investments starts its own stablecoin in a massive bet that future of banking is on blockchain By Helene Braun | Edited by Aoyon Ashraf 1 hour ago The FIDD token will run on Ethereum, serve institutional and retail users, and comply with the new GENIUS Act’s reserve rules. What to know : Fidelity Investments is launching its first stablecoin, the Fidelity Digital Dollar (FIDD), based on the Ethereum network. FIDD will be backed by reserves of cash, cash equivalents, and short-term U.S. Treasuries managed by Fidelity, in line with the new federal GENIUS Act's standards for payment stablecoins. The stablecoin targets use cases such as 24/7 institutional settlement and onchain retail payments, putting Fidelity in direct competition with dominant issuers like Circle’s USDC and Tether’s USDT while laying groundwork for future onchain financial products. Read full story Latest Crypto News Peter Thiel and Galaxy-backed Citrea wants to turn idle bitcoin into a high-speed bank account 7 minutes ago CoinDesk 20 Performance Update: AAVE Gains 2.9%, Leading Index Higher 1 hour ago Criminal use of crypto spikes after years of steady decline, TRM report says 1 hour ago UK advertising watchdog bans Coinbase ads as 'irresponsible' 1 hour ago Fidelity Investments starts its own stablecoin in a massive bet that future of banking is on blockchain 1 hour ago Bullish bitcoin traders grab crash protection as Friday's $8.9 billion expiry nears 2 hours ago Top Stories Tether is buying up to $1 billion of gold per month and storing it in a 'James Bond' bunker 2 hours ago HYPE token's 50% surge is a story of crypto-traditional market convergence, treasury firm says 7 hours ago Ethereum unveils new rules to make AI agents trustworthy 7 hours ago The Fed has an interest rate announcement today — crypto traders think it will be boring 2 hours ago Altcoins jump as dollar slides, bitcoin holds steady: Crypto Markets Today 3 hours ago Here's how China's response to Trump tariffs silently rocks bitcoin 8 hours ago