Filecoin surges 6%, outperforms wider crypto markets

Analysis

Price Impact

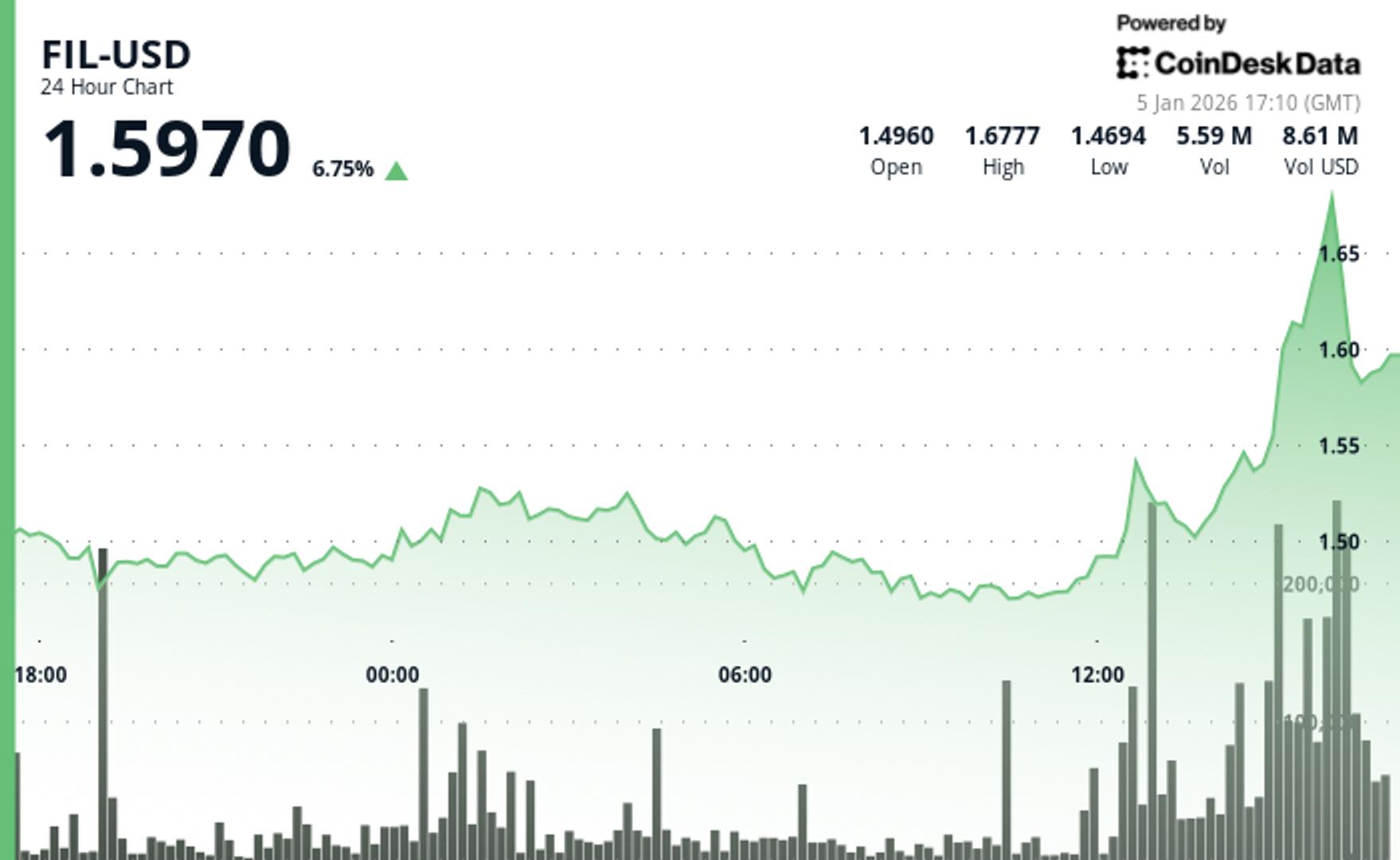

MedFilecoin surged 6%, significantly outperforming the broader crypto market which was up 2.2%. this move broke a key resistance zone, signaling strong short-term momentum.

