XRP weakens after losing support, with $1.85 next in focus

Analysis

Price Impact

HighXrp has significantly weakened after losing short-term support levels, with high volume selling at resistance by larger players. the price has shifted into a lower distribution range, and the next key focus is $1.85, indicating substantial downside pressure.

Trustworthiness

HighThe analysis is from coindesk, a reputable source, and provides detailed technical insights including specific price levels, volume spikes, and observable market behavior, suggesting a well-researched perspective.

Price Direction

BearishXrp lost crucial support around $1.86-$1.87, and high volume at resistance ($1.90) indicates institutional selling. the market expects further downside, with $1.85 as the next target if current levels are not reclaimed.

Time Effect

ShortThe article focuses on intraday price action, immediate support/resistance levels, year-end liquidity thinning, and short-term trading strategies (sell rallies, buy dips), indicating a near-term outlook.

Original Article:

Article Content:

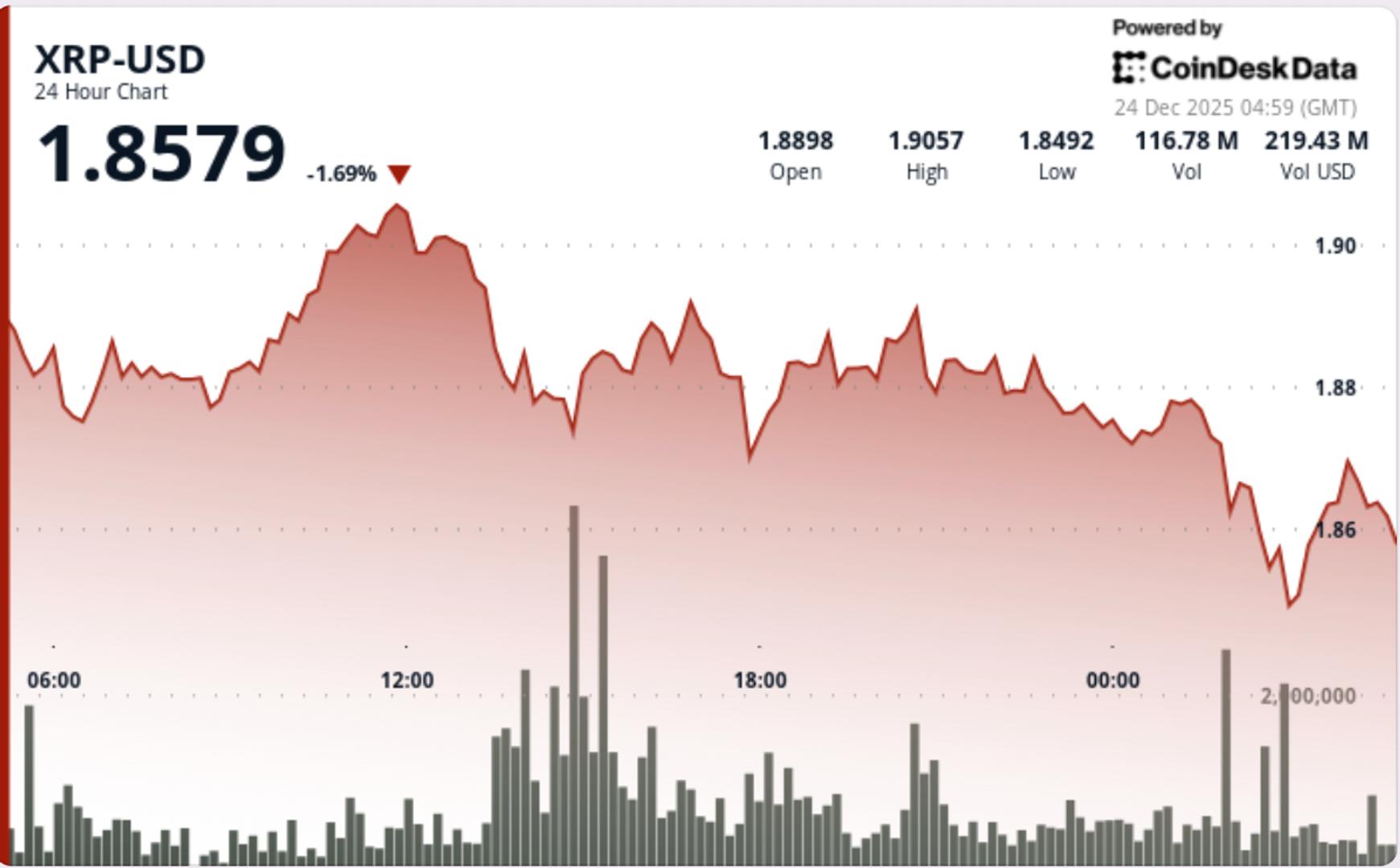

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP weakens after losing support, with $1.85 next in focus XRP's price action was characterized by high volume at resistance, suggesting larger players were selling into strength. By Shaurya Malwa , CD Analytics Updated Dec 24, 2025, 5:10 a.m. Published Dec 24, 2025, 5:10 a.m. (CoinDesk Data) What to know : XRP fell through short-term support levels, with sellers active near $1.90, pushing attention to the $1.85 area. The crypto market remains volatile as year-end liquidity thins, with traders focusing on short-term risk control. XRP's price action was characterized by high volume at resistance, suggesting larger players were selling into strength. XRP slid through short-term support Wednesday as sellers again showed up near $1.90, keeping the token pinned in a tightening range and pushing attention toward the $1.85 area. News background The move comes as crypto markets remain choppy into the year-end window, when liquidity often thins and positioning tends to dominate price action. Traders have leaned into short-term risk control rather than directional conviction, particularly after recent whipsaw moves across majors. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . XRP has also been trading against a backdrop of mixed signals from the analyst community. Some chart-watchers have flagged a rising wedge structure that could pressure price lower if support continues to erode, while others point to RSI divergence patterns that often appear near local exhaustion points. That split has kept conviction low and strengthened the market’s tendency to fade rallies near obvious resistance. Technical analysis XRP spent most of the session using the $1.8615–$1.8700 band as a working support zone, but late-session selling pushed price below that floor and into a lower distribution range. The key tell was volume concentration at resistance. Trading peaked around 75.3 million tokens during the rejection near $1.9061, nearly double the 24-hour average, suggesting larger players were