XRP bounces, but $2 remains the hurdle as exchange supply hits 8-year low

Analysis

Price Impact

HighXrp exchange supply has hit an 8-year low, decreasing by 57% since october, suggesting significant movement into longer-term storage. this fundamental shift in supply dynamics has a high potential to amplify price moves if demand picks up.

Trustworthiness

HighThe analysis is from coindesk data and cd analytics, a reputable source, providing specific data points on exchange balances and detailed technical levels. the analysis clearly outlines both bull and bear cases with specific price targets.

Price Direction

NeutralWhile the dwindling exchange supply creates a strong long-term bullish narrative, xrp is currently facing significant resistance between $1.88 and $2.00. this creates a 'tug-of-war' where immediate upside is capped despite underlying constructive fundamentals.

Time Effect

LongThe 8-year low in exchange supply and the trend of tokens moving into longer-term storage ('hodl' behavior) are significant long-term fundamental indicators. while short-term price action battles resistance, the supply squeeze suggests a constructive setup for extended periods.

Original Article:

Article Content:

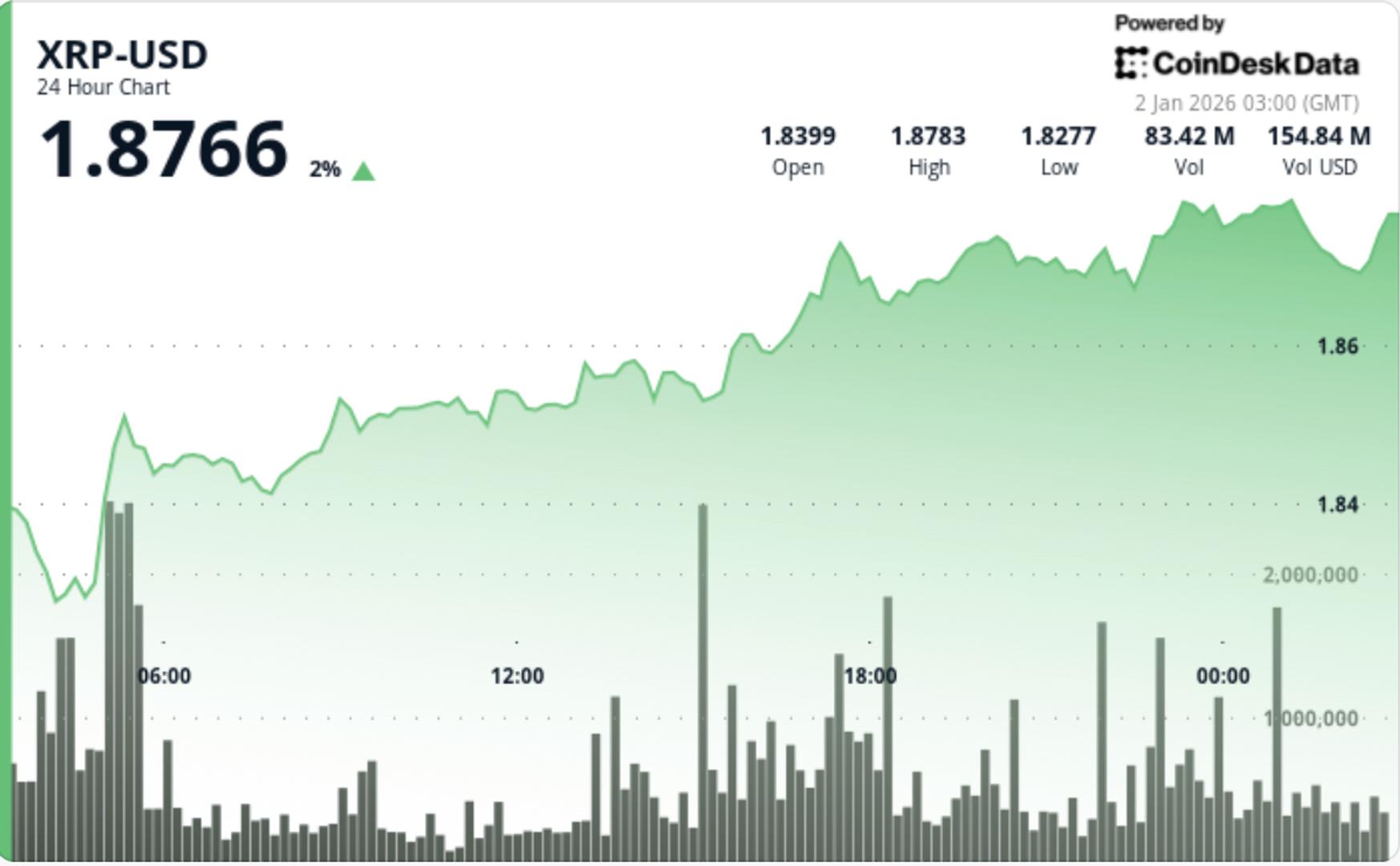

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP bounces, but $2 remains the hurdle as exchange supply hits 8-year low Exchange balances have decreased by about 57% since October, suggesting tokens are moving into longer-term storage. By Shaurya Malwa , CD Analytics Updated Jan 2, 2026, 3:14 a.m. Published Jan 2, 2026, 3:14 a.m. (CoinDesk Data) What to know : XRP's price rose to $1.87 as exchange-held supply fell to its lowest level since 2018, indicating a tightening supply narrative. Exchange balances have decreased by about 57% since October, suggesting tokens are moving into longer-term storage. XRP faces resistance near $1.88, with a broader range between $1.77 and $2.00, as technical indicators show mixed momentum. XRP pushed up to $1.87 as exchange-held supply fell to its lowest level since 2018, reinforcing a tightening-float narrative even as price remains stuck below the heavy $1.88–$2.00 resistance band that has repeatedly capped rebounds. News background Exchange balances are being treated as a key signal again. Supply held on trading venues has fallen to roughly 1.6 billion XRP, down about 57% since October, suggesting more tokens are moving into longer-term storage or custody rather than sitting ready to be sold. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . That drawdown is arriving during a broader phase of selective positioning across majors: institutions have increasingly leaned on structured and regulated rails for exposure while spot markets remain choppy, leaving tokens like XRP trading with a supportive long-term bid but fragile short-term momentum. For XRP specifically, the falling exchange inventory matters because it can amplify moves when demand picks up — but it doesn’t guarantee upside if sellers show up at known technical levels (and $2 has been that level). Technical analysis XRP climbed roughly 1.7% from $1.84 to $1.87, printing higher lows through the session and holding a relatively contained $0.05 range (about 2.5% intraday volatility). Participation improved at the right moment: volume expanded during the push higher (around 32 million, about 50% above average) — a sign this wasn’t simply drifting upward on thin liquidity. But the tape still reads like controlled recovery inside a broader ceiling. XRP repeatedly slowed as it approached the $1.88 area, a level that also lines up with a broader resistance zone ahead of the psychological $2.00 handle. That matters because recent attempts to reclaim $2 have failed quickly, turning the area into a supply zone where sellers are comfortable leaning on rallies. Momentum indicators are mixed. Some oscillators show bullish divergence (momentum improving even as price hasn’t fully broken out), but the market still needs follow-through above resistance to validate it. On the lower side, the structure looks constructive as long