Bitcoin jumps above $87,000, yen slides as Bank of Japan hikes interest rates

Analysis

Price Impact

MedBitcoin saw an initial jump above $87,000 following the bank of japan's anticipated interest rate hike and the subsequent slide of the japanese yen. the hike itself was largely priced in, leading to a muted but positive immediate reaction for btc.

Trustworthiness

HighThe information is from coindesk, a reputable crypto news source, providing direct reporting and market analysis of the event.

Price Direction

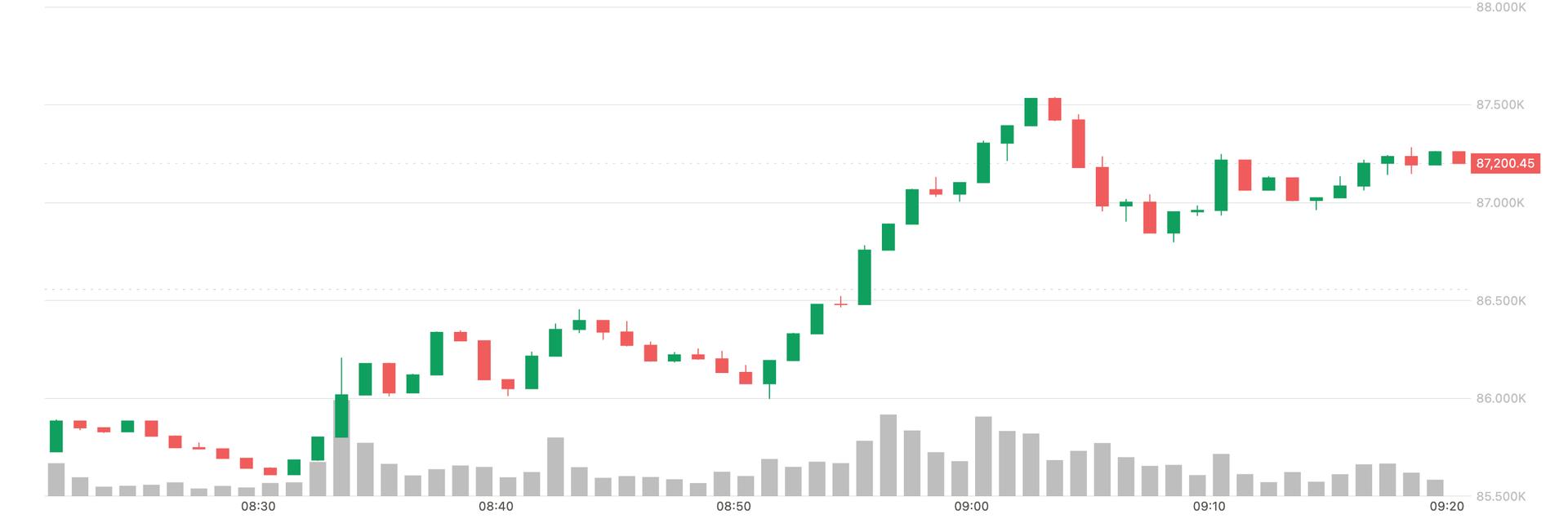

BullishDespite the boj's rate hike, bitcoin strengthened from $86,000 to $87,500. this suggests a bullish short-term reaction, likely due to the yen's weakness and perhaps btc being seen as an alternative asset, although the move was not overly dramatic as the event was anticipated.

Time Effect

ShortThe price movement was an immediate market reaction to the anticipated boj decision. while positive, the 'priced-in' nature of the event limits its potential for a sustained long-term impact solely from this news.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin jumps above $87,000, yen slides as Bank of Japan hikes interest rates The Bank of Japan raised its short-term policy rate by 25 basis points to 0.75%, the highest in nearly 30 years. By Omkar Godbole Dec 19, 2025, 3:52 a.m. BTC price bounce. (CoinDesk) What to know : The Bank of Japan raised its short-term policy rate by 25 basis points to 0.75%, the highest in nearly 30 years. Despite the rate hike, the Japanese yen fell against the U.S. dollar, while Bitcoin saw a slight increase in value. Market reactions were muted as the rate hike was anticipated, with speculators already holding long positions in the yen. Bitcoin strengthened as the Japanese yen dropped after the Bank of Japan hiked rates as expected. The Japanese central bank raised its short-term policy rate by 25 basis points to 0.75%, the highest level in roughly three decades, continuing the gradual shift away from decades of ultra-loose monetary policy. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . In the policy statement, BOJ acknowledged that inflation has held above its 2% target for an extended period due to rising import costs and firmer domestic price dynamics. However, policymakers emphasized that interest rates adjusted for inflation remain negative, implying that monetary conditions are still accommodative even after the hike. The Japanese yen slipped to 156.03 per U.S. dollar from 155.67 following the rate decision. Bitcoin, the leading cryptocurrency by market value, rose from $86,000 to $87,500 before pulling back slightly to trade near $87,000 at press time, CoinDesk data show. The market reaction aligns with expectations, as the rate hike had already been anticipated and largely priced in. Furthermore, speculators had held long positions in the Japanese yen for weeks, preventing any sharp yen-buying response after the announcement. In recent weeks, some observers had expressed concerns that the rate hike could strengthen the yen, triggering an unwinding of yen carry trades and a broad-based risk-off sentiment. CoinDesk, however, debunked these fears, noting the already bullish yen positioning in the market and the upward trend in bond yields. Bitcoin News More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Altcoins plunge as bitcoin's $85,000 test triggers $550 million in liquidations By Krisztian Sandor | Edited by Stephen Alpher 6 hours ago Solana tumbled below $120 to its weakest price since April, while SUI, DOGE and ADA also fell sharply. What to know : Bitcoin is teetering on the brink of falling below $85,000 level, accelerating declines in the crypto market. Altcoins such as SOL, Cardano, ADA, SUI and dogecoin led Thursday's drop. $550M in liquidations hit derivatives markets, but analysts said the pullback looks like orderly deleveraging rather than full-blown panic. Read full story Latest Crypto News Senate confirms Trump crypto-friendly nominees to take over CFTC, FDIC 2 hours ago Altcoins plunge as bitcoin's $85,000 test triggers $550 million in liquidations 6 hours ago WhiteFiber signs 10-year, 40 MW colocation deal with Nscale valued at about $865 million 6 hours ago What if crypto's U.S. market structure effort just never gets there? 7 hours ago XRP slumps as bitcoin once again falls back to $85,000 level after surge 7 hours ago Polkadot's DOT Slips 2% on above average volume 8 hours ago Top Stories Senate confirms Trump crypto-friendly nominees to take over CFTC, FDIC 2 hours ago Altcoins plunge as bitcoin's $85,000 test triggers $550 million in liquidations 6 hours ago What if crypto's U.S. market structure effort just never gets there? 7 hours ago U.S. SEC aids brokers on crypto custody, looks more closely at ATS activity 11 hours ago Coinbase shares rise as ‘ambitious expansion’ wins analyst praise 12 hours ago Gold, silver shine in debasement trade as bitcoin is left behind 12 hours ago