BONK Slips as Governance Vote Nears, Testing Key Technical Support

Analysis

Price Impact

HighThe upcoming dydx governance vote on bonk integration is a significant near-term catalyst that could materially expand bonk’s utility. the recent price dip with elevated volume highlights heightened market positioning and uncertainty surrounding this critical event.

Trustworthiness

HighThe analysis comes from coindesk, a highly reputable source in crypto journalism, and includes specific technical data (volume, price levels) to support its claims.

Price Direction

BearishBonk slipped 3.94%, falling below the psychological $0.00001000 threshold. attempts to break resistance at $0.000010273 failed with high volume, indicating strong selling pressure and a lack of immediate bullish conviction ahead of the vote.

Time Effect

ShortThe dydx governance vote is scheduled for december 11, making its outcome an immediate and short-term driver for bonk's price action.

Original Article:

Article Content:

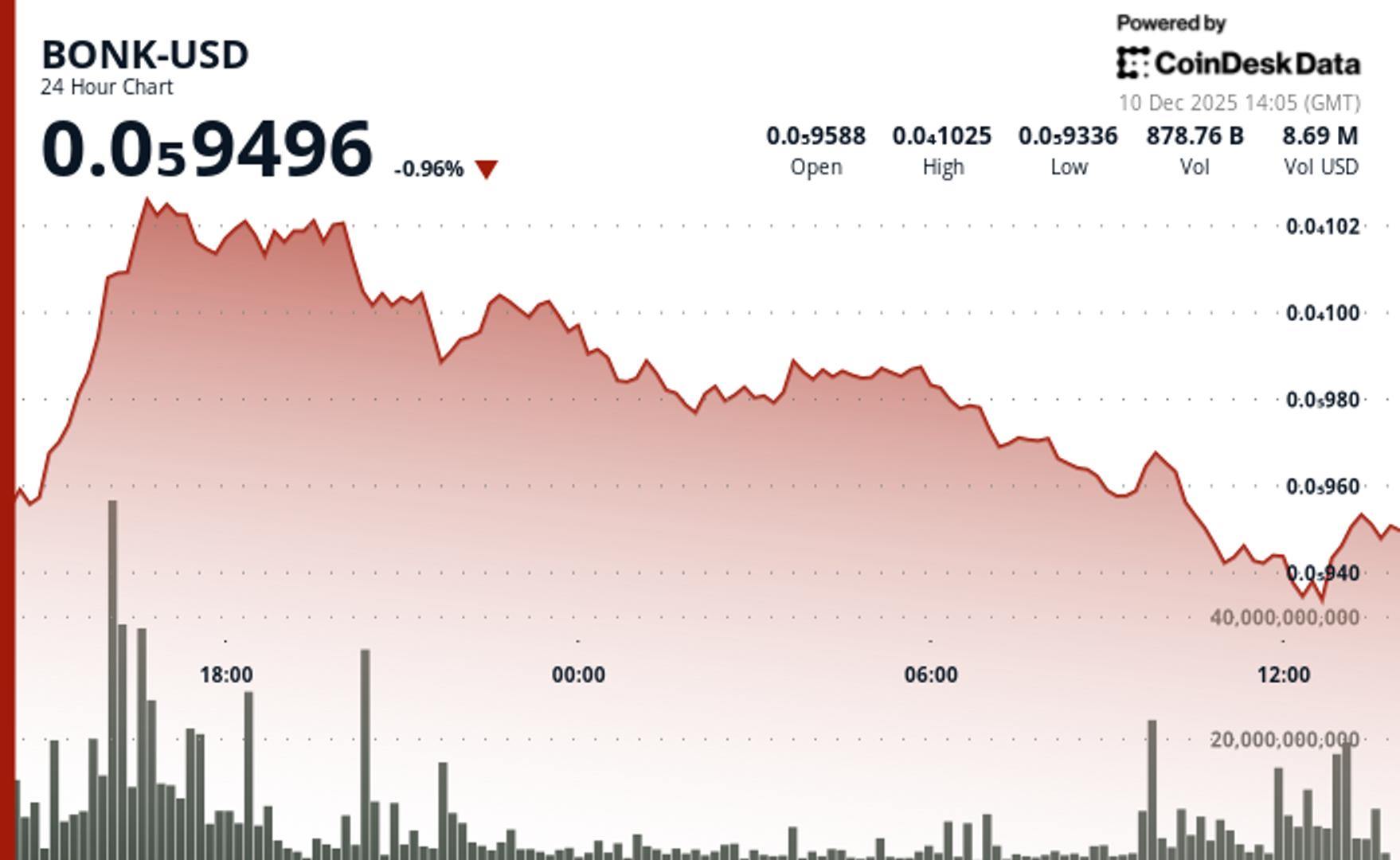

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email BONK Slips as Governance Vote Nears, Testing Key Technical Support The Solana memecoin dipped below the $0.00001000 threshold ahead of a dYdX integration vote, with elevated volume highlighting heightened positioning activity. By Jamie Crawley , CD Analytics | Edited by Nikhilesh De Dec 10, 2025, 2:49 p.m. What to know : BONK fell 3.94% and lost the $0.00001000 psychological level despite strong early-session momentum. Volume reached 1.61T tokens — 137% above average — during a failed breakout attempt at $0.000010273. The December 11 dYdX governance vote on BONK integration remains a key near-term catalyst. BONK declined 3.94% over the past 24 hours, sliding to $0.000009492 as the token broke below the psychological $0.00001000 threshold amid increased trading activity surrounding its pending dYdX governance vote. The Solana-based memecoin rallied to $0.000010273, where volume jumped 137% above the 24-hour average to 1.61 trillion tokens during an attempted test of overhead resistance, according to CoinDesk Research's technical analysis data model. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . That move failed to hold, with the token’s intraday trend reversing into a series of lower highs that produced multiple support breaks through the afternoon. Despite the pullback, BONK found footing near $0.000009380 and stabilized into the session’s close, though attempts to regain lost ground remained limited. The upcoming Dec. 11 vote on a proposed BONK integration into the dYdX Chain added a layer of anticipation to market activity. Under the proposal, BONK would receive 50% of protocol