active on the sell side into strength rather than stepping in to accumulate. On the intraday view, the break from roughly $1.878 down to the mid-$1.86s occurred with repeated volume spikes, including a 2.7 million burst during the $1.867–$1.865 slide, reinforcing that the breakdown was flow-driven, not just drift. Price action summary XRP fell from $1.8942 to $1.8635 over 24 hours Resistance held near $1.9061 on the highest volume of the session The $1.8615–$1.8700 support band cracked late, shifting price into a lower range Trading stayed contained overall, with a $0.0395 range (about 2.1%) What traders should know $1.87 has shifted from support to a near-term decision level. If XRP can reclaim that zone and hold it, the move is more consistent with a range reset and a potential push back toward $1.90–$1.91. If not, the next area traders will focus on is $1.860–$1.855, where buyers are expected to defend to avoid a deeper slide. For now, the pattern remains “sell rallies into $1.90, buy dips near $1.86,” and the next directional move likely depends on whether volume expands on a break — not on another low-liquidity probe inside the range. More For You State of the Blockchain 2025 By CoinDesk Research Dec 19, 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You Bitcoin will be 'top performer' in 2026 after getting crushed this year, says VanEck By Krisztian Sandor | Edited by Aoyon Ashraf 8 hours ago VanEck's David Schassler expects gold and bitcoin to rebound sharply as investor demand for hard assets is expected to rise. What to know : Bitcoin has underperformed compared to gold and the Nasdaq 100 this year, but a VanEck manager predicts a strong comeback in 2026. David Schassler, the firm's head of multi-asset solutions, expects gold's surge to continue to $5,000 next year as fiscal "debasement" accelerates. Bitcoin will likely follow gold’s breakout, driven by returning liquidity and long-term demand for scarce assets. Read full story Latest Crypto News ‘Most important tokenholder rights debate’: Aave faces identity crisis 8 hours ago Bitcoin will be 'top performer' in 2026 after getting crushed this year, says VanEck 8 hours ago Tensions over El Salvador's bitcoin holdings ease as IMF praises economic progress 10 hours ago Bitcoin slips, crypto stocks suffer steep declines, as tax-loss selling drives action, analysts say 10 hours ago JPMorgan’s institutional crypto push could boost rivals like Coinbase, Bullish, analysts say 11 hours ago AI trade isn’t dead: An inside look into Wall Street's lucrative data center deals 11 hours ago Top Stories Bitcoin slips, crypto stocks suffer steep declines, as tax-loss selling drives action, analysts say 10 hours ago ‘Most important tokenholder rights debate’: Aave faces identity crisis 8 hours ago JPMorgan’s institutional crypto push could boost rivals like Coinbase, Bullish, analysts say 11 hours ago Bitcoin will be 'top performer' in 2026 after getting crushed this year, says VanEck 8 hours ago AI trade isn’t dead: An inside look into Wall Street's lucrative data center deals 11 hours ago Bitcoin still hasn't hit $100,000 when adjusted for inflation: Galaxy's Alex Thorn 12 hours ago