BNB falls below $900 even after network upgrade, ecosystem developments as market declines

Analysis

Price Impact

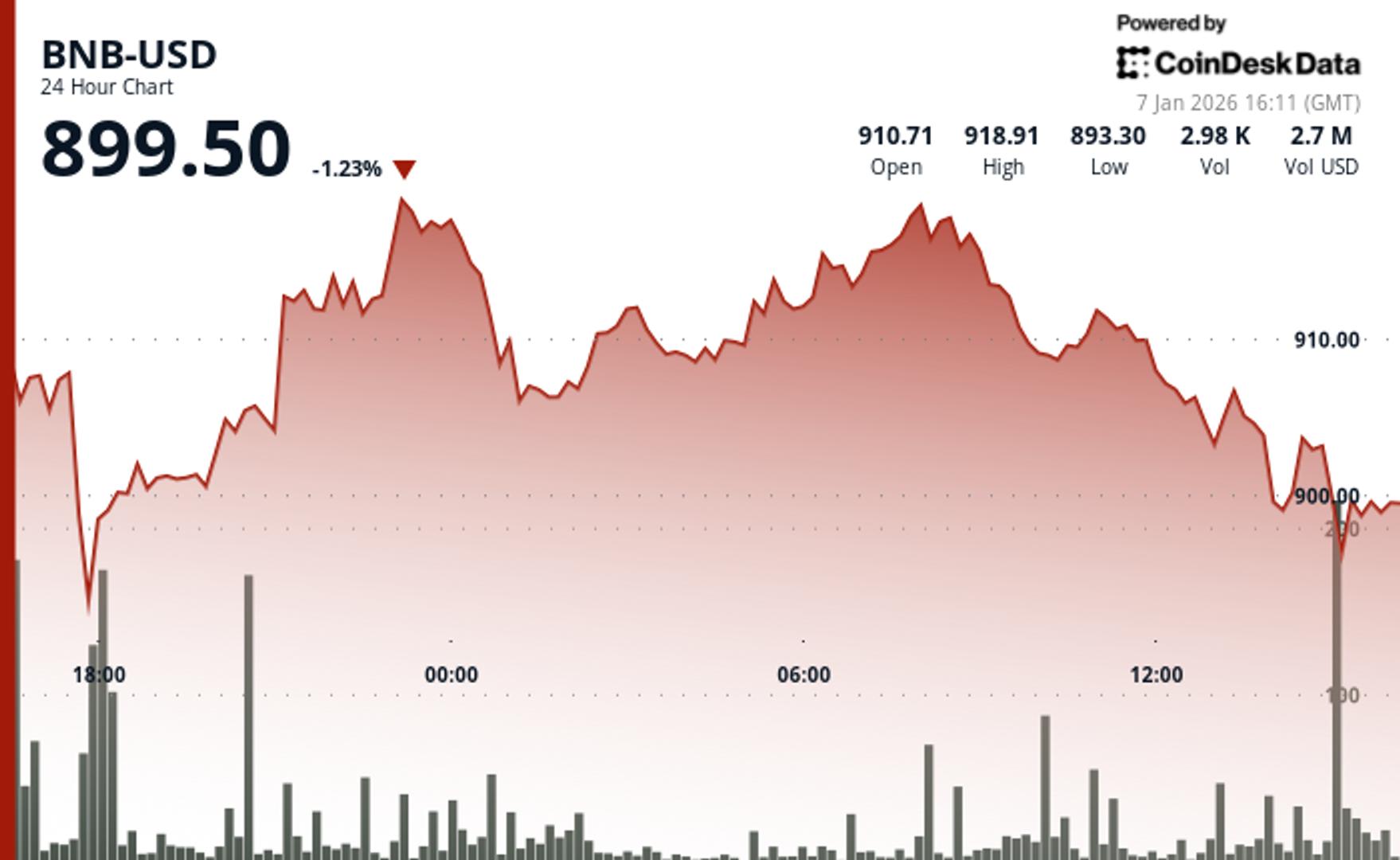

HighBnb dropped 2.2% below $900, breaking a key support level amidst heavy selling and broader market decline. this occurred despite significant technical upgrades (fourier hard fork) and ecosystem developments, indicating strong bearish pressure overriding positive fundamentals.

Trustworthiness

HighThe analysis is from coindesk, a reputable crypto news source, referencing coindesk research's technical analysis data model and explicit technical indicators like descending channels and support/resistance levels.

Price Direction

BearishBnb's price action formed a descending channel with weakening bounces, confirming bearish momentum. the $900 level flipped from support to resistance, and further downside targets near $892 are anticipated unless resistance levels around $906 are reclaimed.

Time Effect

ShortThe analysis focuses on immediate price movements, daily losses, and short-term technical resistance and support levels, indicating a near-term outlook.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email BNB falls below $900 even after network upgrade, ecosystem developments as market declines The BNB Chain's layer-2 network, opBNB, recently completed a major upgrade, the Fourier hard fork, which doubled transaction throughput. By CD Analytics , Francisco Rodrigues | Edited by Sheldon Reback Jan 7, 2026, 4:45 p.m. Make us preferred on Google "BNB drops 2.2% to $899.57, breaking $900 support amid descending channel and resistance at $910." What to know : BNB fell below $900 amid a broader market decline, even after recent technical upgrades and ecosystem developments on the BNB Chain. The BNB Chain's layer-2 network, opBNB, recently completed a major upgrade, the Fourier hard fork, which doubled transaction throughput and cut block times in half. To regain bullish momentum, BNB needs to break out of its current downtrend and reclaim resistance levels near $906, otherwise it may face further pressure toward $892. BNB slipped below $900 after a day of steady losses and heavy selling in the entire cryptocurrency market, despite several technical upgrades and ecosystem developments across the BNB Chain. The token fell 2.2%, with sellers gaining control as attempted rebounds stalled below key resistance zones, according to CoinDesk Research's technical analysis data model. The wider market as measured by the CoinDesk 20 (CD20) index dropped 2.6%. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Volume surged during the day to well above average levels, signaling increased liquidity. Price action formed a descending channel, with each bounce weaker than the last. A sharp breakdown late in the session confirmed bearish momentum and flipped the $900 level from support to resistance. The drop came even as BNB Chain’s layer-2 network, opBNB, completed a major upgrade. The Fourier hard fork cut block times in half, doubling transaction throughput. The change was designed to boost performance for applications built within the network's decentralized finance (DeFi) ecosystem. Elsewhere in the BNB ecosystem, Binance introduced silver perpetual futures contracts, its first foray into commodities, and started a $1 million staking campaign with high yield offers across major tokens. BNB can be used for trading fee discounts on the exchange. Still, traders focused on technicals rather than fundamentals. Broader weakness across altcoins, tied to bitcoin’s recent pullback and overall market caution, weighed on sentiment. For BNB to regain bullish footing, it would need to reclaim resistance levels near $906 and break out of its current downtrend. Until then, pressure may continue, with downside targets near $892 and possibly lower. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights BNB Technical Analysis More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Experts tip privacy tokens to continues outperforming in 2026 By Olivier Acuna | Edited by Oliver Knight 12 minutes ago Analysts believe privacy tokens such as zcash and monero will continue to outperform this year, but they will likely face delisting risks and conflicts with banks over regulatory issues. What to know : Privacy-focused cryptocurrencies have outperformed the market, driven by increasing demand for financial anonymity amid tightening regulations. Analysts warn that while privacy coins are gaining traction, they face significant regulatory challenges that could impact future gains. The trend towards privacy in crypto is expected to continue, with privacy-preserving systems becoming more essential as blockchain adoption grows in regulated environments. Read full story