Long-term bitcoin holders resume selling as price lags behind traditional markets

Analysis

Price Impact

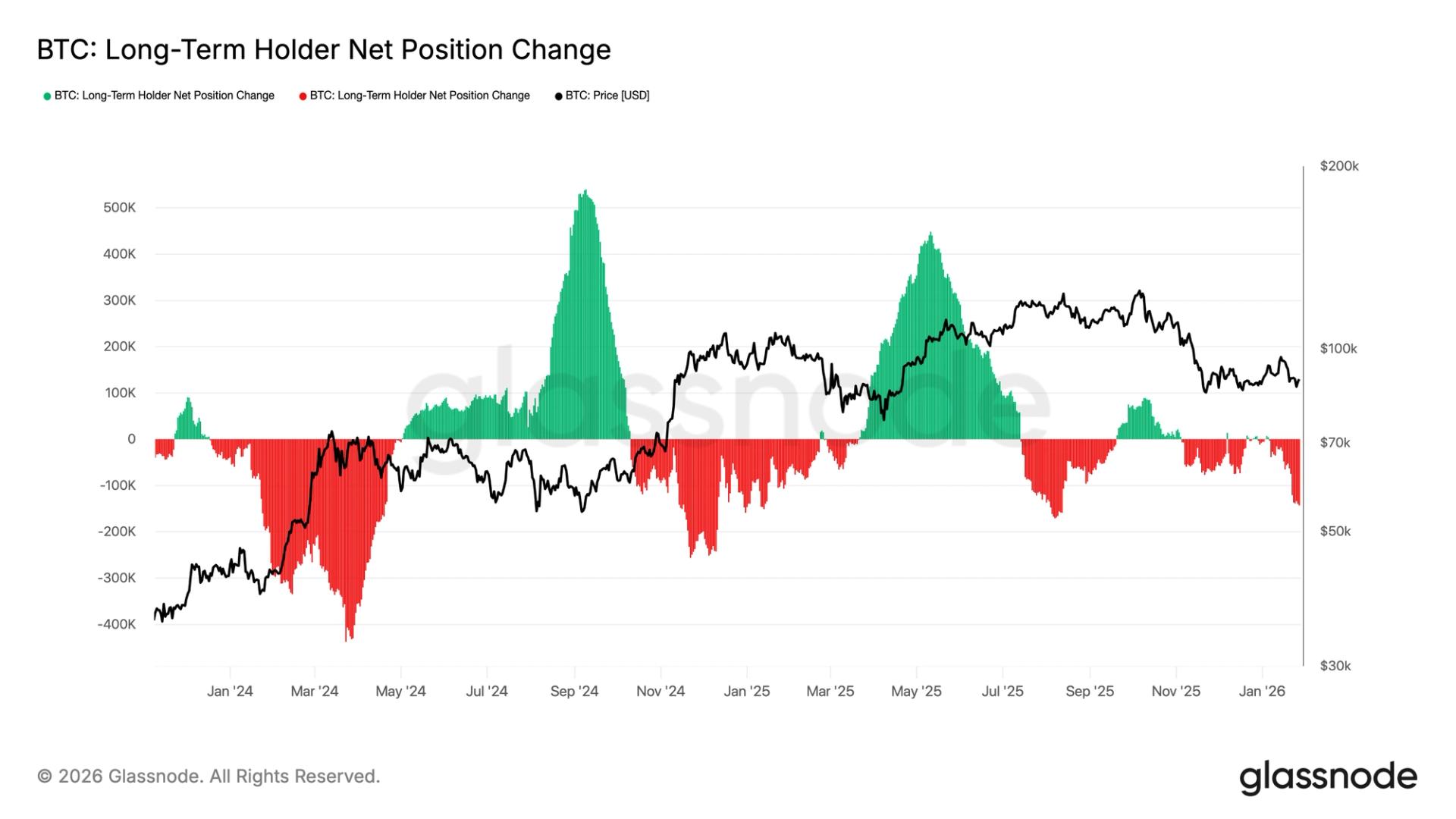

HighLong-term bitcoin holders (lths) are selling at the fastest pace since august, divesting roughly 143,000 btc in the past 30 days. this aggressive distribution from a traditionally conviction-driven cohort creates significant selling pressure and acts as a major headwind for the price, especially as bitcoin lags behind broader financial markets.

Trustworthiness

HighThe data is directly cited from glassnode, a highly reputable on-chain analytics firm, and the analysis is presented by coindesk, a leading and credible source in crypto news.

Price Direction

NeutralWhile not explicitly 'bearish' given the potential for consolidation, the aggressive selling by lths suggests a lack of immediate upside momentum and raises the 'risk of further downside or an extended consolidation.' historically, similar lth selling has preceded market tops or prolonged drawdowns.

