ICP Extends Decline as Range Support Breaks, Testing New Lows Near $3.48

Analysis

Price Impact

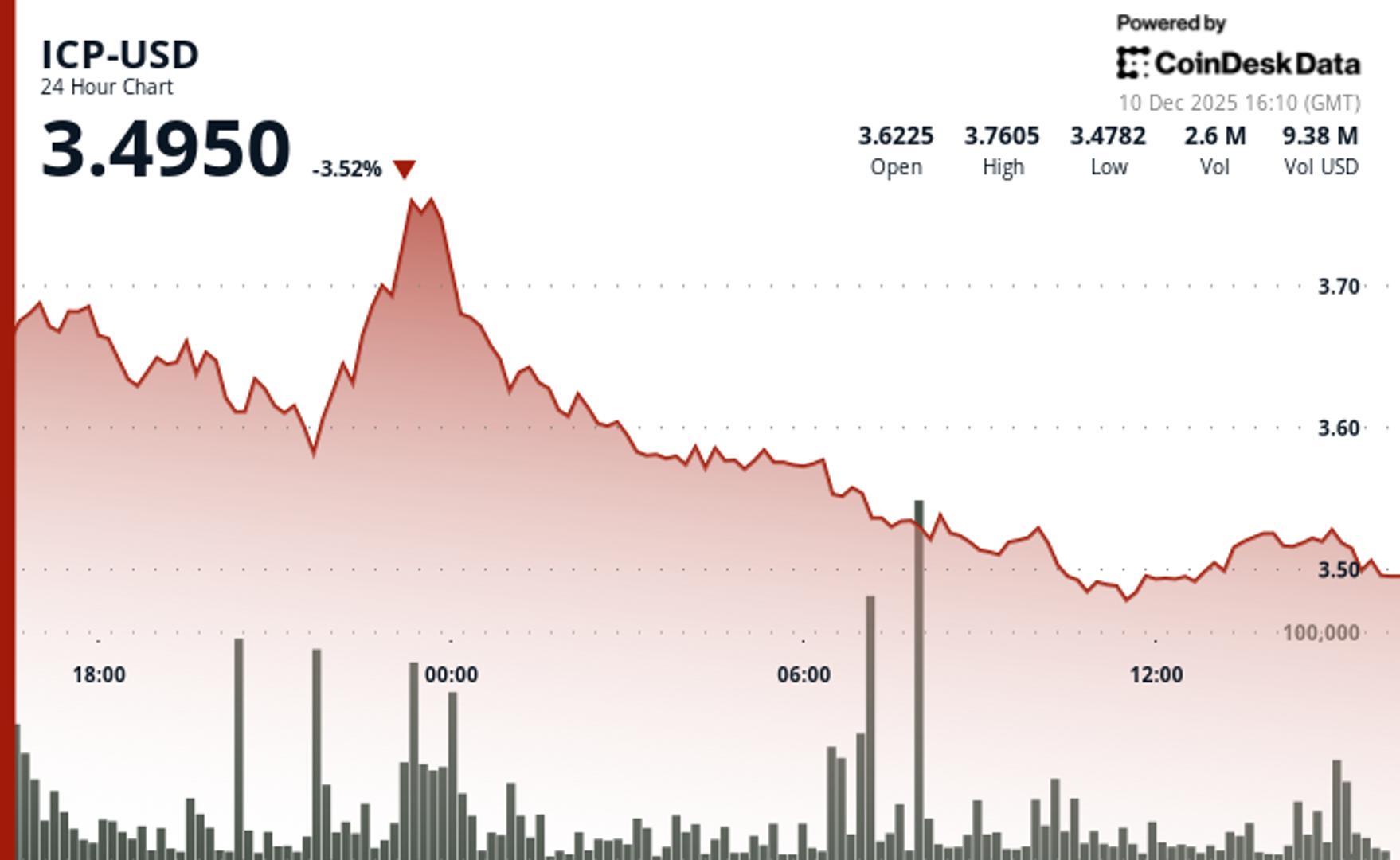

HighIcp has extended its decline, breaking below its multiday consolidation band and testing new lows near $3.48. this represents a significant reversal of early strength and a breach of critical short-term support levels, potentially opening the door to further drops.