trading fees in exchange for developing a dedicated frontend for the dYdX Chain—a step that could materially expand BONK’s utility footprint. The measure is currently undergoing community review before entering the formal voting window. The rejection at $0.000010273 created a resistance ceiling that shaped price direction for the remainder of the day, while support consolidation at $0.000009380 suggests a temporary equilibrium forming ahead of Wednesday’s governance developments. Volume patterns indicate heightened positioning rather than directional conviction, keeping BONK in a structurally fragile zone until it reclaims levels above $0.000009600. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . AI Market Insights Technical Analysis More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You BNB Lags Wider Market Despite Volume Surge Resistance Levels Hold By CD Analytics , Francisco Rodrigues | Edited by Jamie Crawley 16 minutes ago Despite uncertainty and a lack of breakout, BNB's fundamentals may be supportive, with recent developments support a bullish case. What to know : BNB edged higher to top $890, gaining over 1%, but underperformed the wider crypto market which rose 2.5%. Trading volume surged 51% above the weekly average, suggesting possible whale participation, but BNB's price underperformance may indicate a rotation away from the token. Despite uncertainty and a lack of breakout, BNB's fundamentals may be supportive, with recent developments like Binance's ADGM approval and new infrastructure on BNB Chain, but traders remain cautious. Read full story Latest Crypto News Teacher’s Union Says U.S. Senate Crypto Bill Puts Pensions and Economy at Risk: CNBC 10 minutes ago BNB Lags Wider Market Despite Volume Surge Resistance Levels Hold 16 minutes ago CoinDesk 20 Performance Update: Index Declines 1.5% as All Constituents Trade Lower 27 minutes ago Eric Trump's American Bitcoin and Anthony Pompliano's ProCap Add to BTC Holdings 30 minutes ago Telegram Ring Ran Pump-and-Dump Network That Netted $800K in a Month: Solidus Labs 50 minutes ago Helium Expands to Brazil With Mambo WiFi in DePIN Breakthrough 1 hour ago Top Stories Eric Trump's American Bitcoin and Anthony Pompliano's ProCap Add to BTC Holdings 30 minutes ago Telegram Ring Ran Pump-and-Dump Network That Netted $800K in a Month: Solidus Labs 50 minutes ago Superstate Rolls Out Direct Stock Issuance for Public Companies on Ethereum, Solana 1 hour ago Bitcoin Volatility Is Still Compressing, Dimming Year-End Rally Outlook 1 hour ago Crypto Markets Today: Fed Rate-Cut Hopes Lift BTC, ETH as Traders Brace for Volatility 3 hours ago Binance Co-CEO Yi He’s WeChat Account Hacked to Push Memecoin MUBARA 9 hours ago