Metplanet valued at three-month high relative to bitcoin holdings after MSCI decision

Analysis

Price Impact

HighMsci's decision not to exclude digital asset treasury companies from its global indexes removes a significant regulatory overhang for major bitcoin holders like metaplanet and microstrategy. this boosts investor confidence in these companies and, by extension, in bitcoin as a treasury asset.

Trustworthiness

HighThe news comes from coindesk, a reputable crypto news source, reporting on an official decision by msci, a major index provider. the reported price movements of metaplanet and microstrategy are direct observations.

Price Direction

BullishThe removal of near-term index exclusion risk for companies with significant bitcoin holdings enhances their investment appeal. this positive sentiment for corporate bitcoin accumulators could translate into increased institutional interest and demand for btc, pushing its price higher.

Time Effect

ShortThe immediate impact is already seen in the upward movement of metaplanet and microstrategy shares. while msci indicated further consultation on non-operating companies, the current decision provides immediate relief and positive momentum.

Original Article:

Article Content:

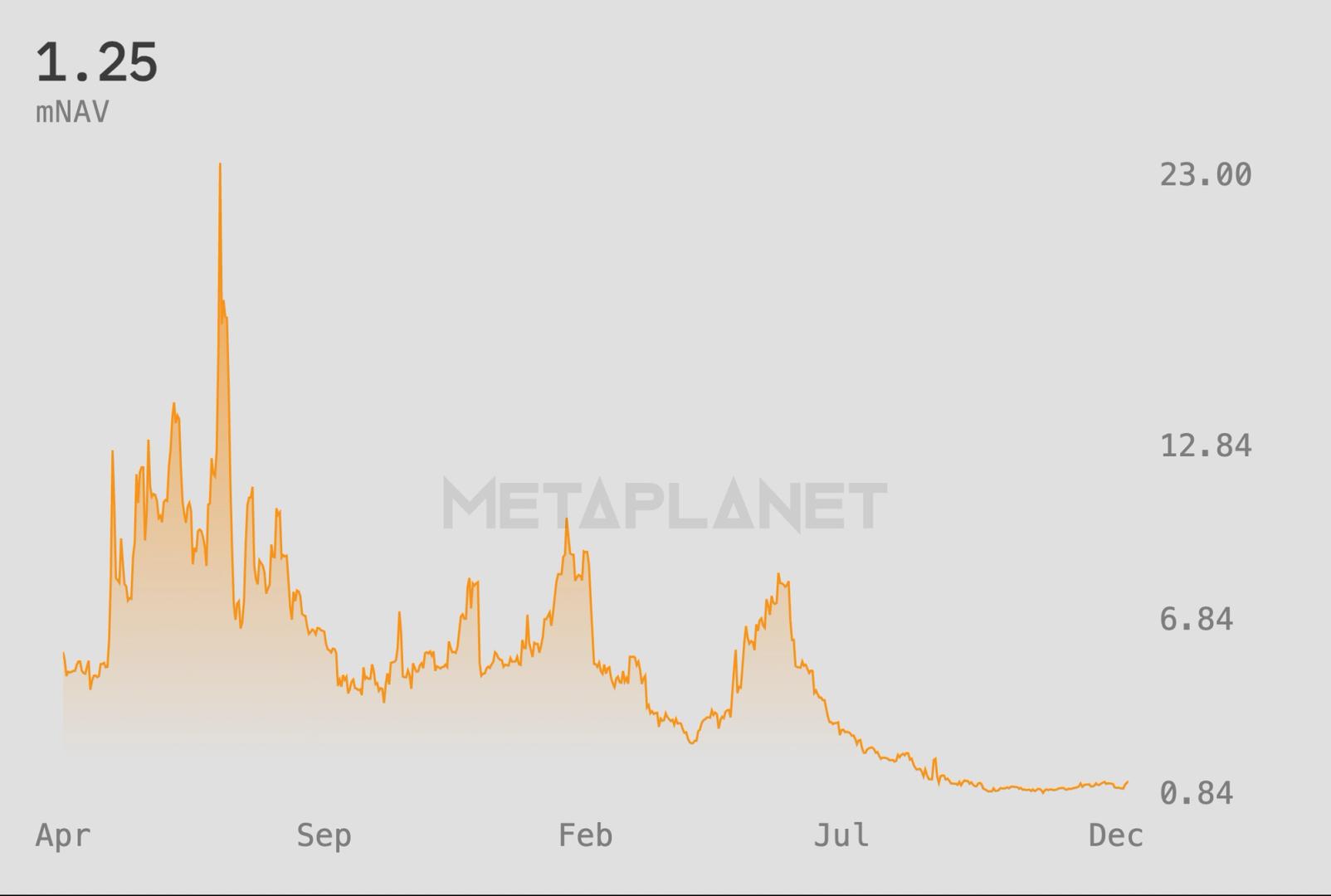

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Metplanet valued at three-month high relative to bitcoin holdings after MSCI decision Select bitcoin treasury equities gained after MSCI removed near-term index exclusion risk. By James Van Straten | Edited by Sheldon Reback Jan 7, 2026, 10:01 a.m. Make us preferred on Google Metaplanet enterprise value relative to bitcoin holdings (Metaplanet) What to know : Metaplanet’s multiple to net asset value (mNAV) rose to around 1.25, its highest level since before the October liquidation crisis. The move followed MSCI’s decision not to exclude digital asset treasury companies from its global indexes. Strategy (MSTR) rose around 5% in pre-market trading while price action across other bitcoin treasury companies remained relatively muted. Digital asset treasury company Metaplanet (3350) rose 4% in Tokyo on Wednesday after index provider MSCI decided not to exclude firms building cryptocurrency stockpiles from its global indexes. Metaplanet is now up 20% since the start of the year. The rally means company is valued at a premium to its bitcoin holdings, with a multiple to net asset value (mNAV) of around 1.25, the highest level since before October's plunge in crypto prices, according to the company’s dashboard . STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The decision ended months of uncertainty around index eligibility and lifted