CoinDesk 20 Performance Update: Uniswap Drops 3.7% as All Index Constituents Decline

Analysis

Price Impact

HighUniswap (uni) experienced a significant drop of 3.7%, making it the top laggard within the coindesk 20 index. this substantial decline indicates strong selling pressure specific to uni, further exacerbated by a general downturn across all index constituents.

Trustworthiness

HighThe information comes directly from coindesk indices, a reputable source for crypto market data and index performance tracking.

Price Direction

BearishAll 20 assets in the coindesk 20 index are trading lower, with uni showing the most significant decline, indicating a broad bearish sentiment across the market, particularly impacting uni.

Time Effect

ShortThis is a daily performance update highlighting recent price movements 'since 4 p.m. et on monday,' reflecting immediate market reactions.

Original Article:

Article Content:

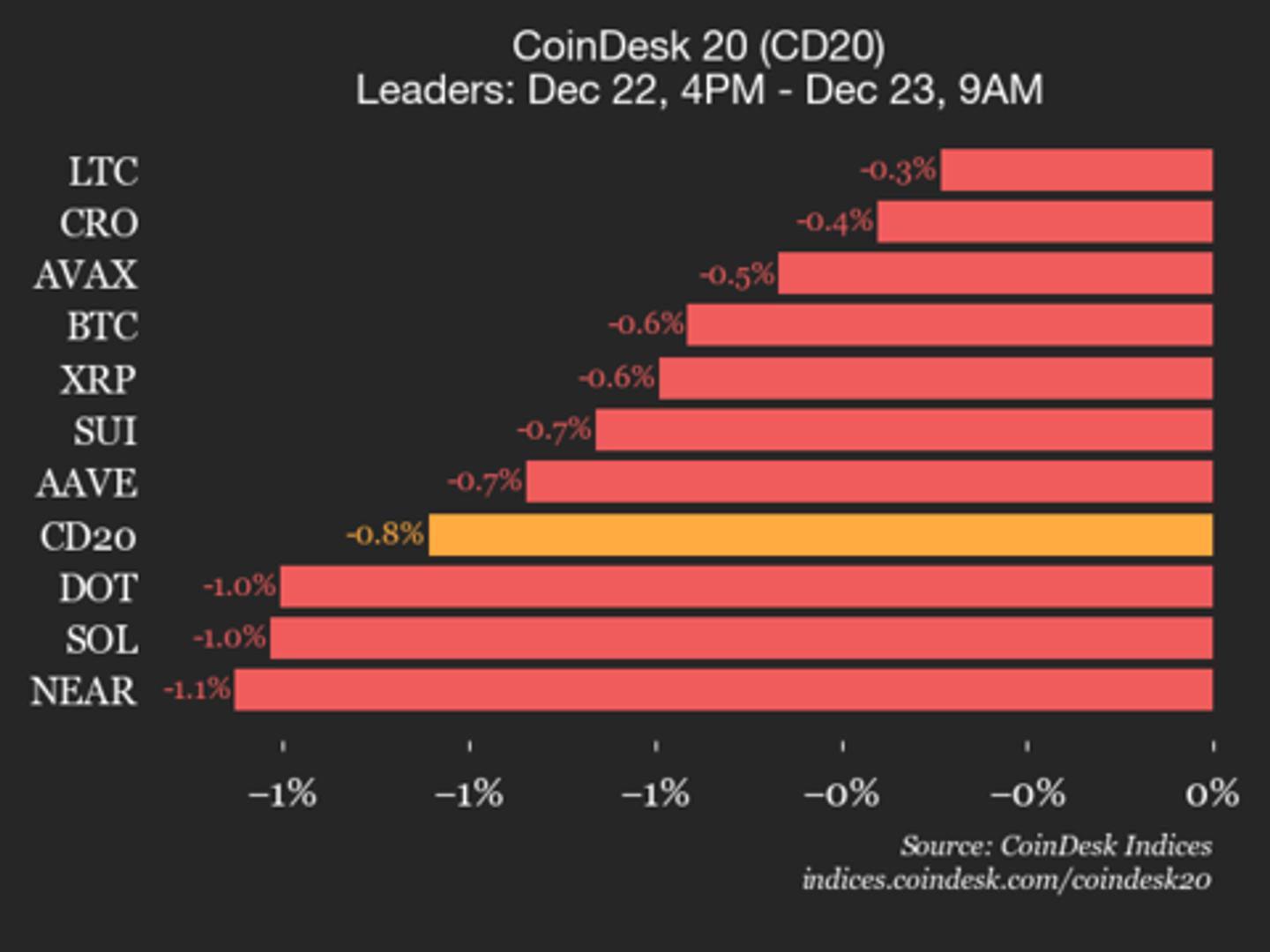

CoinDesk Indices Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email CoinDesk 20 Performance Update: Uniswap Drops 3.7% as All Index Constituents Decline Internet Computer (ICP) was also an underperformer, down 2% from Monday. By CoinDesk Indices Dec 23, 2025, 2:09 p.m. CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index . The CoinDesk 20 is currently trading at 2702.73, down 0.8% (-22.99) since 4 p.m. ET on Monday. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Long & Short Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . None of the 20 assets are trading higher. Leaders: LTC (-0.3%) and CRO (-0.4%). Laggards: UNI (-3.7%) and ICP (-2.0%). The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally. CoinDesk Indices CoinDesk 20 charts Prices More For You State of the Blockchain 2025 By CoinDesk Research Dec 19, 2025 Commissioned by Input Output Group L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know : 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. View Full Report More For You CoinDesk 20 Performance Update: Uniswap (UNI) Surges 19% Over the Weekend By CoinDesk Indices 23 hours ago Cronos (CRO) was also a top performer, rising 2.5%. Read full story Latest Crypto News Polkadot's DOT slips 4.5% as token underperforms wider crypto markets 8 minutes ago BNB slips toward $850 as market pullback weighs on token 12 minutes ago Amplify ETFs targeting stablecoin and tokenization sectors open for trade 42 minutes ago Risk aversion boosts gold, hurts bitcoin: Crypto Daybook Americas 1 hour ago Bitcoin's growing roadblock: The trendline from $126,000 limits gains 2 hours ago Crypto Markets Today: Cardano-based NIGHT crashes, ZEC, XMR also drop 2 hours ago Top Stories Bitcoin heads for its worst Q4 since 2018 as traders predict further declines 9 hours ago Risk aversion boosts gold, hurts bitcoin: Crypto Daybook Americas 1 hour ago Aave falls 18% over week as dispute pulls down token deeper than major crypto tokens 7 hours ago Bitcoin trails gold and copper, as 'fear and AI' trade lifts tangible assets 6 hours ago Crypto Markets Today: Cardano-based NIGHT crashes, ZEC, XMR also drop 2 hours ago Strategy's increased dollar buffer covers more than 2 years of dividend obligations 3 hours ago