as XRP holds above the $1.82–$1.83 base from the session’s early tests — and more broadly above the $1.77 floor that has acted as the next clear demand pocket. Price action summary XRP advanced from $1.84 to $1.87, posting a steady series of higher lows Volume expanded during the move higher, peaking around 32M, roughly 50% above average Price stalled near $1.88 resistance, keeping the broader $1.77–$2.00 range intact Late-session action consolidated around $1.873, signaling an inflection point rather than a breakout What traders should know The story is a tug-of-war between tightening available supply and a well-defined resistance ceiling. Key levels are clean: Bull case: A sustained push above $1.88 opens the door to a run toward $1.95, with $2.00 as the breakout trigger. A clean reclaim of $2 would likely pull in momentum buyers and force repositioning from sellers who have been defending that zone. Bear case: Failure to hold the $1.82–$1.83 base shifts focus back to $1.77, the next meaningful demand pocket. If that breaks, risk extends lower into the next broader support region (where buyers historically reappear), but the near-term battlefield is clearly $1.77 vs. $1.88. For now, shrinking exchange supply keeps the longer-term setup constructive — but the market still needs a decisive win above $1.88–$2.00 before the upside narrative can take control of the tape. More For You KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market By CoinDesk Research Dec 22, 2025 Commissioned by KuCoin KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market. What to know : KuCoin recorded over $1.25 trillion in total trading volume in 2025 , equivalent to an average of roughly $114 billion per month , marking its strongest year on record. This performance translated into an all-time high share of centralised exchange volume , as KuCoin’s activity expanded faster than aggregate CEX volumes , which slowed during periods of lower market volatility. Spot and derivatives volumes were evenly split , each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line. Altcoins accounted for the majority of trading activity , reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover. Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity , indicating structurally higher user engagement rather than short-lived volume spikes. View Full Report More For You Strategy shares register first six-month losing streak since adoption of bitcoin strategy in 2020 By Siamak Masnavi , AI Boost 14 hours ago Crypto analyst Chris Millas has highlighted an unusually persistent slump in Strategy shares, breaking with past drawdown patterns even as the firm continued accumulating bitcoin. What to know : Strategy shares fell in each of the final six months of 2025, marking the first time since the firm adopted bitcoin in August 2020 as a treasury reserve asset. The decline stands out for its persistence, as past selloffs were often followed by sharp rebounds. The stock sharply underperformed both bitcoin and the Nasdaq 100 despite the firm's continued BTC purchases. Read full story Latest Crypto News December FOMC minutes show the Fed is worried short-term funding could seize up 6 hours ago Vitalik Buterin on the two goals Ethereum must meet to become the ‘world computer’ 11 hours ago Strategy shares register first six-month losing streak since adoption of bitcoin strategy in 2020 14 hours ago How crypto's promised year-end fireworks turned into a bloodbath 15 hours ago Coinbase’s Base faces builder backlash over creator coin push Dec 31, 2025 4 predictions for privacy in 2026 Dec 31, 2025 Top Stories Trump Media to distribute new digital tokens to DJT shareholders Dec 31, 2025 Coinbase’s Base faces builder backlash over creator coin push Dec 31, 2025 Bitcoin got stuck after slumping 30% from its peak. Here's why. Dec 31, 2025 XRP and solana volatility in 2025 was twice as bumpy as bitcoin's Dec 31, 2025 Korbit fined $1.9 million for anti money-laundering, customer verification breaches Dec 31, 2025 Bitwise files for 11 'strategy' ETFs, tracking tokens including AAVE, ZEC, TAO Dec 31, 2025