Time Effect

LongLong-term holder movements typically signal shifts in macro market sentiment and can influence bitcoin's price over weeks to months, potentially leading to an extended period of consolidation or a downtrend rather than a quick reversal.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Long-term bitcoin holders resume selling as price lags behind traditional markets Long-term bitcoin holders are selling at the fastest pace since August as the cryptocurrency's price lags behind broader financial markets. By James Van Straten | Edited by Sheldon Reback Jan 28, 2026, 1:14 p.m. Make us preferred on Google BTC: Long-Term Holder Net Position Change (Glassnode) What to know : Long term bitcoin holders have sold roughly 143,000 BTC in the past 30 days, the most aggressive divestment since August. The reductions reverse a brief accumulation phase seen in late December and early January. Long-term distribution remains a headwind for the bitcoin price as broader financial markets rally. In this article JUP JUP $ 0.2199 ◢ 13.79 % SIGN SIGN $ 0.03789 ◢ 1.33 % Long term holders of bitcoin BTC $ 89,917.94 are again selling the largest cryptocurrency, with distribution now at the fastest pace in five months. Last year's action front-ran a market top that occurred, as many had expected, in October. In the past 30 days, investors who've held bitcoin for at least 155 days — a cohort typically viewed as the most conviction-driven market participants — have sold roughly 143,000 BTC, according to Glassnode data . STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy . Bitcoin's price is lagging behind broader financial assets, including metals such as gold and silver, which are trading at or near record highs. The discrepancy points to stress in the crypto market and raises the risk of further downside or an extended consolidation. Their actions mirror the prior distribution peak in August, when around 170,000 BTC was sold over a 30-day period. At the time, the price was trading above $120,000 and bitcoin hit a record high two months later, reinforcing a narrative that the holders were selling into strength The October peak was predicted by a theory that the BTC price follows a four-year cycle related to the periodic halving of rewards paid to bitcoin miners. The last 50% reduction took place in April 2024. Historically, each cycle has tended to see a peak in the fourth quarter followed by a prolonged drawdown and consolidation phase. At the time, nearly the entire long-term holder supply, some 15 million coins, was in profit. After a sharp 36% drawdown from the October high through late November, there was a brief period from late December into early January when long-term holders shifted back to net accumulation . This temporarily eased selling pressure and helped stabilize price action, with bitcoin jumping to as high as $97,000 and roughly 2 million of the coins are now sitting at a loss. Still, this group of investors currently owns about 14.5 million BTC, underscoring that long-term reductions remains a key headwind for price. Glassnode Bitcoin News long-term holder More For You Pudgy Penguins: A New Blueprint for Tokenized Culture By CoinDesk Research Dec 30, 2025 Commissioned by Pudgy Penguins Pudgy Penguins is building a multi-vertical consumer IP platform — combining phygital products, games, NFTs and PENGU to monetize culture at scale. What to know : Pudgy Penguins is emerging as one of the strongest NFT-native brands of this cycle, shifting from speculative “digital luxury goods” into a multi-vertical consumer IP platform. Its strategy is to acquire users through mainstream channels first; toys, retail partnerships and viral media, then onboard them into Web3 through games, NFTs and the PENGU token. The ecosystem now spans phygital products (> $13M retail sales and >1M units sold), games and experiences (Pudgy Party surpassed 500k downloads in two weeks), and a widely distributed token (airdropped to 6M+ wallets). While the market is currently pricing Pudgy at a premium relative to traditional IP peers, sustained success depends on execution across retail expansion, gaming adoption and deeper token utility. View Full Report More For You Altcoins jump as dollar slides, bitcoin holds steady: Crypto Markets Today By Oliver Knight , Omkar Godbole | Edited by Sheldon Reback 1 hour ago The Dollar Index hit a four-year low, while altcoins surged led by HYPE, JTO and Solana memecoin PIPPIN. What to know : Bitcoin held near $89,200 and ether topped $3,000, supported by a sharp drop in the U.S. dollar index (DXY). Altcoins outperformed, with Hyperliquid’s HYPE up 25% and Solana staking token JTO extending a 31% three-day rally. Speculative tokens led gains, including Solana-based memecoin PIPPIN up 64%, as CoinDesk’s altcoin-heavy CD80 index beat CD20. Read full story Latest Crypto News Tether is buying up to $1 billion of gold per month and storing it in a 'James Bond' bunker 8 minutes ago WisdomTree expands tokenized fund access to Solana in multichain push 45 minutes ago Traders bet on calm as Fed rate cut looms 54 minutes ago Altcoins jump as dollar slides, bitcoin holds steady: Crypto Markets Today 1 hour ago Nomura's Laser Digital applies for U.S. national trust bank to offer crypto custody 2 hours ago Stablecoins seen as ‘the default’ for payments as OKX brings crypto card to Europe 5 hours ago Top Stories HYPE token's 50% surge is a story of crypto-traditional market convergence, treasury firm says 5 hours ago Ethereum unveils new rules to make AI agents trustworthy 5 hours ago Here's how China's response to Trump tariffs silently rocks bitcoin 6 hours ago Top stablecoins shrink as crypto cash flees, posing risk to bitcoin's bounce 7 hours ago In this article JUP JUP $ 0.2199 ◢ 13.79 % BTC BTC $ 89,917.94 ◢ 2.29 % SIGN SIGN $ 0.03789 ◢ 1.33 %