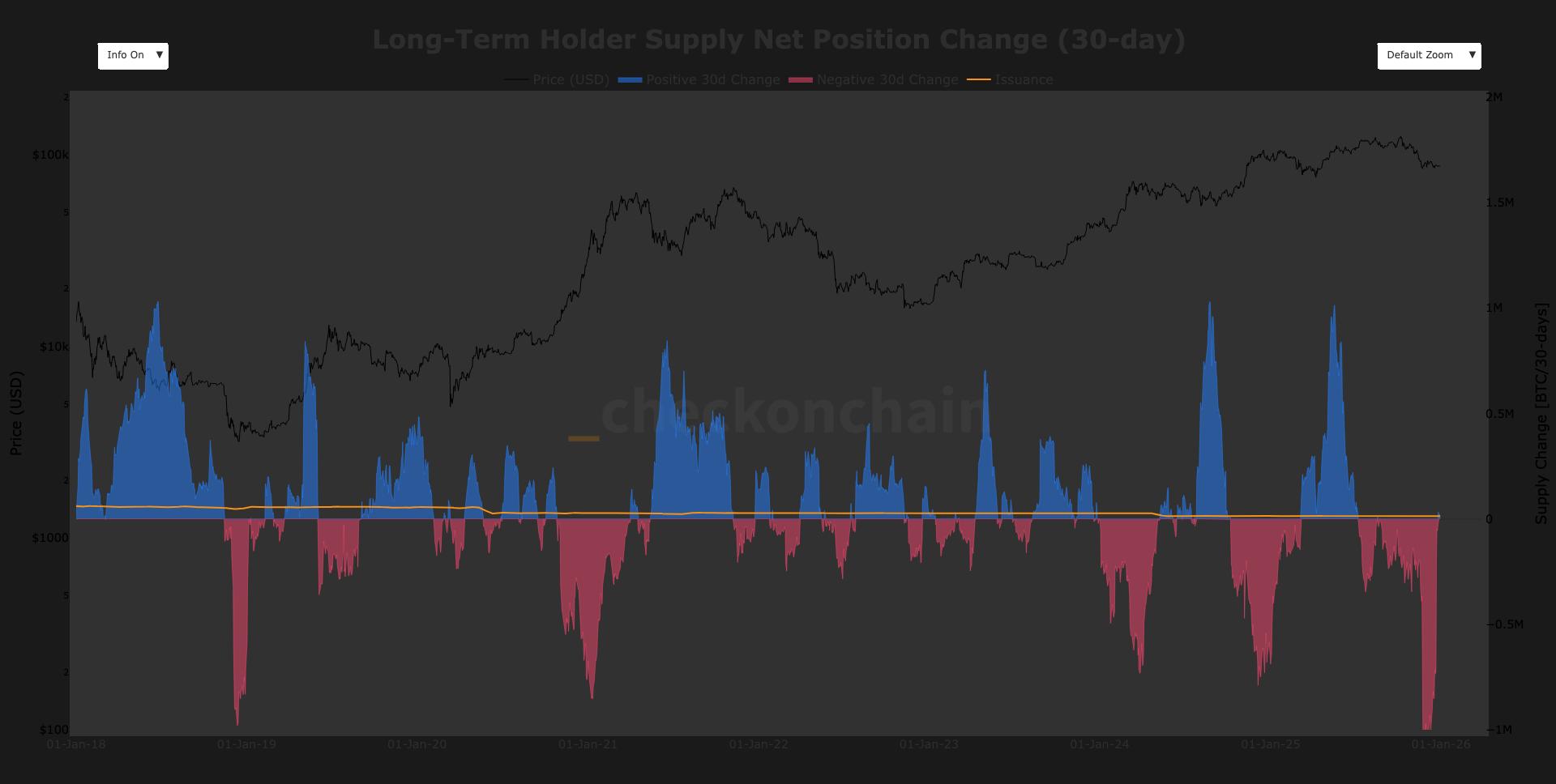

Long-term holders turn net accumulators, easing a major bitcoin headwind

Analysis

Price Impact

HighLong-term holders (lths) have shifted from net sellers to net accumulators for the first time since july, accumulating 33,000 btc in 30 days. this eases a major sell-side headwind that saw over 1 million btc distributed by lths during the recent correction.

