Bitcoin’s $70,000 to $80,000 zone highlights gap in historical price support

Analysis

Price Impact

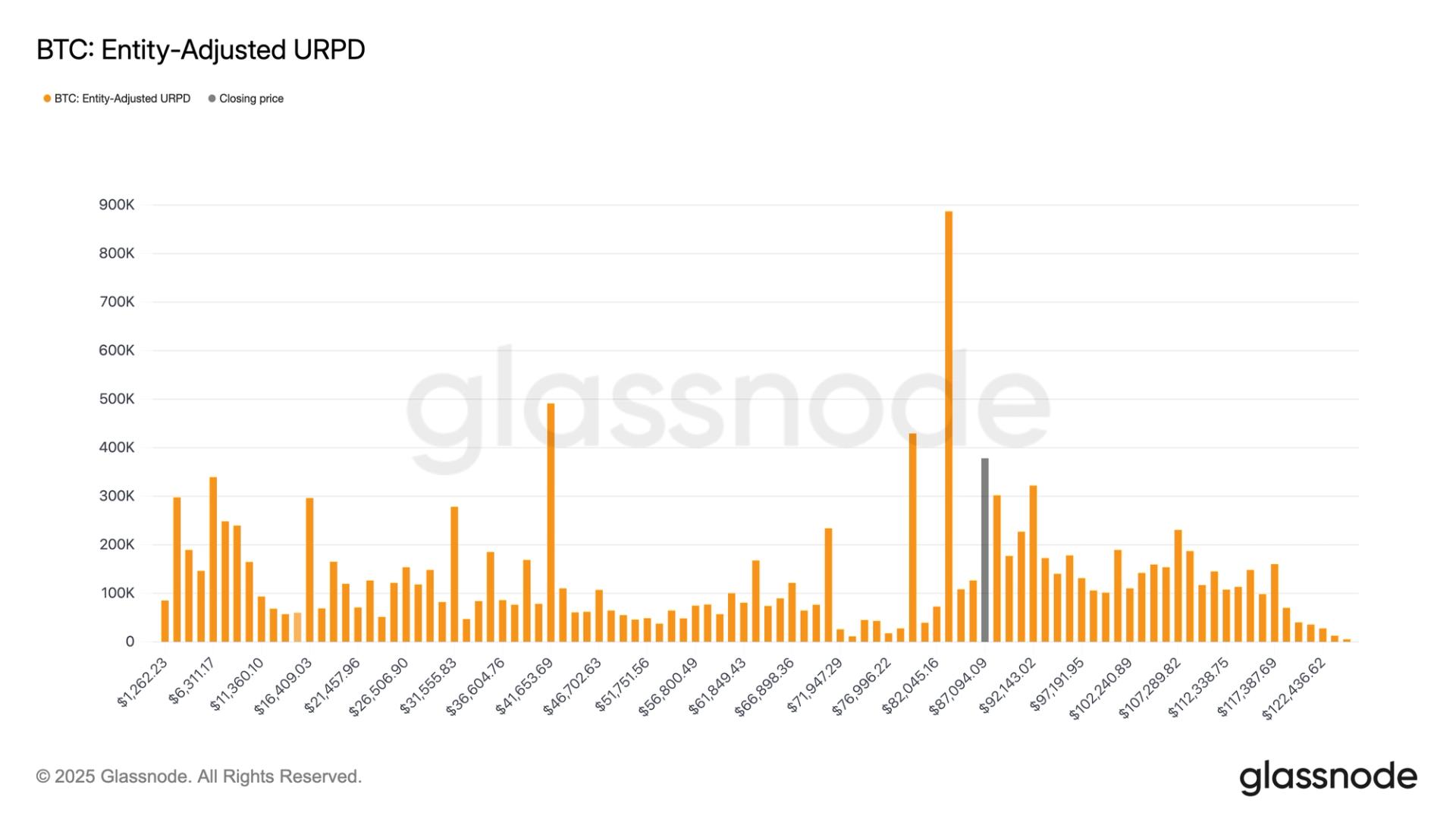

HighThe $70,000 to $80,000 price zone for bitcoin shows a significant gap in historical price support and consolidation according to cme futures data and glassnode's urpd. this structural weakness means if price re-enters this zone, it may struggle to find strong buying pressure.

Trustworthiness

HighAnalysis is based on robust historical cme futures trading data (investing.com) and on-chain metrics (glassnode utxo realized price distribution), which are reliable indicators of market structure and supply distribution.

Price Direction

BearishThe identified lack of developed support between $70,000 and $80,000 suggests that if bitcoin undergoes a significant pullback into this range, it may face continued downward pressure or require substantial time to consolidate and establish new support levels, rather than finding quick rebounds.

