Stellar Edges Higher to $0.251 Despite Altcoin Market Apathy

Analysis

Price Impact

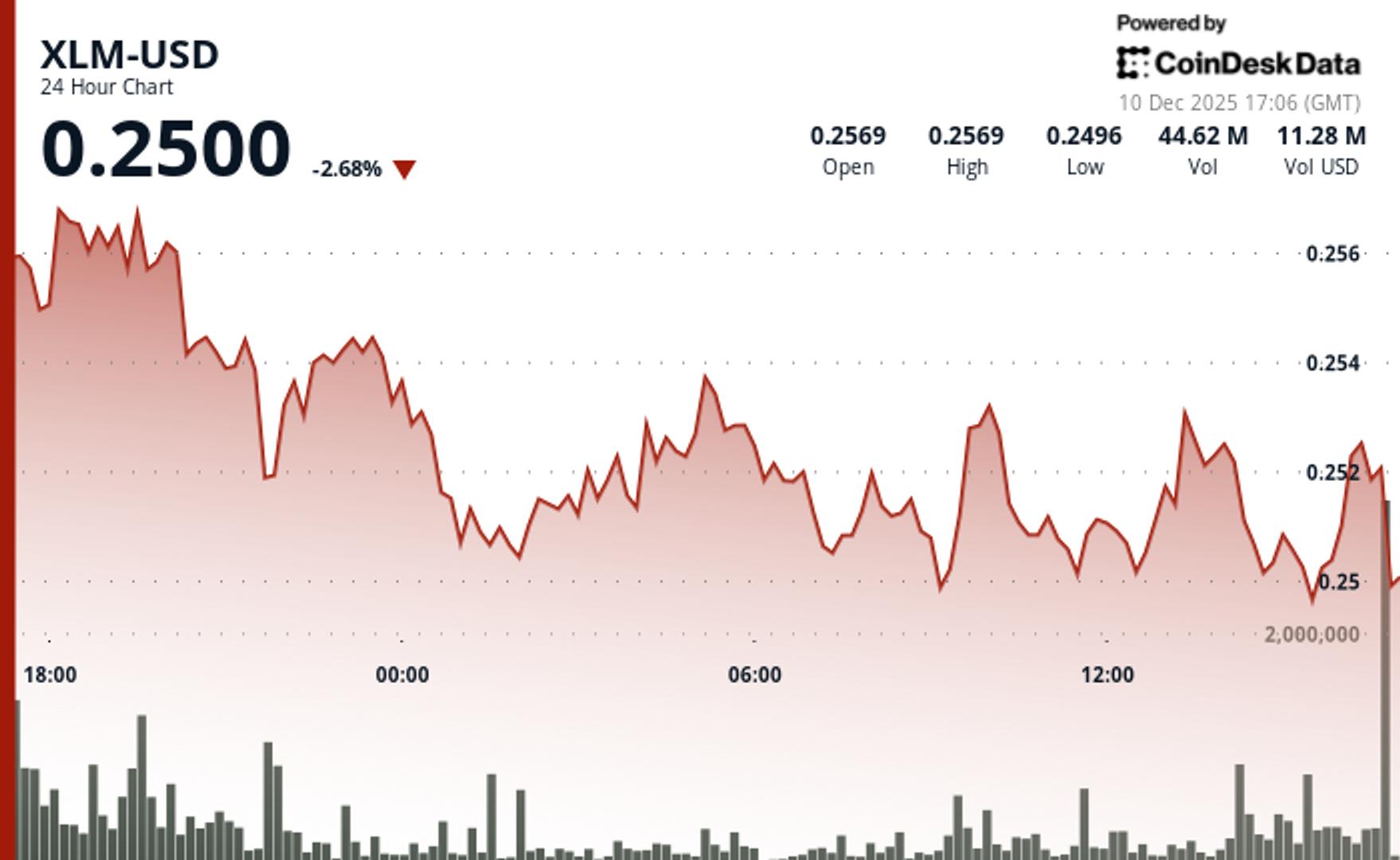

MedStellar (xlm) experienced a 0.85% gain to $0.251 despite broader altcoin market apathy. crucially, trading volume surged 19.36% above the weekly average, signaling notable institutional interest and accumulation around the critical $0.25 support level. while price appreciation was modest, the increased volume amidst consolidation suggests underlying strength or preparation for a future move.

Trustworthiness

HighThe analysis is provided by cd analytics and oliver knight, published by coindesk, a reputable crypto news source. while ai assistance is mentioned, the content is stated to be reviewed by their editorial team, ensuring accuracy and adherence to standards. the technical analysis is data-driven and provides clear support/resistance levels and volume insights.

