Bitcoin Rebounds to $93K from Post-Fed Lows, but Altcoins Remain Under Pressure

Analysis

Price Impact

HighBitcoin (btc) rebounded significantly to $93k after initially dipping post-fed rate cut, showing resilience. however, altcoins remain under pressure, indicating a divergence in market sentiment. while selling pressure is losing steam, the market is 'not yet out of the woods.'

Trustworthiness

HighThe analysis comes from coindesk, a reputable crypto news source, citing insights from established trading firms like wintermute and analytics firm swissblock, providing a well-rounded perspective.

Price Direction

NeutralBitcoin showed a bullish rebound to $93k, recovering from post-fed lows and decoupling somewhat from the initial equity sell-off. however, the broader market remains uncertain, with altcoins continuing to decline and analysts noting that while selling pressure is waning, confirmation of a full recovery is lacking. emerging stagflation concerns and a shift towards crypto regulation as the next major driver add to the neutral stance.

Time Effect

ShortThe rebound in bitcoin was a late-day gain, indicating an immediate reaction to market digestion of the fed decision and a recovering nasdaq. however, the overall market stabilization is still nascent, and longer-term drivers like regulation and stagflation concerns are only 'emerging.'

Original Article:

Article Content:

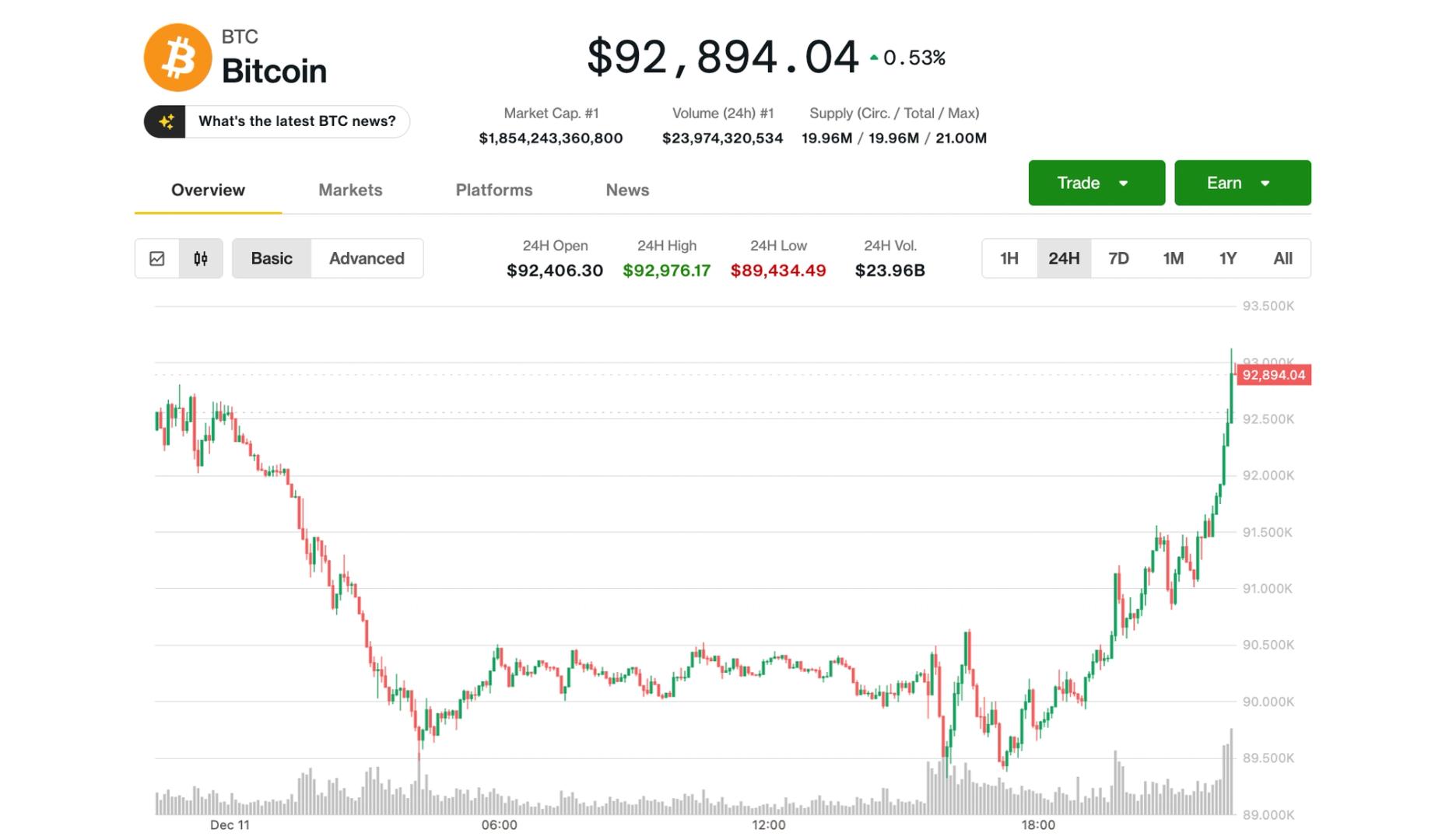

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin Rebounds to $93K from Post-Fed Lows, but Altcoins Remain Under Pressure Downward pressure on bitcoin is losing steam, with the market stabilizing but not yet out of the woods, said one analyst. By Krisztian Sandor | Edited by Stephen Alpher Dec 11, 2025, 9:24 p.m. Bitcoin (BTC) price (CoinDesk) What to know : Bitcoin rebounded from a sharp early selloff on Thursday to trade above $93,000 shortly after the close of U.S. stocks. The late-day gain in bitcoin came alongside a rebound in the Nasdaq from big morning losses; the tech index closed with just a 0.25% loss. Downward pressure on bitcoin is losing steam, said one analyst, but the market is not yet out of the woods. Bitcoin BTC $ 92,918.81 clawed back to $93,000 on Thursday as traders digested the Fed decision, but altcoins mostly didn't join in the bounce. Slipping to $89,000 after the Federal Reserve’s Wednesday rate cut and a sharply lower open for U.S. stocks, bitcoin recently was trading at $93,000, up marginally over the past 24 hours. STORY CONTINUES BELOW 다른 이야기를 놓치지 마세요. 오늘 Crypto Daybook Americas 뉴스레터를 구독하세요 . 모든 뉴스레터 보기 가입하기 가입하면 CoinDesk 제품에 대한 이메일을 받게 되며, 당사의 이용 약관 및 개인정보 보호정책 . Altcoins mostly held onto their early losses, with Cardano's ADA ADA $ 0.4237 and Avalanche's AVAX (AVAX) leading declines, down 6%-7%. Ether ETH $ 3,251.05 was 3% lower on the day, holding above $3,200. Bitcoin's late-day bounce came alongside similar action in U.S. stocks, with the Nasdaq managing to close down just 0.25% after being as much as 1.5% lower. The S&P 500 closed modestly in the green and the DJIA gained 1.3%.. The day's standout rally came from precious