Chainlink's LINK Drops 5% Despite Coinbase Bridge Deal, But Bottoming Signs Emerge

Analysis

Price Impact

HighCoinbase's adoption of chainlink's ccip for a $7 billion wrapped asset bridge is a monumental institutional endorsement, significantly validating chainlink's cross-chain infrastructure. additionally, digital asset firm caliber staking 75,000 link tokens for yield further highlights institutional confidence and utility. while link initially dropped 5% due to broader market weakness, these fundamental developments are highly significant for its long-term value.

Trustworthiness

HighThe information comes from coindesk, a reputable crypto news source, providing specific details on the coinbase deal, caliber staking, and detailed technical analysis including trading volume and price levels, which enhances credibility.

Price Direction

BullishDespite an initial 5% dip influenced by broader market conditions, the emergence of 'bottoming signals,' a significant surge in trading volume (20.4% above average) with institutional activity, and accumulation patterns near key support ($13.46) strongly suggest a potential reversal. the coinbase ccip integration is a major catalyst for future demand and adoption, pointing towards upward price movement once broader market sentiment improves.

Time Effect

LongThe coinbase partnership solidifies chainlink's position as a core infrastructure provider for cross-chain interoperability and tokenization. this fundamental integration is expected to drive long-term adoption, utility, and demand for the link token, transcending short-term market fluctuations.

Original Article:

Article Content:

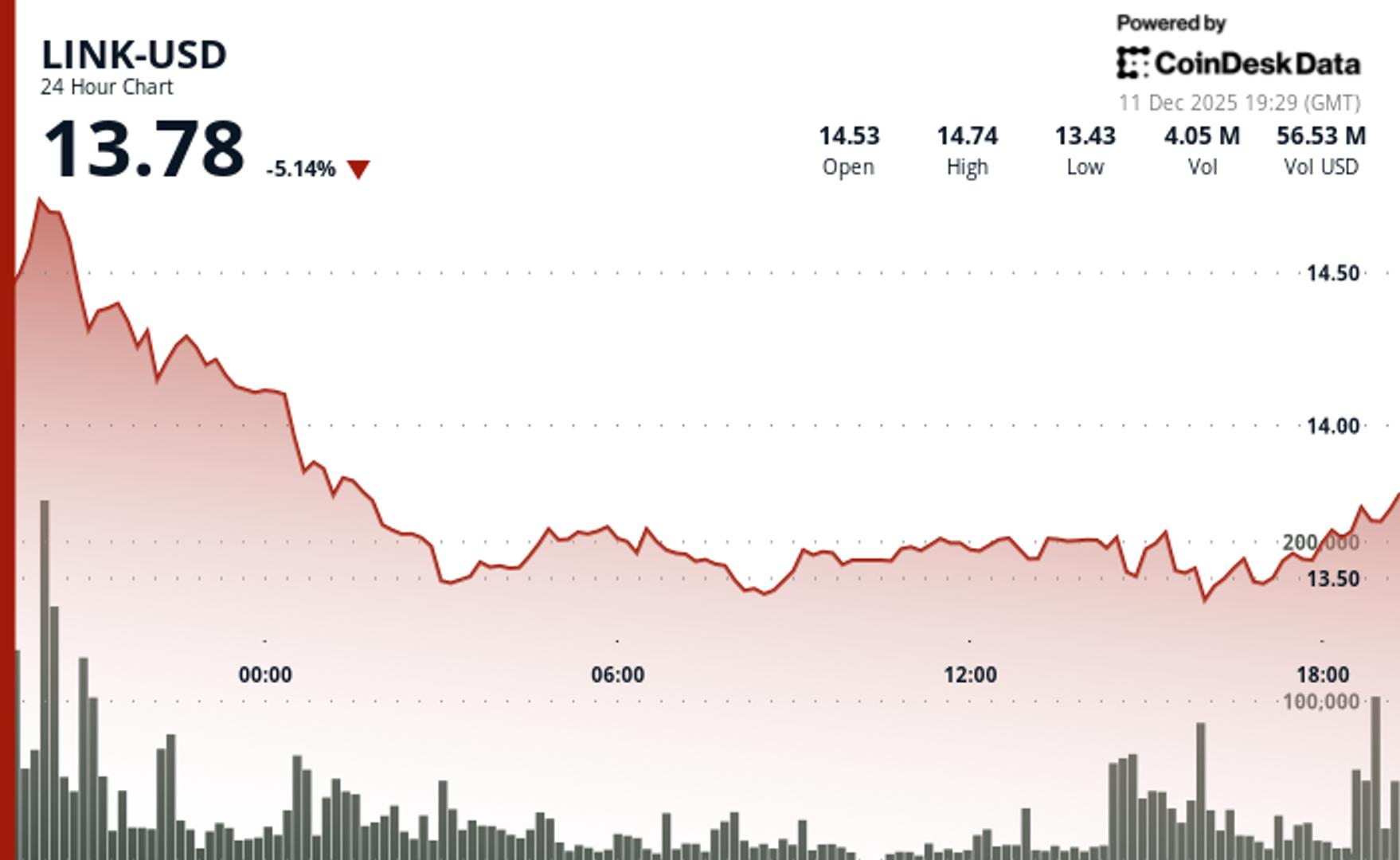

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Chainlink's LINK Drops 5% Despite Coinbase Bridge Deal, But Bottoming Signs Emerge Coinbase tapped Chainlink services for $7 billion bridge, but broader crypto weakness weighed on price. By CD Analytics , Krisztian Sandor | Edited by Nikhilesh De Dec 11, 2025, 8:21 p.m. "LINK climbs 2.4% to $13.74 as Coinbase adopts CCIP for $7B bridge, signaling selective institutional interest." What to know : LINK declined 5% over the past 24 hours amid broader market weakness Trading volume surged 20% above weekly average, with institutional activity emerging near session lows. On the news front, Coinbase named Chainlink CCIP as its interoperability provider for a new $7 billion wrapped asset bridge and digital asset treasury firm Caliber started staking its holdings for yield. Chainlink’s LINK token fell nearly 5% over the past 24 hours to $13.74 on Thursday, reversing early gains despite a major announcement from Coinbase. Earlier in the day, Coinbase revealed it had selected Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to power a new bridge connecting its $7 billion in wrapped assets, including cbETH, cbBTC and cbDOGE. The move marked a major institutional endorsement of Chainlink’s cross-chain infrastructure and positioning within the tokenization space. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . In other news, Nasdaq-listed digital asset treasury firm Caliber (CWD) said it has started staking its LINK holdings for yield, starting with a 75,000 token deployment. Despite the headlines, broader market conditions dampened sentiment. Weak altcoin momentum and renewed concerns around the Federal Reserve’s rate outlook contributed to LINK’s drop from Wednesday's high of $14.46 to a Thursday low of $13.43. Still, bottoming signals began to form late in the session. Trading volume surged 20.4% above the 7-day average, with a burst of over 340,000 LINK exchanged between 18:42 and 18:45 UTC, CoinDesk data showed. Accumulation patterns emerged just above key support at $13.46, suggesting institutional positioning amid broader weakness, CoinDesk Research's technical analysis tool noted. Key Technical Levels Signal Stabilization Support/Resistance: Primary support: $13.46 (session low) Resistance: $14.88 (recent rejection zone) Psychological resistance: $14.00 Volume Analysis: Late-session spike of 340K tokens (2,000%+ above session average) confirmed renewed buying interest Overall daily volume rose 20.4% above weekly average Chart Patterns: Consolidation between $13.43–$13.67 after early selloff Final-hour breakout to $13.76 suggests possible short-term bottoming Targets & Risk/Reward: Break above $14.00 could target $14.38 and $14.88 Failure to hold $13.46 risks retrace toward $13.20 Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights Chainlink More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Robinhood Stock Slides 8% After Big Decline in November Trading Volumes By Helene Braun | Edited by Stephen Alpher 2 hours ago Slumps across equity, options and crypto trading in November raised concerns that retail investor momentum may be fading. What to know : Robinhood reported a sharp drop in trading volumes across equities, options and crypto in November. The company's total platform assets also fell 5% month-over-month to $325 billion. The slowdown in trading activity raised investor concerns that retail engagement may be fading heading into year-end. Read full story Latest Crypto News U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto 26 minutes ago Coinbase Expands Reach of Stablecoin-Based AI Agent Payments Tool 29 minutes ago Do Kwon’s Sentencing Hearing Drags on as Court Weighs Mountain of Victim Testimony 34 minutes ago U.S. Senate Rolls Toward Last Vote on Confirming Crypto Regulators at CFTC, FDIC 58 minutes ago JPMorgan Pushes Deeper Into Tokenization With Galaxy's Debt Issuance on Solana 1 hour ago Binance Overhauls Stablecoin Trading with Trump-Linked USD1 2 hours ago Top Stories Binance Overhauls Stablecoin Trading with Trump-Linked USD1 2 hours ago Do Kwon’s Sentencing Hearing Drags on as Court Weighs Mountain of Victim Testimony 34 minutes ago Bitcoin Stumbles Back Below $90K as Dollar Sinks to 7-Week Low After Fed Rate Cut 4 hours ago U.S. CFTC's Pham Moves for Do-Over on 'Actual Delivery' Guidance on Crypto 26 minutes ago Crypto Trading Volumes Deteriorated Across Board Last Month as Market Slumped: JPMorgan 5 hours ago Crypto Investment Firm Blockstream to Acquire TradFi Hedge Fund Corbiere Capital 2 hours ago