Gold wins the debasement trade in 2025, but it is not the full story

Analysis

Price Impact

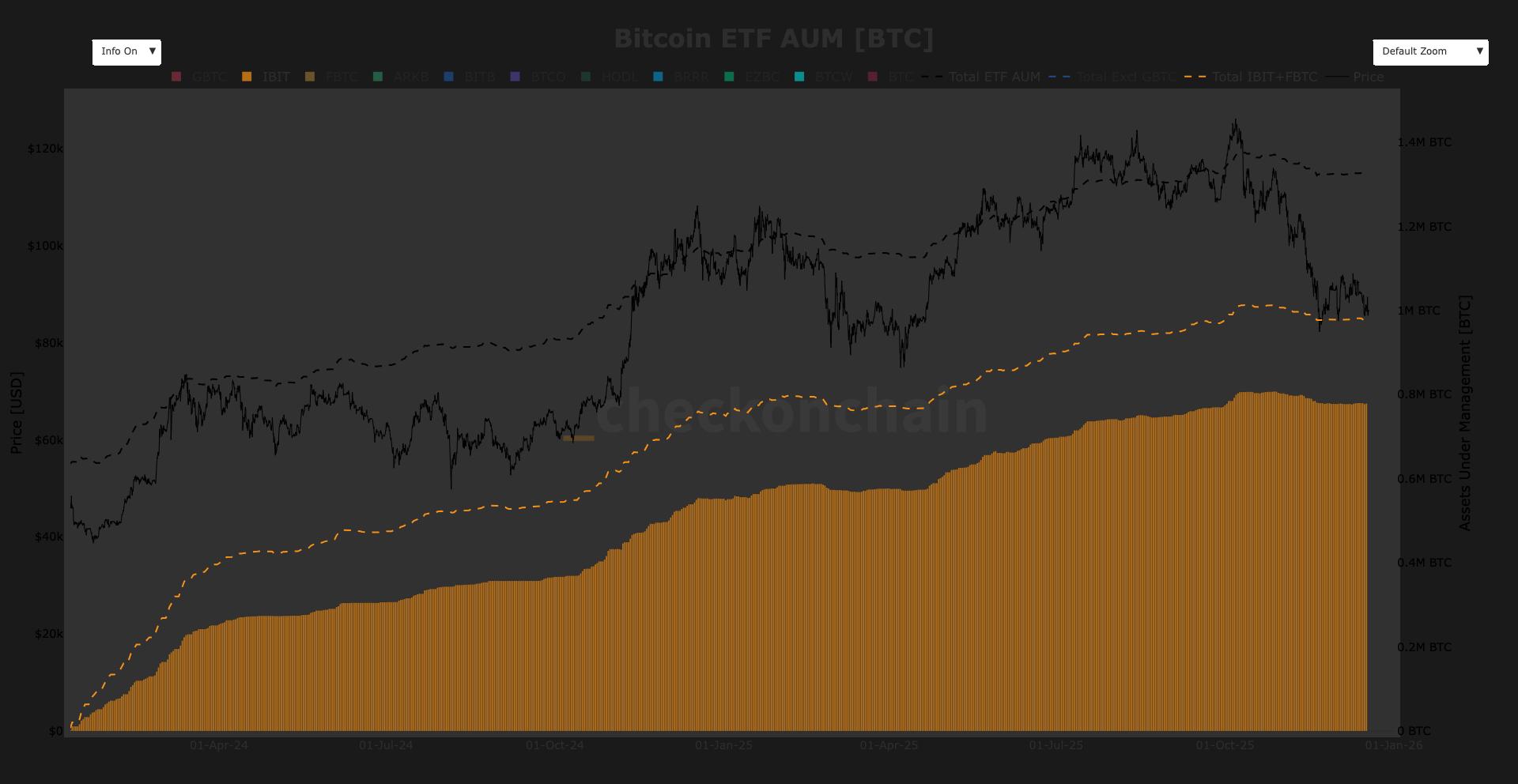

HighDespite a 36% price correction from its october all-time high in 2025, u.s. spot bitcoin etf aum fell less than 4%. this resilience from institutional investors, who are not selling off despite significant price drops, indicates strong conviction and accumulation, suggesting a significant long-term positive impact.

Trustworthiness

HighThe information is from coindesk, a reputable crypto news source, citing specific data from checkonchain and insights from bitwise managing director bradley duke. the detailed statistics on etf holdings and aum provide a strong basis for the analysis.

