Gold, silver outrun bitcoin as 2025's go-to protectors of paper money

Analysis

Price Impact

HighDespite underperforming gold and silver in 2025 as a 'debasement trade' asset, market analysts and prediction markets strongly anticipate bitcoin to 'regain its mojo' and exhibit 'greater torque' in 2026, catching up to or surpassing traditional safe havens. recent significant institutional buying further adds to this positive outlook.

Trustworthiness

HighThe analysis is supported by specific institutional analyst insights (re7 capital) referencing historical lead-lag relationships between gold and bitcoin, robust prediction market odds (polymarket favoring btc for 2026), and ongoing institutional accumulation of bitcoin (e.g., metaplanet).

Price Direction

BullishWhile 2025 saw a -6% decline for btc, the consensus among analysts is a strong rebound in 2026. expectations are high for bitcoin to catch up with and potentially outperform gold, leveraging its historical 'greater torque' in debasement scenarios and a typical 26-week lag behind gold's movements.

Time Effect

LongThe article's core focus is on a retrospective of 2025 performance and forward-looking predictions for 2026. the analyst commentary explicitly discusses multi-month lags (26 weeks) and extended trends, indicating a long-term outlook for price movements.

Original Article:

Article Content:

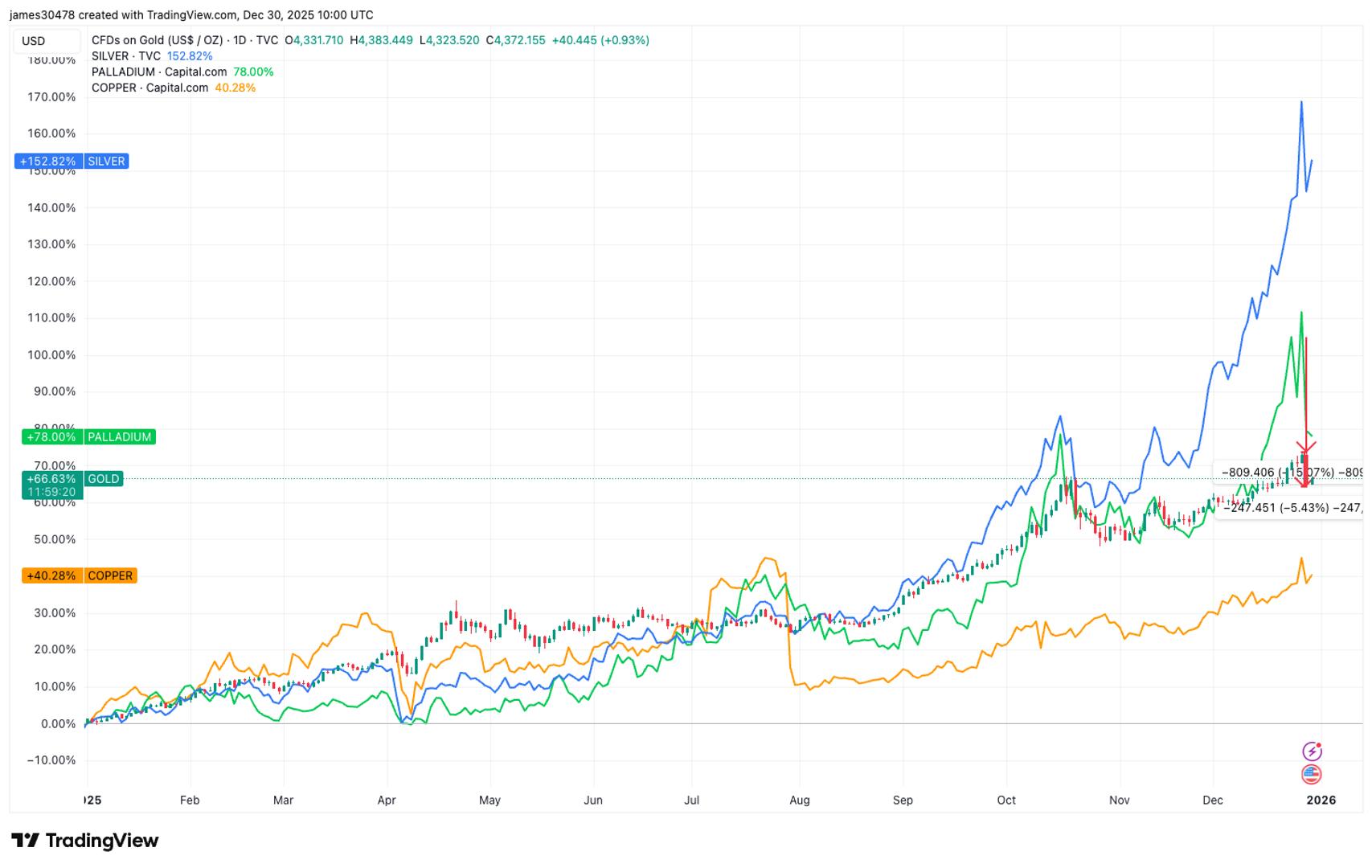

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Gold, silver outrun bitcoin as 2025's go-to protectors of paper money Traders expect BTC to regain its mojo next year. By James Van Straten , Omkar Godbole | Edited by Sheldon Reback Dec 30, 2025, 11:17 a.m. Gold, Silver, Copper, Palladium (TradingView) What to know : Metals have emerged as the clear winners of the debasement trade in 2025, with gold and silver posting outsized gains while bitcoin has lagged. Gold’s advance has been underpinned by exceptional strength on price charts, staying above its 200-day moving average for roughly 550 trading days, the second-longest streak on record. This year, investors decisively chose precious metals such as gold to hedge against the potential erosion of paper money value, sidelining bitcoin BTC $ 87,925.62 . Gold has risen almost 70% since Jan. 1 and silver about 150%, far outpacing the largest cryptocurrency, which has fallen about 6%. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Analysts attributed the rally to the so-called "debasement trade." That's an investment strategy that involves buying perceived store-of-value assets and waiting for the fiat currency to devalue, or debase. The depreciation, the result of ultra-easy monetary policies and fiscal deficit, leads to a loss of purchasing power and drives up the price of the asset. Early this year, BTC bulls made bold predictions, citing the debasement trade as a key catalyst driving their year-end forecasts. Bitcoin's rally, however, abruptly ran out of steam above $126,000 in early October. Since then, it has pulled back to below $90,000. Record rally in gold Gold’s rally has been particularly notable from the perspective of technical analysis, according to The Kobeissi Letter . The metal has remained above its 