Polkadot's DOT declines in U.S. afternoon selloff

Analysis

Price Impact

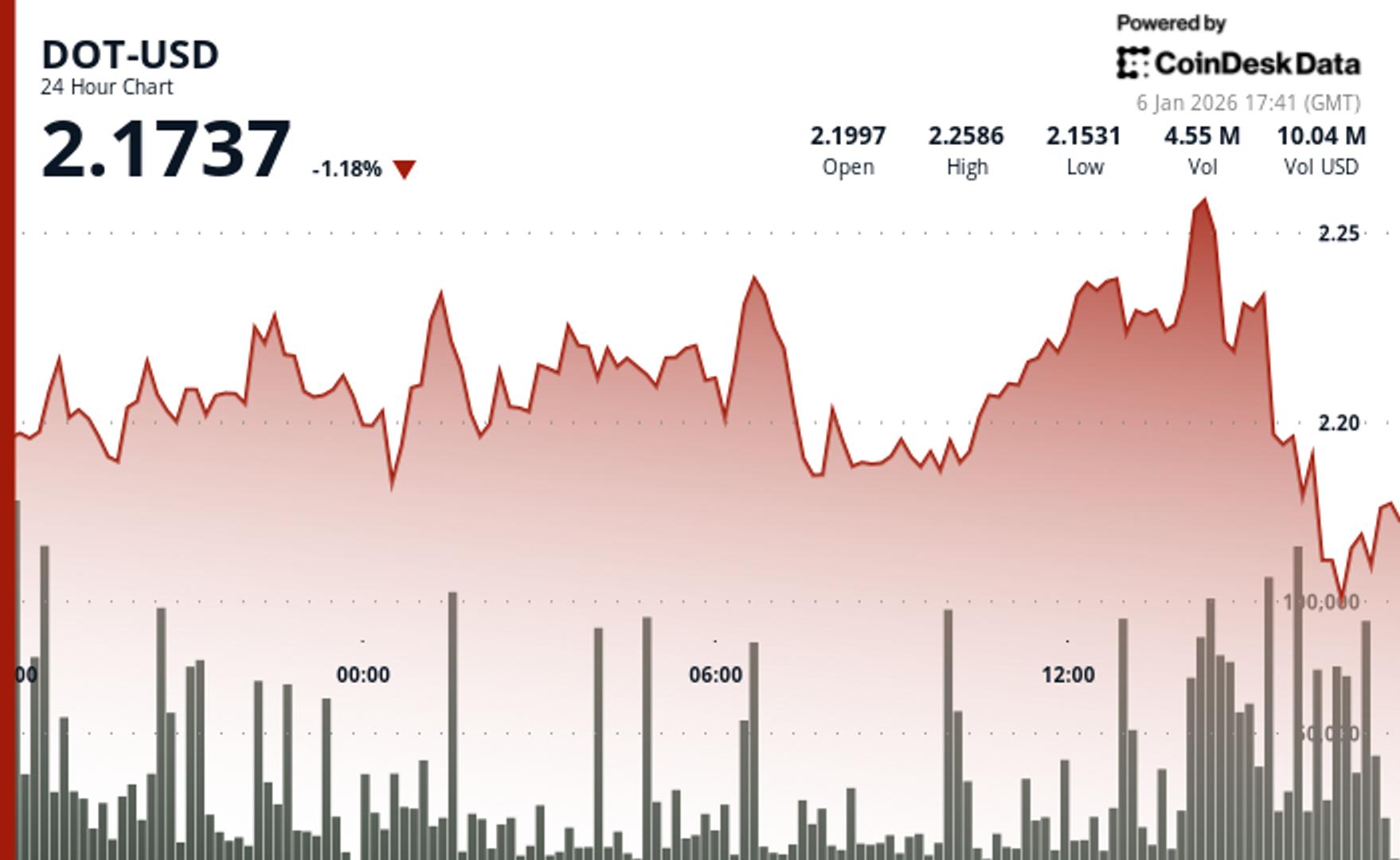

HighPolkadot (dot) experienced a significant selloff in the u.s. afternoon, erasing earlier gains and declining by 3.3%. this was marked by a technical breakdown on heavy volume, suggesting institutional distribution.