U.S. peers when the announcement was made after regular trading hours on Tuesday. Strategy (MSTR), the largest corporate holder of bitcoin BTC $ 91,577.24 was recently 5% higher in pre-market trading. Other digital asset treasury companies rose to a lesser extent. Metaplanet shares closed at 531 yen ($3.4), having bottomed near 340 yen on Nov. 18. The company holds 35,102 BTC, making it the fourth-largest publicly listed bitcoin treasury company globally. MSCI’s announcement removes a near term overhang for crypto treasury stocks, particularly those already included in major indexes. However, the index provider also signaled that a broader consultation on non operating and investment oriented companies is forthcoming, indicating that regulatory and index related risks for bitcoin treasury firms have been deferred, not eliminated. Bitcoin News MetaPlanet MSCI MicroStrategy More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Crypto traders can now take leveraged bets on silver via Binance Futures By Omkar Godbole | Edited by Sam Reynolds 1 hour ago Binance Futures will launch silver perpetual contracts on Wednesday, offering up to 50x leverage on silver priced in U.S. dollars per troy ounce. What to know : Binance Futures will launch silver perpetual contracts on Wednesday, offering up to 50x leverage on silver priced in U.S. dollars per troy ounce. The contracts are margined and settled in tether (USDT) with a minimum notional value of 5 USDT. Crypto traders are increasingly diversifying into precious metals. Read full story Latest Crypto News Hedge Fund Karatage appoints IMC veteran Shane O’Callaghan as senior partner 1 hour ago Crypto traders can now take leveraged bets on silver via Binance Futures 1 hour ago Bitcoin and the Japanese yen are moving together like never before 3 hours ago Bitcoin miners chase AI demand as Nvidia says Rubin is already in production 4 hours ago XRP could outperform bitcoin as XRP/BTC chart shows rare Ichimoku breakout since 2018 5 hours ago Asia Morning Briefing: Bitcoin holds steady above $90K as fresh money returns to crypto 7 hours ago Top Stories Crypto traders can now take leveraged bets on silver via Binance Futures 1 hour ago Bitcoin and the Japanese yen are moving together like never before 3 hours ago Asia Morning Briefing: Bitcoin holds steady above $90K as fresh money returns to crypto 7 hours ago XRP could outperform bitcoin as XRP/BTC chart shows rare Ichimoku breakout since 2018 5 hours ago Bitcoin miners chase AI demand as Nvidia says Rubin is already in production 4 hours ago Strategy surges 6% on MSCI decision not to exclude DATs from indexes 12 hours ago In this article BTC BTC $ 91,577.24 ◢ 2.10 %