U.S. Senate Rolls Toward Last Vote on Confirming Crypto Regulators at CFTC, FDIC

Analysis

Price Impact

MedThe imminent confirmation of mike selig at the cftc and travis hill at the fdic signals a more crypto-friendly regulatory environment in the u.s. both nominees are expected to pursue policies that favor innovation and provide clearer guidelines for the crypto sector, reducing regulatory uncertainty. this is a net positive for the overall market.

Trustworthiness

HighThe news comes from coindesk, a reputable source, detailing ongoing procedural votes in the u.s. senate, which are verifiable public events.

Price Direction

BullishConfirmation of pro-crypto leadership in key regulatory bodies like the cftc and fdic is expected to foster a more favorable operational landscape for crypto businesses and increase institutional confidence, leading to potential growth and adoption.

Time Effect

LongWhile there might be a short-term sentiment boost, the true impact of these regulatory confirmations will unfold over months and years as new policies are implemented and clarity encourages innovation and investment.

Original Article:

Article Content:

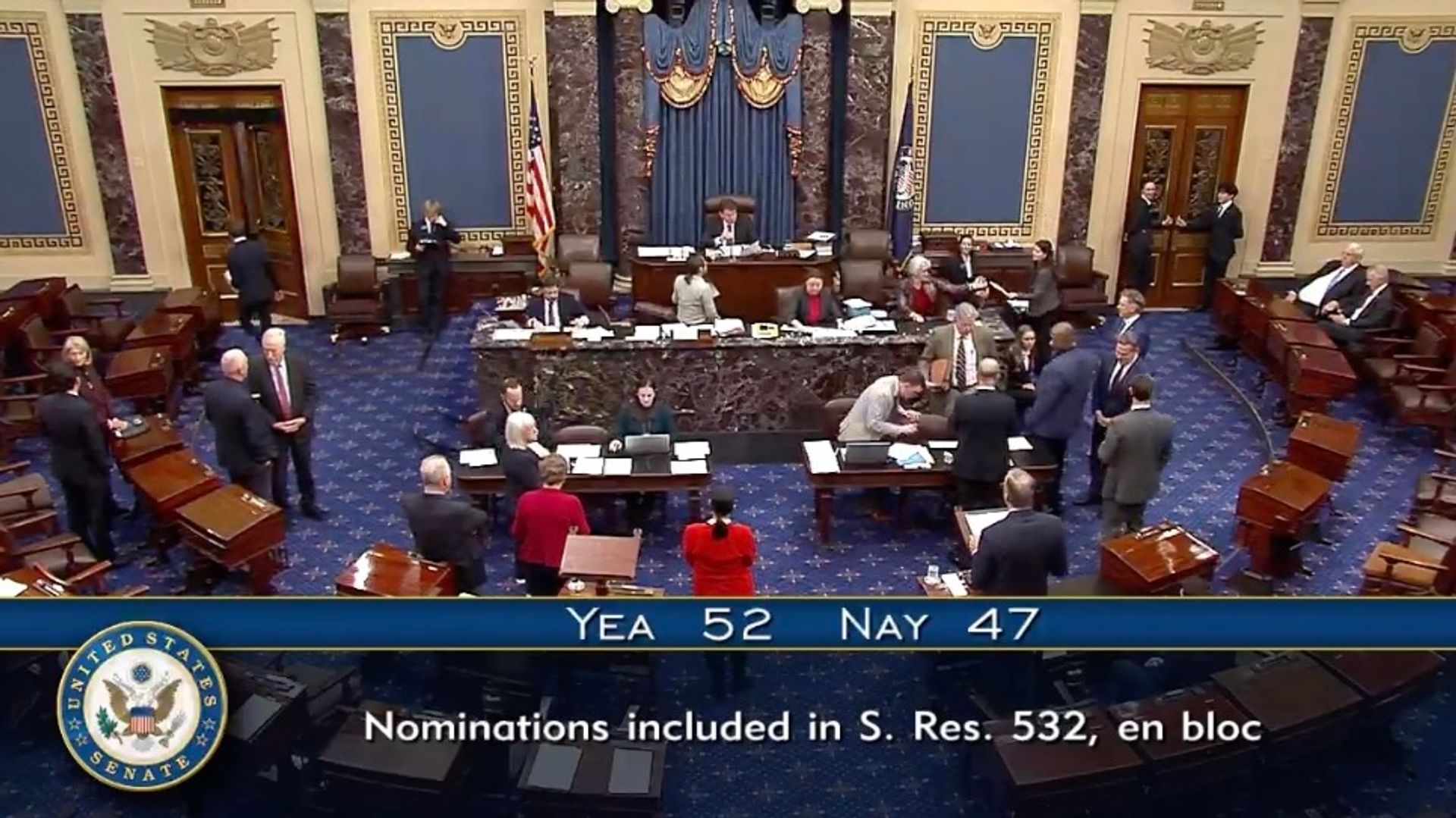

Policy Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email U.S. Senate Rolls Toward Last Vote on Confirming Crypto Regulators at CFTC, FDIC In the prolonged process of the Senate, two key officials have faced a series of procedural steps on their way to a final vote, possibly early next week. By Jesse Hamilton | Edited by Nikhilesh De Dec 11, 2025, 7:23 p.m. A procedural vote moves CFTC and FDIC nominees closer toward confirmation. (U.S. Senate) What to know : The Senate made another positive move toward an eventual confirmation vote on two top U.S. crypto regulators poised to fill the chair roles at the Commodity Futures Trading Commission and the Federal Deposit Insurance Corp. A Senate staffer predicts a final vote next week on confirming 97 nominees of President Donald Trump, including Mike Selig for the CFTC and Travis Hill for the FDIC. Both the U.S. Commodity Futures Trading Commission and the Federal Deposit Insurance Corp. will have significant reach into supervising the U.S. crypto sector, and President Donald Trump's nominees to be their chairman have been crawling through a Senate confirmation process that's close to its end — though the Senate likely remains days away from actually holding the final vote. STORY CONTINUES BELOW Don't miss another story. Subscribe to the State of Crypto Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . After a Thursday approval 52-47 of the resolution that sets up the final vote, Mike Selig is one step away from taking over the CFTC, and Travis Hill's ascent to chairman at the FDIC will also soon be decided. A spokeswoman for Senate Majority Whip John Barrasso posted on social media site X that the final vote is likely "early next week." The Republicans in the Senate have leaned into an unusual approach of confirming dozens of Trump's nominees at a time. In this case, there are 97 confirmation