XRP Slides as Traders Take Bitcoin Profits, With ETF Flows Still Strong

Analysis

Price Impact

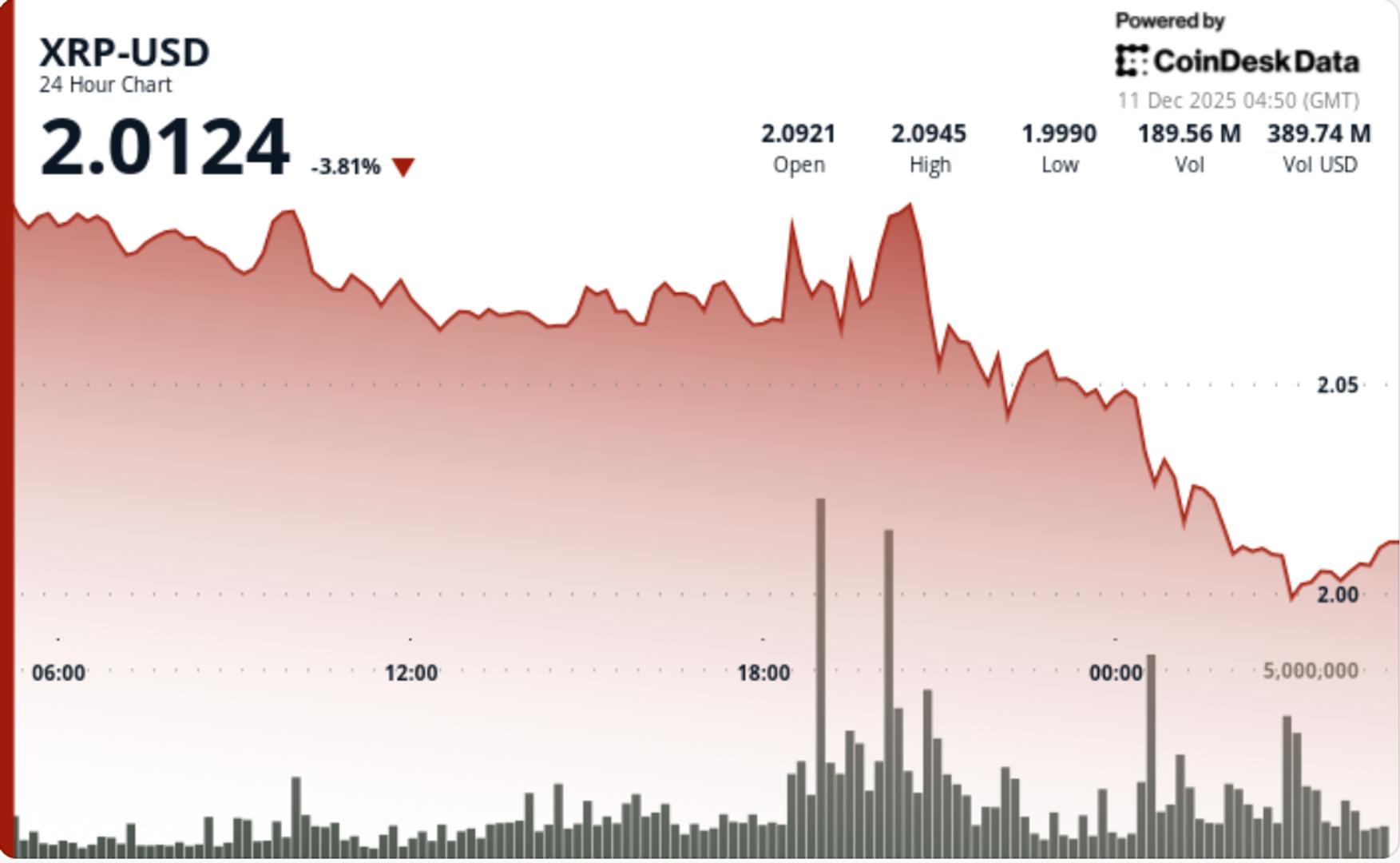

MedXrp saw a 4.3% decline from $2.09 to $2.00 after failing to break the $2.09-$2.10 resistance level. this rejection was driven by significant institutional selling, with volume 54% above the weekly average, pushing the token back into a tight trading range.

Trustworthiness

HighThe analysis comes from coindesk data and cd analytics, a reputable source known for detailed on-chain and market data analysis. specific data points like volume spikes, institutional flow percentages, and exchange balance changes are provided.

Price Direction

BearishThe decisive rejection at the $2.09-$2.10 resistance, coupled with aggressive institutional selling and xrp underperforming the broader crypto market, indicates short-term bearish momentum. the structure remains in multi-week compression, with a clear ceiling established.

