Bitcoin Volatility Is Still Compressing, Dimming Year-End Rally Outlook

Analysis

Price Impact

HighDeclining implied volatility (bviv index) and s&p 500's vix suggests reduced expected price turbulence, thereby weakening the case for a significant year-end rally in bitcoin. matrixport notes this volatility compression implies low odds of a meaningful upside breakout.

Trustworthiness

HighThe analysis comes from coindesk, a reputable crypto news source, citing data from volmex's bviv index and tradingview, and expert commentary from matrixport, a well-known crypto financial services firm.

Price Direction

NeutralThe compression in volatility indicates a market expectation of fewer large price swings, specifically dampening prospects for an upward year-end rally, suggesting a period of stability or stagnation rather than a strong bullish breakout.

Time Effect

ShortThe article explicitly focuses on the 'year-end rally outlook' and price movements 'into year-end,' indicating a near-term to short-term impact horizon.

Original Article:

Article Content:

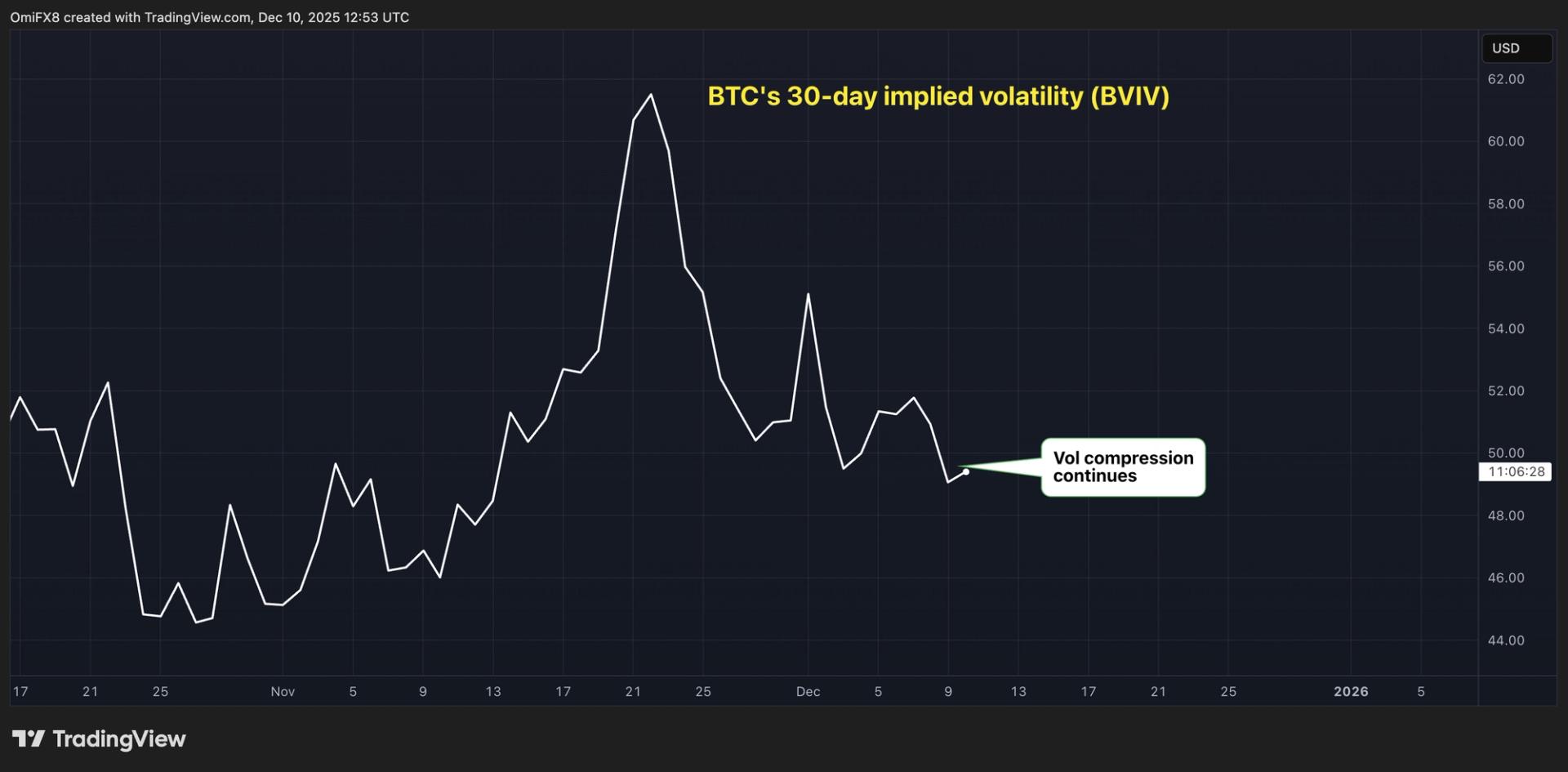

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin Volatility Is Still Compressing, Dimming Year-End Rally Outlook Bitcoin's volatility indices are declining, just like the S&P 500's. By Omkar Godbole | Edited by Sheldon Reback Dec 10, 2025, 1:05 p.m. BVIV. (TradingView) What to know : Bitcoin's volatility indices are declining, just like the S&P 500's. The drop in bitcoin's implied volatility weakens the case for a year-end rally. Matrixport notes that the volatility compression suggests low odds of a significant price breakout. Bitcoin's BTC $ 92,082.19 volatility indexes are still declining, mirroring those of the S&P 500, bringing a price stability that weakens the case for a year-end rally, according to one analyst. BTC's annualized 30-day implied volatility, as measured by Volmex's BVIV index, has dropped to 49%, nearly reversing the spike to 65% from 46% over the 10 days through Nov. 21, according to TradingView data. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Implied volatility is an options-based measure that represents the market's outlook for price swings over a specific period. The drop from 65% to 49% means expected price turbulence over the 30 days has declined from as much as 5 percentage points to 14%. The VIX index, which represents the 30-day implied volatility in the S&P 500, has also dropped, reaching 17% from 28% since Nov. 20. According to Matrixport, the so-called volatility compression