BONK Extends Slide as Resistance Rejection Pushes Token Back Toward Support

Analysis

Price Impact

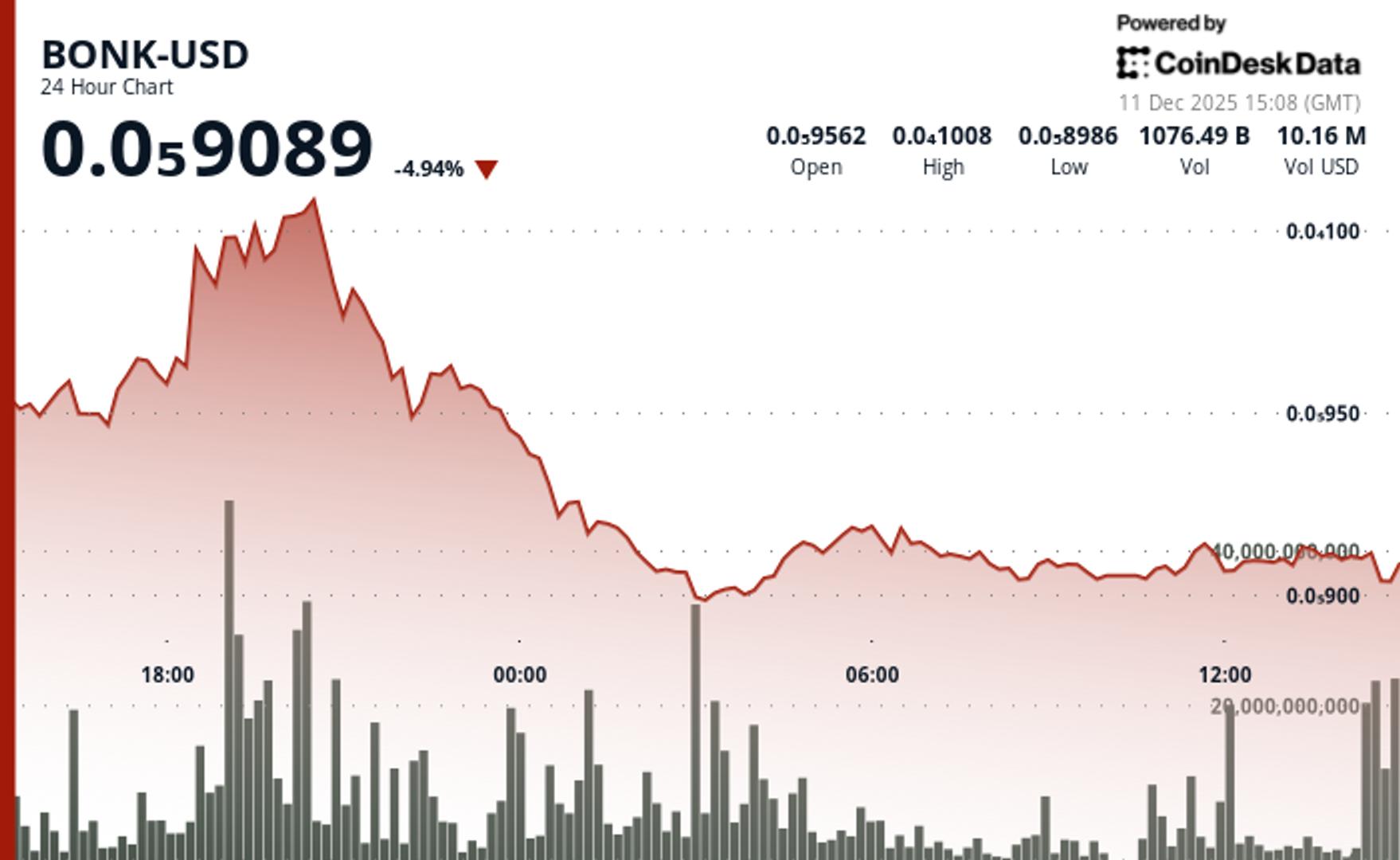

HighBonk experienced a significant 4.5% price drop after being rejected at a key resistance level near $0.00001010, accompanied by a 2.03t-token volume surge that confirmed the resistance. this sharp reversal has pushed the token into a tight consolidation band.