Trustworthiness

HighThe information comes from coindesk, a highly reputable and well-established source in the cryptocurrency news sector, known for its market analysis and technical reports.

Price Direction

BearishThe token is in a clear declining pattern, failing to hold short-term resistance levels and reestablishing a broader downward structure. the break below range support at $3.50-$3.55 indicates strong bearish momentum, with potential retest of deeper november lows if current support near $3.45 fails.

Time Effect

ShortThe analysis focuses on recent 24-hour price action, multiday patterns, and immediate technical support/resistance levels. the impact is expected to manifest in the very near term as traders react to the broken support and new lows.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email ICP Extends Decline as Range Support Breaks, Testing New Lows Near $3.48 Internet Computer slipped back into a declining pattern after early strength faded, with the slide pushing the token toward key December support levels. By Jamie Crawley , CD Analytics | Edited by Sheldon Reback Dec 10, 2025, 4:48 p.m. What to know : ICP fell 5% to $3.4945 after gains reversed into a steady decline. The session’s $3.7605 high failed to hold, with the price breaking below its multiday consolidation band. Support near $3.45–$3.50 is now a key threshold for determining whether the downtrend extends or stabilizes. ICP fell 5% in 24 hours to $3.4945, reversing early attempts to regain lost ground and breaking below several short-term support levels. The token briefly traded as high as $3.7605 before momentum faded and a broad retracement pulled the price steadily lower, according to CoinDesk Research's technical analysis data model. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The 24-hour trading window spanned a $0.28 range, reflecting 8% intraday volatility as repeated recovery attempts encountered resistance overhead. Volume reached 2.6 million tokens, with the most active period occurring during a sharp sell-off shortly after 00:00 UTC on Wednesday. That decline drove ICP back toward $3.55, erasing the prior day’s rebound and reestablishing a broader downward structure. The price then entered a stabilization phase in the $3.50–$3.55 band before a late-session drop carried ICP to lows of $3.4782. The decline continues a multiday pattern with ICP repeatedly failing to hold above short-term resistance levels. Technical observers are now monitoring whether the token can remain above the $3.45–$3.50 area that has served as a buffer throughout early December. A sustained break below this zone would open the door to a retest of deeper November levels, while any rebound above $3.55 would indicate early signs of momentum repair. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . AI Market Insights Technical Analysis ICP Internet Computer More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You GameStop Posted $9.4M Loss on Bitcoin Holdings in Q3 By Helene Braun | Edited by Stephen Alpher 23 minutes ago The firm has not announced any new bitcoin purchases since May, when it bought 4,710 BTC. What to know : GameStop's (GME) bitcoin stash was worth $519.4 million at the end of its third quarter (Nov. 1). The company booked a $9.2 million loss thanks to bitcoin's price decline over the three month period. GameStop’s stock is down 5.8% on Wednesday. Read full story Latest Crypto News GameStop Posted $9.4M Loss on Bitcoin Holdings in Q3 23 minutes ago Tether Rolls Out Privacy-Focused Health App as Expansion Into AI Accelerates 25 minutes ago Investors Are Hunting for Countercyclical Value in Privacy Coins 47 minutes ago Strategy Pushes Back on MSCI’s Digital Asset Exclusion Proposal 1 hour ago SpaceX’s $300M Bitcoin Stack Puts Crypto Inside the World’s Biggest Planned IPO 1 hour ago Most Influential: Rushi Manche 1 hour ago Top Stories Strategy Pushes Back on MSCI’s Digital Asset Exclusion Proposal 1 hour ago Eric Trump's American Bitcoin and Anthony Pompliano's ProCap Add to BTC Holdings 2 hours ago Telegram Ring Ran Pump-and-Dump Network That Netted $800K in a Month: Solidus Labs 2 hours ago Superstate Rolls Out Direct Stock Issuance for Public Companies on Ethereum, Solana 3 hours ago SpaceX’s $300M Bitcoin Stack Puts Crypto Inside the World’s Biggest Planned IPO 1 hour ago Bitcoin Volatility Is Still Compressing, Dimming Year-End Rally Outlook 3 hours ago