Trustworthiness

HighThe information is based on on-chain data from 'checkonchain' and reported by coindesk, a reputable source for crypto market analysis.

Price Direction

BullishThe shift to accumulation by lths signals renewed confidence and a reduction in available supply from strong hands. this suggests that a significant source of sell pressure has abated, paving the way for potential upward price movement as new buyers mature into holders.

Time Effect

LongLth accumulation patterns typically indicate a longer-term positive outlook, as these holders tend to keep their assets for extended periods, providing sustained support for the asset's price.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Long-term holders turn net accumulators, easing a major bitcoin headwind During this current correction, long term holders have sold over 1 million BTC, the largest sell pressure event from this cohort since 2019. By James Van Straten | Edited by Jamie Crawley Dec 30, 2025, 11:25 a.m. long-term holder 30-day change (checkonchain) What to know : Long-term holders have recorded a positive 30-day net position change, accumulating around 33,000 BTC as recent buyers mature into holders. During this current correction, long term holders have sold over 1 million BTC, the largest sell pressure event from this cohort since 2019. This marked the third major wave of long term holder selling this cycle, following distribution in March and November 2024. Long-term holders (LTH) of bitcoin BTC $ 87,852.48 have shifted back into accumulation for the first time since July. LTHs, defined as entities that have held bitcoin for at least 155 days, have accumulated roughly 33,000 BTC on a 30-day net basis, according to onchain data analysts checkonchain . STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Selling from LTHs has been one of the two of the largest sources of sell pressure this year along with miner capitulation . LTHs were a major source of distribution, while miners are typically forced to sell bitcoin while mining at a loss. Since it takes 155 days for short-term holders to transition into long-term holders, this suggests that buyers from the past six months are now becoming long-term holders and are outpacing the distribution. LTHs sold more than 1 million BTC during the 36% correction from October, marking the largest sell-pressure event from this cohort since 2019, a period that ultimately coincided with the bear market low that year, with bitcoin at around $3,200. The October sell-off was the third LTH distribution phase since the current cycle began in 2023. The first occurred in March 2024 when bitcoin reached $73,000 and over 700,000 BTC were sold, while the second took place that November when bitcoin reached $100,000 and more than 750,000 BTC were distributed by LTHs. Bitcoin News long-term long-term holder More For You State of the Blockchain 2025 By CoinDesk Research Dec 19, 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You Gold, silver outrun bitcoin as 2025's go-to protectors of paper money By James Van Straten , Omkar Godbole | Edited by Sheldon Reback 8 minutes ago Traders expect BTC to regain its mojo next year. What to know : Metals have emerged as the clear winners of the debasement trade in 2025, with gold and silver posting outsized gains while bitcoin has lagged. Gold’s advance has been underpinned by exceptional strength on price charts, staying above its 200-day moving average for roughly 550 trading days, the second-longest streak on record. Read full story Latest Crypto News Gold, silver outrun bitcoin as 2025's go-to protectors of paper money 8 minutes ago Traders split over whether Lighter’s LIT clears $3 billion FDV after launch 1 hour ago Metaplanet buys 4,279 bitcoin, lifts total holdings to 35,102 BTC 2 hours ago Institutions are increasingly using the bitcoin options playbook for altcoins: STS Digital 3 hours ago Lighter DEX launches LIT token with 25% airdrop 3 hours ago Silver overtakes bitcoin on volatility as year-end trading thins 3 hours ago Top Stories ETH, ADA SOL slip as year-end selling lingers as bitcoin traders eye $80,000 to $100,000 range 6 hours ago BlackRock’s BUIDL hits $100M million in dividends and passes $2 billion in assets 5 hours ago Gold, silver outrun bitcoin as 2025's go-to protectors of paper money 8 minutes ago Crypto winter looms in 2026, but Cantor sees institutional growth and onchain shifts 19 hours ago Institutions are increasingly using the bitcoin options playbook for altcoins: STS Digital 3 hours ago Silver overtakes bitcoin on volatility as year-end trading thins 3 hours ago In this article BTC BTC $ 87,852.48 ◢ 0.39 %