Former CFTC Commissioner Brian Quintenz joins SUI Group board

Analysis

Price Impact

HighThe appointment of former cftc commissioner brian quintenz, a figure with deep regulatory and capital markets expertise from his time at the cftc and a16z crypto, to sui group's board is a significant validation for the sui ecosystem. this move is intended to bolster the nasdaq-listed firm's sui-focused treasury strategy and adds crucial regulatory credibility, which is vital for institutional adoption in the digital asset space.

Trustworthiness

HighThe news is reported by coindesk, a well-regarded crypto news source, detailing a verifiable corporate board appointment of a public figure with a clear background. the information is precise and details the implications for sui group and the sui token.

Price Direction

BullishQuintenz's strong background provides a layer of regulatory legitimacy and expertise, potentially de-risking the sui ecosystem for institutional investors. his involvement signals a serious commitment to navigating complex regulatory landscapes, which can attract more capital and foster long-term growth for the sui token. the article also notes sui's recent 14% rally.

Time Effect

LongRegulatory credibility and strategic institutional focus, especially from a figure of quintenz's caliber, build foundational strength. while there might be immediate positive price action, the real impact will be seen over the long term as the sui ecosystem benefits from enhanced trust, institutional adoption, and robust regulatory navigation.

Original Article:

Article Content:

