APT falls as token underperforms wider crypto markets

Analysis

Price Impact

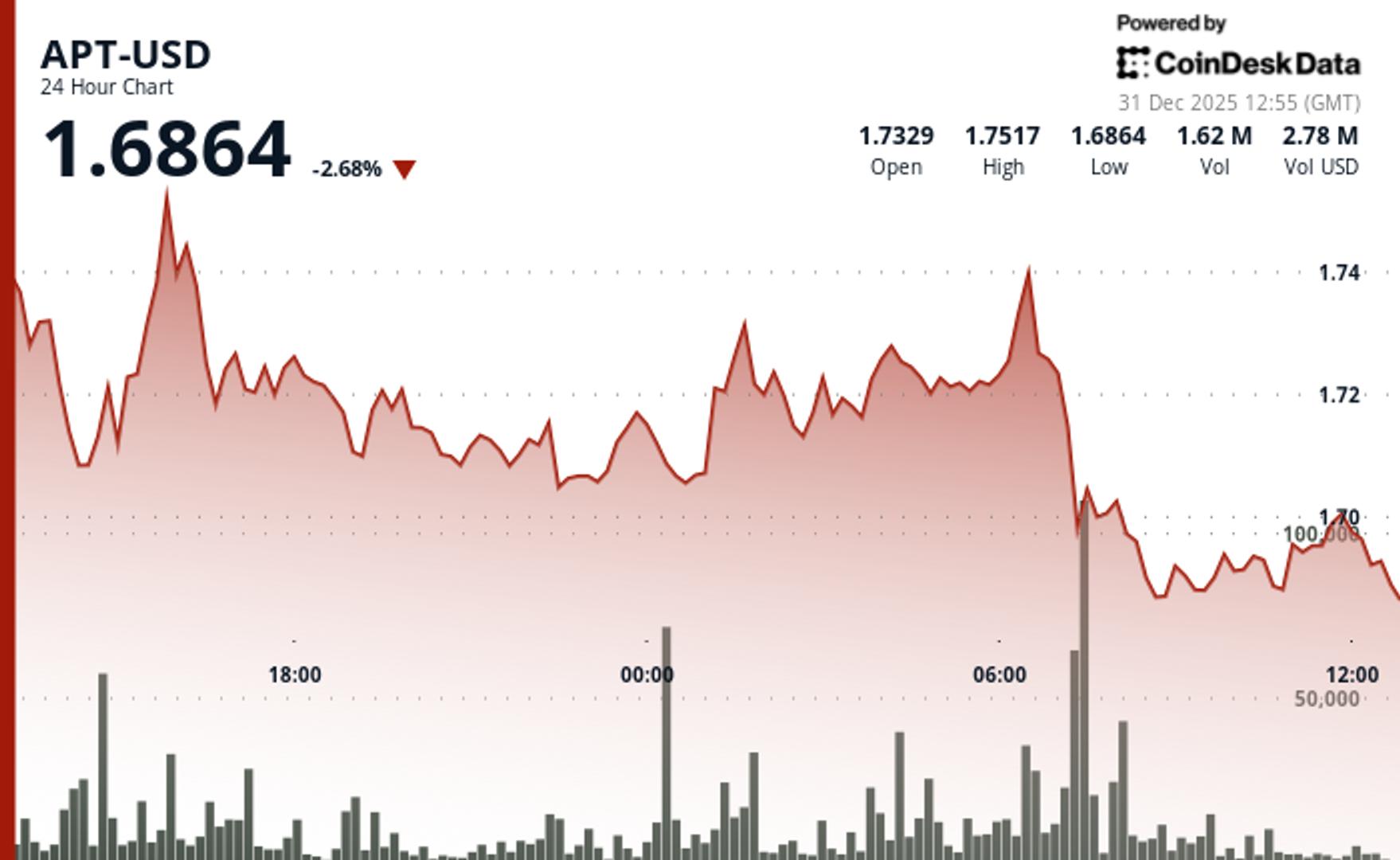

MedApt fell 2.4% over 24 hours, significantly underperforming the broader crypto market. technical indicators are overwhelmingly bearish across all major moving averages, with strong resistance at $1.75 confirmed by high volume.

Trustworthiness

HighThe analysis is provided by coindesk, a reputable source, leveraging coindesk research's technical analysis model and ai market insights, ensuring a high degree of credibility.

