Why XRP’s drop below $1.93 shifts short-term market structure

Analysis

Price Impact

HighXrp's failure to sustain momentum above resistance and subsequent drop below the critical $1.93 fibonacci level, confirmed by high selling volume, signals a significant shift in short-term market structure towards bearish control.

Trustworthiness

HighThe analysis comes from coindesk, a reputable source, and is based on detailed technical analysis, specific price levels, and confirmed by volume data, indicating a data-driven assessment.

Price Direction

BearishThe breakdown below $1.93, a key technical pivot, combined with increased selling volume and multiple failed attempts to hold resistance, clearly indicates short-term bearish control. the market has transitioned from range expansion to range rejection, with upside attempts likely corrective.

Time Effect

ShortThe article explicitly focuses on 'short-term market structure,' 'short-term bearish control,' and immediate support/resistance levels ($1.93, $1.88-$1.90), indicating the analysis pertains to immediate price movements and trends.

Original Article:

Article Content:

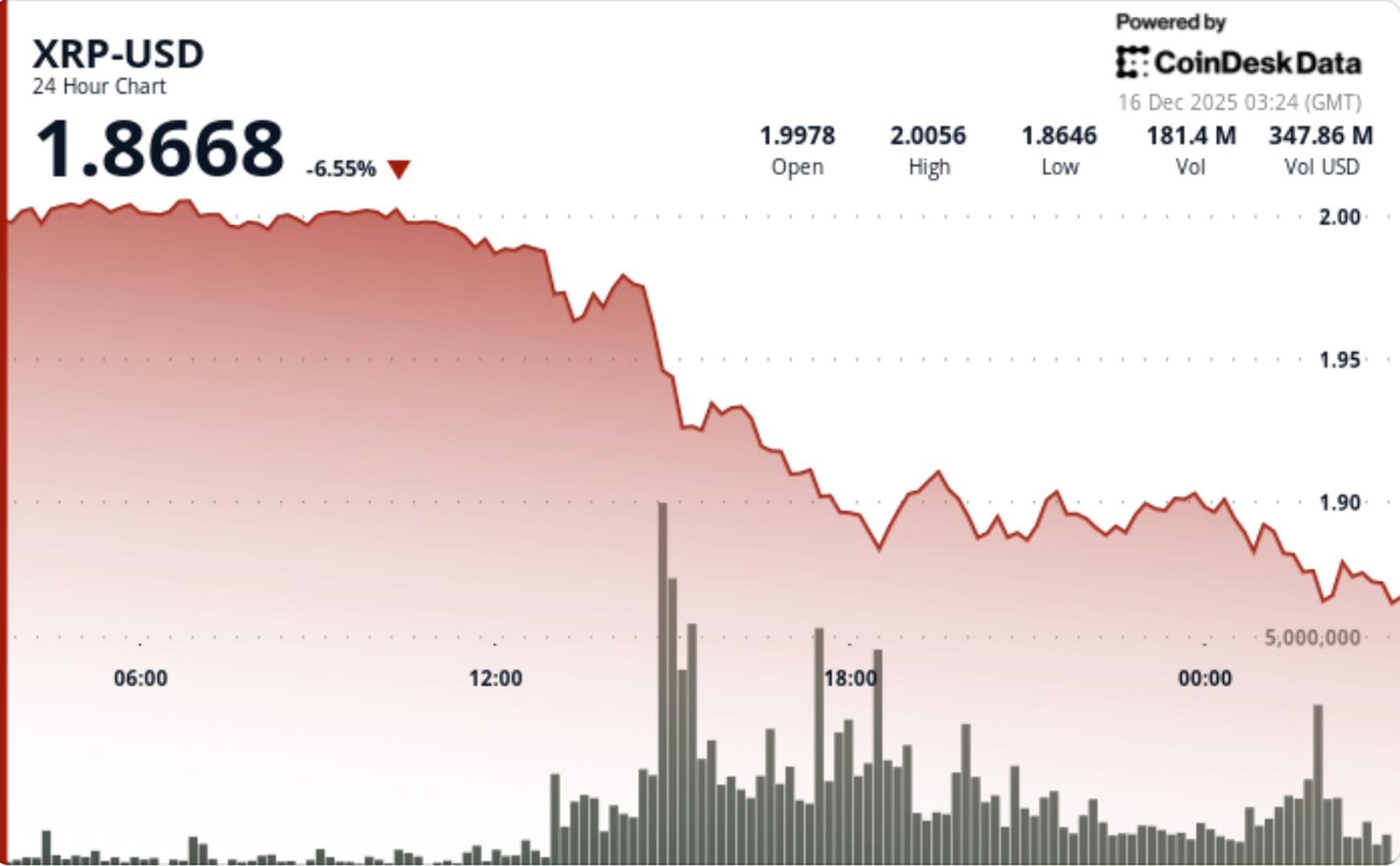

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Why XRP’s drop below $1.93 shifts short-term market structure The move followed multiple failed attempts to sustain momentum above recent resistance, leaving XRP vulnerable once support levels were tested again. By Shaurya Malwa Updated Dec 17, 2025, 4:12 a.m. Published Dec 17, 2025, 4:12 a.m. (CoinDesk Data) What to know : XRP fell 2.6% to $1.90 after failing to break resistance, indicating short-term bearish control. The breakdown below the $1.93 Fibonacci level marked a technical failure, with increased volume confirming active selling. Traders should watch the $1.93 resistance and $1.88–$1.90 support levels for potential shifts in momentum. XRP lost a key technical level after a failed breakout attempt, with heavy volume confirming a shift toward short-term bearish control. News background XRP declined 2.6% over the past 24 hours, falling from $1.95 to $1.90 as broader crypto markets showed signs of fatigue. The move followed multiple failed attempts to sustain momentum above recent resistance, leaving XRP vulnerable once support levels were tested again. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . There were no fresh fundamental catalysts driving the selloff. Instead, the move unfolded in a technically sensitive zone, where positioning had built up following earlier rebound attempts. As price stalled near resistance, selling pressure re-emerged, overwhelming bids during the European trading session. Technical analysis The breakdown below the $1.93 Fibonacci level marked a clear technical failure. This zone had previously acted as a pivot during consolidation, and its loss shifts short-term structure back in favor of sellers. Volume expanded sharply during the rejection, with turnover rising 107% above daily averages, confirming that the move was driven by active distribution rather than low-liquidity drift. The rally attempt toward $1.95 showed early momentum with higher highs, but the inability to hold above $1.92 triggered systematic selling