Hedera Tumbles 4% as Altcoins Continue to Suffer

Analysis

Price Impact

HighHbar tumbled 4% breaking critical support levels with exceptional institutional volume, signaling strong selling conviction and a deteriorating market structure. this is a significant technical breakdown.

Trustworthiness

HighThe article is from coindesk, a reputable crypto news source, providing specific technical analysis, volume data, and chart patterns, indicating a well-resealed and data-driven assessment.

Price Direction

BearishThe token established a clear lower high pattern, broke through multiple higher timeframe support levels on above-average volume, and despite some immediate stabilization, the decisive break points to further downside risk to $0.123 support floor.

Time Effect

ShortThe immediate impact is a short-term bearish trend due to the technical breakdown and institutional selling pressure. while some consolidation may occur, the established lower high pattern suggests continued short-term weakness.

Original Article:

Article Content:

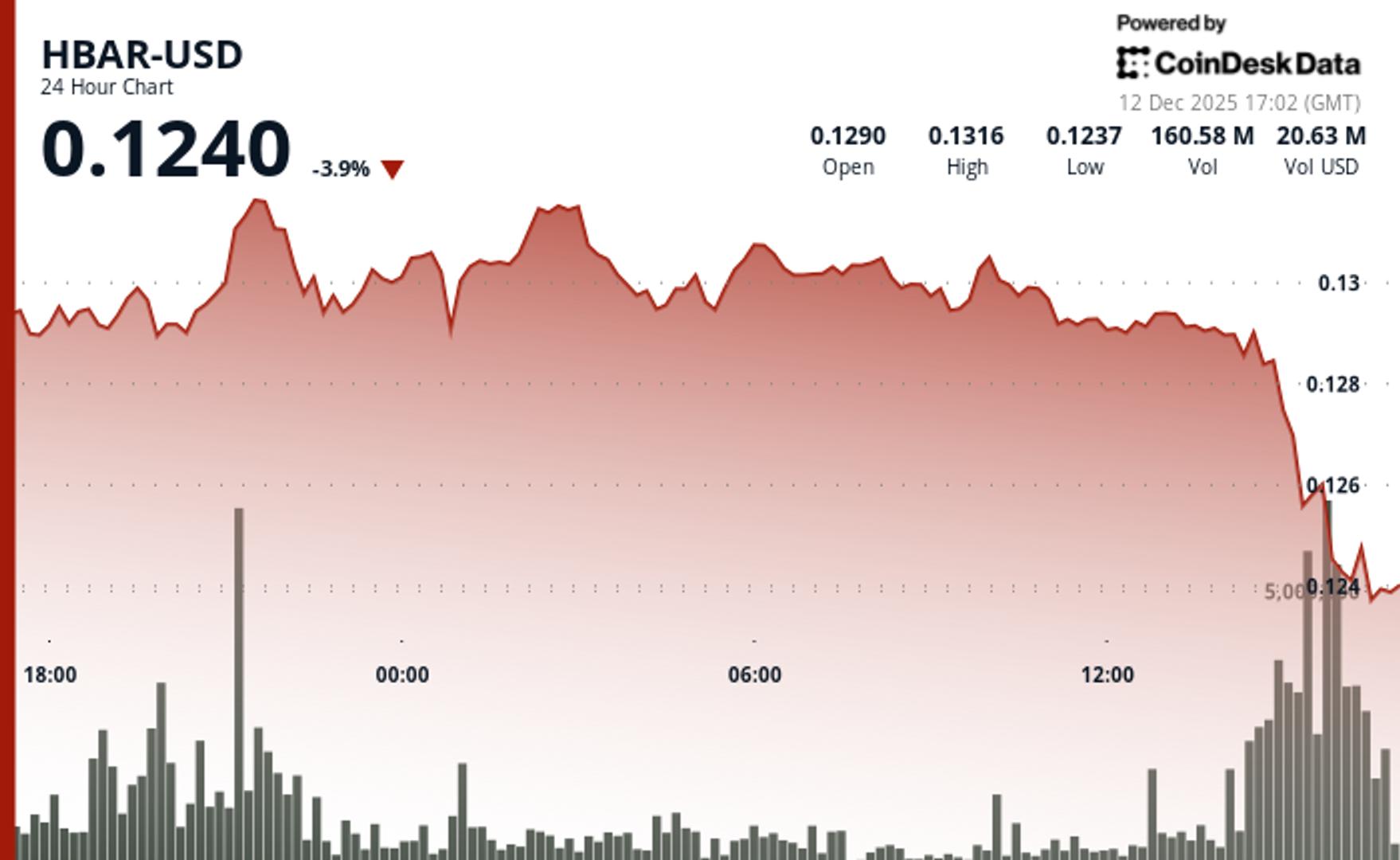

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Hedera Tumbles 4% as Altcoins Continue to Suffer Hedera's native token retreated from resistance levels as institutional volume surged during key reversal hour. By CD Analytics , Oliver Knight Updated Dec 12, 2025, 5:14 p.m. Published Dec 12, 2025, 5:14 p.m. "HBAR falls 4% to $0.1247 amid afternoon selloff and surge in institutional volume breaking support." What to know : HBAR dropped from $0.1291 to $0.1247, breaking critical support on exceptional volume. Flash crash occurred at 15:00 UTC with 175% above-average trading activity. Token stabilized near $0.1235 as buyers emerged at technical support levels. HBAR trades lower Thursday after breaking through multiple technical levels during an afternoon selloff that pushed the token down 4% to $0.1247. The native token of the Hedera network posts a $0.0082 range representing 6.4% volatility as resistance at $0.1320 proves insurmountable for bulls attempting to extend gains. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Volume patterns reveal heightened institutional participation throughout the session. The surge in trading activity confirms genuine price discovery rather than low-liquidity movements characteristic of smaller altcoins. The afternoon cascade establishes a clear lower high pattern from the initial Dec. 11 spike, creating deteriorating market structure that accelerates downward momentum through previously established support zones. Technical levels at $0.1235 become paramount as HBAR tests critical support following rejection at $0.1320 resistance. The stabilization pattern around $0.124-$0.125 following dramatic capitulation creates potential for mean reversion back to $0.126 resistance. Traders remain cautious given the decisive break of higher