Bitcoin rally masks fragile liquidity as spot volumes hit year-long lows

Analysis

Price Impact

HighBitcoin's recent rally is occurring on year-long low spot trading volumes, indicating weak underlying demand and fragile market liquidity. this condition makes the market highly susceptible to exaggerated price swings and sudden reversals.

Trustworthiness

HighAnalysis is based on data from reputable on-chain analytics firm glassnode and corroborated by coindesk research, both highlighting structural liquidity issues.

Price Direction

NeutralDespite current price gains, the lack of supporting volume suggests this rally is fragile and potentially unsustainable. thin liquidity increases the risk of sharp downward corrections or amplified volatility if selling pressure emerges.

Time Effect

ShortThe immediate-term price action is highly vulnerable to quick reversals due to thin order books and low participation, making the current rally unsustainable in the short term.

Original Article:

Article Content:

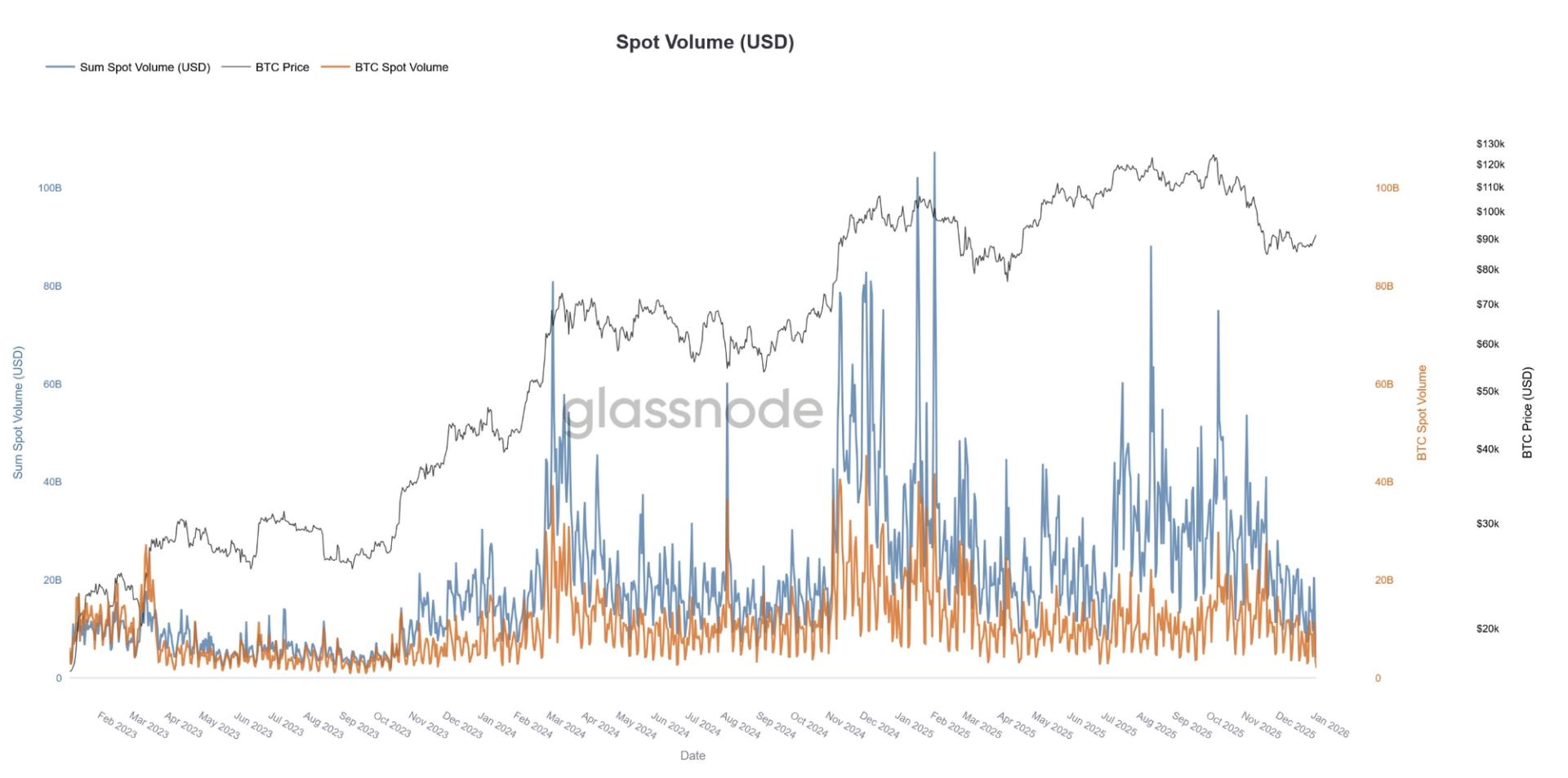

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin rally masks fragile liquidity as spot volumes hit year-long lows Bitcoin and altcoin prices have pushed higher, but Glassnode data shows spot trading activity has dropped to its weakest levels since late 2023. By Oliver Knight | Edited by Cheyenne Ligon Jan 5, 2026, 4:14 p.m. Crypto spot volume chart (Glassnode) What to know : Spot trading volumes for bitcoin and altcoins have fallen to their lowest levels since November 2023, even as prices move higher, signaling weak underlying demand, Glassnode data shows. Thin liquidity can amplify price moves, as shallow order books allow relatively small trades to push markets sharply higher or lower — a dynamic flagged in CoinDesk research following October’s crash. Crypto market depth has failed to fully recover since October’s $19 billion liquidation event, leaving markets more vulnerable to exaggerated price swings and sudden reversals. Bitcoin and the wider crypto market has started to wake up recently, but underlying liquidity conditions appear strikingly weak, according to onchain analytics firm Glassnode — a dynamic that echoes concerns raised in a CoinDesk analysis in November on hollow crypto market liquidity following the October crash. Glassnode’s latest data shows that both bitcoin spot trading volume and aggregate altcoin spot volume have sunk to their lowest readings since November 2023, even as prices have climbed — a divergence that typically points to thinning market participation and fragile demand underneath the recent strength. