U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard

Analysis

Price Impact

HighThe u.s. financial stability oversight council (fsoc) has officially removed digital assets from its list of potential hazards to the financial system. this significant shift in regulatory perception, especially under the trump administration, signals a more favorable stance towards crypto, potentially reducing regulatory uncertainty and fostering institutional confidence.

Trustworthiness

HighThe information is from an official fsoc report, reported by coindesk, a reputable crypto news source, quoting treasury secretary scott bessent directly.

Price Direction

BullishRemoving the 'potential hazard' label from digital assets by a key u.s. financial watchdog is a major positive development. it implies less future regulatory friction, increased legitimacy, and a more welcoming environment for institutional capital and innovation, which could drive long-term price appreciation across the crypto market.

Time Effect

LongWhile there might be an immediate positive sentiment boost, the full effects of this policy shift, such as increased institutional adoption, clearer regulatory frameworks, and reduced systemic risk perception, will likely unfold over an extended period, leading to sustained growth rather than a short-term pump.

Original Article:

Article Content:

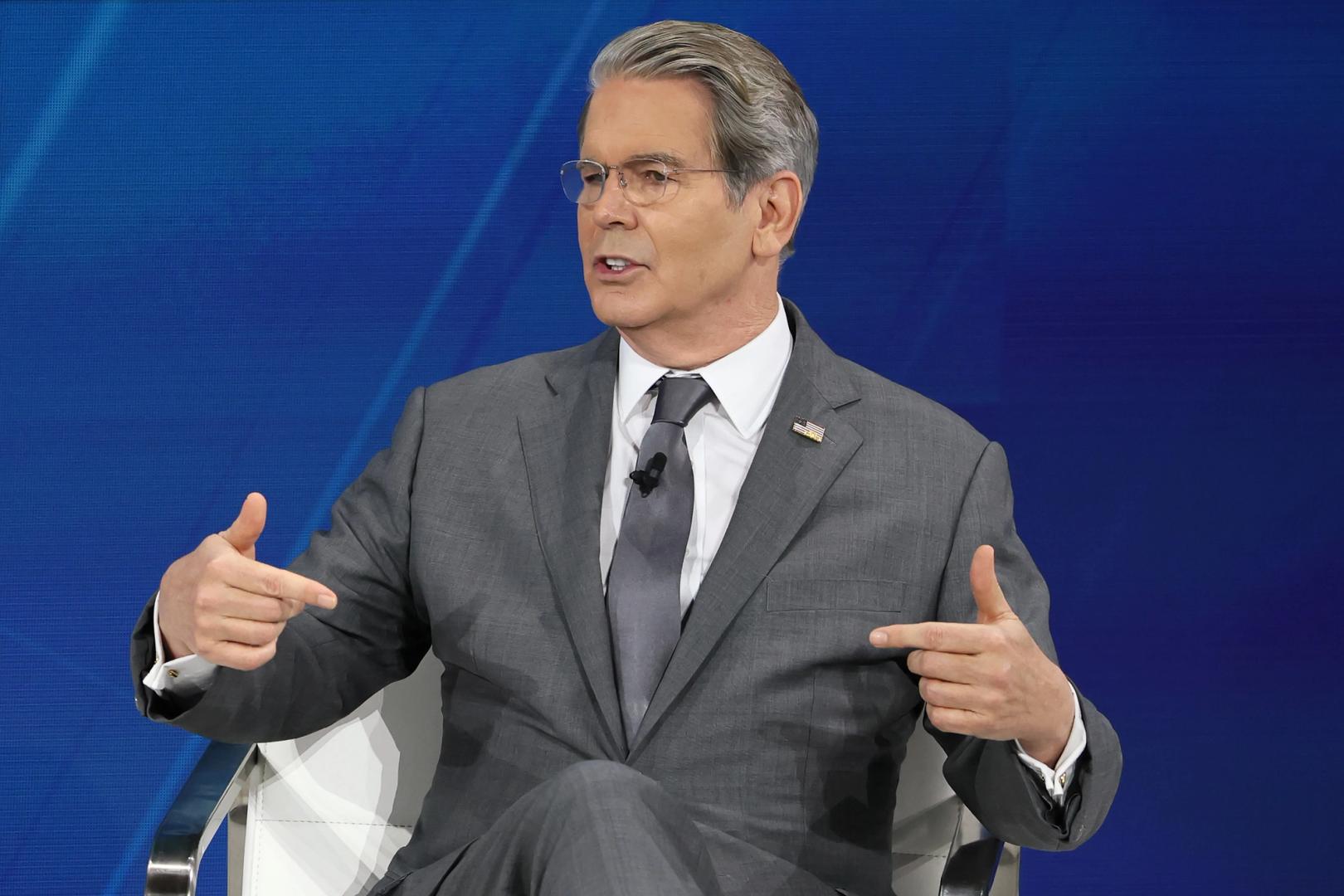

Policy Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard From Donald Trump's crypto-friendly regulators, the yearly report that once flagged financial-stability risks is no longer issuing "vulnerability" warnings. By Jesse Hamilton | Edited by Nikhilesh De Dec 11, 2025, 9:31 p.m. Treasury Secretary Scott Bessent said the newest Financial Stability Oversight Council isn't as focused on vulnerabilities to the financial system. (Michael M. Santiago/Getty Images) What to know : The ultimate watchdog of U.S. financial risks — the Financial Stability Oversight Council — has put a stop to flagging crypto (and many other things) as looming dangers to the wider financial system. Treasury Secretary Scott Bessent argued in the council's annual report that the body's financial-stability role is well served by focusing on economic growth. The crypto sector has been freed from its annual reference in the Financial Stability Oversight Council's litany of financial risks posed to the U.S. system, though it's not unique in that, because the report has effectively removed much of its focus on "vulnerabilities" to the financial system. STORY CONTINUES BELOW Don't miss another story. Subscribe to the State of Crypto Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The FSOC , established after the 2008 mortgage meltdown that crashed the global economy, was meant to be an early-warning effort in which the council of regulatory chiefs tries to collectively spot dangers coming down the road. The digital assets industry was an annual item on that list, though the reports always noted the still-limited market size while suggesting that products such as stablecoins and exchange-traded funds could pose risks if the space got overly interconnected with the rest of the financial system. That's no longer an explicit concern in the 2025 report released on Thursday by President Donald Trump's regulators. The document's table of contents has entirely erased the once-ubiquitous word "vulnerabilities," and Treasury Secretary Scott Bessent acknowledged in the report's opening letter that the analysis historically focused on identifying dangers that could disrupt the financial system. "But