questions being voted on, with Selig and Hill just two among them. Selig, a senior official working on crypto matters at the Securities and Exchange Commission, would replace Acting Chairman Caroline Pham, who has been leading the CFTC through a number of pro-crypto policy initiatives. The CFTC is expected to take a leading role on crypto oversight in the U.S., especially if Congress eventually passes a market structure bill that cements the agency's authority. Even before any legislation makes its way through the Senate, the CFTC has gone on an aggressive blitz, forming a CEO council to weigh in on policy issues, allowing Bitcoin BTC $ 90,937.77 , Ether ETH $ 3,204.36 and USDC (among other payment stablecoins) to be used as collateral and allowing registered firms provide spot crypto trading services. Hill has already been leading the FDIC as an interim chief, so his confirmation would make that role official for him. He's also pursued an agenda that favors friendly crypto banking policies. Read More: Trump's CFTC Pick, Mike Selig, Clears Hurdle on Way Toward Confirmation Vote U.S. Senate U.S. Federal Deposit Insurance Corp. U.S. Commodity Futures Trading Commission Mike selig More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Save the Children Introduces Bitcoin Fund to Streamline Crisis Response By Olivier Acuna | Edited by Jamie Crawley 3 hours ago New fund enables Save the Children to hold bitcoin, pilot digital wallets, and speed up emergency aid delivery. What to know : Save the Children has launched a Bitcoin Fund to hold cryptocurrency donations for up to four years, allowing donors more control over conversion timing. The fund aims to enhance the speed and efficiency of aid delivery by utilizing blockchain technology and piloting new forms of direct assistance. This initiative reflects a growing interest in decentralized finance to reduce costs and increase transparency in humanitarian aid. Read full story Latest Crypto News JPMorgan Pushes Deeper Into Tokenization With Galaxy's Debt Issuance on Solana 9 minutes ago Binance Overhauls Stablecoin Trading with Trump-Linked USD1 1 hour ago El Salvador Partners with Elon Musk’s Grok in AI-Powered Education for 1M Students 1 hour ago Crypto Investment Firm Blockstream to Acquire TradFi Hedge Fund Corbiere Capital 1 hour ago Robinhood Stock Slides 8% After Big Decline in November Trading Volumes 1 hour ago Aptos Slumps 7% as Token Unlock Weighs on Sentiment 2 hours ago Top Stories Binance Overhauls Stablecoin Trading with Trump-Linked USD1 1 hour ago Bitcoin Stumbles Back Below $90K as Dollar Sinks to 7-Week Low After Fed Rate Cut 3 hours ago Crypto Investment Firm Blockstream to Acquire TradFi Hedge Fund Corbiere Capital 1 hour ago Fifth XRP Spot ETF on the Way After CBOE Approval of 21Shares Application 6 hours ago Robinhood Stock Slides 8% After Big Decline in November Trading Volumes 1 hour ago Crypto Trading Volumes Deteriorated Across Board Last Month as Market Slumped: JPMorgan 4 hours ago In this article BTC BTC $ 90,937.77 ◢ 2.17 % ETH ETH $ 3,204.36 ◢ 5.50 %