Dogecoin Hovers Near Key Support as Fed Easing Fails to Spark Risk Rally

Analysis

Price Impact

MedThe federal reserve's 25-basis-point rate cut led to mixed market reactions, failing to spark a significant risk rally for dogecoin. doge is currently consolidating within a defined range, dependent on broader market sentiment rather than direct fed action.

Trustworthiness

HighThe analysis is based on a report from coindesk data/cd analytics, a well-regarded source for cryptocurrency news and market insights.

Price Direction

NeutralDogecoin is hovering near key support levels, trading quietly within its established $0.13-$0.15 consolidation range. despite whale accumulation and increased trading activity post-etf launch, it faces resistance near $0.1425, with strong support around $0.1380, indicating a compression phase.

Time Effect

ShortThe analysis focuses on the immediate market reaction to the federal reserve's rate cut and the short-term technical consolidation of doge price, with immediate support and resistance levels being key.

Original Article:

Article Content:

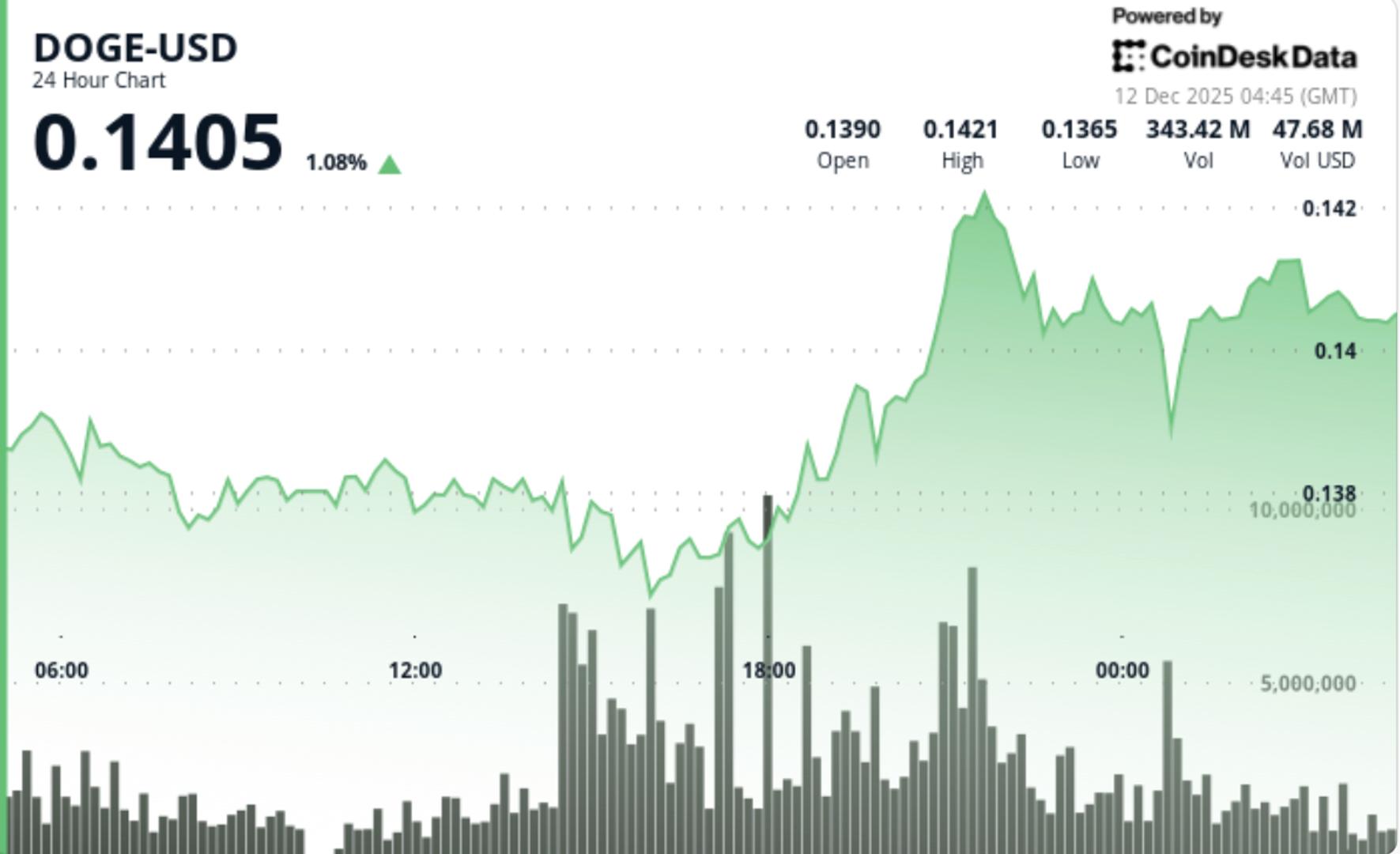

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Dogecoin Hovers Near Key Support as Fed Easing Fails to Spark Risk Rally Despite elevated trading activity, Dogecoin faces resistance near $0.1425, and its future movement is likely dependent on broader market sentiment. By Shaurya Malwa , CD Analytics Updated Dec 12, 2025, 5:45 a.m. Published Dec 12, 2025, 5:45 a.m. (CoinDesk Data) What to know : The Federal Reserve's 25-basis-point rate cut has led to mixed market reactions, with Dogecoin trading quietly within its established range. Dogecoin's price remains stable between $0.13 and $0.15, with whale wallets accumulating significant amounts of the cryptocurrency. Despite elevated trading activity, Dogecoin faces resistance near $0.1425, and its future movement is likely dependent on broader market sentiment. Dogecoin traded quietly after the Federal Reserve delivered a widely anticipated rate cut, holding key support as traders assessed what easier policy means for risk assets. News Background The Federal Reserve announced a 25-basis-point cut to its benchmark rate on Wednesday, lowering the target range to 3.5%–3.75%. While the move marked the third cut of the year, policymakers signaled growing internal disagreement. Some members supported further easing to protect a weakening labor market, while others warned that additional cuts risk reigniting inflation pressures. The mixed tone limited immediate risk-on follow-through across markets, with crypto prices stabilizing rather than extending gains. Against this backdrop, Dogecoin continued to see steady on-chain engagement. Whale wallets accumulated roughly 480 million DOGE over recent sessions, and trading activity remained elevated following the launch of spot DOGE ETFs from Grayscale and Bitwise. However, ETF-related flows have so far failed to produce sustained directional momentum. Price Action Summary DOGE rose 0.69% to around $0.1405 over the past 24 hours, remaining firmly within its multi-week $0.13–$0.15 consolidation range. Price moved between $0.1382 and $0.1408 during the session, reflecting restrained participation despite the