Aptos' APT falls amid a decline in wider crypto markets

Analysis

Price Impact

LowApt's recent fall is primarily attributed to a decline in wider crypto markets, with no specific fundamental drivers for aptos mentioned. the trading volume, while elevated, is not in 'surge territory' indicative of strong directional conviction. this suggests a market-wide sentiment rather than a token-specific event driving significant price impact.

Trustworthiness

HighThe analysis comes from coindesk analytics, a reputable source, and utilizes a technical analysis model with specific support and resistance levels, enhancing its reliability for short-term predictions.

Price Direction

NeutralApt is currently range-bound between $1.87 (support) and $1.91 (initial resistance), with a key overhead barrier at $1.95. while it recently slipped, the lack of strong directional conviction on elevated volume indicates a neutral stance until either support breaks or resistance is convincingly overcome.

Time Effect

ShortThe analysis focuses on immediate technical levels and short-term trading conditions (24-hour volume, recent price action). without new fundamental catalysts, price movements are expected to remain tied to these near-term technical boundaries.

Original Article:

Article Content:

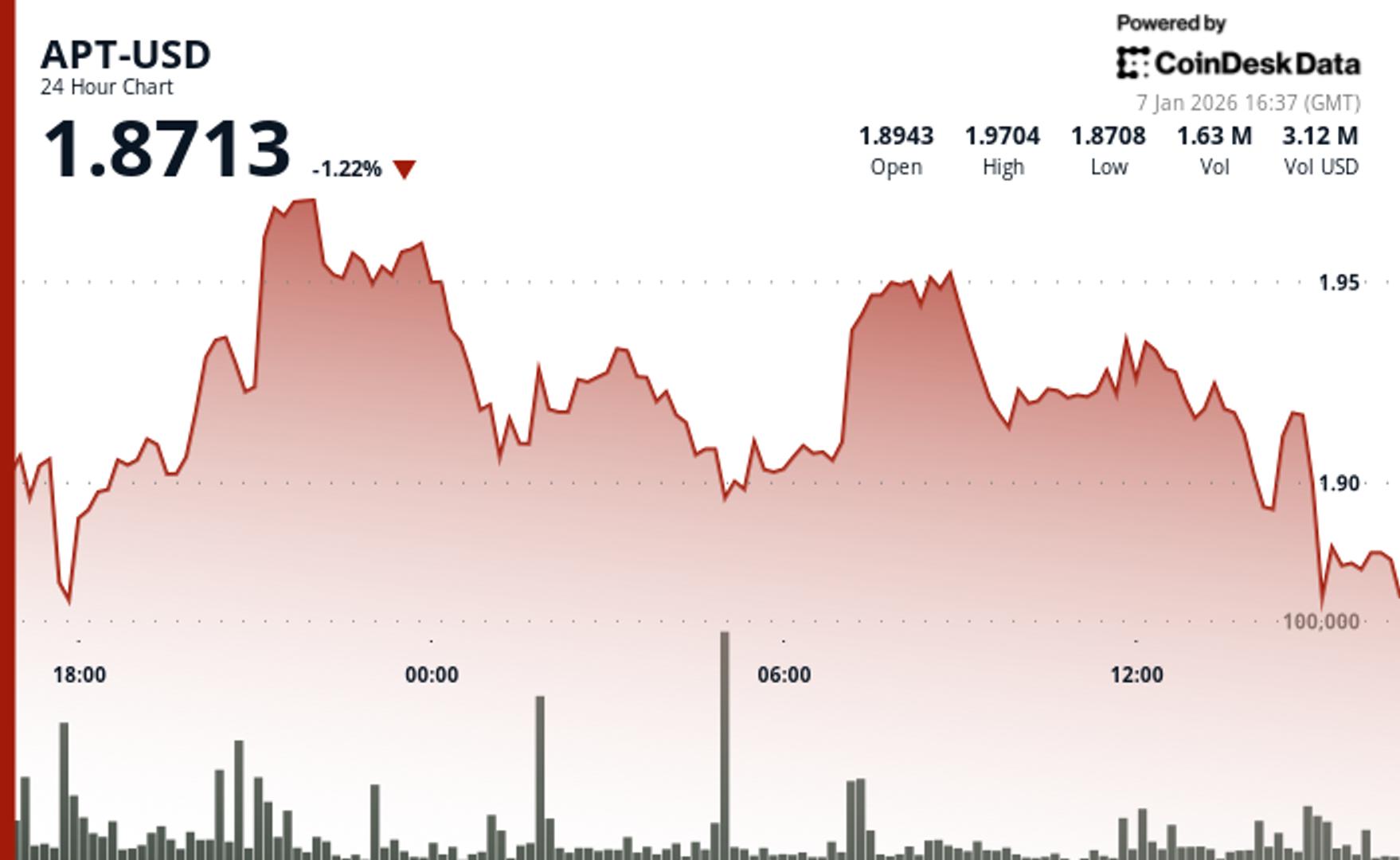

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Aptos' APT falls amid a decline in wider crypto markets The token retreated in quiet trading conditions as it remained tightly coupled with broader crypto market movements. By Will Canny , CD Analytics | Edited by Sheldon Reback Jan 7, 2026, 5:02 p.m. Make us preferred on Google Aptos' APT declines on thin volume. What to know : APT slipped from $1.91 to $1.88. Volume increased 24% above weekly averages. APT $ 1.8759 slid 1.1% to $1.88 over the last 24 hours, marking another session of range-bound price action. The token traded within an $0.11 range, according to CoinDesk Research's technical analysis model. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The model showed that APT opened at $1.89 and fell before finding buyers near $1.87 as participants positioned defensively. Trading volumes rose 24% above weekly norms at 3.29 million tokens, yet failed to spark directional conviction, according to the model. The session's heaviest volume hit 5.3 million tokens overnight, 61% more than the 24-hour average, as sellers rejected price near $1.91. The elevated trading activity indicates heightened participant engagement without crossing into surge territory that typically accompanies sustained breakouts, the model indicated. In the absence of fundamental drivers specific to Aptos, technical levels at $1.87 support and $1.91 resistance became the focal points for near-term price direction. The broader market gauge, the CoinDesk 20 index, was 2.6% lower at publication time. Technical Analysis: Primary support established at $1.87 Key overhead barrier at $1.95 24-hour volume running 24% above 7-day average at elevated but sub-surge levels Peak concentration of 5.30M at $1.91 resistance (61% above 24-hour SMA) Downside risk toward $1.87 support if consolidation resolves lower Initial upside target at $1.91 resistance, with extension toward $1.95 on breakout Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Aptos Technical Analysis More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You BNB falls below $900 even after network upgrade, ecosystem developments as market declines By CD Analytics , Francisco Rodrigues | Edited by Sheldon Reback 17 minutes ago The BNB Chain's layer-2 network, opBNB, recently completed a major upgrade, the Fourier hard fork, which doubled transaction throughput. What to know : BNB fell below $900 amid a broader market decline, even after recent technical upgrades and ecosystem developments on the BNB Chain. The BNB Chain's layer-2 network, opBNB, recently completed a major upgrade, the Fourier hard fork, which doubled transaction throughput and cut block times in half. To regain bullish momentum, BNB needs to break out of its current downtrend and reclaim resistance levels near $906, otherwise it may face further pressure toward $892. Read full story