Time Effect

ShortThe immediate impact is short-term bearish due to the decisive rejection and selling pressure. however, the underlying long-term trend of decreasing exchange supply and multi-month triangular compression suggests a larger, more significant price move is building in the longer term once a clear direction is established.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP Slides as Traders Take Bitcoin Profits, With ETF Flows Still Strong Institutional flows surged 54% above the weekly average, indicating strategic selling rather than retail panic. By Shaurya Malwa , CD Analytics Updated Dec 11, 2025, 5:18 a.m. Published Dec 11, 2025, 5:18 a.m. (CoinDesk Data) What to know : XRP fell from $2.09 to $2.00, marking a 4.3% decline and underperforming the broader crypto market. Institutional flows surged 54% above the weekly average, indicating strategic selling rather than retail panic. Despite ETF inflows, XRP struggles to break the $2.09–$2.10 resistance, maintaining a tight trading range. Institutional flows jumped more than 50% above trend on Wednesday as XRP failed again to break through the $2.09–$2.10 ceiling. Sellers slammed the token off resistance and forced a clean move back into the $2.00 psychological shelf, leaving the broader structure stuck in multi-week compression while ETF inflows quietly tighten supply underneath. What to Know XRP slipped from $2.09 to $2.00, losing 4.3% on the session and underperforming the broader crypto market by roughly 1%. The rejection was decisive: a 172.8M volume spike (205% above the daily average) hit right as XRP tagged $2.08, flipping the entire move into a failed breakout.The selloff didn’t come from retail panic. Volume across the session ran 54% above the 7-day average — classic institutional distribution above resistance rather than emotional dumping. Exchange balances dropped from 3.95B to 2.6B tokens over the last 60 days, compressing supply even as spot price failed to hold the breakout attempt. That divergence is setting up an increasingly asymmetric structure as XRP trades in a narrowing multi-month triangle News Background U.S. spot XRP ETFs pulled in over $170 million in weekly inflows, marking another week with zero outflows. Heavy spot selling continues to hit the $2.09–$2.10 band, where XRP has now failed multiple times. Market makers flagged rising distribution pressure ahead of yesterday’s move, with heavy offers sitting above $2.10. Exchange supply continues to grind lower, falling to 2.6B tokens, strengthening long-term supply compression. Despite the ETF support, XRP lagged broader crypto as CD5 fell 3.1% on the day — suggesting the move was token-specific rather than macro-driven. Price Action Summary XRP dropped 4.3% from $2.09 → $2.00 • Intraday range: 5.4% as resistance rejection triggered high-volatility unwind • Volume: 172.8M peak at 19:00 UTC (up 205% above daily average) • Multiple rejections at $2.08–$2.10 created a hard ceiling • Late-session stabilization formed higher lows near $1.999–$2.005 • Relative performance: lagged broader crypto by ~1% STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Technical Analysis Support:$2.00 psychological shelf. Below that sits a soft zone at $1.95, aligned with prior demand clusters. Resistance:$2.09–$2.10 is the dominant wall — the session created a clear supply shelf here. Any close above $2.10 flips the entire structure short-term bullish. Volume Structure: 54% above weekly averages = institutional flows, not noiseThe 172.8M spike exactly at the failed breakout confirms aggressive sellers defending the level. Pattern: Multi-month triangular compression tightening as exchange supply falls. Price remains mid-range; neither breakout nor breakdown confirmed. Momentum skewed bearish short-term after clean rejection. Bounce attempts capped below $2.08 on declining volume is equal to a weak follow-through. What Traders Are Watching. Can $2.00 survive a second test? A clean break exposes a fast move toward $1.95. ETF inflows remain the biggest offset to spot weakness — any slowdown removes the floor. A breakout requires multiple hourly closes above $2.10 with sustained >100M volume. Compression now extremely tight — the next move should be larger than the last. Exchange balance drop is the wildcard: thinner supply = faster swings once direction confirms More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Why is Bitcoin Trading Lower Today? By Omkar Godbole | Edited by Sam Reynolds 47 minutes ago Market uncertainty persists due to internal Fed divisions and unclear future rate paths until 2026. What to know : Bitcoin and Ether prices fell following the Federal Reserve's rate cut and mixed signals about future monetary policy. The Fed's decision to purchase short-term Treasury bills aims to manage liquidity, not to implement quantitative easing. Market uncertainty persists due to internal Fed divisions and unclear future rate paths until 2026. Read full story Latest Crypto News Why is Bitcoin Trading Lower Today? 47 minutes ago U.S. Senate's Crypto Market Structure Bill Gets Messy as Calendar Weighs Down 1 hour ago Asia Morning Briefing: Fed Cut Brings Little Volatility as Bitcoin Waits for Japan 3 hours ago Bhutan Debuts TER Gold-Backed Token on Solana 3 hours ago State Street and Galaxy to Launch Tokenized Liquidity Fund on Solana in 2026 6 hours ago Crypto CEOs Join U.S. CFTC's Innovation Council to Steer Market Developments 6 hours ago Top Stories U.S. Senate's Crypto Market Structure Bill Gets Messy as Calendar Weighs Down 1 hour ago Why is Bitcoin Trading Lower Today? 47 minutes ago Bitcoin Swings Wildly as Fed's Powell Straddles Labor Market and Inflation Issues 8 hours ago Federal Reserve Cuts Rates 25 Basis Points, With Two Members Voting for Steady Policy 10 hours ago Crypto CEOs Join U.S. CFTC's Innovation Council to Steer Market Developments 6 hours ago U.S. Banking Regulator Warns Wall Street on 'Debanking,' Claims Practices 'Unlawful' 7 hours ago