Time Effect

LongThe weakness identified is structural, based on historical trading patterns over five years. building new, strong support in this neglected price zone would require sustained consolidation over a longer period, rather than a quick resolution.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin’s $70,000 to $80,000 zone highlights gap in historical price support Five years of CME futures data shows where bitcoin has, and has not, built meaningful price support. By James Van Straten | Edited by Stephen Alpher Dec 25, 2025, 2:00 p.m. BTC, URPD (Glassnode) What to know : Bitcoin has spent relatively little time between $70,000 and $80,000, just 28 trading days, making that level among the least developed price ranges in terms of historical consolidation and support. This lack of time spent is reinforced by Glassnode’s UTXO Realized Price Distribution, which shows limited supply concentrated between $70,000 and $80,000, suggesting that if another pullback occurs, bitcoin may need to consolidate in this zone to establish stronger structural support. By checking the past five years of bitcoin BTC $ 87,605.75 CME futures trading data, it is possible to assess where that crypto has historically spent time consolidating and, by extension, where support has been more or less established. One useful way to frame this is by examining the number of trading days bitcoin has spent within specific price bands. The more time price has spent in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Data from Investing.com shows clear disparities across price ranges. Excluding the very brief time bitcoin traded at record highs above $120,000, BTC has spent the least amount of time in the $70,000 to $79,999 band, just 28 trading days. Further, it has spent just 49 days in the $80,000 to $89,999 range. By contrast, lower price zones such as $30,000 to $39,999 or $40,000 to $49,999 saw almost two hundred trading days, highlighting how extensively those areas were tested and consolidated. For most of December, bitcoin has been trading in that $80,000-$90,000 range following its sharp pullback from the October all-time high. That correction has retraced price back toward an area where the market has historically spent relatively little time, especially when compared with much of 2024, during which bitcoin spent a significant number of days between $50,000 and $70,000. This uneven distribution suggests that support in the $80,000s, and even between $70,000 and $79,999, is less developed than in lower ranges. BTC Trading Days (Investin.com) This observation is reinforced by Glassnode data. The UTXO Realized Price Distribution (URPD) shows where the current supply of bitcoin last moved, using an entity-adjusted framework that assigns each entity’s full balance to its average acquisition price. The URPD indicates a noticeable lack of supply concentrated between $70,000 and $80,000, aligning with the futures data. Both datasets suggest that if bitcoin were to undergo another corrective phase, the $70,000 to $80,000 region could represent a logical area where price may need to spend more time consolidating to establish stronger support. Disclaimer: This analysis is based on the daily Open price of Bitcoin CME futures, with weekends excluded, meaning the figures reflect how often bitcoin began a trading session within each price band rather than intraday or closing price activity. Bitcoin News Glassnode CME Futures market analysis More For You State of the Blockchain 2025 By CoinDesk Research Dec 19, 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You Bitcoin and ether ETFs see outflows ahead of Christmas, led by IBIT and ETHE By Shaurya Malwa 7 hours ago The biggest single-day exit came from BlackRock’s IBIT, which saw $91.37 million leave the fund. Grayscale’s GBTC followed with a $24.62 million outflow. What to know : Bitcoin and ether spot ETFs experienced significant outflows on Dec. 24, with traders reducing risk ahead of the Christmas break. BlackRock's IBIT and Grayscale's GBTC led the bitcoin ETF outflows, while Grayscale's ETHE saw the largest outflow among ether ETFs. Despite the outflows, Grayscale's Ethereum Mini Trust ETF recorded a notable inflow, highlighting varied investor strategies during low liquidity periods. Read full story Latest Crypto News Hong Kong regulators target 2026 legislation for virtual asset dealer and custodian rules 2 hours ago Bitcoin and ether ETFs see outflows ahead of Christmas, led by IBIT and ETHE 7 hours ago XRP ETF net assets cross $1.25 billion milestone, but price-action muted 7 hours ago Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in flash move 9 hours ago Circle platform promising tokenized gold, silver swaps is 'fake,' company says 19 hours ago Filecoin drops 2% as crypto markets weaken 22 hours ago Top Stories Bitcoin briefly trades at $24,000 on Binance’s USD1 pair in flash move 9 hours ago Circle platform promising tokenized gold, silver swaps is 'fake,' company says 19 hours ago Hong Kong regulators target 2026 legislation for virtual asset dealer and custodian rules 2 hours ago Crypto M&A hits record $8.6 billion in 2025 as Trump’s regulatory stance spurs deals Dec 24, 2025 Bitcoin and ether ETFs see outflows ahead of Christmas, led by IBIT and ETHE 7 hours ago XRP ETF net assets cross $1.25 billion milestone, but price-action muted 7 hours ago In this article BTC BTC $ 87,605.75 ◢ 0.75 %