macro catalyst. Trading volume reached approximately 651.7 million tokens, about 7% above the seven-day average, suggesting positioning rather than aggressive accumulation. Repeated attempts to clear resistance near $0.1425–$0.1430 were rejected, while buyers continued to defend the $0.1380 area. Technical Analysis Technically, DOGE remains in a compression phase. Horizontal support near $0.1380 has now held through multiple tests, reinforcing its importance as a near-term floor. Momentum indicators remain neutral, consistent with range-bound conditions rather than trend development. The structure continues to resemble a pennant or volatility coil, implying that a sharper move is more likely to come from a breakout or breakdown than gradual drift. Until price reclaims the upper boundary of the range, upside attempts are likely to face selling pressure. What Traders Should Know With the Fed cut now priced in and policymakers signaling uncertainty about further easing, DOGE appears more sensitive to broader risk sentiment than to token-specific catalysts. Holding above $0.1380 keeps the structure intact, but failure to reclaim $0.1420–$0.1450 suggests upside remains capped for now. A sustained break above that zone would open the door toward $0.16–$0.18, while a loss of $0.1380 would expose the lower end of the range near $0.13. For now, DOGE remains a consolidation trade in a post-Fed, wait-and-see market. More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Stablecoins Get Backing From Cross-Party UK Lawmakers Urging Pro-Innovation Rules By Omkar Godbole , AI Boost | Edited by Sam Reynolds 2 minutes ago The group calls for a forward-looking framework to maintain the U.K.'s fintech leadership and attract international investment. What to know : A coalition of U.K. lawmakers is urging Chancellor Rachel Reeves to revise the Bank of England's proposed stablecoin framework to prevent stifling innovation and capital flight. Lawmakers warn that current proposals could make pound-backed stablecoins unattractive, pushing investors toward dollar-pegged alternatives. The group calls for a forward-looking framework to maintain the U.K.'s fintech leadership and attract international investment. Read full story Latest Crypto News Stablecoins Get Backing From Cross-Party UK Lawmakers Urging Pro-Innovation Rules 2 minutes ago XRP Lands on Solana, Ethereum and Others, in Boost for Ripple Ecosystem 1 hour ago CFTC Gives No-Action Leeway to Polymarket, Gemini, PredictIt, LedgerX Over Data Rules 7 hours ago Terraform's Do Kwon Sentenced to 15 Years in Prison for Fraud 7 hours ago U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard 8 hours ago Bitcoin Rebounds to $93K From Post-Fed Lows, but Altcoins Remain Under Pressure 8 hours ago Top Stories XRP Lands on Solana, Ethereum and Others, in Boost for Ripple Ecosystem 1 hour ago Terraform's Do Kwon Sentenced to 15 Years in Prison for Fraud 7 hours ago CFTC Gives No-Action Leeway to Polymarket, Gemini, PredictIt, LedgerX Over Data Rules 7 hours ago Bitcoin Rebounds to $93K From Post-Fed Lows, but Altcoins Remain Under Pressure 8 hours ago U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard 8 hours ago Binance Overhauls Stablecoin Trading with Trump-Linked USD1 11 hours ago