Bitcoin’s rebound fades as XRP slips to $1.86 even with ETF assets at $1.25B

Analysis

Price Impact

HighXrp is in a tight trading range ($1.85-$1.91) with increasing institutional interest via etfs, suggesting a decisive price move is imminent. the struggle between buyers at $1.86 and sellers at $1.90 indicates significant pressure building up.

Trustworthiness

HighThe analysis is provided by coindesk data and cd analytics, a reputable source in crypto journalism. it includes detailed technical levels, volume analysis, and clear explanations of market dynamics.

Price Direction

NeutralCurrently, xrp is range-bound between $1.85 and $1.91. while institutional demand through etfs provides a strong underlying bullish sentiment and acts as a stabilizer, short-term sellers are actively defending the $1.90-$1.91 resistance. a break above $1.91 could lead to a rally towards $1.95-$2.00, while a break below $1.86 could see it slide to $1.77-$1.80.

Time Effect

ShortThe article emphasizes a 'potential decisive move soon' due to the tightening trading range and 'short-term price action remains choppy.' the technical setup suggests an imminent resolution to the current consolidation.

Original Article:

Article Content:

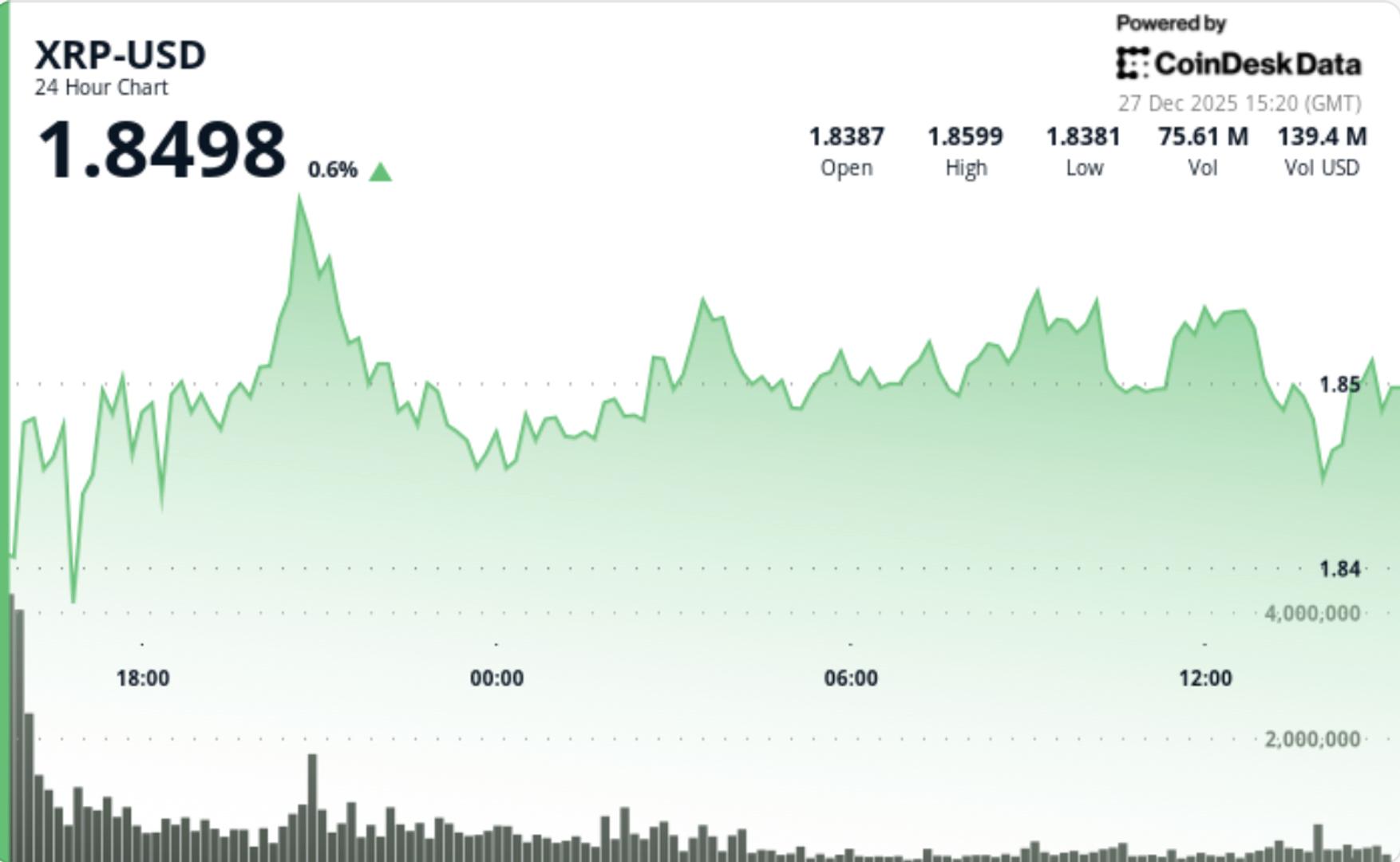

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin’s rebound fades as XRP slips to $1.86 even with ETF assets at $1.25B XRP remains in a tight trading range, with sellers defending the $1.90 resistance and buyers supporting the $1.86 level, indicating a potential decisive move soon. By Shaurya Malwa , CD Analytics Updated Dec 27, 2025, 3:26 p.m. Published Dec 27, 2025, 3:26 p.m. (CoinDesk Data) What to know : XRP's price slipped to $1.86 as traders sold into rallies, despite steady demand for spot ETFs and a rise in total ETF-held assets to $1.25 billion. Institutional investors are increasingly using structured products like ETFs for XRP exposure, preferring them for reduced custody and compliance friction. XRP remains in a tight trading range, with sellers defending the $1.90 resistance and buyers supporting the $1.86 level, indicating a potential decisive move soon. XRP slipped to $1.86 as traders continued to sell into rallies, even as spot ETF demand stayed steady and total ETF-held assets climbed to $1.25 billion — a gap that suggests the market is still digesting supply at key technical levels. News background Institutional appetite for XRP exposure continued to build through exchange-traded funds, with investors adding $8.19 million in recent sessions. That pushed total ETF-held net assets to $1.25 billion, reinforcing the idea that professional investors are building positions through regulated vehicles rather than chasing spot momentum. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The flow trend fits a broader pattern in institutional crypto allocation: portfolio managers increasingly prefer structured products that reduce custody and compliance friction, especially when liquidity is deep and regulatory clarity is improving. XRP’s depth across venues and the steady ETF bid has kept longer-term demand intact, even as short-term price action remains choppy. In the wider market, bitcoin’s attempted rebound lacked follow-through during U.S. hours, leaving majors stuck in a risk-off, range-bound tape where flows matter but technical levels still dictate the day-to-day trade. Technical analysis XRP fell from $1.88 to $1.86, staying pinned inside a $1.85–$1.91 channel as sellers repeatedly defended the $1.9060–$1.9100 resistance area. Volume rose sharply during the