Price Direction

BearishDespite recent ecosystem developments, apt's underperformance, coupled with overwhelming bearish technical signals across all timeframes and a confirmed strong resistance at $1.75, points to a continued bearish trend. while 60-minute charts show a bullish recovery pattern within a tight consolidation channel, the overall sentiment remains negative.

Time Effect

ShortThe analysis focuses on 24-hour price movements, immediate support/resistance levels, and short-term recovery patterns on 60-minute charts, indicating a short-term price effect.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email APT falls as token underperforms wider crypto markets The token underperformed broader digital assets as trading activity remained subdued despite recent ecosystem developments. By Will Canny , CD Analytics | Edited by Oliver Knight Updated Dec 31, 2025, 1:32 p.m. Published Dec 31, 2025, 1:32 p.m. APT falls as token underperforms wider crypto markets. What to know : APT fell 2.4% over 24 hours. Technical indicators remained overwhelmingly bearish across all major moving averages. APT $ 1.6973 fell 2.4% to $1.69 on below-average volume, significantly underperforming the broader crypto market. The broader market gauge, the CoinDesk 20 index (CD20), was 0.5% higher at publication time. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . This relative weakness against major cryptocurrencies signals selective investor caution toward APT, according to CoinDesk Research's technical analysis model. The model showed that the token declined from $1.73 to $1.69 over the 24 hour period, establishing a volatile range-bound pattern with a total range of $0.09. The most significant volume event occurred earlier this morning with exceptional volume of 12.2 million tokens, 214% above the 24 hour moving average, confirming strong resistance near $1.75, according to the model. Price action showed consolidation within a tight channel following the initial decline, according to the model, with momentum decelerating as volume normalizes after the high-volume rejection. APT's decline comes on tepid trading activity, with 24 hour volume running 31% above its 7-day average but failing to reach significant threshold levels. Technical Analysis: Primary support established at $1.68-$1.69 psychological level, with major resistance confirmed at $1.75 following high-volume rejection. Peak volume of 12.17 million (214% above SMA) confirms resistance failure, while recent recovery shows accelerating volume above $1.695 breakout level. Range-bound consolidation within $0.09 channel following initial decline, with 60-minute charts showing bullish recovery pattern. Immediate upside target at $1.70-$1.705 resistance cluster, with broader range highs near $1.75 representing next major test. Technical indicators showing overwhelming bearish signals across all timeframes. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Aptos Technical Analysis Mais para você State of the Blockchain 2025 Por CoinDesk Research 19 de dez. de 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. O que saber : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You Bitcoin got stuck after slumping 30% from its peak. Here's why. By Olivier Acuna | Edited by Sheldon Reback , Aoyon Ashraf 1 hour ago The October flash crash exposed how fragile bitcoin’s rally had become. It also illustrated a fundamental change in how BTC is perceived. What to know : Bitcoin's 2025 bull run was disrupted by a flash crash, revealing the volatility and unpredictability of digital asset trading. Institutional acceptance has shifted bitcoin from a fringe asset to part of the institutional macro complex, affecting its price dynamics. Despite optimistic forecasts, bitcoin ended the year significantly below expectations, influenced by macroeconomic factors and cautious capital. Read full story Latest Crypto News Korbit fined $1.9 million for anti money-laundering, customer verification breaches 45 minutes ago Bitcoin got stuck after slumping 30% from its peak. Here's why. 1 hour ago Bitwise files for 11 'strategy' ETFs, tracking tokens including AAVE, ZEC, TAO 2 hours ago XRP and solana volatility in 2025 was twice as bumpy as bitcoin's 2 hours ago Winklevoss-backed Cypherpunk buys $28 million of zcash, now owns 1.7% of supply 3 hours ago South Korean retail keeps buying ether hoarder BitMine despite 80% drop: Report 6 hours ago Top Stories Bitcoin got stuck after slumping 30% from its peak. Here's why. 1 hour ago Korbit fined $1.9 million for anti money-laundering, customer verification breaches 45 minutes ago XRP and solana volatility in 2025 was twice as bumpy as bitcoin's 2 hours ago Bitwise files for 11 'strategy' ETFs, tracking tokens including AAVE, ZEC, TAO 2 hours ago Winklevoss-backed Cypherpunk buys $28 million of zcash, now owns 1.7% of supply 3 hours ago South Korean retail keeps buying ether hoarder BitMine despite 80% drop: Report 6 hours ago