monitoring and addressing these vulnerabilities, although important, is not sufficient for safeguarding financial stability," he contended. "Financial stability also requires and is interdependent with sustainable long-term economic growth and economic security." The 2024 report , a 140-page document written under the watch of regulators in the administration of former President Joe Biden, had mostly focused its digital assets recommendations on nudging Congress to regulate stablecoins and to assign specific regulation on the spot markets. This year's shorter, 87-page report doesn't include digital assets "recommendations" or flag explicit worries about the industry. Under the digital assets section, it has a "further actions" subsection that refers to this year's President's Working Group report on U.S. crypto activity and the administration's agenda, noting that previous report "contains recommendations for Congress and various government agencies, including certain council member agencies, to enable innovation and American leadership in digital financial technology." The 2025 FSOC report's digital assets sections detailed how U.S. financial regulators with a say over crypto matters withdrew their previous policy stance in which they generally cautioned regulated financial firms with the risks of getting involved in the industry and sometimes stood in the way. It mostly praises the strengths of the growing sector, though it notes in the "illicit finance" subsection that stablecoins may be "abused to facilitate illicit finance transactions." However, it also said that the "continued use of U.S. dollar-denominated stablecoins is expected to support the role of the U.S. dollar in the international financial system over the next decade." Read More: FSOC's Still Worried About Stablecoins Financial Stability Oversight Council Scott Bessent Risk Systemic Risk Treasury More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto By Jesse Hamilton | Edited by Nikhilesh De 1 hour ago In what are likely her final days at the agency, the acting chairman checked another box from President Donald Trump's crypto agenda. What to know : One of the leading U.S. regulators for crypto activity, the Commodity Futures Trading Commission, has scrapped its earlier definition for how assets change hands in a crypto commodities transaction. Acting Chairman Caroline Pham said the earlier guidance on "actual delivery" was withdrawn as part of President Donald Trump's efforts to create friendly crypto policies. Read full story Latest Crypto News Bitcoin Rebounds to $93K From Post-Fed Lows, but Altcoins Remain Under Pressure 29 minutes ago Chainlink's LINK Drops 5% Despite Coinbase Bridge Deal, But Bottoming Signs Emerge 1 hour ago U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto 1 hour ago Coinbase Expands Reach of Stablecoin-Based AI Agent Payments Tool 2 hours ago Do Kwon’s Sentencing Hearing Drags on as Court Weighs Mountain of Victim Testimony 2 hours ago U.S. Senate Rolls Toward Last Vote on Confirming Crypto Regulators at CFTC, FDIC 2 hours ago Top Stories Bitcoin Rebounds to $93K From Post-Fed Lows, but Altcoins Remain Under Pressure 29 minutes ago U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto 1 hour ago Binance Overhauls Stablecoin Trading with Trump-Linked USD1 3 hours ago Do Kwon’s Sentencing Hearing Drags on as Court Weighs Mountain of Victim Testimony 2 hours ago Crypto Trading Volumes Deteriorated Across Board Last Month as Market Slumped: JPMorgan 7 hours ago Crypto Investment Firm Blockstream to Acquire TradFi Hedge Fund Corbiere Capital 4 hours ago