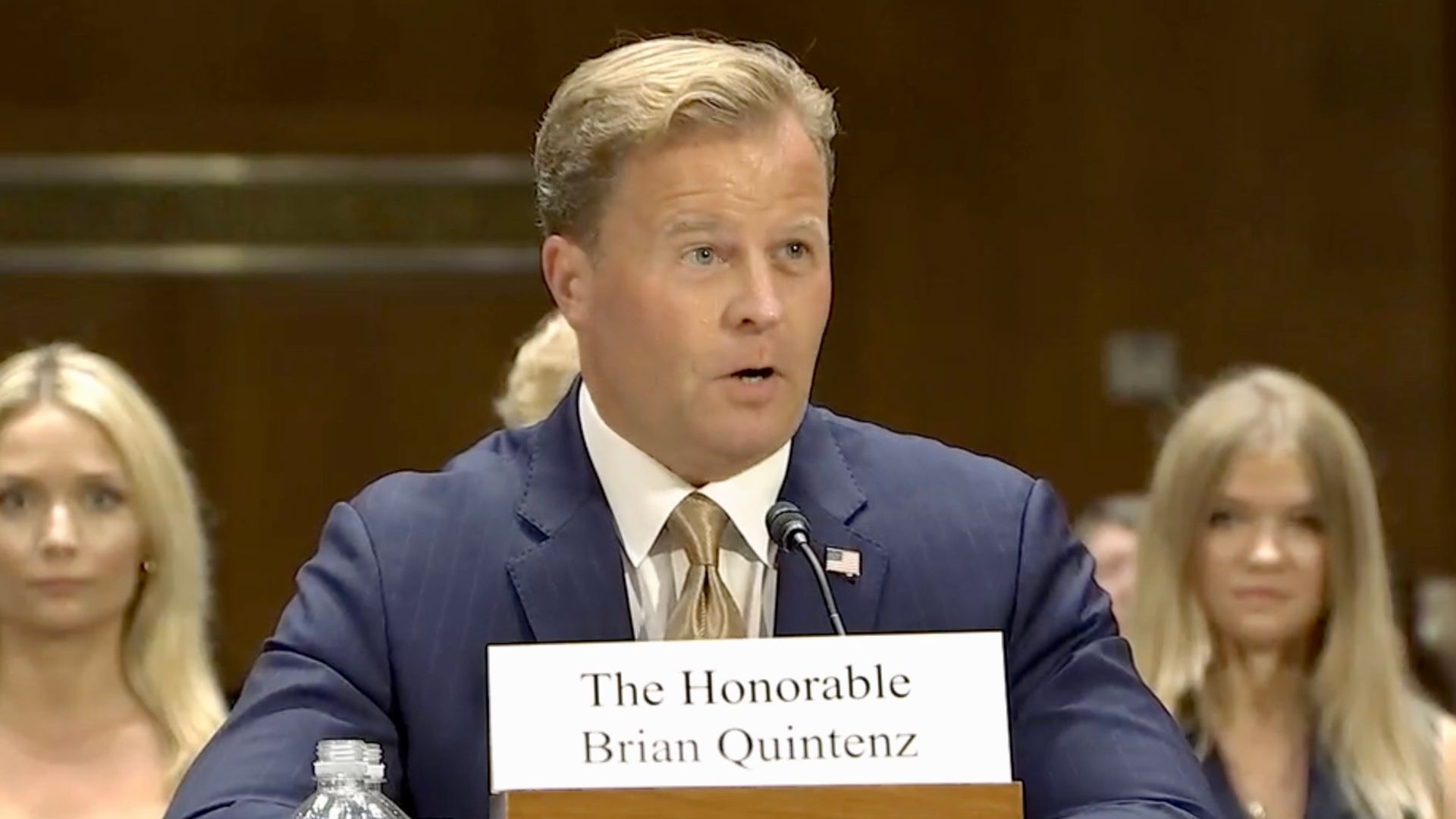

Finance Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Former CFTC Commissioner Brian Quintenz joins SUI Group board Quintenz, who previously led policy at a16z crypto, joins the Nasdaq-listed firm as it advances its SUI-focused treasury strategy. By Will Canny , AI Boost | Edited by Stephen Alpher Jan 6, 2026, 4:10 p.m. Brian Quintenz (Senate Agriculture Committee, modified by CoinDesk) What to know : Former CFTC commissioner Brian Quintenz joined SUI Group’s board as an independent director. Quintenz previously served as global head of policy at a16z crypto and sits on Kalshi’s board. The move comes as the Nasdaq-listed company develops a digital asset treasury strategy centered on the SUI token. SUI Group (SUIG), a Nasdaq-listed company tied to the Sui blockchain ecosystem, has appointed Brian Quintenz as an independent director to its board, the firm said in a press release on Tuesday. Quintenz will also serve on the board’s audit committee, the company said. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . SUIG shares are lower by 2.2% on Tuesday. The SUI token continued its 2026 rally, higher by 14% over the past 24 hours. His appointment follows the transition of SUI Group chief financial officer Joseph A. Geraci II from a board seat to a board observer role. With the change, the board now has five members, three of whom are considered independent under Nasdaq listing standards. Quintenz is a former commissioner of the U.S. Commodity Futures Trading Commission (CFTC), where he served after being nominated by Presidents Barack Obama and Donald Trump and confirmed unanimously by the Senate. During his tenure at the agency, he was involved in oversight of derivatives markets, financial technology and early regulation of bitcoin BTC $ 93,235.03 futures. More recently, Quintenz was global head of policy at a16z crypto, the digital asset arm of venture capital firm Andreessen Horowitz, where he led regulatory and government engagement efforts. He currently serves on the board of Kalshi, a CFTC-regulated event-based derivatives exchange, and has advised companies across digital assets and traditional financial markets. The White House withdrew Quintenz's nomination to run the CFTC in September, capping off a month-long fight over U.S. President Donald Trump's pick for the agency chair. Michael Selig was sworn in as the sixteenth Chairman in December. SUI Group said the appointment adds regulatory and policy experience as it develops a treasury strategy centered on the SUI token. “Brian is a widely respected leader in the digital asset industry, with a rare combination of capital markets expertise, regulatory credibility, and deep infrastructure knowledge,” said Marius Barnett, chairman of the board, in the release. “His decision to join our board and support our SUI treasury strategy represents a meaningful validation of both SUIG and the long-term potential of the Sui ecosystem," he added. The company maintains a formal relationship with the Sui Foundation and is focused on building what it describes as an institutional-grade digital asset treasury platform, while continuing its specialty finance operations. Read more: Sui Blockchain to Host Native Stablecoins Backed by Ethena and BlackRock's Tokenized Fund Brian Quintenz Hiring CFTC Sui AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Buck launches bitcoin-linked ‘savings coin’ tied to Michael Saylor’s Strategy By Olivier Acuna | Edited by Jamie Crawley 1 hour ago The new governance token targets a roughly 7% annual yield funded by income from Strategy’s bitcoin-linked preferred stock. What to know : Buck Labs has launched the Buck crypto token, designed as a yield-bearing savings coin for users seeking returns on dollar-denominated crypto holdings. The token is backed by Strategy shares and offers rewards targeted at around 7% annually, with returns accruing minute-by-minute. Buck is structured as a governance token, allowing holders to vote on reward distribution, and is initially intended for non-U.S. users. Read full story Latest Crypto News BNB breaks $910 resistance on wider crypto market rally momentum 30 minutes ago Ethereum’s staking queues have cleared and that changes the ETH trade 41 minutes ago This metric suggests bitcoin's late November plunge was the bottom and major upside lies ahead 57 minutes ago Buck launches bitcoin-linked ‘savings coin’ tied to Michael Saylor’s Strategy 1 hour ago CoinDesk 20 Performance Update: SUI Gains 5.5% as Index Moves Higher 2 hours ago Storage token Filecoin rises on heavy volume 2 hours ago Top Stories This metric suggests bitcoin's late November plunge was the bottom and major upside lies ahead 57 minutes ago Morgan Stanley files for bitcoin and solana ETFs, deepening crypto push 4 hours ago Ethereum’s staking queues have cleared and that changes the ETH trade 41 minutes ago Buck launches bitcoin-linked ‘savings coin’ tied to Michael Saylor’s Strategy 1 hour ago Crypto Markets Today: Bitcoin tests key resistance as memecoin trading volume explodes 4 hours ago Arthur Hayes' Maelstrom enters 2026 at 'almost maximum risk' betting on altcoins 4 hours ago In this article BTC BTC $ 93,235.03 ◢ 0.84 %