Filecoin declines as crypto markets retreat

Analysis

Price Impact

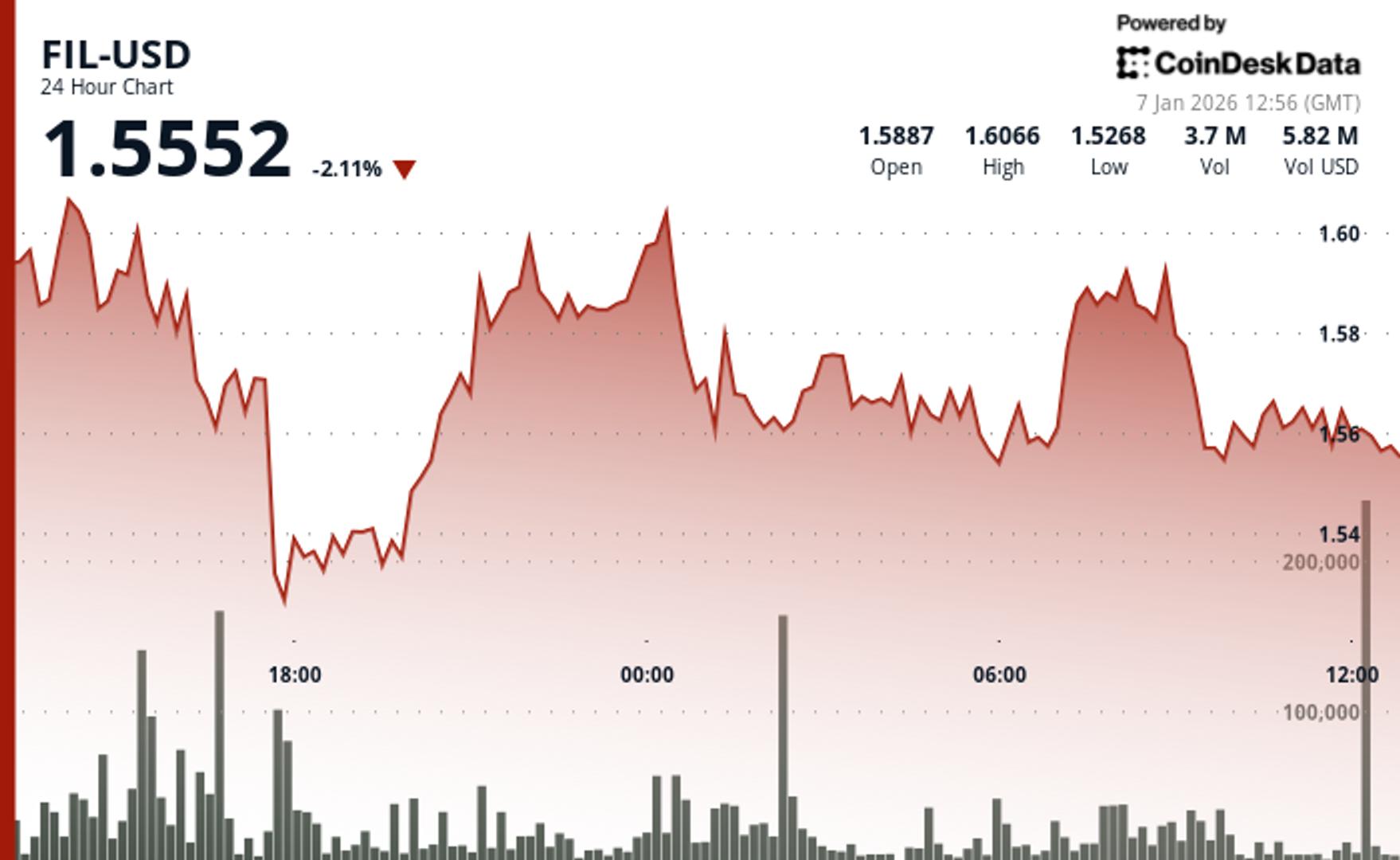

MedFilecoin (fil) declined 3.6%, tracking the broader crypto market's retreat. the coindesk 20 index also fell 3.6%, indicating a market-wide weakness rather than a fil-specific negative event.

Trustworthiness

HighThe analysis comes from coindesk, a reputable crypto news source, including detailed technical analysis from 'coindesk research's technical analysis model' and 'cd analytics'.