Trustworthiness

HighThe analysis is provided by coindesk research and cd analytics, a reputable source, using technical analysis and a data model based on real-time price action and volume data.

Price Direction

BearishThe token faced a strong rejection at resistance, leading to a noticeable slide. while it's currently consolidating around $0.00000910, failure to hold this support could lead to a further retest toward the $0.00000890 region, indicating a bearish short-term outlook.

Time Effect

ShortThe analysis focuses on intraday price movements, a 24-hour slide, and short-term positioning for the 'next session,' indicating an immediate to very near-term outlook.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email BONK Extends Slide as Resistance Rejection Pushes Token Back Toward Support BONK fell 4.5% as resistance near $0.00001010 capped early strength, sending the token into a tight consolidation band around $0.00000910. By Jamie Crawley , CD Analytics Dec 11, 2025, 3:33 p.m. What to know : BONK fell 4.5% after price was rejected near $0.00001010, reversing a brief early advance A 2.03T-token volume surge marked the session’s turning point and defined the resistance ceiling Price stabilized near $0.00000910 with repeated tests of nearby resistance, forming a developing consolidation base BONK declined 4.5% over the past 24 hours, sliding from $0.000009524 to $0.000009097 after prior strength reversed sharply at a key resistance zone. The token’s intraday range reached 11.8%, with price action topping out at $0.000010183 before turning lower and settling into a narrow consolidation band, according to CoinDesk Research's technical analysis data model. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . A substantial increase in trading activity marked the reversal point, with volume rising to 2.03 trillion tokens during the move into the $0.00001010 area. The scale of activity at that level reinforced its significance as a ceiling that capped upside attempts. Once the rejection took hold, BONK trended steadily lower before stabilizing above $0.00000910, where volatility contracted during the latter portion of the session. BONK attempting to steady near support, with hourly data capturing several brief upward tests toward $0.000009147, accompanied by intermittent volume spikes of roughly 27.6 billion tokens. These movements indicate market participants were active around the lower bound of the range, with price behavior forming the early structure of a potential consolidation base heading into the next session. Short-term positioning now hinges on whether BONK can sustain stability above the $0.00000910 zone. A move through nearby resistance around $0.00000915–$0.00000920 would signal meaningful progress toward unwinding Tuesday’s decline, while failure to maintain support increases the risk of a retest toward the $0.00000890 region. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . AI Market Insights Technical Analysis More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Crypto Trading Volumes Deteriorated Across Board Last Month as Market Slumped: JPMorgan By Will Canny , AI Boost | Edited by Stephen Alpher 58 minutes ago Bitcoin, ether and most majors fell last month as spot, derivatives and stablecoin volumes dropped and U.S. crypto ETPs saw heavy outflows. What to know : Spot, stablecoin, DeFi and NFT volumes slumped around 20% month-on-month in November as volatility and selling froze trading activity, according to JPMorgan. U.S. bitcoin spot ETFs saw $3.4 billion in net outflows and ether ETPs had their worst month on record, the report said. Total crypto market cap fell 17% last month to $3 trillion, with bitcoin down 17% and ether down 22%. Read full story Latest Crypto News Hong Kong's OSL Group to Offer U.S.-Regulated Stablecoin with Anchorage Digital 10 minutes ago Most Influential: The Social Media Traders 34 minutes ago Most Influential: Sirgoo Lee 34 minutes ago Coinbase Taps Chainlink CCIP as Sole Bridge for $7B in Wrapped Tokens Across Chains 34 minutes ago Most Influential: Shayne Coplan 34 minutes ago Most Influential: Arthur Hayes 34 minutes ago Top Stories Another XRP Spot ETF on the Way After CBOE Approval of 21Shares Application 2 hours ago Crypto Trading Volumes Deteriorated Across Board Last Month as Market Slumped: JPMorgan 58 minutes ago Klarna Partners With Privy to Explore Crypto Wallet Use Within its Ecosystem 1 hour ago Cardano Ecosystem Gets a Privacy Boost as Midnight’s NIGHT Goes Live 1 hour ago Bitcoin Pulls Back to $90K as Oracle Results Sour Market Mood: Crypto Daybook Americas 3 hours ago U.S. Senate's Crypto Market Structure Bill Gets Messy as Calendar Weighs Down 11 hours ago