Trustworthiness

HighThe analysis is provided by coindesk, a reputable crypto news source, leveraging coindesk research's technical analysis model. while ai-assisted, it's editorially reviewed and cites specific technical indicators.

Price Direction

BullishFil's 6% surge was driven by breaking a key resistance zone, responding to algorithmic momentum strategies and rotational interest in storage infrastructure plays. measured volume indicates controlled directional positioning.

Time Effect

ShortThe analysis focuses on a 24-hour price movement, immediate support/resistance levels, and short-term technical breakouts. the catalysts are primarily technical, suggesting a short-term trading opportunity.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Filecoin surges 6%, outperforms wider crypto markets The storage token outperformed the broader crypto market during a volatile session. By CD Analytics , Will Canny | Edited by Nikhilesh De Jan 5, 2026, 5:29 p.m. Filecoin surges 6% after breaking through key resistance zone. What to know : FIL jumped 6% on Monday to $1.59 outpacing the broader crypto market. The CoinDesk 20 index was 2.2% higher. Filecoin FIL $ 1.4919 rallied 6% on Monday to $1.59 during the 24-hour period, outperforming the wider cryptocurrency market. The broader market gauge, the CoinDesk 20 index, was 2.2% higher at publication time. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The storage token climbed from $1.51 to $1.59 over the session, carving out a $0.21 range (13.9%) while volume registered at approximately 91% of its 30-day average, suggesting controlled directional positioning rather than speculative froth, according to CoinDesk Research's technical analysis model. The model showed that the measured volume profile, falling short of the 110% threshold that signals elevated institutional participation, pointed to efficient positioning by informed traders. The outperformance versus the crypto benchmark suggested rotational interest in storage infrastructure plays rather than Filecoin-specific developments, the model said. The rally occurred without clear fundamental catalysts, making technical factors the primary driver, according to the model, with algorithmic momentum strategies responding to breakout signals rather than fundamental repositioning. Technical Analysis: Immediate support at $1.58-$1.59 zone; breakdown below $1.575 negates bullish structure Primary support base at $1.50-$1.52 consolidation range established by high-volume accumulation Resistance at $1.63 must be reclaimed with sustained volume for continuation Session high resistance at $1.68 represents key upside target 24-hour session volume at 91% of 30-day average indicated measured participation A reclamation of $1.63 with volume targets retest of $1.68 session high Breakdown below $1.575 targets $1.52-$1.54 support zone Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Filecoin Technical Analysis More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Tom Lee calls for a new bitcoin ATH in January, while warning of a volatile 2026 By Olivier Acuna | Edited by Nikhilesh De 10 minutes ago The Fundstrat co-founder and Bitmine chair said bitcoin has yet to peak in January and reiterated his belief that ether is ‘dramatically’ undervalued. What to know : Tom Lee of Fundstrat Global Advisors predicted Bitcoin could reach a new all-time high by the end of January 2026. Lee forecasted a volatile but ultimately positive year for crypto markets in 2026, with a strong second half. He projected the S&P 500 to hit 7,700 by the end of 2026, driven by resilient corporate earnings and AI-driven productivity gains. Read full story Latest Crypto News Tom Lee calls for a new bitcoin ATH in January, while warning of a volatile 2026 10 minutes ago BNB token ticks higher as technical upgrades frame tight price compression 57 minutes ago Goldman Sachs sees regulation driving next wave of institutional crypto adoption 1 hour ago Robinhood leaning into advanced traders as crypto volatility reshapes user behavior 1 hour ago Bitcoin rally masks fragile liquidity as spot volumes hit year-long lows 1 hour ago Bitcoin eyes $94,000 as crypto prices manage early U.S. gains for second straight session 1 hour ago Top Stories Bitcoin eyes $94,000 as crypto prices manage early U.S. gains for second straight session 1 hour ago Goldman Sachs sees regulation driving next wave of institutional crypto adoption 1 hour ago Bitcoin rally masks fragile liquidity as spot volumes hit year-long lows 1 hour ago Crypto wallet firm Ledger faces customer data breach through payment processor Global-e 4 hours ago Memecoin comeback talk builds as DOGE, SHIB, BONK rally in early 2026 3 hours ago Strategy boosted bitcoin holdings and cash reserve last week 4 hours ago In this article FIL FIL $ 1.4919 ◢ 0.58 %