suggests low odds of a year-end rally. "Implied volatility continues to compress, and with it, the probability of a meaningful upside breakout into year-end," the firm said in a market update Wednesday. "Today's FOMC meeting represents the final major catalyst, but once it passes, volatility is likely to drift lower into the year-end." Matrixport's view aligns with bitcoin's historical positive price-volatility correlation, though this relationship has gradually shifted toward the negative since November 2024. On Wall Street, implied volatility compression is typically associated with a bullish reset in the market sentiment. Bitcoin News Markets Volatility More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You KindlyMD Turns to Kraken as Fourth Provider for Bitcoin-Backed $210M Loan at 8% By James Van Straten | Edited by Sheldon Reback 1 hour ago An SEC filing shows the Kraken facility will be used to retire an outstanding Antalpha loan and requires significant bitcoin collateral. What to know : KindlyMD turned to Kraken for a $210 million loan “bearing a fee of 8% per annum” with maturity on Dec. 4, 2026. The company said it will use the proceeds to satisfy its obligations to Antalpha Digital in full. Kraken becomes the company’s fourth financing source this year following earlier arrangements with Yorkville Advisors, Two Prime and Antalpha. Read full story Latest Crypto News Superstate Rolls Out Direct Stock Issuance for Public Companies on Ethereum, Solana 9 minutes ago TenX Protocols to Start Trading on TSX Venture Exchange After Raising $24M in 2025 9 minutes ago Blockstream Connects Lightning and Liquid for Faster, Private Bitcoin Payments 9 minutes ago Ether, Silver in the Spotlight: Crypto Daybook Americas 54 minutes ago Pineapple Financial Starts Migrating its $10B Mortgage Portfolio Onchain via Injective 1 hour ago KindlyMD Turns to Kraken as Fourth Provider for Bitcoin-Backed $210M Loan at 8% 1 hour ago Top Stories Crypto Markets Today: Fed Rate-Cut Hopes Lift BTC, ETH as Traders Brace for Volatility 1 hour ago IMF Flags Stablecoins as Source of Risk to Emerging Markets, Experts Say We Aren't There Yet 5 hours ago Binance Co-CEO Yi He’s WeChat Account Hacked to Push Memecoin MUBARA 7 hours ago Strive Starts $500M Preferred Stock "At-The-Money" Program for Bitcoin Purchases 2 hours ago Ether, Silver in the Spotlight: Crypto Daybook Americas 54 minutes ago Metaplanet Stock Jumps 12% as mNAV Climbs to 1.17, Highest Level Since Crypto Crisis 1 hour ago In this article BTC BTC $ 92,082.19 ◢ 1.80 %