metals, with silver surging 5% to a fresh all-time high of $64 per ounce and gold climbing over 1% to near $4,300. The advance was helped by the U.S. dollar index (DXY) slipping to its weakest since mid-October. Crypto exchange Gemini stood out among crypto stocks, gaining over 30% on news of obtaining regulatory approval to offer prediction markets in the U.S. Crypto diverges from equities Jasper De Maere, desk strategist at trading firm Wintermute, said Thursday’s action reinforced crypto’s growing decoupling from equities, especially around macro catalysts. "Only 18% of the past year’s sessions have seen BTC outperform the Nasdaq on macro days," he noted. "Yesterday fit that pattern: equities rallied while crypto sold off, suggesting the rate cut was fully priced and that marginal easing is no longer providing support." De Maere added that early signs of stagflation concerns are emerging into the first half of 2026, and markets are beginning to shift focus from Fed policy toward U.S. crypto regulation as the next major driver. Bitcoin sell pressure waning Analytics firm Swissblock noted the downward pressure on bitcoin is losing steam, with the market stabilizing but not yet out of the woods. "The second selling wave is weaker than the first, and selling pressure is not intensifying," the firm said in an X post . "There are signs of stabilization... but not confirmation." Market Wrap Bitcoin News Breaking News More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Chainlink's LINK Drops 5% Despite Coinbase Bridge Deal, But Bottoming Signs Emerge 작성자 CD Analytics , Krisztian Sandor | 편집자 Nikhilesh De 1시간 전 Coinbase tapped Chainlink services for $7 billion bridge, but broader crypto weakness weighed on price. 알아야 할 것 : LINK declined 5% over the past 24 hours amid broader market weakness Trading volume surged 20% above weekly average, with institutional activity emerging near session lows. On the news front, Coinbase named Chainlink CCIP as its interoperability provider for a new $7 billion wrapped asset bridge and digital asset treasury firm Caliber started staking its holdings for yield. Read full story Latest Crypto News Chainlink's LINK Drops 5% Despite Coinbase Bridge Deal, But Bottoming Signs Emerge 1시간 전 U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto 1시간 전 Coinbase Expands Reach of Stablecoin-Based AI Agent Payments Tool 1시간 전 Do Kwon’s Sentencing Hearing Drags on as Court Weighs Mountain of Victim Testimony 1시간 전 U.S. Senate Rolls Toward Last Vote on Confirming Crypto Regulators at CFTC, FDIC 2시간 전 JPMorgan Pushes Deeper Into Tokenization With Galaxy's Debt Issuance on Solana 2시간 전 Top Stories U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto 1시간 전 Binance Overhauls Stablecoin Trading with Trump-Linked USD1 3시간 전 Do Kwon’s Sentencing Hearing Drags on as Court Weighs Mountain of Victim Testimony 1시간 전 Bitcoin Stumbles Back Below $90K as Dollar Sinks to 7-Week Low After Fed Rate Cut 5시간 전 Crypto Trading Volumes Deteriorated Across Board Last Month as Market Slumped: JPMorgan 6시간 전 Crypto Investment Firm Blockstream to Acquire TradFi Hedge Fund Corbiere Capital 3시간 전