into strength. From a structure perspective, XRP transitioned from range expansion to range rejection. As long as price remains capped below the $1.93–$1.95 zone, upside attempts are corrective rather than trend-changing. Price action summary XRP traded through a $0.09 range during the session, initially pushing toward $1.95 before reversing sharply. Selling intensified once price slipped back into the $1.92–$1.94 band, with bids thinning near the lower boundary. Following the breakdown, XRP stabilized near $1.90, where selling pressure eased and volume began to normalize. Hourly price action shows consolidation forming just above the $1.88–$1.90 area, though no strong reversal signals have emerged yet. What traders should know The $1.93 level now acts as first major resistance. Any recovery attempt must reclaim this zone on strong volume to shift momentum back toward neutral. Failure to do so keeps downside risk in play. On the downside, $1.88–$1.90 is the immediate area to watch. A sustained break below this base would expose deeper support levels, while successful defense could allow XRP to consolidate before the next directional move. For now, volume behavior remains critical. Continued selling on rallies would confirm ongoing distribution, while fading volume near support would suggest the market is transitioning from breakdown to stabilization. XRP News More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Crypto exchange HashKey's shares fall 5% on trading debut in Hong Kong By Sam Reynolds , AI Boost 1 hour ago Investors questioned whether Hong Kong’s dominant licensed exchange can turn surging volumes and regulatory advantage into sustainable profits. What to know : HashKey Holdings' shares fell about 5% in their Hong Kong trading debut, highlighting investor caution despite the company's dominant market position. The company reported significant losses due to its ultra-low fee strategy, which has not kept pace with operating costs. HashKey's growth is increasingly tied to Hong Kong's regulatory framework, affecting its market outlook. Read full story Latest Crypto News Crypto exchange HashKey's shares fall 5% on trading debut in Hong Kong 1 hour ago Hyperliquid’s $200 billion pitch: Is this next Solana-scale DeFi bet?: Asia Morning Briefing 2 hours ago Exodus joins stablecoin race with MoonPay-backed digital dollar 6 hours ago Zero-Knowledge Tech Is the Key to Quantum-Proofing Bitcoin 7 hours ago Bitcoin's massive underperformance to stocks in Q4 bodes well for January, says K33's Lunde 7 hours ago Bitcoin derivatives point to broad price range play between $85,000-$100,000 8 hours ago Top Stories Bitcoin's massive underperformance to stocks in Q4 bodes well for January, says K33's Lunde 7 hours ago U.S. FDIC proposes first U.S. stablecoin rule to emerge from GENIUS Act 11 hours ago Bitcoin derivatives point to broad price range play between $85,000-$100,000 8 hours ago U.S. Senate's Warren asks for Trump-tied crypto probe as market structure bill drags 10 hours ago Bitcoin bounces from Monday's worst levels, but sub-$80,000 may come next, analyst says 12 hours ago Eric Trump’s American Bitcoin jumps to 20th among public BTC treasury companies 11 hours ago