Price Direction

NeutralXlm is currently in a volatile consolidation pattern around $0.25. while $0.25 has proven to be a key support and sustained holding above it maintains a 'bullish structure for breakout potential,' the article also notes a 'systematic decline through lower highs pattern.' elevated volume without corresponding significant price momentum indicates a standoff between buyers and sellers, leading to a neutral outlook until a clear breakout or breakdown occurs.

Time Effect

LongThe described pattern of increased institutional accumulation and consolidation typically precedes more sustained, longer-term price movements rather than immediate, sharp spikes. the 'gradual accumulation phases' mentioned suggest a build-up that could materialize into a significant trend over an extended period.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Stellar Edges Higher to $0.251 Despite Altcoin Market Apathy Trading volume surged 19% above weekly averages as XLM consolidated around critical $0.25 support level. By CD Analytics , Oliver Knight Updated Dec 10, 2025, 5:15 p.m. Published Dec 10, 2025, 5:15 p.m. "Stellar (XLM) consolidates near $0.25 with institutional volume up 19% amid broader market underperformance." What to know : XLM gained 0.85% to $0.251 while underperforming broader crypto market by 0.45%. Trading volume spiked 19.36% above 7-day average, signaling institutional interest. Price established volatile consolidation pattern with $0.25 emerging as key support. Stellar (XLM) edged higher over the past 24 hours, posting a 0.85% gain to $0.251 amid muted altcoin market activity. The token underperformed the broader digital asset index by 0.45%, indicating XLM-specific dynamics drove price action rather than sector-wide momentum. Trading volume jumped 19.36% above the weekly average, suggesting accumulation despite modest price appreciation. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Price action revealed distinct two-phase trading on Wednesday. XLM consolidated around $0.251 through early afternoon before plunging to $0.2492, then recovering methodically to $0.2502. In the absence of clear fundamental catalysts, technical levels around $0.25 became critical as institutional flows shaped price discovery. Elevated volume without corresponding momentum suggests a standoff between buyers and sellers around current levels. This pattern typically precedes either consolidation breakouts or gradual accumulation phases. The outcome depends on whether institutional interest can overcome existing selling pressure at current levels. XLM/USD (TradingView) Key technical levels signal consolidation phase for XLM Support/Resistance: Critical support holds at $0.2500 following multiple successful tests; resistance forms at $0.2578 after initial surge failure. Volume Analysis: Peak institutional activity hits $0.2578 with 245% surge above 24-hour averages; volume exhaustion marks session end. Chart Patterns: Volatile sideways consolidation spans $0.0081 range (3.2%); systematic decline through lower highs pattern. Targets & Risk/Reward: Breakdown below $0.2500 triggers additional selling pressure; sustained hold above maintains bullish structure for breakout potential. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Hedera Rises 1.8% to $0.1372 as Government Adoption Momentum Builds By CD Analytics , Oliver Knight 12 minutes ago Technical consolidation occurs alongside renewed focus on enterprise tokenization initiatives. What to know : HBAR advanced from $0.1348 to $0.1372 during the 24-hour period ending Dec. 10. Volume surged 81% above average at session peak, confirming breakout above $0.1386 resistance. Georgia's Ministry of Justice partnership highlighted growing government adoption of Hedera infrastructure. Read full story Latest Crypto News Hedera Rises 1.8% to $0.1372 as Government Adoption Momentum Builds 12 minutes ago Surf Raises $15M to Build AI Model Tailored to Crypto Research 26 minutes ago ICP Extends Decline as Range Support Breaks, Testing New Lows Near $3.48 29 minutes ago GameStop Posted $9.4M Loss on Bitcoin Holdings in Q3 51 minutes ago Tether Rolls Out Privacy-Focused Health App as Expansion Into AI Accelerates 53 minutes ago Crypto Long & Short: Investors Are Hunting for Countercyclical Value in Privacy Coins 1 hour ago Top Stories Strategy Pushes Back on MSCI’s Digital Asset Exclusion Proposal 1 hour ago Eric Trump's American Bitcoin and Anthony Pompliano's ProCap Add to BTC Holdings 2 hours ago Telegram Ring Ran Pump-and-Dump Network That Netted $800K in a Month: Solidus Labs 3 hours ago Superstate Rolls Out Direct Stock Issuance for Public Companies on Ethereum, Solana 4 hours ago SpaceX’s $300M Bitcoin Stack Puts Crypto Inside the World’s Biggest Planned IPO 2 hours ago Bitcoin Volatility Is Still Compressing, Dimming Year-End Rally Outlook 4 hours ago