session’s most active window, with 75.3 million changing hands — about 76% above average — during the rejection, underscoring that this isn’t a low-liquidity drift. It’s a market meeting real offers overhead. Price briefly pushed out of its $1.854–$1.858 consolidation pocket and tested $1.862 on a burst of activity that spiked roughly 8–9x versus typical intraday flow. But the move lacked persistence, and XRP rotated back toward $1.86 as supply returned. The repeated defense of $1.90+ suggests sellers are still using that zone to distribute into strength. At the same time, bids near $1.86–$1.87 have shown up consistently enough to keep the market from unraveling — creating a tightening coil where the next break is likely to be decisive. Price action summary XRP slid from $1.8783 to $1.8604, staying locked in a $1.85–$1.91 range The strongest selling response arrived near $1.9061 resistance on above-average volume Bulls held the $1.86 handle on multiple retests, limiting downside follow-through A short-lived pop above the prior consolidation pocket failed to turn into a sustained move What traders should know Two forces are competing, and that’s the story: ETF flows keep leaning supportive in the background, but near-term traders are still treating $1.90–$1.91 as a sell zone. The levels are clean: If $1.87 holds and XRP can reclaim $1.875–$1.88, the next test is the heavy supply cluster at $1.90–$1.91. A close above there would force short-covering and pull price toward $1.95–$2.00. If $1.86 fails, the market likely slides into the next demand pocket around $1.77–$1.80, where prior buyers have historically defended and where “fear” sentiment tends to peak. For now, the tape reads like consolidation with distribution overhead — but with ETF flows acting as a stabilizer that could make downside moves more grinding than free-falling unless bitcoin breaks down sharply again. More For You State of the Blockchain 2025 By CoinDesk Research Dec 19, 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You Bitcoin sinks below $87,000 as crypto assets slide, metals soar post-Xmas By Helene Braun | Edited by Stephen Alpher 23 hours ago Gold, silver, platinum and copper all surged to new records as metals — not bitcoin — attracted capital on the debasement trade and geopolitical tension. What to know : Major cryptocurrencies and crypto stocks slid in early U.S. trade Friday, with bitcoin slipping back below $87,000 and bitcoin miners down 5% or more across the board. Gold, silver and other metals surged, with geopolitical concerns adding to the debasement trade. Read full story Latest Crypto News State of Crypto: Year in review 27 minutes ago Bitcoin sinks below $87,000 as crypto assets slide, metals soar post-Xmas 23 hours ago Bitcoin mining in 2025: IREN claims the crown as Bitdeer's stock trails the pack 23 hours ago Coinbase named a top three 2026 fintech pick at Clear Street Dec 26, 2025 Uniswap's token burn, protocol fee proposal backed overwhelmingly by voters Dec 26, 2025 Trust Wallet users lose $7 million to hacked Chrome extension Dec 26, 2025 Top Stories Bitcoin sinks below $87,000 as crypto assets slide, metals soar post-Xmas 23 hours ago Coinbase named a top three 2026 fintech pick at Clear Street Dec 26, 2025 Trust Wallet users lose $7 million to hacked Chrome extension Dec 26, 2025 Bitcoin’s $70,000 to $80,000 zone highlights gap in historical price support Dec 25, 2025 Uniswap's token burn, protocol fee proposal backed overwhelmingly by voters Dec 26, 2025 Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in flash move Dec 25, 2025