Price Direction

BullishWhile bitcoin underperformed gold in 2025 and corrected significantly, the fact that etf holdings remained remarkably stable (declining less than 4% amidst a 36% price fall) demonstrates strong institutional accumulation and conviction. this 'hodling' behavior by institutional players through market volatility sets a strong bullish foundation for future price appreciation.

Time Effect

LongThe article focuses on 'year one of institutional adoption' (2024) and 'year two saw continued strong participation' (2025), indicating a sustained, multi-year trend of institutional integration and holding. the resilience in etf aum suggests long-term investor confidence rather than short-term speculation.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Gold wins the debasement trade in 2025, but it is not the full story U.S. bitcoin ETF AUM fell less than 4% despite a 36% price correction from the October high. By James Van Straten | Edited by Jamie Crawley Dec 19, 2025, 3:33 p.m. BTC ETF AUM (Checkonchain) What to know : Gold surged 65% in 2025, while bitcoin fell 7% after both assets were up roughly 30% through August. Bitcoin corrected 36% from its October all-time high, while U.S. spot bitcoin ETF holdings declined by only about 3.6%, from 1.37M BTC in October to roughly 1.32M BTC. Despite bitcoin underperforming gold on price, bitcoin exchange traded product flows outpaced gold ETP flows in 2025 Looking back on 2025, the sound money, or debasement trade, was decisively won by the metals over bitcoin. Gold delivered one of its best years on record, up 65%, while bitcoin so far is down 7%. Until August, the two assets had similar returns, both up roughly 30%. From that point, gold surged while bitcoin rolled over sharply. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . This divergence reinforced that gold won the debasement trade narrative leaving bitcoin firmly behind . Bitcoin remains in recovery mode after a 36% correction from its October all-time high, struggling in the $80,000 range. Despite the price weakness, capital flows tell a different story. Bitwise managing director Bradley Duke pointed out that that flows in bitcoin exchange traded product's (ETP) outpaced gold ETP flows in 2025 despite gold's blockbuster year. The debut of U.S. spot bitcoin ETFs in January 2024 marked year one of institutional adoption, while year two saw continued strong participation even as price failed to follow. The most notable takeaway from this current correction in bitcoin is the ETF investor resilience. Despite a 36% price drawdown, total bitcoin ETF assets under management (AUM) declined less than 4%. Data from Checkonchain shows U.S. ETFs held 1.37 million BTC at the October peak and still hold around 1.32 million on Dec. 19. This suggests the bulk of the sell off did not come from ETF holders. BlackRock’s iShares Bitcoin Trust (IBIT) has increased its dominance during this correction, now holding just under 60% market share with roughly 780,000 BTC under management. It is clear to see bitcoin’s correction was not driven by ETF outflows. Bitcoin News BlackRock Bitcoin ETF More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You DraftKings enters prediction markets with CFTC-approved app for real-world events By Helene Braun , AI Boost | Edited by Jamie Crawley 38 minutes ago The sports-betting giant enters the growing world of event contracts with CFTC-registered DraftKings Predictions in 38 states. What to know : DraftKings has unveiled a CFTC-regulated app letting users trade on real-world outcomes like sports and finance in 38 U.S. states. The move puts it in direct competition with crypto-native prediction markets like Polymarket or other competitors like Kalshi and Robinhood. Prediction markets have emerged as one of the biggest financial trends of the year, fueled by regulatory clarity and rising demand for real-time speculation. Read full story Latest Crypto News Most Influential 2025's Honorable Mentions 23 minutes ago Most Influential: Hsiao-Wei Wang and Tomasz K. Stańczak 34 minutes ago Most Influential: Luke Dashjr 34 minutes ago Most Influential: Jeff Yan 34 minutes ago Most Influential: The Solana Developers 34 minutes ago Most Influential: Stani Kulechov 34 minutes ago Top Stories DraftKings enters prediction markets with CFTC-approved app for real-world events 38 minutes ago Wall Street bank JPMorgan says stablecoin market could grow to $600 billion by 2028 39 minutes ago Bitcoin gains as yen surprisingly tumbles after BOJ rate hike: Crypto Daybook Americas 3 hours ago Jump Trading sued for $4 billion in connection to Do Kwon’s Terra Labs collapse: WSJ 3 hours ago Coinbase files lawsuits in 3 states over attempts to regulate prediction markets 5 hours ago Wall Street bank JPMorgan says stablecoin market could grow to $600 billion by 2028 39 minutes ago