Trustworthiness

HighThe analysis comes from coindesk, a highly reputable source in crypto journalism, citing coindesk research's technical analysis model and specific data points.

Price Direction

BearishThe technical structure shifted 'decisively bearish' after a failed breakout attempt at the $2.24-$2.26 resistance zone. dot plunged through critical support levels, including $2.19, with accelerated price deterioration.

Time Effect

ShortThe decline occurred 'over the past hour,' negating 'daily gains.' the technical analysis focuses on immediate support/resistance and a 'late session selloff,' indicating a short-term market reaction.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Polkadot's DOT declines in U.S. afternoon selloff The technical breakdown erased earlier gains as DOT plunged through $2.19 support on heavy volume. By Will Canny , CD Analytics | Edited by Stephen Alpher Jan 6, 2026, 6:16 p.m. Make us preferred on Google Polkadot declines in late session selloff. What to know : DOT slipped from $2.18 to $2.12 over the past hour, erasing earlier gains. Volume was 17% above the 30-day average during the failed breakout attempt. DOT $ 2.1509 surrendered earlier gains in a sharp reversal Tuesday to trade 3.3% lower over the last 24 hours. The token underperformed wider crypto markets. The Coindesk 20 index was 1.3% lower at publication time. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . DOT volume ran 17% higher than the 30-day moving average, suggesting institutional distribution rather than retail capitulation, according to CoinDesk Research's technical analysis model. The model showed that the day began with DOT climbing to $2.17 on strengthening participation, tracking closely with the broader cryptocurrency complex. Resistance at the $2.24-2.26 zone repelled a breakout attempt, setting the stage for the subsequent breakdown, according to the model. Price deterioration accelerated as DOT carved through multiple support zones in three distinct capitulation waves, the model said. This breakdown below the critical $2.19 support level fully negated daily gains and exposed portfolio managers to amplified volatility risk. Technical Analysis: Immediate resistance now established at $2.19 Critical support at $2.14-2.15 demand zone 24-hour volume elevated 17% above 30-day moving average Failed breakout at $2.26 confirmed strong resistance zone Steep downtrend with lower highs at $2.203, $2.191, $2.187, and $2.167 Technical structure shifted decisively bearish Recovery resistance: $2.19 must reclaim to negate breakdown Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Polkadot Technical Analysis More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Riot Platforms sold $200 million of bitcoin in 2025's last two months By James Van Straten , AI Boost | Edited by Stephen Alpher 54 minutes ago VanEck’s head of digital assets said bitcoin sales and the AI trade are increasingly linked as miners fund infrastructure build-outs. What to know : Riot Platforms sold 1,818 bitcoin in December and 383 in November, generating approximately $200 million and reducing its BTC balance to 18,005 coins. Matthew Sigel of asset manager VanEck said the sales could fully fund the first phase of Riot’s Corsicana AI data center build. Read full story Latest Crypto News Riot Platforms sold $200 million of bitcoin in 2025's last two months 54 minutes ago Crypto prices retreat in return to downward U.S. trading day action 1 hour ago Don’t hold your breath for Venezuela’s bitcoin 1 hour ago Former CFTC Commissioner Brian Quintenz joins SUI Group board 2 hours ago Liquidity lifts bitcoin, but ‘halving cycle’ fears could limit rally in 2026, says Schwab 2 hours ago BNB breaks $910 resistance on wider crypto market rally momentum 2 hours ago Top Stories Crypto prices retreat in return to downward U.S. trading day action 1 hour ago This metric suggests bitcoin's late November plunge was the bottom and major upside lies ahead 3 hours ago Morgan Stanley files for bitcoin and solana ETFs, deepening crypto push 6 hours ago Ethereum’s staking queues have cleared and that changes the ETH trade 2 hours ago Buck launches bitcoin-linked ‘savings coin’ tied to Michael Saylor’s Strategy 3 hours ago Crypto Markets Today: Bitcoin tests key resistance as memecoin trading volume explodes 6 hours ago In this article DOT DOT $ 2.1508 ◢ 2.95 %