timeframe support levels and exceptional volume during the decline that indicates conviction selling. This limits near-term upside potential despite the immediate price recovery that brings some relief to bulls. HBAR/USD (TradingView) Key technical levels signal consolidation range for HBAR Support/Resistance: Immediate support established at $0.1235 following afternoon decline. Strong resistance confirmed at $0.1320 after multiple rejection attempts. New trading range between $0.123-$0.125 on 60-minute timeframes. Volume Analysis: Exceptional surge to 165.9 million tokens (175% above 24-hour average) during key reversal. 60-minute flash crash volume peaked at 15.7 million (700% above hourly average). Sustained above-average activity confirming institutional participation. Chart Patterns: Lower highs pattern established from Dec. 11 peak creating bearish structure. Flash crash and recovery formation suggesting accumulation near support. Deteriorating momentum through multiple support levels indicating trend shift. Targets & Risk/Reward: Immediate upside target at $0.126 mean reversion level. Downside risk to $0.123 support floor if current consolidation fails. Key resistance remains $0.1285 where initial breakdown occurred. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Bitcoin Plunges Below $90K as AI Worries Drag Nasdaq, Crypto Stocks Down By Helene Braun , James Van Straten , Krisztian Sandor | Edited by Oliver Knight 1 hour ago Chipmaker Broadcom's 10% slide weighs on the market as Chicago Fed's Goolsbee signals more cuts than the median for 2026. What to know : Bitcoin drops below $90,000 as ongoing AI related jitters weighed on U.S. stock market indices. Broadcom shares fell 10% on Friday after earnings outlook disappointed investors' high expectations. Chicago Fed President Austan Goolsbee, who opposed a rate cut in December, said he is projecting more interest rate cuts in 2026 than the current median outlook. Read full story Latest Crypto News Five Crypto Firms Win Initial Approvals as Trust Banks, Including Ripple, Circle, BitGo 35 minutes ago Bitcoin Plunges Below $90K as AI Worries Drag Nasdaq, Crypto Stocks Down 1 hour ago Pakistan, Binance Sign MOU to Explore Tokenization of $2B in State Assets: Reuters 1 hour ago Prediction Markets Are Coming to Phantom's 20M User Via Kalshi 2 hours ago Most Influential: Changpeng “CZ” Zhao 2 hours ago Most Influential: Tom Lee 2 hours ago Top Stories Five Crypto Firms Win Initial Approvals as Trust Banks, Including Ripple, Circle, BitGo 35 minutes ago Bitcoin Plunges Below $90K as AI Worries Drag Nasdaq, Crypto Stocks Down 1 hour ago U.S. SEC Gives Implicit Nod for Tokenized Stocks 4 hours ago Most Influential: Tom Lee 2 hours ago Ripple Payments Lands First European Bank Client in AMINA 5 hours ago YouTube Now Allows U.S. Content Creators to Get Paid in PayPal’s Stablecoin: Fortune 5 hours ago