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Spot volume is a metric that assesses actual buying and selling activity on exchanges, a barometer of real trading interest. Traditionally, healthy price advances are supported by rising volumes, as fresh capital and buyers enter the market. But in this case, spot volumes have not only failed to increase alongside prices, they’ve fallen to year-long lows, underscoring a lack of broad participation behind the moves. Loading... This assessment reiterates issues raised in a CoinDesk research piece published in November, which documented how liquidity across centralized exchanges — including bitcoin and ether market depth — failed to recover fully after the October liquidation cascade. The research highlighted that post-crash, order-book depth remained structurally lower than before the sell-off, suggesting a new, thinner baseline of liquidity that leaves markets more vulnerable to exaggerated price reactions. The October event, which resulted in $19 billion worth of leveraged positions being wiped out in a matter of hours, did more than unwind overextended bets. It reshaped the market’s underlying structure, leading to a sustained pullback in resting liquidity as market-making firms and liquidity providers pulled back, making markets shallower and less capable of absorbing large trades without meaningful price impact. Bitcoin is currently trading at $93,500 after rising by 7.5% since Jan. 1, but the move on minimal volume is presenting traders with a number of warning signs. Bitcoin Trading Liquidity Spot Trading More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Bitcoin eyes $94,000 as crypto prices manage early U.S. gains for second straight session By Helene Braun , James Van Straten | Edited by Stephen Alpher 18 minutes ago Digital asset treasury companies — 2025's worst performers — were leading crypto-related stock gains. What to know : Crypto prices climbed during early U.S. trading, adding to gains from a broader overnight rally. Strive (ASST) and DeFi Development (DFDV) were among the digital asset treasury companies (DATs) higher by double-digit percentages. The Coinbase Bitcoin Premium Index, which had fallen to its lowest level in nine months on Jan. 1, has climbed sharply in the first week of 2026, signaling a rebound in U.S. demand. Read full story Latest Crypto News Bitcoin eyes $94,000 as crypto prices manage early U.S. gains for second straight session 18 minutes ago Japan’s finance minister says she supports crypto trading at stock exchanges 21 minutes ago Crypto traders can now speculate on housing prices through Polymarket 1 hour ago Starknet back online after four-hour outage, warns some transactions may be affected 1 hour ago Bitcoin miners continue to face dwindling profits despite lower competition, JPMorgan says 1 hour ago Bitmine Immersion adds 33,000 ETH, bringing total crypto and cash holdings above $14 billion 1 hour ago Top Stories Bitcoin eyes $94,000 as crypto prices manage early U.S. gains for second straight session 18 minutes ago Memecoin comeback talk builds as DOGE, SHIB, BONK rally in early 2026 2 hours ago Goldman Sachs upgrades Coinbase to buy, cuts eToro to neutral 2 hours ago Strategy boosted bitcoin holdings and cash reserve last week 2 hours ago Crypto wallet firm Ledger faces customer data breach through payment processor Global-e 3 hours ago CME Group’s average crypto derivatives volume hit record $12 billion in 2025 1 hour ago