200-day simple moving average, a widely followed long-term trend indicator that smooths price action over roughly nine months, for around 550 consecutive trading days. This marks the second-longest streak on record, trailing only the approximately 750-session stretch that followed the 2008 financial crisis. Still, the bitcoin bulls aren't phased. Crypto analysts expect the cryptocurrency to catch up with gold next year, living up to its tendency to rally with a lag. "Gold has been leading BTC by roughly 26 weeks, and its consolidation last summer matches Bitcoin’s pause today," Lewis Harland, a portfolio manager at Re7 Capital, told CoinDesk. "The metal’s renewed strength reflects a market increasingly pricing in further currency debasement and fiscal strain into 2026, a backdrop that has consistently supported both assets, with Bitcoin historically responding with greater torque." The predictions market seems aligned with that view. As of writing, traders on Polymarket assigned a 40% probability of BTC being the best-performing asset next year, with gold at 33% and equities at 25%. Gold Bitcoin News More For You State of the Blockchain 2025 By CoinDesk Research Dec 19, 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You Traders split over whether Lighter’s LIT clears $3 billion FDV after launch By Sam Reynolds | Edited by Jamie Crawley 1 hour ago Prediction markets show traders clustering around a $2 billion–$3 billion range, with odds for $4 billion and $6 billion outcomes falling steadily after October's crash. What to know : Lighter's LIT token has not yet begun open trading, but its premarket valuation is already sparking debate, with estimates ranging from $2 billion to over $3 billion. The fully diluted valuation (FDV) of LIT is a contentious topic, as it reflects potential market value based on maximum token supply, which can be misleading without considering liquidity. Premarket trading suggests a valuation above $3 billion, but prediction markets show uncertainty, with traders on Polymarket giving even odds for LIT exceeding this figure. Read full story Latest Crypto News Traders split over whether Lighter’s LIT clears $3 billion FDV after launch 1 hour ago Metaplanet buys 4,279 bitcoin, lifts total holdings to 35,102 BTC 2 hours ago Institutions are increasingly using the bitcoin options playbook for altcoins: STS Digital 2 hours ago Lighter DEX launches LIT token with 25% airdrop 3 hours ago Silver overtakes bitcoin on volatility as year-end trading thins 3 hours ago BlackRock’s BUIDL hits $100M million in dividends and passes $2 billion in assets 5 hours ago Top Stories ETH, ADA SOL slip as year-end selling lingers as bitcoin traders eye $80,000 to $100,000 range 6 hours ago BlackRock’s BUIDL hits $100M million in dividends and passes $2 billion in assets 5 hours ago Crypto winter looms in 2026, but Cantor sees institutional growth and onchain shifts 19 hours ago Silver overtakes bitcoin on volatility as year-end trading thins 3 hours ago As Democrats gain in odds to take U.S. House, Waters bashes SEC chair on crypto 13 hours ago Metaplanet buys 4,279 bitcoin, lifts total holdings to 35,102 BTC 2 hours ago In this article BTC BTC $ 87,925.62 ◢ 0.47 %