Price Direction

BearishFil is showing short-term bearish pressure, having declined 3.6% and failing to breach the $1.59-$1.60 resistance zone on declining volume. while critical support holds at $1.52, overall market weakness suggests further downside risk if this support breaks.

Time Effect

ShortThe analysis focuses on recent 24-hour price action, current support/resistance levels, and immediate volume spikes, indicating short-term trading dynamics influenced by overall market conditions.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Filecoin declines as crypto markets retreat FIL has support at the $1.52 level and resistance in the $1.59-$1.60 zone. By Will Canny , CD Analytics | Edited by Cheyenne Ligon Jan 7, 2026, 2:22 p.m. Make us preferred on Google Filecoin declines as crypto markets retreat. What to know : FIL slipped 3.6% to $1.54. The CoinDesk 20 index was 3.6% lower at publication time. Storage token Filecoin FIL $ 1.5218 fell 3.6% over the last 24 hours, tracking weakness in the wider cryptocurrency market. The broader market gauge, the CoinDesk 20 index, was also 3.6% lower at publication time. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Filecoin's volume ran 30% above the 30-day moving average, though participation failed to breach elevated thresholds that typically confirm directional conviction, according to CoinDesk Research's technical analysis model. The model showed that the token exhibited range-bound volatility. Total range measured $0.08 (5.0%) with a session high of $1.61 and low of $1.52. The most significant volume event materialized yesterday evening when participation spiked to 7.30 million, 95% above the 24-hour simple moving average of 3.74 million, according to the model. This spike coincided with sharp downside rejection from resistance near $1.60 and established critical support at $1.52, the model said. The model showed that price subsequently recovered to retest the $1.59-$1.60 resistance zone multiple times on declining volume, forming a consolidation pattern with support holding above $1.55 through the final hours. Technical Analysis: Primary resistance: $1.59-$1.60 zone tested multiple times on declining volume, indicating exhaustion Critical support: $1.52 established during spike low with 7.30 million volume 24-hour participation: 30% above 30-day moving average, below elevated interest threshold Failed breakout: Two-minute whipsaw from $1.561 to $1.57 and back suggests algorithmic activity Declining volume retests: Multiple attempts at $1.59-$1.60 resistance on diminishing participation Downside risk: Support breakdown below $1.52 exposes limited technical structure Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Filecoin Technical Analysis More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Rumble introduces crypto wallet with Tether, allowing tips in BTC, USDT, XAUT By Helene Braun , AI Boost | Edited by Stephen Alpher 10 minutes ago Integrated into the Rumble app, the non-custodial wallet allows fans to tip content producers. What to know : Rumble has launched a non-custodial crypto wallet in partnership with Tether, allowing users to tip creators in BTC, USDT, and XAUt. The Rumble Wallet is the first live deployment of Tether’s Wallet Development Kit and keeps user custody fully decentralized. The feature, integrated into the Rumble app and powered by MoonPay, adds a new income stream for creators outside ads or subscriptions. Read full story Latest Crypto News Former Brazil central bank official unveils real-pegged stablecoin with yield sharing 8 minutes ago CoinDesk 20 Performance Update: Uniswap (UNI) Falls 1.5% as Index Trades Lower 9 minutes ago Rumble introduces crypto wallet with Tether, allowing tips in BTC, USDT, XAUT 10 minutes ago Babylon Labs raises $15 million from a16z crypto to develop Bitcoin collateral infrastructure 39 minutes ago Ripple again rules out IPO, saying balance sheet gives it room to stay private 51 minutes ago Strategy’s STRC perpetual preferred stock returns to $100, may trigger more bitcoin buying 1 hour ago Top Stories Crypto Markets Today: Bitcoin slides as Asia-led sell-off hits altcoins 2 hours ago Morgan Stanley files for ether trust after bitcoin and solana ETF push 2 hours ago Ripple again rules out IPO, saying balance sheet gives it room to stay private 51 minutes ago Bitcoin miners chase AI demand as Nvidia says Rubin is already in production 8 hours ago XRP could outperform bitcoin as XRP/BTC chart shows rare Ichimoku breakout since 2018 9 hours ago Start-of-the-year recovery rally stalls: Crypto Daybook Americas 2 hours ago In this article FIL FIL $ 1.5218 ◢ 4.08 %